Model errors, RM losses cause REG to revise Q2 adjusted EBITDA

June 23, 2020

BY Renewable Energy Group Inc.

Renewable Energy Group Inc., North America’s largest biodiesel producer, announced that the company’s second quarter 2020 adjusted EBITDA is expected to be between negative $12 million and negative $2 million. Previously, on April 30, REG estimated a range of $20 million to $35 million. The company’s adjusted EBITDA for the first half of 2020 is expected to be between $78 million and $88 million.

Several factors contribute to the company’s revised outlook. The guidance model used in connection with the previous estimate contained inadvertent calculation errors, which on their own would have resulted in a significant reduction in the company’s previous adjusted EBITDA estimate.

Additionally, markets have been volatile during the second quarter, with industry margins first dropping and then showing signs of recovery. As of April 30, the company had incurred risk management (RM) gains. Now, quarter-to-date, the company has incurred an RM loss. The margin impact and RM loss are expected to be more than offset by production and sales volume performance, both of which are exceeding the company’s previous expectations.*

Advertisement

“We are of course disappointed with our expected Q2 results,” said Cynthia “CJ” Warner, president and CEO of REG. “Despite all the challenges presented by the market environment, including an industry margin collapse in the quarter, we believe our underlying fundamentals are strong and margins are beginning to improve, and we remain confident in our strategy and ongoing opportunities to create shareholder value.”

The company will provide further details regarding its performance and results for the second quarter of 2020 in its upcoming earnings call in August.

*Appendix to Q2 Revised Outlook Release

1. The guidance model consulted when preparing the company’s April 30 estimate had forecast the Biodiesel Mixture Excise Tax Credit (BTC)—which was reinstated late in December 2019 after having lapsed for 2018 and 2019—using formulas that overestimated REG’s BTC revenue. The guidance model also overstated biodiesel gross margins owing to a manual data entry error resulting from the use of different software tools to accommodate the work-from-home environment during the COVID-19 pandemic. Although the model is not the only input used to estimate the company’s projected adjusted EBITDA, these errors in the aggregate resulted in the adjusted EBITDA model output being overstated by approximately $43 million.

Advertisement

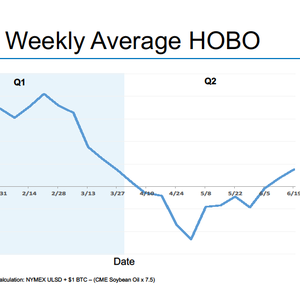

2. The heating oil-to-soybean oil spread, or HOBO, dropped to lows in April and May but is showing signs of recovery in June.

3. Gallons sold in April and May exceeded the original guidance by 7.2 million. The company expects gallons sold in the second quarter to modestly exceed the previously stated forecast of 155 to 175 million gallons.

4. The original guidance included $8 million of RM gains at that time. The company has since estimated RM losses of $8 million quarter-to-date through June 22.

5. Shipment timing and changes in RM from movement in ULSD and feedstock prices, among other factors, could further affect adjusted EBITDA between now and the end of the quarter.

Related Stories

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Saipem has been awarded an EPC contract by Enilive for the expansion of the company’s biorefinery in Porto Marghera, near Venice. The project will boost total nameplate capacity and enable the production of SAF.

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

International Air Transport Association has announced the release of the Sustainable Aviation Fuel (SAF) Matchmaker platform, to facilitate SAF procurement between airlines and SAF producers by matching requests for SAF supply with offers.

Alfanar on June 20 officially opened its new office in London, further reaffirming its continued investment in the U.K. The company is developing Lighthouse Green Fuels, a U.K.-based SAF project that is expected to be complete in 2029.

Upcoming Events