2020 Biodiesel Plant Map Reflections

January 7, 2020

BY Ron Kotrba

Maintaining and updating a project such as Biodiesel Magazine’s U.S. & Canada Biodiesel Plant Map is no small feat. It requires untold hours of research, communication and an unwavering commitment to stay on top of changes in the industry throughout the year. For the 2020 iteration, Biodiesel Magazine made more than 100 phone calls in October alone, sent countless emails and performed hours of research to obtain the latest information on the state of the industry through its myriad individual projects.

Naturally, one recurring theme that kept rearing its ugly head was the toll that the lack of the $1 per gallon federal biodiesel tax credit, which expired at the end of 2017, and the U.S. EPA’s small refinery exemptions were having on the industry. Many producers had already announced plant closures, including three of World Energy’s sites in Georgia, Mississippi and Pennsylvania; Renewable Energy Group’s New Boston, Texas, plant; two of W2Fuel’s facilities in Michigan and Iowa; Duonix (the Beatrice, Nebraska-based joint venture between Flint Hills Resources and Benefuel); and later, after our map efforts for the year had concluded, Integrity Biofuels in Indiana.

Others yet, like American GreenFuels in New Haven, Connecticut, owned by Kolmar Americas, publicly announced significant cutbacks to production. There were numerous producers Biodiesel Magazine spoke with that were on the verge of idling production, many of which had already made the tough decision to begin manufacturing at only a fraction of their capacity, due to the ongoing policy issues facing the biodiesel industry.

Years ago, Biodiesel Magazine made the conscious decision not to list whether a biodiesel plant was producing or idled, or at what level of production they were achieving if, indeed, they were producing at any given time. Due to the fickle nature of this industry, and the historic tie between production levels and federal policies such as the tax credit and Renewable Fuel Standard volumes, it was thought best to only list installed capacities—what a plant could produce given the right market signals—at existing assets and those under construction or expansion. Thus, unless the companies that own these known, idled assets divest themselves of these facilities, they will continue to be listed on the plant map.

After all, like Roy Strom, president and CEO of W2Fuel told Biodiesel Magazine in late September, “We are preparing everything to be mothballed for at least several months. We are protecting our reputation by doing this the right way, so if market conditions change, we can restart operations quickly. Our hope is the market will come back to equilibrium, making it viable for us to operate again. We don’t plan to sell—we’ve already made significant investments in our assets.” Strom says he doesn’t have a Plan B. And the same is true for many other producers.

US Biodiesel

In mid-October, during the height of the 2020 map’s data collection efforts, Biodiesel Magazine learned that Cargill’s 60 MMgy project in Wichita, Kansas, had been completed and was online. A company spokesperson said the plant was operating at capacity in October after opening in July. Plans for the $90 million project were first announced in September 2017. The new biodiesel facility is located next to Cargill’s oilseed processing plant and replaced an existing soybean oil refinery. Air Liquide Engineering & Construction was contracted for engineering, having already built six biodiesel plants for Cargill around the world using its Lurgi biodiesel process technology.

Another project flipped the switch from under construction/expansion to existing as Green Biofuels Miami, a 7 MMgy plant in south Florida, became operational. In July 2018, Fabio Santos, engineer and CEO, advised that the company was working to expand capacity from 4 to 7 MMgy. A year later, this past summer, Santos said the facility had started up and begun regular operations.

SJV Biodiesel in Pixley, California, a 5 MMgy supercritical plant co-located next to the Calgren Renewable Fuels ethanol refinery, was completed in 2019. Renewable Process Solutions designed and built the project. Lyle Schlyer, president of Calgren, said the plant was in operation long enough to discover that it needed additional equipment for post-distillation filtering to get the acid number down. “About the same time, there was a failure with both of our vacuum pumps, so we had to replace them,” he said. “We’re going to install them and restart the plant [early this year].”

SME Dublin in Georgia is also nearing completion. Frankie Mathis of Tactical Fabrication told Biodiesel Magazine that its capacity has been increased from 5 to 7.5 MMgy and SME Dublin should be online in the first quarter of this year. The plant will solely process brown grease, Mathis said.

Kolmar Americas also has an added plant on this year’s map. The company quietly took over the old Endicott Biofuels site in Port Arthur, Texas, and can produce 25 MMgy of biodiesel from palm fatty acid distillate. In October, Paul Teta, vice president of government and public affairs for Kolmar Americas, said American GreenFuels-Texas was running at 50 percent capacity and would shut down at the end of December if no certainty on the tax credit was provided.

White Mountain Biodiesel in Haverhill, New Hampshire, changed ownership but its entry on the map hasn’t changed. “The White Mountain plant has been purchased by Renewable Fuels by Peterson LLC,” Howard Peterson told Biodiesel Magazine. “RFP has a sole member, which is Peterson’s Oil Service Inc. of Worcester, Massachusetts. The plant is currently in production and is manufacturing biodiesel used for thermal energy in Massachusetts homes. All of the product is produced from feedstocks qualified under the Massachusetts APS credit program and blended with petroleum-based heating fuel. We currently are permitted under Title V and from the State of New Hampshire to produce 6.5 MMgy. The EIA rates the plant at 4 MMgy and will raise the rating when we exceed 4 MMgy in production. We are currently producing 3 to 3.5 MMgy. Our current focus is to finetune the production process and then ramp up to higher volumes. We still manufacture under ... the White Mountain name.”

Delek Renewables added a third biodiesel plant to its repertoire, in addition to its two production facilities in Texas and Arkansas. According to sources at the plant, Delek acquired the 7.5 MMgy JNS Biofuels plant in New Albany, Mississippi, and renamed it Delek Renewables-New Albany.

Gold Coast Refining, a 40 MMgy plant in Chattanooga, Tennessee, has rebranded as GC Lipids. General Manager Mark Mauss said the plant is producing methyl esters but not biodiesel fuel currently. He added this could change, however, if the tax credit comes back.

In May, High Plains Bioenergy, a division of Seaboard Foods, rebranded and subsequently changed the names of its two biodiesel plants in Missouri and Oklahoma. The 30 MMgy enzymatic biodiesel production facility in St. Joseph, Missouri, formerly owned by Blue Sun Biodiesel, which High Plains Energy acquired in 2016, has changed names from HPB-St. Joe Biodiesel to Seaboard Energy Missouri LLC. The company’s biodiesel plant in Guymon, Oklahoma, has changed names from High Plains Bioenergy LLC to Seaboard Energy Oklahoma LLC. While the plant has historically featured a nameplate capacity of 30 MMgy, Mel Davis, Seaboard Foods vice president of bioenergy, told Biodiesel Magazine in May the facility has gradually increased its capacity to 45 MMgy over the past few years through a series of debottlenecking efforts.

A new 60 MMgy project was added to the list this year under the name Tara Industries. According to William Johnson, vice president, the project is located in Tina, Missouri, and plans to use soy oil and animal fats. Biodiesel Magazine will continue to follow its development.

Crimson Renewable Energy’s expansion project from 24 to 36 MMgy being performed by Austria-based BDI-BioEnergy International continues to make progress. The new plant will feature RepCat technology, a patented biodiesel production system for low-quality feedstock with high free fatty acids (FFA) that employs a recyclable catalyst. BDI says the process technology’s low-cost, recyclable catalyst bypasses complex treatment of glycerin, providing a high-purity coproduct and relatively low operating costs. Furthermore, the technology is extremely feedstock-flexible, allowing efficient processing of waste oils and fats of different kinds and origin. Tyson Keever of SeQuential, which was acquired by Crimson in 2018, said the Bakersfield expansion is well-underway. “We are producing around 2 million gallons per month there and we are hoping to add another million per month [in 2020] when the expansion is complete.” The expansion project was first announced in late 2017. BDI introduced the technology 12 years ago and the Crimson installation is a first of its kind in the U.S.

Jennifer Case, co-founder of San Diego-based New Leaf Biofuels, said the expansion project to more than double capacity from 5 to 12 MMgy at her plant is ongoing. “We hope to be commissioning the new plant equipment by June,” she said.

After our 2019 map efforts concluded, Hero BX had acquired the former Clinton County Biodiesel facility in Clinton, Iowa. Hero BX purchased the assets from Tenaska Commodities LLC in late September 2018. Hero BX Iowa is operating, “although at drastically reduced rates,” said Chris Peterson, Hero BX president, in early October. “It is a 10 MMgy multifeedstock plant and will be ramped up as soon as economics warrant. Things are difficult, as you can imagine, but we are fortunate compared to others in the industry. We are struggling along but have been able to retain all of our employees.” Revamping the South Roxana, Illinois, plant has been put on hold pending the credit, Peterson said, but the design has changed from 15 to 20 MMgy. “When our engineers got into it, we found that the sizing and equipment list was not considerably more expensive to do 20 vs. 15,” he said. “We are ready to go as soon as the credit comes back, and the weather is cooperative. Assuming an early 2020 start, we should be operational there in early 2021.”

Sadly, the U.S. biodiesel industry lost two of its own this past year. Stu Lamb, president and CEO of Viesel Fuel, died Aug. 5, 2019, at 77 years old. Michelle Nyberg, Viesel Fuel senior vice president and chief financial officer, said the plant in North Fort Myers, Florida, is closed and if it ever reopens, it will likely be under new ownership with a new name. Also, the chief organic chemist and production manager specialist for American Biodiesel Energy, Chase Akerly, died at age 28. In late 2017 Akerly said the company was incorporated by his grandfather in 2007 and started operating a traditional biodiesel process. After a 2011 fire, the company rebuilt but was unsuccessful. Akerly said he began testing enzymatic processing with Novozymes in 2014.

All in all, the 2019 plant map contained 121 U.S. biodiesel plants and projects under construction or expansion, while the 2020 map was reduced to 105 entries since several plants were removed after discovery that they were dismantled, repurposed, auctioned, or otherwise had been verified to no longer exist. In 2019, total capacity of existing plants in the U.S. was 2.471 billion gallons with another 190.5 million gallons under construction or expansion. For 2020, the capacity of existing U.S. plants ticked up slightly to nearly 2.516 billion gallons with 181 million gallons under construction or expansion.

Canada

While not much has changed north of the border with respect to biodiesel production capacity, there are three developments of note. Following Innoltek Inc.’s acquisition in late 2017 of the 19 MMly Evoleum biodiesel plant formerly known as QFI Biodiesel in St-Jean-sur-Richelieu, Quebec, the company ceased operations at its biodiesel plant in Thetford Mines, Quebec, and has concentrated production in St-Jean-sur-Richelieu. Innoltek has relocated its headquarters to St-Jean-sur-Richelieu as well. CEO Simon Doray said production capacity at its new headquarters is 20 MMly. The Thetford Mines site was suffering from a location without rail access and was not near major highways, Doray said. In addition, the plant had limited capacity. It was dismantled and some of the equipment was moved to its new site.

Invigor Bioenergy Corp. in Lethbridge, Alberta, which was listed on the 2019 map as existing with a 71 MMly capacity has been swapped to under construction/expansion with an 81 MMly capacity, as the company works to retrofit and expand operations.

Also, Consolidated Biofuels Ltd., an 11.4 MMly plant in Delta, British Columbia, was added to the map. The plant is not new but did not gain the attention of Biodiesel Magazine until recently.

The 2019 map featured 10 biodiesel plants in Canada with 663 million liters of existing capacity and 45 million liters under construction or expansion. The 2020 map features nine biodiesel plants in Canada with nearly 598 million liters of existing capacity and 126 million liters under construction or expansion.

Renewable Diesel

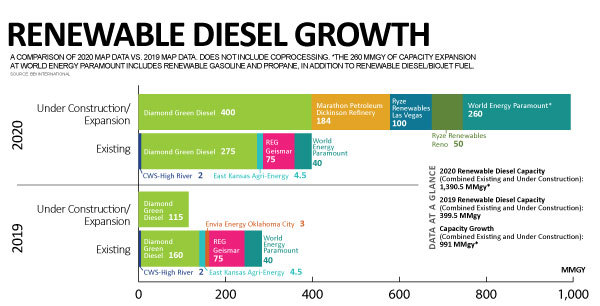

The most striking trend when comparing the 2019 map to the latest iteration is the growth of U.S. renewable diesel projects. Out of six renewable diesel listings on the 2019 map, the only construction or expansion project was Diamond Green Diesel’s project in Norco, Louisiana, to move from 160 to 275 MMgy. Since the 2019 map was published in Fall 2018, that project had since been completed and the company nearly immediately undertook another major expansion, from 275 to 675 MMgy. Other than the World Energy Paramount (at 40 MMgy) facility in California and REG’s Geismar, Louisiana, plant (75 MMgy), the other renewable diesel plants on the 2019 map were rather small. This changed, however, in 2020.

Ryze Renewables has two projects under construction. One is at the old site of Biodiesel of Las Vegas in Nevada, at 100 MMgy. The other is near Reno, Nevada, and is scaled at 50 MMgy.

Marathon Petroleum is also well underway with Phase 2 of its renewable diesel project in Dickinson, North Dakota. Phase 1 was coprocessing vegetable oils with crude oil feedstock, but Phase 2 is complete conversion of the oil refinery to produce renewable diesel at a scale of 184 MMgy. According to Ron Day with the refinery, full conversion is expected to be complete by late 2020.

In late October 2018, World Energy announced a $350 million expansion project at Paramount over the next two years, to complete conversion of this former oil refinery to produce more than six times the volume of renewable fuels the 40 MMgy renewable diesel and biojet plant could previously produce. The plan is to produce 300 MMgy of renewable diesel, biojet fuel, green gasoline and renewable propane.

“California has in many ways become like a separate country,” Gene Gebolys, founder of World Energy, told Biodiesel Magazine this fall. “The LCFS program is strong and getting stronger. We have the only renewable diesel and [biojet] facility in the state. We are full steam ahead on that project. If anybody ever wondered whether strong, consistent public policy really leads to investment, our Los Angeles project certainly answers that question.”

All told, nearly 1 billion additional gallons of renewable diesel capacity growth is under construction in the U.S. (see chart) year over year. There are many more proposed renewable diesel projects in development, and the 2021 map is sure to reflect this.

Author: Ron Kotrba

Editor, Biodiesel Magazine

218-745-8347

rkotrba@bbiinternational.com

Advertisement

Advertisement

Related Stories

Biodiesel capacity in the U.S. and Canada dipped slightly stable in 2024, with several renewable diesel producers reporting headwinds and lower margins alongside a drove of SAF projects in various stages of development.

The IEA’s Task 39 group has new research regarding the development and status of the sustainable aviation fuel industry.

The U.S. EPA on Nov. 16 released updated RIN data, reporting that nearly 2.11 billion RINs were generated under the RFS in October, up from 1.81 billion generated during the same month of last year.

Conestoga to host SAFFiRE cellulosic ethanol pilot plant

Conestoga Energy and SAFFiRE Renewables LLC announced on Nov. 16 their agreement for Conestoga to host SAFFiRE’s cellulosic ethanol pilot plant at Conestoga’s Arkalon Energy ethanol facility in Liberal, Kansas.

Officials at Calumet Specialty Products Partners L.P. discussed the company’s proposed plans to boost sustainable aviation fuel (SAF) production at its Montana Renewables biorefinery during third quarter earnings call, held Nov. 9.

Upcoming Events