Joint Evolution

IMAGE: BDI-BIOENERGY INTERNATIONAL

April 14, 2020

BY Ron Kotrba

It’s no secret that global biodiesel production got its start nearly 30 years ago with virgin vegetable oils—rapeseed oil in Europe and soybean oil in the U.S. “A lot of early biodiesel plants were put on the backend of crush facilities, and biodiesel wasn’t steering the ship,” says Alex Slichter, global commercial director at Crown Iron Works, one of the early market entrants in biodiesel process design and longtime oilseed process technology provider. Jim Willits, former president of Desmet Ballestra North America, another oilseed processing pioneer and early competitor in the biodiesel design space, says, “If you bought refined, bleached and deodorized soybean oil, there really isn’t any pretreatment necessary. The early concept of biodiesel plants was simple.”

Markus Dielacher, CEO of BDI-BioEnergy International, says many companies offering pretreatment systems came from the vegetable oil side. “They started with clean feedstock and it worked,” he says. “We came from the other side, the worst feedstocks, and went to the cleaner ones. It’s important if you’re working with heavily impure feedstock to have a robust system, as most don’t work properly with this type of feedstock. For instance, you can use a degumming unit for pretreating the worst feedstock, but it clogs up [quickly] and then doesn’t work. So, you need more robust systems, different kinds of separation units, and further steps in front to pretreat.”

The evolution of the biodiesel industry to rely more on waste fats, oils and greases was largely an economic consideration, as feedstock costs can represent 80 percent of operational expenses for production, and regulation driven as governments around the world tie regulations to carbon intensity and sustainability. “Biodiesel was an extension of the soy processing industry and evolved into more of a standalone business that had to survive by processing feedstocks that were competitive in price and availability,” Willits says.

Not all biofuels are created equal, from both monetary and sustainability points of view, Slichter says. “With more waste oils being used, instead of just neutralizing [free fatty acids (FFA)] and making soap, producers today are being more diligent in separating contaminants like FFA, and they’re doing more physical than chemical refining,” he says.

In Crown’s early days, pretreatment for soy biodiesel plants employed chemical neutralization and an adsorbent step to remove soaps. “That’s still the situation today for soy plants,” says Kris Knudson, vice president of global marketing and sales for Crown. “That was valid then, and it’s valid now, but we’ve made some enhancements on the pretreatment side by using enzymes and acid degumming—different techniques in the refining step from our portfolio. In the past 10 or 12 years, as animal fats, palm [distillates] and higher FFA feedstocks crept into the marketplace, we’ve employed different technologies from our toolbox, such as deacidification columns vs. traditional neutralization, working with our customers as the market evolves.”

Christine Riedl, technical sales manager at BDI, says when “second-generation” feedstock first appeared on the market, the used cooking oil (UCO) and animal fats were higher quality than what’s available today, so pretreatment demands were not huge. “But as lower-quality feedstock was being introduced into systems,” she says, “pretreatment requirements increased as higher amounts of impurities were coming in with that.”

Pretreated feedstocks need to meet very strict specifications, not exceeding a few parts per million for phosphorus, alkali metals, chlorine and other contaminants. “Reaching these strict specifications is particularly difficult for cheaper, lower-quality feedstock such as acid oils, certain animal fats and side streams such as distillates and distillation pitches,” Willits says.

The key for biodiesel and renewable diesel pretreatment technology providers, Willits says, is knowing the sensitivity of both biodiesel and renewable diesel to the contaminants in the feedstock, and knowing the constituents or analytical makeup of those alternative feedstocks. Martin Ernst, head of biofuels R&D for BDI, says as reliance on waste feedstock with greater impurities grows, the more important feedstock analytics become.

“The more varieties of feedstock you have, the more analytic information is necessary,” Ernst says. “But these analytical methods must be pretty easy and fast to keep up with the logistics of the biodiesel process, where you’re pulling in multiple truckloads a day.” He adds that feedstock categorization is critical, and the quality parameters identified from that categorization will determine which pretreatment steps are necessary. Dielacher adds that the analytical results will then determine which pretreatment steps to run, and which recipe should be followed.

Because of BDI’s history with waste feedstock, Ernst says the company has long been aware of polyethylene in animal fats introduced from packaging, ear tags and other means like plastic bags used to separate brains and internal organs from meat, which has become a growing problem over the years. “We developed a patented pretreatment system to remove this, which we are now offering now to customers,” Ernst says. The “usual approach” of filtration does not produce reliable results, he adds. “Our approach involves a pre-unit that accumulates polyethylene using heat and a filter aid,” he says. The polyethylene particles attach themselves to the filter media. The process then employs a centrifuge and tricanter to remove the solid particles. “The fine, small particles we get out with our fat treatment unit,” Ernst says. “We do water extraction for FFA and can use existing equipment.” He says the polyethylene removal module is installed at the beginning of pretreatment and a majority of the contaminants are removed in subsequent steps. BDI patented this two years ago.

Riedl says although many different separators and suppliers exist, BDI has relied on Flottweg for years. “We’ve been working with them for more than 10 years,” she says. “They provide the best machines for what we need, which is a big advantage from our side. Their machines are stable, robust and reliable for pretreatment.”

While virgin vegetable oil feedstocks have minor variations from year to year, this variation pales in comparison to variations in animal fats or UCO. “When you get into animal fats and UCO, there’s a great difference in quality and thus those nontriglyceride items (i.e., contaminants) as a result of the processing,” Willits says. “If they were frying onions, there can be a high amount of sulfur, so you have to look at this coming in batch to batch and judge what you can handle.”

Sulfur

Ernst says in the case of sulfur, BDI switched its focus from pretreatment to the backend. “We looked well into sulfur removal in pretreatment systems, but there the removal capacity is limited,” he says. “There are two kinds of sulfur, organic and inorganic, and for organic sulfur bound to fatty acids, there’s really no good removal in a pretreatment system—adsorbents maybe, but with some waste materials the sulfur content is so high you can only remove so much on the frontend. This is why we employ a special distillation unit optimized for sulfur removal.”

Advertisement

Standard distillation can handle up to 100 parts per million (ppm) of sulfur in feedstock, or in the biodiesel before distillation, Riedl says. “But we also implement an additional sulfur removal unit that allows up to 150 to 170 ppm of sulfur in biodiesel.” Even with higher amounts of sulfur, this additional unit means the fuel can still meet ultra-low sulfur requirements of 10 or 15 ppm, depending on the region.

A startup company named Environmental Fuel Research LLC is working to prove out its polarity-based desulfurization process that leverages a specific type of adsorbent and a process developed by Rich Cairncross, EFR senior research engineer and associate professor at Drexel University. “Our technology is more than an adsorbent,” Cairncross says. “That can be purchased from a variety of manufacturers. There are really tight specifications on what the adsorbent has to look like, pertaining to its physical properties and in terms of how it’s used. So, we’re not in the business of selling anything, but supplying customers all they need to know to effectively remove sulfur, which includes specs for the adsorbent, conditions under which it’s used, and the ability to regenerate the adsorbent to reduce costs.”

Don Wilson, EFR technical director, says he and Cairncross have investigated both frontend and backend sulfur removal with their technology. “It does work on both, although during biodiesel conversion, some level of desulfurization happens on its own,” Wilson says. “Since this process is probably not as inexpensive as some might like, it is best saved for the end when sulfur levels are at their lowest level.” Wilson explains that EFR investigated many forms of distillation, and while many did significantly lower sulfur levels, EFR’s adsorbent-based approach outperformed each of them.

Although most of EFR’s work in desulfurization has focused on purifying biodiesel rather than feedstock, one particular project did focus on feedstock pretreatment. “There, we were dealing with trap grease and other forms of brown grease, purifying the FFA out of dirty feedstocks to maximize yield,” Cairncross says. “We hydrolyzed and then did purification and adsorption, and we were successful in getting sulfur content that met specification in the feedstock. But this is more difficult to do on FFA than on biodiesel. It’s harder to meet spec.” Wilson says while he would call EFR’s approach a polishing step instead of pretreatment, he wouldn’t rule it out as purification for feedstock. “There are potential applications for people who are collecting grease that may want to desulfurize it for end users,” he says. “Then they could charge more.”

The preferred adsorbent for EFR’s polarity-based desulfurization technology is silica. “But it comes down to the physical properties,” Wilson says. “There’s as many different flavors of silica out there as bottled water. Specific grades work better than others. And there are others that work better for what we’re assuming our different species of sulfur are. We’re still working on confirming the effects of speciation and we’re hoping to have data this summer. We do know different adsorbents tend to desulfurize better based on feedstock—silica works well generally, but adsorbents made of different materials may work better on poultry grease, for instance.”

EFR has developed a technoeconomic model, and although the expense of deploying the system is influenced by electricity, labor and input costs, a penny per ppm per gallon “would put them in the ballpark,” Wilson says. “Our focus has been if someone wants to use the dirtiest of the dirty feedstocks, distill it first, and while that alone won’t get them to 15 ppm, then use our process to go from 25 or 30 ppm sulfur to below 15 ppm.”

The key to all this is, Willits says, is about having the ability to understand what kind of impurities are in the feedstock, and what can be taken out. “But you also need to understand the feedstock and purchasing program, and your ability to blend stocks,” he says. “If you buy and process, buy and process, then there’s big limitations. So, one of the major keys is the ability to blend oils available to you. Sometimes the only solution is dilution—mixing high- and low-contaminant feedstock and then processing that through the plant. That can be done on the frontend. My preference is blending feedstock and pretreatment, based on known quantities through analyzing what’s in your tank. The other way is producing biodiesel and then blending down to necessary levels. Either way, you need to know the quality and parameters in the feedstock or finished product to accomplish this. To handle wide swings in feedstock, blending is an analytical ability of determining what’s in your tanks and then what blend will produce the best yield going through the pretreatment operation.”

If the feedstock is extremely bad, this may require running product through the pretreatment system twice, Willits says. “Or a high concentration of chemicals or slowing the plant down so you can process the material,” he explains. “All are expensive things to do. The key is, if you don’t have the ability to blend stocks, and if you’re tied to buying all your oil from a select number of suppliers, then work with them to balance what’s coming in. If you can’t, then as your feedstock comes in, you need a full analysis to determine what adjustments you have to make to process it. This makes it much more difficult, however, and there’s a higher opportunity for failure.”

State of the Art

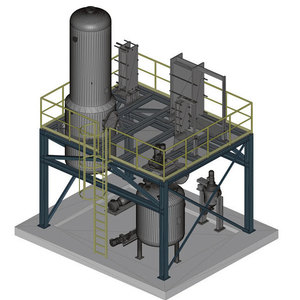

Crown’s most sophisticated biodiesel pretreatment system, according to Patrick Harrington, Crown’s global technology lead for renewable diesel, was designed for a multifeedstock biodiesel plant whose production lines are dedicated to processing different feedstocks. “One is dedicated to soy, and we’re doing enzymatic degumming there,” Harrington says. “That’s sort of the latest, greatest technology in terms of pretreatment on soy oil. Then there’s a separate line for waste fats, which utilizes high temperature deacidification to physically remove the FFAs.” Harrington says prior to deacidification, there is an acid degumming step to remove the bulk of the phospholipids, followed by a water wash.

Cavitation may also be employed in pretreatment. “Cavitation is an up-and-coming technology,” Harrington says, “but it has a niche application depending on the feedstock, so lab tests will prove whether cavitation is effective to run on certain feedstocks. In layman’s terms, cavitation is a blender on steroids.”

Slichter says the differentiation in Crown’s pretreatment design is feedstock flexibility vs. employing brand new technologies. “We build in robustness,” he says. “So, 50/50 actually means 25/75.” He says Crown can design a pretreatment system to handle the worst-case scenario, “but there are capital implications there as well,” Slichter says.

Willits details Desmet Ballestra’s state-of-the-art biodiesel pretreatment. When a truckload arrives, the first step is to make sure it contains minimal particulate matter. “We’ve become more sophisticated using filtration and cleaning the material up from the big things—the bricks, bats and dead rats,” he jokes. “Once unloaded and the large material is taken out, we’ve gone from an old bag in the tank filters or metal screens to automated filters that clean themselves and return dirty materials back to a place they can be utilized. The next issue is whether we have to worry about polyethylene. If it’s melted, we use cooling and a filtration process to remove the plastic.”

Next is removal of phospholipids, or phosphorus-bearing materials in the oil. “There are hydratable and nonhydratable,” Willits says, “so we acid pretreat to make all phospholipids hydratable. Then we degum. To separate the oil and water mixture, we use a centrifuge to remove water from the oil portion. If it’s been acid pretreated, all those products have been turned into hydratables, which greatly reduces phosphorous in the oil. Along with the gums, this will take out other contaminants and it’ll [reduce] the metals content. Since we used acid in degumming, now we have to neutralize the acid, so we mix in caustic to remove. Depending on what we’re trying to do, if we’re taking the FFA out, we can add additional caustic to transform the FFA into soaps and remove them in a water wash.”

Bleaching comes next using bentonite clay treated with acid, dried and mixed with oil, heated up, agitated for 20 to 30 minutes and then filtered out. “This takes the trace phosphorus and soaps out,” Willits says, “but there’s still water left in the oil so then it’s dried under a vacuum flash to take the moisture off.” If waxes from distillers corn oil, for instance, must be removed, then the dried oil is cooled, allowing the wax to crystalize, and then they’re filtered out. “This will improve the quality of the finished product so it will pass the [Cold Soak Filtration Test],” Willits says. “Then, depending on the sulfur content, if we need to strip sulfur out, we’ll run it through vacuum distillation to strip the material off.” He adds that this approach is “a much more robust system than what we’ve had to supply in the past for soy oil. It’s not simple, but it gives you much more control over feedstock variability.”

Advertisement

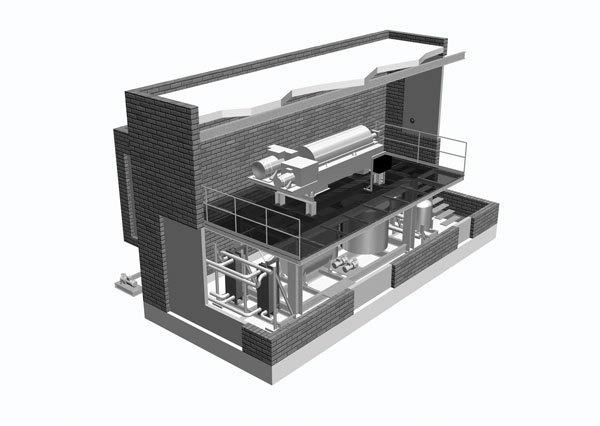

“State of the art” is developed through what’s been learned over time. Depending on the kinds of impurities, BDI can employ several combinations of processing steps in pretreatment—washing extractions, separation techniques, solids removal, filtrations, adsorptions, bleaching. “We utilize any and all pretreatment steps that are either available on the market, or which we have developed specifically for our pretreatment systems,” Riedl says. “The big advantage is we develop a pretreatment concept according to requirements of the existing biodiesel process and of the customer’s requirements. Usually the customer will come to us and say, ‘I want to use this or that with these impurities, so how can you install the most efficient pretreatment system for the parameters of my plant and feedstock?’ With more than 20 years of experience in waste materials and different technologies available, we will find the best, most cost-effective combination to provide them a reasonable and working solution for what they need.” Dielacher reiterates the importance of cost efficiency. “Process yields, how much chemicals or energy is needed to treat, output—we have optimized these steps to lose as little feedstock in pretreatment as possible,” he says. “If we put a pretreatment unit in front of a biodiesel process not designed by us, then we’ll adjust the pretreatment according to the needs of the customer.” Ernst emphasizes that, for pretreatment, there is no “one size fits all.”

Like any reputable technology provider, Willits says Desmet Ballestra has made modifications to its processes over time to go in wider directions. “We’ve had to improve mixing of our oils and chemistries, and we’ve leveraged nanotechnology to try and get better, more complete reactions,” he says. “There’s been a lot of tweaking to the process, but also a lot of research done on feedstocks.

When we first got into biodiesel, and then into renewable diesel, we gathered hundreds of samples of potential feedstock, ran them through our analytics lab and pilot plant to try and understand what we can do to help our customers deal with these. We learned a lot along the way and maintained that learning. It’s as much now the counseling of our potential customer to what they need to know of those feedstocks and the effect on their finished product as it is the technology or state of the industry. We’re still applying chemistry. The physics don’t change. But how those feedstocks change, and the chemistry we can control applied to those feedstocks, that’s where we’ve grown.”

Renewable Diesel

As renewable diesel interest and project development picked up, tech providers that have historically serviced biodiesel producers are adapting to capture new market share. Crown created a dedicated renewable diesel team, which Harrington leads. Given that many renewable diesel players are petrochemical refiners, the industry and, as an offshoot, its pretreatment systems must be more familiar to the energy sector and less tied to agriculture, Slichter says.

“We continue to evolve pretreatment to look less like a legacy [soy oil or biodiesel] refinery and more like a petrochemical refinery,” he says. “We need to integrate these onsite, using new technologies and innovate without the legacy burden.” For renewable diesel pretreatment, technology providers must ask questions such as, “How can I get out phospholipids if I don’t care about the color of the oil or its impact on flavor?” Slichter says Crown’s approach, in the hierarchy of pretreatment refining rigor, has biodiesel at the bottom, meaning the least rigor, followed by edible oil and then renewable diesel requiring the most processing. “For renewable diesel, we’re talking about less than 1 ppm on a number of contaminants,” Slichter says, adding that hydrotreating catalysts used in renewable diesel production are expensive and sensitive to impurities—particularly metals and polyethylene.

Crown’s renewable diesel pretreatment technology consists of four standard operations, which Slichter says can be mixed and matched as needed. The first step is a proprietary process for removing polyethylene. “In tallow, that’s a problem,” he says. “This can be an instantaneous problem and cause a catastrophic shutdown.” Since polyethylene can be fat soluble at moderate temperatures, Slichter says Crown has designed a system to take out larger impurities as well as polyethylene. “We do this upfront,” he says. “Others may do this on the back end in bleaching, but bleaching clay can be expensive for solids.”

The second step is a degumming and acid wash step. “First, we take out the gums, proteins—anything that’s complex or creating miscibles that can be shielding ions or contaminants that have an affinity to be removed with water, so we create a pH change to coax those molecules out. This is a good place to lose FFAs if you’re not careful, if you’re not controlling pH.” He says Crown’s design is intended to not routinely need any caustic.

One significant difference between biodiesel and renewable diesel pretreatment approaches is FFAs in biodiesel feedstock must be removed before conventional caustic processing or they’ll turn to soap, but for renewable diesel, “it’s just another source of carbon,” Willits says. Slichter adds that since the hydrotreater converts FFAs to yield in renewable diesel processing, pretreatment approaches have to be gentle “because FFAs are the first thing to be lost in a waste stream, if a continuous pretreatment system is not designed properly to minimize losses. It’s not uncommon to see a 10 percent FFA loss in pretreatment,” he says, if the design doesn’t take this into account.

The third step in Crown’s renewable diesel pretreatment approach is a water wash, and then the material is ready for the fourth and final treatment: a two-stage bleaching process. “Bleaching clay can be a major operating expense, and disposal can be a major pain for petrochemical companies that are not used to dealing with it,” Slichter says. “They know stack gases, flare off and wastewater, but there’s not a lot of solid waste generated at a refinery, so the idea of having a dumpster a day of bleaching clay coming out of the plant is a major concern. So, we’ve maximized the efficiency of our bleaching system.” With polyethylene removal upfront, Crown can elevate the temperature of the feedstock during the bleaching process to perform a true double-pass to maximize time. “And there’s the option to use two types of adsorbents,” Slichter says. “Some just add bleaching clay twice,” but silica, cellulose or other filter aids could be used to bring contaminant levels from less than 5 ppm down to 1 ppm. Harrington says Crown has worked with many adsorbent suppliers to get specific adsorbents into the renewable diesel market.

Besides robustness, Slichter says the other phrase Crown uses for its pretreatment system is “future-proof.” Regulations will change, and questions will arise that no one knows or has the answers to yet. “They may be putting more investment up front,” Knudson says, “but they’ll spend less in the long run on solid disposal from adsorbents, for instance. This ‘future-proof’ design gives us and our customers the flexibility to test new adsorbents and optimize the system going forward. We listen to the market, watch it evolve, and listen to the mindset of our customer.”

While sulfur is a concern in feedstock for biodiesel, experts say it’s not much of one for the petroleum companies moving into renewable diesel since they have long known how to manage sulfur.

“Petroleum companies have been dealing with sulfur ever since they began processing petroleum,” Willits says. For renewable diesel, the primary contaminants, according to Slichter, are phosphorous, metals, chloride, and polyethylene. “Sulfur would be considered a second-tier contaminant,” he says. “We’ve worked closely with hydrotreater technology licensors and it’s on their radar but it’s not driving the bus, so to speak.”

Desmet Ballestra designed the pretreatment process for Diamond Green Diesel’s renewable diesel plant in Louisiana. “The renewable diesel pretreatment process has to be focused on metals removal whereas with biodiesel, if you’ve taken out phosphorous, you’ve gone a long way to getting there,” Willits says. Shortly after designing and installing Diamond Green Diesel’s original pretreatment unit, the company expanded and relied on Desmet Ballestra again to double its pretreatment process line. The plant is currently expanding yet again, building a duplicate plant next door, and it called on Desmet Ballestra for even more work. “There’s other opportunities for future expansion with them, and others,” Willits says, intimating Diamond Green Diesel’s investigation of another large-scale renewable diesel plant in Port Arthur, Texas, may also contract Desmet Ballestra for pretreatment.

BDI is also making its nearly 25-year history and vast experience pretreating waste feedstocks for the biodiesel industry available to the renewable diesel sector. “Renewable diesel certainly needs even more pretreatment steps,” Dielacher says. “But our experience comes from cleaning up the worst feedstocks, so it’s easier for us to clean them up and produce a cleaner feedstock with lower impurities of metals. This is something we can do by adding further pretreatment steps.” Dielacher adds that BDI has been working intensively with catalyst producers to better understand what they need. “We have the experience to jump into this field and fill a gap,” he says. “Renewable diesel producers do not have much knowledge of pretreatment, so they need someone who can run the unit afterwards.”

Author: Ron Kotrba

Editor in Chief, Biodiesel Magazine

218-745-8347

rkotrba@bbiinternational.com

Related Stories

Biodiesel capacity in the U.S. and Canada dipped slightly stable in 2024, with several renewable diesel producers reporting headwinds and lower margins alongside a drove of SAF projects in various stages of development.

The IEA’s Task 39 group has new research regarding the development and status of the sustainable aviation fuel industry.

The U.S. EPA on Nov. 16 released updated RIN data, reporting that nearly 2.11 billion RINs were generated under the RFS in October, up from 1.81 billion generated during the same month of last year.

Conestoga to host SAFFiRE cellulosic ethanol pilot plant

Conestoga Energy and SAFFiRE Renewables LLC announced on Nov. 16 their agreement for Conestoga to host SAFFiRE’s cellulosic ethanol pilot plant at Conestoga’s Arkalon Energy ethanol facility in Liberal, Kansas.

Officials at Calumet Specialty Products Partners L.P. discussed the company’s proposed plans to boost sustainable aviation fuel (SAF) production at its Montana Renewables biorefinery during third quarter earnings call, held Nov. 9.

Upcoming Events