Big Oil, biodiesel join forces to combat electrification

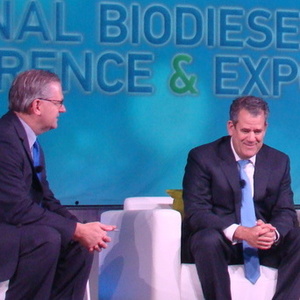

Photo: Ron Kotrba, Biodiesel Magazine

January 23, 2018

BY Ron Kotrba

Even though the petroleum and biodiesel industries rarely see eye to eye on U.S. energy policy, the two factions find common ground in a new threat to all liquid fuels—electric vehicles. The opening general session of the National Biodiesel Conference & Expo on Jan. 23 in Fort Worth, Texas, featured an unlikely group of petroleum executives and the CEO of the National Biodiesel Board, Donnell Rehagen. “These guys are not our arch enemy,” Rehagen said.

“The refining industry has no beef with biodiesel alone,” said Chet Thompson, the president and CEO of American Fuel & Petrochemical Manufacturers. “You’ll never hear us talk bad about the product. But biodiesel is synonymous with the Renewable Fuel Standard, and our members don’t like mandates—they support free markets.”

Ryan McNutt, CEO of SIGMA: America’s Leading Fuel Marketers, said, “When RFS came out, we were against it. We are a free market organization. But since then, we’ve adapted. And it’s been good for our organization.”

Petroleum Marketers Association of America Director of Government Relations Rob Underwood said his organization’s fight is more with ethanol than biodiesel.

Advertisement

Advertisement

“With biodiesel, there is still room for growth,” Underwood said, explaining that the diesel fuel infrastructure could sustain growth from 3 to 4 percent biodiesel market saturation where it is today, to 20 percent. “Most underground storage tanks are good until you get above B20 and E10,” he said. “We’ll sell anything if we can do it safely. If the quality is there and it’s competitively priced, we’ll sell biodiesel all day long.” Underwood said Bioheat—biodiesel-blended heating oil—is a fuel that carries home heating oil into the future.

McNutt said people don’t realize the importance of having a broad fuel supply until a disaster, such as a hurricane, strikes.

Another type of disaster—not natural but instead policy-driven—is the political momentum driving electrification. The consensus on the panel was that the liquid fuels industries must mend their differences and work toward a larger goal of exploiting the benefits that liquid fuels offer and exposing the myth of zero emissions vehicles.

“We need to improve the efficiency of the internal combustion engine and educate people that there is no such thing as a zero emissions vehicle,” Thompson said.

Advertisement

Advertisement

Renewable fuels such as biodiesel have been subject to rigorous lifecycle or well-to-wheel analyses, so to claim an electric vehicle has no emissions is farcical as significant power generation is coal-fired. Lithium mining for batteries must also be factored into the equation, as well as where all the spent batteries will go at their end of life.

Nevertheless, a growing number of governments are establishing policies to phase out internal combustion engines in the future.

“Electrification is the biggest single threat to liquid fuels,” McNutt said. “And this may not necessarily lead to a better carbon footprint.”

McNutt added that the subsidies funneling into “frankly a regulated monopoly”—the utilities—is unconscionable, and to replace the current, convenient liquid fuel infrastructure with a new electrified infrastructure is nonsensical. “To pay a higher cost to damage a stable, longstanding industry does not make sense for us.”

Related Stories

The USDA has announced it will delay opening the first quarterly grant application window for FY 2026 REAP funding. The agency cited both an application backlog and the need to disincentivize solar projects as reasons for the delay.

Neste and DHL Express have strengthened their collaboration with the supply of 7,400 tons (9.5 million liters) of neat, i.e. unblended, Neste MY Sustainable Aviation Fuel to DHL Express at Singapore Changi Airport starting July 2025.

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

Upcoming Events