Alternative Feedstock & Process Technology Overview

PHOTO: WILL SMITH

January 11, 2017

BY Will Smith

While the majority of U.S. biodiesel is still produced from soybean and canola oil, the role of alternative feedstock has increased steadily over the past decade. The lower production costs they afford have had a significant effect on economic viability as the industry undergoes consolidation and weathers the political storms of tax credits and renewable fuel standard (RFS) volume revisions. Here we will take a look back at the past several years and examine trends in alternative feedstock usage from a technical perspective, and review technologies that have found commercial use in processing these feedstocks. The term “alternative feedstock” used in this article will include waste oils such as yellow and brown greases, crude corn oil from ethanol production, and fats derived from animal byproduct rendering.

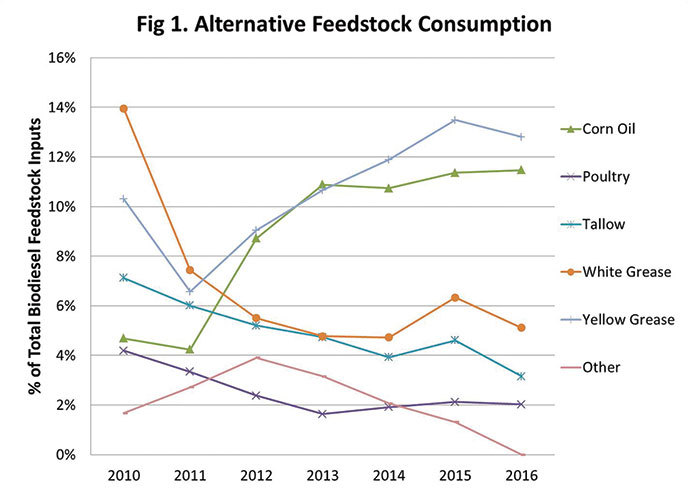

The U.S. Energy Information Administration has tracked the source of biodiesel inputs since 2010 and posts monthly consumption and production figures. Figure 1 uses EIA data to illustrate the amount of each alternative feedstock used over the past six years, as a percentage of the total feedstock inputs in U.S. biodiesel production. As a percentage of the total feedstock pool, alternative feedstock represent on average 39 percent of the feedstock used in U.S. biodiesel production from 2010-’16.

The accompanying chart illustrates how yellow grease (YG) and crude corn oil (CCO) have emerged as the clear leaders in alternative feedstock use, with their volumes increasing significantly since 2011. While both feedstock have their own processing challenges, they have two things in common catapulting them to the front of the pack. Both YG and CCO are readily available in large quantities, and they represent feedstock with low carbon intensity, meaning there is less carbon dioxide emitted in producing the fuel compared to other feedstock sources.

YG has been the most common alternative feedstock going back to the beginning of the industry in the late 1990s. In 2015, biodiesel production accounted for 62 percent of all YG produced in the U.S., according to EIA consumption data and National Rendering Association production data. The processing issues associated with yellow grease, including high levels of free fatty acids (FFA) and water/solids contamination have been known for many years, and a great number of producers have adapted to these characteristics. However, the biggest driver in recent years has been the favorable carbon intensity value assigned to YG biodiesel in California’s low carbon fuel standard (LCFS), which has created additional revenue for producers able to reach that market.

The amount of biodiesel produced from CCO extracted from ethanol plant stillage has increased nine-fold since 2010, to a little more than 1 billion pounds in 2015. The first extraction processes were brought online in the mid-2000s with ethanol producers quickly realizing the value of corn oil as a coproduct. ICM Inc. of Colwich, Kansas, is one of the leading providers of corn oil extraction systems and has installed more than 50 oil recovery systems in ethanol plants nationwide. Aaron Williamson, ICM product manager, estimates there are less than 10 percent of ethanol plants in operation that do not employ corn oil extraction. ICM has also worked extensively on improving the efficiency of the process, with yields of corn oil up to 100 percent higher than some early installations. In addition to being readily available with consistent quality and in large volumes, CCO has been assigned a very low carbon intensity value in California’s LCFS, making it very desirable. With FFA in the range of 10 to 20 percent, a majority of biodiesel pretreatment technologies can process crude corn oil, although the presence of waxes and other contaminants can require more substantial processing to meet cold soak filtration standards.

Animal fats, preferred by some producers for their typically low FFA levels, have not grown significantly and, in some cases, have declined in use over the past six years, with the biggest challenge to widespread adoption being poor cold temperature properties of the finished fuel. However, the advent of renewable diesel technology has renewed interest in these feedstocks, as their saturated fats require less hydrogen to convert to hydrocarbons and there is typically less metal contamination than other low-cost feedstock like YG.

In the late 2000s, a handful of companies seemed close to commercializing biodiesel from 100 percent brown grease—the holy grail of low-cost feedstock. At half the price of YG, brown grease has always drawn a lot of attention. Presently, however, no dedicated facilities exist in the U.S. utilizing 100 percent brown grease. Substantial contamination issues, especially sulfur and polymers, have meant high capital costs for dedicated brown grease facilities. One method of dealing with these problems has been blending brown grease with other feedstock such as YG. Pacific Biodiesel’s Big Island Biodiesel plant is one facility making use of this blended feedstock approach, with the capability to use up to 50 percent brown grease in its feedstock mix. The blending approach results in lower operating costs while addressing the other major problem of brown grease: its relatively dispersed and low-volume availability.

Brown grease is derived mainly from grease trap waste, which contains up to 90 percent water. Obtaining brown grease in substantial quantity means first setting up dewatering and wastewater treatment facilities for recovering the grease. While several dozen of these dewatering plants exist in the U.S., low feedstock prices have made it challenging for these processors. Additionally, there has been some competition for the grease trap waste from anaerobic digestion facilities, especially in the western U.S. Despite these challenges, tightening laws for disposal of grease trap waste in Florida, Michigan and elsewhere have spurred new interest in brown grease recovery. With further consolidation of production and a continued move within the industry toward biodiesel distillation, it is likely that we will continue to see brown grease as a small but growing piece of the feedstock market.

Pretreatment Technologies

Over the past 15 years, the technology required for pretreatment of high-FFA feedstock has been a major source of debate in the biodiesel production community. Many technologies have been proposed, and some such as enzymatic esterification and solid catalyst processes appear to hold promise, however, acid catalyzed esterification, fatty acid stripping, and glycerin esterification have emerged as the most popular techniques used at commercial scale.

Acid catalyzed esterification, specifically homogenous acid esterification using sulfuric or sulfonic acid, is the preferred method of pretreatment for plants in the small-to-medium-size range across the industry. The equipment is straightforward to install and can handle moderate amounts of FFA, typically up to 20 percent. The downside of acid esterification is the need to recycle wet methanol, which typically means expanding or adding new methanol rectification equipment at the plant.

Fatty acid stripping—the process of removing FFAs by vacuum distillation—has found favor with larger producers and is well-suited for medium- to large-scale facilities. Crown Iron Works, a provider of oleochemical and biodiesel process technology, has supplied 12 fatty acid stripping systems in capacities from 30 to 60 MMgy. Renewable Energy Group Inc., the nation’s largest producer of biodiesel, makes use of fatty acid stripping to handle high-FFA feedstock in their facilities. Though it is more capital intensive than acid esterification, fatty acid stripping is capable of achieving extremely low FFA levels, and in the end is less energy intensive to operate than many acid esterification systems, when the energy costs of recycling the wet methanol are considered.

Glycerin esterification, or glycerolysis, is another FFA pretreatment method that is used at commercial scale in the U.S. By esterifying the high-FFA feedstock with glycerin at high temperature, the FFA are converted to mono- and diglycerides, which are subsequently processed using traditional transesterification techniques. Employed for many decades in the oleochemical industry, the process is installed at the facilities originally designed and constructed by Nova Biosource. All of these facilities are still in operation, and represent 100 MMgy of production capacity.

Post-treatment Technologies

In addition to pretreatment to reduce FFA levels, most alternative feedstocks possess some level of contamination that requires processing beyond traditional water washing or resin adsorption to remove. Two technologies that have emerged as clear leaders in this area are cold filtration and biodiesel distillation.

Cold filtration is a technique that is used to remove contaminants such as waxes, sterol glucosides, residual soaps, proteins and other unsaponifiable matter that contribute to cold soak filtration issues. The technique is modeled to some degree on the cold soak filtration test itself. It involves mixing a filter aid, typically diatomaceous earth or magnesium silicate, with the methyl ester stream, then cooling the mixture to a point just above the cloud point of the methyl ester. The contaminants with higher melting points precipitate out of solution and are removed in a filter press or pressure leaf filter. When compared to alternatives such as ester distillation, cold filtration is inexpensive to install and operate, and results in minimal yield loss. Cold filtration does produce a solid waste byproduct in the form of the filter cake, but this is a very small stream, typically less than 0.5 percent by weight of the plant throughput.

Biodiesel distillation has grown from being relatively rare to a process that is now installed in more than 350 MMgy of U.S. plant capacity. Once relegated to use on feedstock with high levels of sulfur or other difficult-to-remove contaminants, biodiesel distillation is now finding favor with producers meeting customer needs for very low levels of monoglycerides, exceptional cold soak filtration times, and consistent color. The high capital costs of biodiesel distillation make it more suited to larger facilities, but it has been installed at plants with throughputs as low as 5 MMgy where it is needed to handle very low-grade feedstock. The drawbacks to distillation, including yield loss and energy consumption, are often offset by the ability to process blends of very low-cost feedstock, including CCO and the previously mentioned brown grease blending scenario.

Renewable Diesel

No discussion of process technology would be complete without also addressing renewable diesel, which has emerged as a competitive technology to ester-based biodiesel. Renewable diesel is produced by hydrotreating and isomerizing vegetable oils and fats, followed by distillation to recover fuel gas, naptha and diesel fractions. The technology can also be adapted to produce renewable jet fuel. The technology is capable of using a wide variety of feedstock with elevated FFA levels, but requires extensive pretreatment to prevent trace metals in the feedstock from deactivating the hydotreating catalysts. The diesel fuel fraction produced by hydrotreating has high renewable content, and is virtually identical to traditional petroleum diesel, with no vehicle manufacturer restrictions on high blends or cold weather blending issues. Capital costs for renewable diesel facilities are significantly higher than traditional biodiesel processes, with renewable diesel plants typically being large to take advantage of economies of scale. The largest renewable diesel plant in the U.S., Diamond Green Diesel, was completed in 2013 and uses UOP Honeywell technology. Diamond Green Diesel recently announced an expansion from 160 to 275 MMgy. REG purchased the former 75 MMgy Dynamic Fuels renewable diesel plant in 2015. Several smaller facilities in the 3 to 30 MMgy range are also nearing commercial production. Many eyes are watching these projects to see how they fare in the marketplace, and what success could mean for ester-based biodiesel going forward.

The wild markets of the past several years have weeded out a significant number of business models and technologies unable to make it through the leaner times. The technology required to process alternative feedstock has become more mature, with plants now much more efficient and producing higher-quality products and coproducts. The industry today is more competitive and producing more low carbon fuel than ever, and with RFS biomass-based diesel volumes continuing to trend upward, the increased use of less-expensive and low-carbon feedstock of all types will continue.

Author: Will Smith

Owner, Springhouse Consulting

540-605-9716

wsmith@springhouseconsult.com

Advertisement

Advertisement

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

The USDA’s National Agricultural Statistics Service on June 30 released its annual Acreage report, estimating that 83.4 million acres of soybeans have been planted in the U.S. this year, down 4% when compared to 2024.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Scientists at ORNL have developed a first-ever method of detecting ribonucleic acid, or RNA, inside plant cells using a technique that results in a visible fluorescent signal. The technology could help develop hardier bioenergy and food crops.

Upcoming Events