Vegetable oil prices under pressure due to coronavirus pandemic

March 25, 2020

BY UFOP

The vegetable oil markets are currently extremely calm. The coronavirus pandemic is creating pressure in the financial and commodities markets and also pulling down spot prices for oilseeds and byproducts. Above all, crude oil has lost substantial ground in the wake of the oil output dispute between OPEC and Russia. The restrictions to curb public life, imposed as a consequence of the corona crisis, are reflected in the demand for transport fuels. Municipalities are ramping down local public transport. Road-based goods traffic, construction activities and the number of commuters all have dropped sharply. Diesel sales are in steep decline internationally. Demand for, or use of, biodiesel as a blending component and, finally, biodiesel producers’ demand for vegetable oil is decreasing to the same extent.

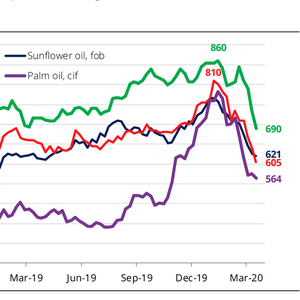

Rapeseed oil most recently cost 690 euros per metric ton. This translates to a more than 18 percent decline within one month. Soybean oil stood at 605 euros per ton, down just about 15 percent, not least because soybean and rapeseed prices in Chicago and Paris dwindled considerably. Sunflower oil and palm oil recorded a decline of 11.5 and 16 percent respectively compared to the previous month. The main stimulus for palm oil comes from the international futures market, which is impacted negatively by the estimated 20 percent slump in Malaysian palm oil exports in March 2020.

Advertisement

Advertisement

Related Stories

Airbus is taking a significant step toward scaling the adoption of sustainable aviation fuel (SAF) by testing a new “Book and Claim” approach. This initiative aims to boost both supply and demand for SAF worldwide.

Signature Aviation, the world’s largest network of private aviation terminals, has announced the expansion of its blended SAF offering at six new locations across Europe following multiple blended SAF supply agreements.

China’s exports of used cooking oil (UCO) reached a record high in 2024 but fell sharply in December after the Chinese government eliminated the 13% export tax rebate for UCO, according to a report filed with the USDA.

Ash Creek Renewables expands global reach with exclusive camelina seed licenses and 'Forks and Fuels' initiative

Ash Creek Renewables, a portfolio company of Tailwater Capital LLC, on March 20 announced it has secured exclusive licensing rights from Montana State University for a new high-performance camelina seed variety.

Virgin Australia has entered an agreement with Viva Energy to SAF for its flights departing from Proserpine, Queensland. The SAF will consist of Jet A1 and a 30-40% synthetic blend component made from waste and residue feedstocks.

Upcoming Events