Spotlight: Here to Serve the Biodiesel Industry

PHOTO: OIL-DRI CORPORATION OF AMERICA

August 8, 2017

BY Ron Kotrba

Lanxess

Lanxess, a spin-off of Bayer AG, is a global leader in antioxidants with a range of stabilizers based on phenolic and aminic chemistry sold under the Baynox brand. The company has serviced the European and U.S. biodiesel industries since the beginning, adapting its products as feedstocks and technologies change.

“We started with solid antioxidants based on Baynox (BHT) for palm- and rapeseed-based biodiesel,” says Susan Sokol, Lanxess business development manager. “Later, we added stronger antioxidants like Baynox Plus (double BHT) for soybean- and sunflower-based biodiesel, and easier-to-handle liquid antioxidants.” Lanxess’ latest offering is the ultra-strong antioxidant Baynox Ultra X containing two balanced antioxidants plus a neutral metal chelator in an organic solvent. “It covers a broad spectrum of features, has a high oxidation stability index (OSI) starting value and a long shelf life,” Sokol says. “Other products may also have high OSI values, but deteriorate faster and can corrode engines.”

During transesterification, natural vitamin E gets destroyed, Sokol says. “Therefore, we have to bring in chemical molecules to replace the vitamin E, which selectively bind the free radicals,” she explains.

Feedstock choice affects biodiesel stability, antioxidant choice and dosage rates. “Soy oil, common in the U.S., is difficult because it contains polyunsaturated fatty acids, so you have to choose a product with high effectiveness,” Sokol says. “In this case, Baynox Ultra X would be the right one. In Europe, rapeseed oil is often used and, for this, a basic product like Baynox Solution is the best choice.”

Advertisement

Depending on the initial rancimat value of the oil, the transesterification process and the nature of the antioxidant, dosage rates can be from 10 to 1,000 ppm, or higher in cases where long-term stability is needed—like in heating oil.

Lanxess leads the industry with six Baynox products on the no-harm list of AGQM, the German biodiesel quality management association. “For AGQM approval, several criteria have to be fulfilled, ranging from engine, nozzle fouling and filtration tests, to a compatibility check with engine oil, rancimat tests and more,” Sokol says.

Lanxess is committed to quality and puts the customer first, Sokol says, by offering innovative solutions and services. Lanxess offers complimentary biodiesel lab testing and product recommendations. “We have technical experts around the world for consultation,” she says, “and when a new facility is built, we often provide tank storage additive advice and more. We see our position as a partner in the biodiesel world. Therefore, we are also members of AGQM and the National Biodiesel Board to strengthen the biodiesel world.”

Lanxess has recently undergone global realignment, especially in North America. “The company now has a clear focus with leading positions in mid-sized, profitable specialty chemicals markets, a well-balanced portfolio of less cyclical specialty chemicals, and a strong focus on the growing North American region,” Sokol says. Lanxess recently acquired U.S.-based Chemtura, significantly expanding its production footprint in North America and its portfolio of additives—one of the most attractive in the specialty chemicals industry.

Oil-Dri Corporation of America

With its roots in World War II era Chicago, Oil-Dri Corporation of America has grown into an international leader in sorbent minerals. Steven Powell, regional North American sales manager, says Oil-Dri offers a variety of adsorbents and provides valuable technical service supported by its Innovation Center in Chicagoland.

As biodiesel production grew, Oil-Dri introduced its mainstay product line—Select —to the industry. Select products are specially modified, natural silicates for the removal of soaps, metals and phospholipids to help purify feedstock and biodiesel. While Oil-Dri offers a variety of other products, such as Pure-Flo bleaching earths, Powell says a majority of Oil-Dri’s product sales in biodiesel are for its Select FF product. “While all products are air-swept, Select FF is air-classified, which means it filters better,” Powell says. “It works better when processing oil with a high level of soaps, which is why we sell so much in the biodiesel industry.” FF stands for fast filtering.

Biodiesel customers use Select FF for feedstock pretreatment or dry-wash, with most relying on its feedstock purification abilities. Before caustic refining, producers rely on Select FF to remove soaps and metals, but Select has an added benefit of removing color and chlorophyll—providing a lighter color—along with removing other polar contaminants that hinder reaction. On the backend, customers employ Select FF for a light polish to remove soaps and free glycerin. “It helps improve the flash point as well, by acting as a catalyst to evaporating some of the methanol off,” Powell explains. “For example, we’ve seen Select FF lower free glycerin from 0.05 to 0.016 percent, improve cloud point, and boost B100 oxidative stability index from 1.8 to 3.3 hours in tested control samples.”

Select FF targets polar compounds. The forces at work include physical attraction, or the Van der Waals forces, and chemical interactions in which the charged molecules of Select FF attract and bond with polar contaminants. Finally, a molecular sieve force allows “good” molecules to pass through adsorbent media in filtration while contaminants cannot. “The product is a unique charged-clay mineral with many layers of aluminosilicate microstructures containing numerous pores,” Powell says. “We add a proprietary surface treatment, giving it a higher affinity for metals and soaps.”

For feedstock pretreatment, most use Select FF in combination with sodium hydroxide for chemical refining. Once the soaps are removed, Select FF is added at a ratio of about 0.05 percent by weight of oil. The oil is heated to 160 to 180 degrees Fahrenheit for 20 minutes under agitation. Then the oil is filtered, removing solids and trapped polar contaminants—especially metals and soaps.

For fuel polishing, the soaps and glycerin are decanted off, methanol is stripped, and between 0.5 and 1 percent Select FF is added by weight. The product is heated to 140 F and agitated for 30 minutes. Afterward, the fuel is filtered.

Powell says as new techniques like supercritical processing emerge, using Select FF is important to remove metals from feedstock to prevent fouling equipment downstream, especially heat exchangers.

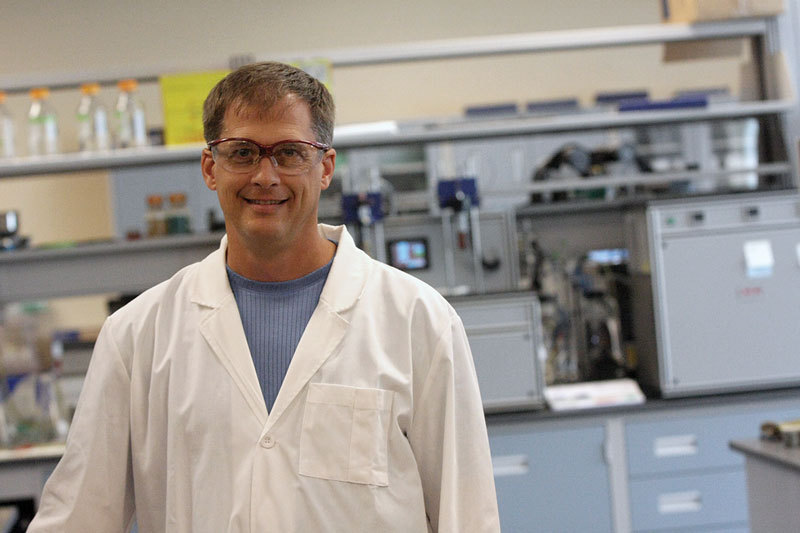

Iowa Central Fuel Testing Laboratory

The Iowa Central Fuel Testing Laboratory began in 2006 as an offshoot of the Biofuels Technology Program at Iowa Central Community College. ICCC assisted in the Two Million Mile Haul, a B20 field trial with Decker Trucking. From there, the idea to form an on-campus, independent fuel testing lab was created. With federal and state funding, instrumentation was purchased and the ICFT Lab was born. Today, ICFT is a BQ-9000-certified lab and the only such facility located on a community college campus. The facility is renowned throughout the biofuels space for its credibility, reasonable pricing and fast turnaround. It is also the state-designated fuel lab for the Iowa Weights and Measures Bureau.

“We officially got our BQ-9000 certification in 2010,” says ICFT Lab Director Donald Heck. The lab is also ISO-9001-certified for testing petroleum-based fuels. “There are a lot of labs out there that aren’t accredited,” Heck says. “With BQ-9000 and ISO-9001 certification, we have third-party accountability and procedures in place that are monitored. Clients need to know their data is being handled professionally and correctly.”

Having worked with more than 200 clients in 40 states and five countries, ICFT Lab offers a range of analytical services for biodiesel producers, from the full slate of ASTM D6751 tests and critical spec slates, to a la carte requests. “We even do glycerin and feedstock testing,” Heck says. “If a client has a specific request, we can even make a custom panel and give a price break on it.” While a few tests must be outsourced to partner labs, ICFT Lab performs a vast majority of its testing services in-house. “We’re looking into purchasing octane and cetane test engines, but that depends on finding a new facility,” Heck says. “We’ve outgrown the one we’re in. We’re in the middle of that decision now.”

Heck says biodiesel producers turn to ICFT Lab because it’s a cost-effective, not-for-profit, homegrown effort. “We are self-sustaining and revenue-generating,” he says. “We have rapid turnaround and we’re a small, close-knit outfit that works diligently. People appreciate our customer-friendly service. With a phone call, a customer can speak to any of the five of us. We take time to talk and explain results to them. Also, if they have an odd request, we’ll do what we can to help out, whether it’s putting a study together for them or something else.”

ICM

ICM Inc. is one of the most recognized names in ethanol, and now it wants to carry over its vast service knowledge and experience into biodiesel. About 60 percent of North American ethanol plants employ ICM process technology, says Debbie Harding, ICM’s marketing manager.

The company already provides behind-the-scenes benefits to biodiesel producers with nearly 50 percent of the market in distillers corn oil (DCO) extraction technology, increasing availability of lower-cost feedstock to biodiesel producers. ICM’s corn oil extraction design employs a horizontal three-phase decanter, or tricanter, design. “We’ve had buyers of distillers corn oil say they prefer to get it from ICM systems because the product is more consistent,” says Brock Beach, ICM’s vice president of sales and marketing. ICM has also helped increase extraction rates. “We started with a base tricanter system,” Beach says. “That recovered 0.5 to 0.6 pounds per bushel. Then we added our Selective Milling Technology that increased recovery by 5 percent. Our Fiber Separation Technology added another 10 percent bump in corn oil. ICM’s Thin Stillage Solid Separation System (TS4) provided another increase. And at the end of the line, we have our gen 1.5 corn fiber to ethanol process. So now, in all, our systems can recover up to 1.2 pounds of DCO per bushel.”

James Weber, ICM’s reliability services manager, says the company would like to grow its presence in biodiesel. “There’s a lot of the same services,” Weber says. “Soy-based plants have dryers, we have experienced crews doing work on all types of dryers. And in combustion, boilers—anything that’s gas-fired—we can service and work on any gas-fired burners. For piping projects, we do custom manufacturing in our shop. We do conveyor work, millwright work, and we repair pumps and valves. There’s a wide variety of things we can help out and service biodiesel producers in.”

ICM also has a surplus cache of parts and equipment bought from ethanol plants and reconditioned, which could be sold to biodiesel producers. “We also have very good relationships with lots of suppliers, so we get really good pricing on parts,” Weber says. “The same goes for pump and valve manufacturers. We have buying power, and we can offer that to biodiesel plants as well.”

Harding and Weber say they want biodiesel producers to view ICM as a one-stop shop. “We want them to come to us for everything they need,” Weber says. “We believe our level of experience and expertise is the differentiating factor.”

Reiter Scientific

Reiter Scientific started as a one-man operation in 2007 and has grown into a fully staffed consulting, trading and logistics company. “When I started, I would fix biodiesel plants having production—primarily quality—issues, which led to facility and process design work,” says founder Kristof Reiter. “Now we’re called upon by major producers when they have quality issues they can’t figure out.” In 2009-’10, Reiter Scientific entered the trading business.

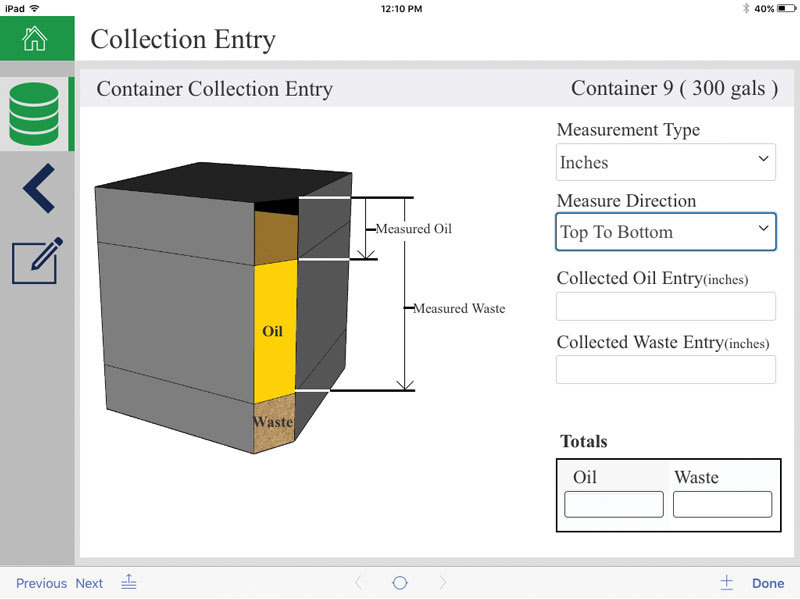

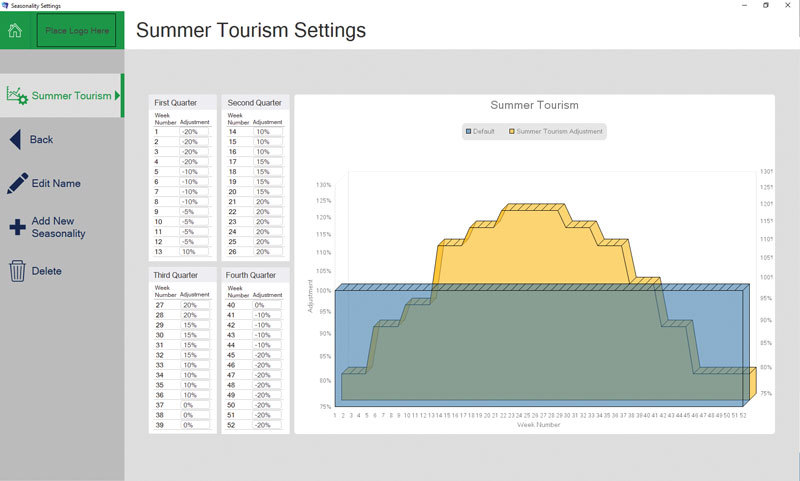

The company is in the midst of launching a software company with its flagship product debuting by fall. “More biodiesel companies are running their own oil collection routes, competing against the big guys who have really advanced software that allows them to operate efficiently, manage contracts, fuel, labor and all that,” Reiter says. “Only the top companies had access to that automation while everyone else is just winging it on spreadsheets or makeshift software.”

Reiter decided to build a system to help automate his customers’ collection systems since no off-the-shelf programs were readily available. “Our in-house development team’s been working on it for more than a year,” Reiter says. “It’s the Cadillac of oil collection.” The system encompasses route optimization, tracking fuel, accounts, profitability, contracts, employee hours, vehicles, and providing the ability for drivers to photograph and digitally log issues or notes so nothing is lost. “We worked with a network of companies we trade with to find out what their needs are,” Reiter says. Five companies are beta testing the new software.

Next year, the company will take its new automation to logistics for its trading business, the largest arm of Reiter Scientific. “The customer will get a client portal, see their order, and the trucks moving, and get an estimated time of arrival,” he says.

People turn to Reiter Scientific because of its people, Reiter says. “Our judgment, responsibility and care for our customers is why we’re successful,” he says. “We’re not trying to trade the most volume or make the most money. We maintain a reputation for fairness. Everything’s transparent and we offer quality product.”

Gladys Shoemake, Reiter Scientific’s logistics and operations manager, says the company’s experience is multifaceted—feedstock, production, logistics. “What you get with Reiter is educated responses to questions, and people doing more than just making money,” she says. “We’re solving problems by providing solutions.” Reiter even provides complimentary consulting to his sellers and buyers. “Our goal is to sell trouble-free product, and part of that is understanding the customer,” he says.

Universal Green Commodities

Boston-based boutique trading and logistics company Universal Green Commodities was launched in 2008 and will soon celebrate its 10-year anniversary in the American biodiesel industry. President and Founder Jamie O’Brien and his group’s biodiesel plant in Manchester, Tennessee—Tennessee Bioenergy Inc.—was lost to fire in 2010. “We were literally baptized by fire in the biodiesel business,” O’Brien says. Building upon his newfound industry relationships, O’Brien ventured full-time into trading to capitalize on new market opportunities.

“People call us traders or brokers, but at the end of the day we’re simply expert deal makers,” O’Brien says. “I look at it like geology, the study of time and pressure. Make the calls, stay in front of people, be engaged, be relentless at knocking down the doors, do what you say you’re going to do, find the opportunities, service the hell out of the clients and business will get done. We’ve earned a lot of respect across the country from the lumps we’ve taken over the years in this industry and by doing things the right way while walking the righteous path. This business was built on integrity and that’s why we are so well-positioned in the industry today.”

O’Brien says when he started the company, used cooking oil (UCO) was king. “And it’s still king in renewables,” he says. Now UGC trades not only in UCO but heavily in yellow grease, beef tallow, choice white, brown greases, soybean oil, DCO and tons of poultry fat. “That’s one thing that’s changed over the years,” O’Brien says. “A lot on our books is poultry fat now, as we have carved out a stronghold there.”

UGC services both small and large feedstock renderers. “We have a lot of loyal suppliers we’ve serviced since 2008,” he says. “Not just the guys hustling in the streets of New Jersey and in major cities, but the big boys too. You’ve got to be a chameleon in this business and adapt to a wide range of character, personalities and egos. I love it. No call is the same as the previous one. All counterparts that have survived like us are now vetted, but back in the early days, you didn’t know who to trust. The people I’m dancing with today are the people I want to be dancing with.”

UGC has its own railcar fleet and ships feedstock across the U.S. “We take possession of every transaction we deal in,” O’Brien says. “My partner and I bankroll deals with our own money. We don’t deal with banks. I have as much skin and risk in the game as anyone in a transaction.”

Historically, about 75 percent of UGC’s business has been feedstock trading with the remainder biodiesel. “That will change soon,” O’Brien says. “I’ve brought on a seasoned player who’s very smart in the space.” The new addition to UGC is Azzedine Katane, previously with Archer Daniels Midland Co. “He came on as my business manager last year and in tandem, he’ll focus on my biodiesel book forward. The plants across the country trust and rely on us to feed their machine, so they are more than happy to sell us their biodiesel.”

UGC doesn’t just buy, sell and ship. “We consult with our clients on how to make their businesses better,” O’Brien says. “The smaller- to mid-sized guys, we teach them how to do things better and keep them in the know so they can angle, plan and act accordingly. The bigger guys simply appreciate the efficiency and professionalism. As a buyer, our clients are paid promptly. They count on us for optimal cash flow experiences and to orchestrate logistics to keep product moving.”

O’Brien says time served, vast business experience, a strong management team and excellent logistics are what brings customers to UGC—and keeps them there. “They trust me, and they know I’ll deliver,” he says. “When things go sideways, we get it fixed fast. We’re here for the long-term, and we’re not going anywhere. Plus, we’re an all-things-biodiesel company. We’ve never traded a pound of renewable feedstock into the feed or ag industries. We live and die in the bio economics and our biodiesel plant counterparts across the country respect us highly because of that.”

The Dallas Group of America

The Dallas Group of America Inc. is an adsorbent pioneer in the biodiesel industry. In 1959, entrepreneur Robert H. Dallas formed what was to become one of the larger privately owned chemical companies in the post-war era U.S. In 1989, The Dallas Group of America Inc. was established as a spin-off and grew into a diversified manufacturer of basic and specialty chemicals. The Dallas family still owns and operates the company, which has facilities in North America, Europe and a newly constructed plant in China.

The company debuted its D-SOL D series products under the Magnesol trademark in 2002. It was the first adsorbent introduced into the biodiesel market and the original dry-wash agent, says Brian Cooke, director of technical services. D-SOL D series adsorbents remove contaminants such as soap, excess catalyst, glycerin, metals, water and sterol glucosides after transesterification and glycerin separation. “D-SOL improves cold soak for biodiesel as well as increasing oxidative stability,” Cooke says.

In the mid-to-late 2000s, The Dallas Group introduced the D-SOL R series to clean up various biodiesel feedstocks. “We recently introduced a patented process to enable biodiesel producers to clean up feedstock to improve process efficiencies or use lower-quality feeds,” Cooke says. D-SOL R series adsorbents help remove contaminants that interfere with transesterification, such as free fatty acids, soaps, metals including phosphorus and sulfur, and sterol glucosides, gums, waxes and water.

D-SOL products are synthetic magnesium silicates. “They do not contain crystalline silica and are safe to use,” says George Hicks, an AOCS approved chemist and Dallas Group’s innovation and development manager. “D-SOL has both acidic and basic sites, which allow D-SOL to attract and hold onto polar compounds.”

D-SOL is typically added to feedstock or crude biodiesel in an agitated tank. “The process can be performed batch-wise or continuous,” Hicks says. “Our adsorbents work over a wide range of temperatures, so it’s not necessary to chill the biodiesel before filtration. Typically the liquid to be purified is recirculated through the filter for a few minutes to build a filter cake. After a cake is formed, the clear filtrate is sent to a clean holding tank.”

Having introduced the original biodiesel dry-wash product, The Dallas Group continues to provide innovative solutions to biodiesel producers on both ends of the process. Cooke says D-SOL products are unique among the choices available to biodiesel producers. “Magnesium silicate is a true adsorbent that also possesses superior filtration characteristics whether used alone or with a filter aid,” he says. “Its affinity for polar compounds is unsurpassed and we engineer our products to enhance selectivity to remove, for example, metals or free fatty acids.”

Hicks says the company is focused on providing effective and efficient solutions that deliver value. “We recently increased our field sales team and they are supported by an experienced technical staff and lab,” he says, adding that The Dallas Group is committed to, and partners with, its customers. “The need for solutions is on an uptick, especially as producers try to squeeze more product out of existing assets. Our goal is to help simplify and clean up the biodiesel process.”

Advertisement

Author: Ron Kotrba

Editor, Biodiesel Magazine

218-745-8347

rkotrba@bbiinternational.com

Related Stories

Desmet has been awarded a new contract by LG-ENI Biorefining, a joint venture between LG Chem and ENI Italy, to will deliver a HVO pretreatment plant in Daesan, South Korea. The biorefinery will produce SAF, renewable diesel and naphtha.

In a rapidly evolving energy landscape, the 41st International Fuel Ethanol Workshop & Expo will return June 9–11 to the CHI Health Center in Omaha, Nebraska. The event is recognized as the largest and longest-running ethanol conference in the world.

The U.S. EPA on April 11 reported that 1.82 billion RINs were generated under the RFS in March, down from 1.93 billion generated during the same month of 2024. Approximately 5.34 billion RINs were generated during the first quarter of 2025.

The U.S. EPA on April 17 published updated SRE data showing that five new SRE petitions have been filed under the RFS during the past month. According to the agency, 161 SRE petitions are currently pending,

The Iowa Biodiesel Board and Iowa Soybean Association on April 11 issued a statement expressing deep appreciation to Gov. Kim Reynolds for her biofuels advocacy. Reynolds on April 11 announced that she will not seek another term.

Upcoming Events