As fuel prices rise, biodiesel production margins widen

October 26, 2018

BY Ron Kotrba

Crude oil prices recently reached a four-year high, helping drive up biodiesel fuel prices and improve biodiesel manufacturing margins.

A major Central European biodiesel producer told Biodiesel Magazine that they observed biodiesel prices rise “dramatically” since the beginning of October. “Of course we are happy for that,” the producer said. “However, nobody really knows what the reason is for that.”

According to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI), biodiesel prices are up 22 percent from this spring.

Germany’s Union for the Promotion of Oil and Protein Plants (UFOP) noted that wholesale prices for “agricultural diesel,” biodiesel and rapeseed oil surged considerably over the past several months. “However,” the organization stated, “none of these transport fuels shot up as sharply as agricultural diesel did.”

Advertisement

As in the U.S., where off-road diesel is taxed less than on-road diesel, agricultural diesel in Europe also receives tax privileges. The difference, however, according to Dieter Bockey of UFOP, is that in Europe the volume of tax-reduced diesel is limited for farmers to the size of the farm.

“The farmer buys the fully taxed diesel, and he gets back the corresponding share of the tax upon request the following year,” Bockey told Biodiesel Magazine. Bockey added that the legal basis for this is an EU energy tax directive that empowers the member states to reimburse up to 100 percent.

“This is the reason why the tax on diesel in Germany is about 26 [euro] cents per liter whereas in France it is only less than 6 cents,” Bockey said. Furthermore, in the U.S., all off-road diesel is dyed red, but in Europe only heating oil is dyed with Solvent Yellow 124.

According to UFOP, the four-year high in crude oil prices has caused agricultural diesel prices to rise to 87.50 euro cents per liter.

Advertisement

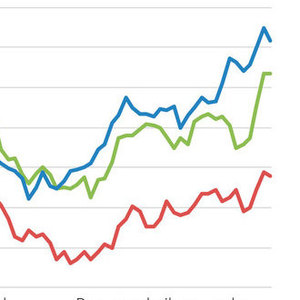

“In March, agricultural diesel and biodiesel stood at the same level, whereas rapeseed oil fuel has been cheaper than agricultural diesel since the end of 2017,” the organization stated.

The term “rapeseed oil fuel” refers to straight vegetable oil—a nontransesterified or nonhydrotreated vegetable oil—used as a fuel.

“Price curves are similar,” UFOP stated, “but price gaps have widened significantly in some cases. This means that it pays off to process rapeseed oil into biodiesel. What is more, the latter sells fast for blend uses, not least because it is needed to meet quality requirements for winter diesel. The unexpectedly brisk demand for fuel has also driven up prices for biodiesel, along with mineral oil prices.”

The organization stated also that low water, smaller harvests in 2018 and reductions in sowings for 2019 are also factors that have added to the price of rapeseed.

Related Stories

The International Air Transport Association has established the Civil Aviation Decarbonization Organization to manage the IATA-developed Sustainable Aviation Fuel (SAF) Registry when it is released.

LRQA, the leading global assurance partner backed by Goldman Sachs Alternatives, has acquired EcoEngineers, a U.S.-based consulting, auditing and advisory firm with an exclusive focus on the energy transition.

The USDA on March 25 announced it will release previously obligated funding under the Rural Energy for America Program To receive the funds, applicants will be required to remove “harmful DEIA and “far-left climate features” from project proposals.

BIO, in partnership with Kearney, a global management consulting firm, on March 24 released a report showing the U.S. bioeconomy currently contributes $210 billion in direct economic impact to the U.S. economy, excluding healthcare.

Airbus is taking a significant step toward scaling the adoption of sustainable aviation fuel (SAF) by testing a new “Book and Claim” approach. This initiative aims to boost both supply and demand for SAF worldwide.

Upcoming Events