Lux Research: FOG-based biodiesel remains significant opportunity

Image: Lux Research

December 27, 2016

BY Lux Research

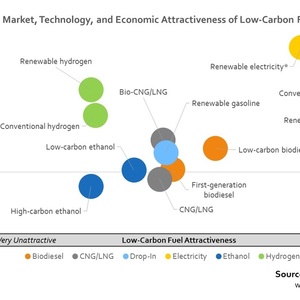

Biomass-based diesel and conventional electricity lead the race to meet new emissions reduction goals, and diversified energy companies are well-placed, according to Lux Research.

Traditionally policies to promote greener transportation fuels have focused on mandating volumes of specific biofuels that must be used. However, a new generation of policies is based on technology-agnostic carbon intensity metrics, led by the California Air Resources Board low-carbon fuel standard (LCFS). Renewable diesel and conventional electricity will be the near-term winners according to Lux Research, followed by renewable electricity in a close third.

Carbon intensity—the amount of carbon by weight emitted per unit of energy consumed—is driven by factors such as feedstock, process technology, and power source, while technology viability is also a factor in the march toward low-carbon fuels commercialization.

Advertisement

“Energy companies with diversified energy portfolios are well-positioned to take advantage of this paradigm change, shifting towards renewable sources to reduce carbon intensity values,” said Yuan-Sheng Yu, Lux Research analyst and lead author of the report titled, “Identifying Winners in Low-Carbon Fuels.”

“With electricity a near-term winner, pioneers for the ‘utility of the future’ hold a strong position moving forward,” he added.

Lux Research analysts used data from the CARB LCFS to evaluate fuels’ commercial, technological and economical attractiveness, based on criteria such as addressable market size, carbon intensity, and pathway maturity. Among their findings:

Advertisement

-California is a model. Currently, California uses seven different low-carbon fuels derived from 26 different feedstocks, making up 11.3 percent of its fuel consumption. Under the state’s new regulations, growth of petroleum consumption has slowed to a mere 0.5 percent quarterly, while low-carbon fuels grew at 1.6 percent quarterly.

-Waste oil halves biodiesel’s carbon intensity. In ideal conditions, biodiesel derived from fats, oil and grease (FOG), has the potential to cut carbon intensity by half. Plenty of FOG-derived biodiesel is projected to be available—up to 2.5 billion gallons per year—and even though processing poor quality waste adds to cost, FOG-based diesel remains a significant opportunity.

-Carbon-negative fuels, today. CARB LCFS’s well-to-wheel analysis of biogas shows that the long-sought carbon-negative fuel is commercially viable today. With California’s large transportation fuel market as a draw, improved biogas technologies as well as similar carbon-negative fuel pathways will emerge to expedite carbon emissions reduction.

The report, titled “Identifying Winners in Low-Carbon Fuels,” is part of the Lux Research Alternative Fuels Intelligence service.

Related Stories

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events