Pushing Through the Pandemic

July 3, 2020

BY Ron Kotrba

Despite the onset of U.S. lockdowns from the coronavirus pandemic initiated in March, U.S. biodiesel production rose slightly that month over February. Biodiesel production in March hit 151 million gallons, 19 million gallons higher than February’s volumes, according to data from the U.S. Energy Information Administration. In addition to the burgeoning health and economic crisis that began in the U.S. in March, many biodiesel plants that idled production in 2019 due to the prolonged federal tax credit lapse and copious small refinery exemptions (SREs) relieving oil companies of their obligations under the Renewable Fuel Standard had not yet restarted by March, and none of them had received their retroactive tax credit refunds for 2018-’19 from the IRS after the incentive was reinstated in late December.

U.S. biodiesel production volumes this March did not just increase over February despite the health crisis, lack of online operating capacity and absence of working capital, but they also exceeded volumes for the same month in the previous two years. Although an uptick of 19 million gallons in one month may not seem like much, when annualized this small increase is more than 200 million gallons. Historical data also show that U.S. biodiesel production doesn’t typically ramp up until the warmer months.

This slight production increase does not include renewable diesel production nor imports. Interestingly, after two years in a row of U.S. biomass-based diesel imports declining since the peak in 2016 that initiated tariffs on Argentine and Indonesian biodiesel, imports grew 26 percent in 2019 to approximately 414 million gallons, according to EIA data. The majority of biomass-based diesel imports in 2019 came from renewable diesel imports, which since 2015 have been sourced exclusively from Neste’s Singapore plant, and rose 49 percent to a record of more than 260 million gallons last year.

With the economy shut down this spring and stay-at-home orders in effect, the energy complex took a beating. Gasoline consumption dropped by historic levels. In one week alone in late March, gasoline consumption dropped nearly 30 percent compared to the week prior—and it only got worse in April. With gasoline demand down such sharp levels, crude oil storage space was running out. Offshore tankers were being used for storage and the energy crisis came to a head in April when crude oil traded at minus $37 a barrel. One oil and gas industry source told Biodiesel Magazine that the energy complex in April was a “giant dumpster fire.”

As gasoline demand eroded, so did ethanol demand and production. Ethanol plants across the U.S. began shutting down, some permanently and others temporarily, causing a crisis in the heartland. Unfortunately, this came in the wake of one of the worst years for ethanol demand destruction in the U.S. as the EPA—the agency in charge of administering the nation’s Renewable Fuel Standard—granted a record number of SREs under the program, including 31 on a single day last August.

“Ultimately, the ethanol industry is going to go through some of what we in the biodiesel industry have gone through,” Gene Gebolys, founder and CEO of World Energy, told Biodiesel Magazine in late March. “They’ve been limping along with excess capacity, which now must be rationalized. These companies are taking a beating, so the likelihood rationalization will occur in the ethanol industry is pretty high.”

While gasoline and ethanol demand fell to record lows, the diesel-powered supply chain rolled on. “Stuff still needs to get consumed, whether that’s heads of lettuce or toilet paper,” Gebolys said. Biodiesel producers, however, are not unscathed by the crisis. For one, while diesel demand remained steady or even slightly higher through the spring, prices fell, challenging biodiesel blending margins—even with the $1-per-gallon tax credit in effect.

Secondly, under the RFS program, the obligated parties’ (oil companies’) renewable volume obligations (RVOs) are percentages based on projected gasoline demand and production. When actual production and demand fall short, so will the volume of ethanol and biodiesel that are required to be blended in the motor fuel pool. “Demand for compliance credits will be off proportional to the demand for fuel,” Gebolys said.

“The other indirect impact will be on nesting, in the advanced category,” Chris Peterson, president of Hero BX, told Biodiesel Magazine in April. “Specifically, obligated parties deal with the ethanol blend wall by over-blending biodiesel to make up for the shortfall in D6 RINs. Now, with the absolute destruction of gasoline demand, the D6 requirement will be much smaller, so they will not need the excess D4 RINs to make up for this. We’ll feel the pain too in RIN compliance and valuation. Luckily the crisis has not hit us nearly as strong yet as it has the ethanol industry. It’s coming though, hanging over our heads, so we need to be cognizant of this. One piece of recent good news in the midst of all this is the Trump administration is not challenging the Jan. 24 court ruling on SREs, so this should prevent more widespread use and abuse of SREs in coming years. The current issue with gasoline demand will certainly have an impact though, and it will play a role in what biomass-based diesel demand will look like for 2020, for sure.”

Third, what have historically been lower-cost, lower-quality feedstocks such as used cooking oil (UCO) and distillers corn oil (DCO) are rising in value due to waste feedstock demand for low carbon intensity biodiesel and renewable diesel in carbon markets such as California and elsewhere on the West Coast. More recently, with restaurants—and ethanol plants—shutting or slowing down due to the coronavirus pandemic, less UCO and DCO are being produced.

World Energy

When the pandemic hit, Gebolys sent a memo to his staff, saying, “At least we are battle-tested.” Last August, World Energy announced it was shutting down three of its five operating biodiesel manufacturing plants in Georgia, Pennsylvania and Mississippi due to poor market conditions resulting from the prolonged tax credit lapse and EPA’s prolific granting of SREs. Its two other operating biodiesel plants in Hamilton, Ontario, and Houston, Texas, would continue running, along with its renewable diesel refinery in Paramount, California. World Energy’s two nonoperational projects in Sombra, Ontario, and Estill, South Carolina, were effectively put on hold.

“We were bringing our plants back online that we shut down in Georgia, Mississippi and Pennsylvania when this hit,” said Gebolys, referring to the coronavirus pandemic. By late March, the 18 MMgy Georgia biodiesel plant—World Energy Rome at U.S. Biofuels Inc.—was running again. In Natchez, Mississippi, the company was waiting for the annual rise of the Mississippi River to subside before restarting the 72 MMgy facility there, since this impacts supply chains to and from the site. The river was expected to crest in Natchez at 57 feet by early to mid-April. “In any case, the plan has been that the Pennsylvania plant (the 45 MMgy World Energy Harrisburg in Camp Hill) would be the last one up,” Gebolys said.

Despite the pandemic, World Energy’s short-term goals for 2020 include moving forward with the $350 million expansion of its renewable diesel refinery in Paramount, California, which the company announced in 2018, and doubling down on the commitment to making its biodiesel plants as efficient as possible. “There are improvements we can still bring to those assets,” Gebolys said. “I may be in the minority thinking that biodiesel is still quite alive and well. There is this perception that renewable diesel will replace biodiesel. I don’t think so. We will continue to invest in our biodiesel plants, and in biodiesel in general.”

Hero BX

“We’ve had our belts tightened for the better part of two years, watching our pennies, and in the short term we will continue in that mode,” Peterson said in mid-April. According to Peterson, Hero BX owner Pat Black strives to provide stability for his staff to assure them with confidence that, no matter what happens, paychecks will be issued and medical benefits will stay in place.

Like millions of other businesses trying to survive the historic pandemic, Hero BX utilized tools provided in the $2 trillion CARES Act, such as the Paycheck Protection Program. “With the PPP and the added unemployment benefits, hopefully people find the help and support they need,” Peterson said. “The government seems to be working overtime to get dollars in people’s pockets.”

Hero BX’s vendors and customers have helped the company get through the tough period after the tax credit was reinstated last December and after the pandemic hit, but before the tax credit refunds were disbursed in mid- to late April. “Customers are paying us ahead of time while our vendors are stretching payment terms on feedstock purchases,” Peterson said April 9. “They, and we, see a light at the end of the tunnel. It’s just a matter of time.” Peterson said the company is “extremely pleased” the blenders tax credit is in effect three years forward. “We’ve never had that,” he said. “With that confidence and knowing this going into transactions, Mr. Black is [committed] to growing the footprint of our company in this space. And we are taking steps to execute this.”

When asked about if and how Hero BX’s plans for 2020 have been disrupted by the health crisis and economic downturn, Peterson said, first and foremost, he hopes as many people as possible remain healthy, and that this unfortunate pandemic goes away sooner rather than later. He said Hero BX’s flagship biodiesel production facility in Erie, Pennsylvania, a 50 MMgy plant, has remained operational, as well as its 20 MMgy facility in Moundsville, Alabama.

In May 2018, Hero BX began a tolling arrangement with Iowa Renewable Energy in Washington, Iowa. Peterson said IRE was not running April 9, but the facility has been operating sporadically and planned to ramp up and run more consistently by May.

Advertisement

In summer 2018, Hero BX acquired the former Midwest Biodiesel Products facility, an idled 12 MMgy biodiesel plant in South Roxana, Illinois. After Hero BX purchased the plant, the original plan was to make it multifeedstock-capable and slightly increase capacity from 12 to 15 MMgy. But once the company dug into the engineering, it soon realized the cost difference to move from 15 to 20 MMgy was negligible. “We’re finishing final engineering for South Roxana,” Peterson said in April. “As soon as the weather and the pandemic allow, we will be putting construction people to work.” He said the project is planned for completion by end of summer 2021.

In September 2018, Hero BX acquired the former Clinton County Biodiesel facility in Clinton, Iowa, from Tenaska Commodities. Named Hero BX Iowa, the facility was running at drastically reduced production rates last fall, but Hero BX has been retrofitting the site to handle feedstock with higher free fatty acid content. Peterson said the last step to the retrofit is installation of an acid esterification unit, which was scheduled for completion this spring.

With low carbon markets soaking up available recycled feedstock and the health crisis limiting output of UCO, Peterson said Hero BX is making adjustments. “We’re running heavier rations of soy oil,” he said. “That’s what is available. Margins are thin at best, if not slightly negative. They may not cover depreciation costs, but they may slightly cover the cash price paid. It’s a push. We’re not in a big hurry to go crazy and run at capacity. But we are getting the bugs worked out and keeping people working so that when the markets turn positive, we are ready to run. Instead of spending time commissioning and bringing operators off unemployment, we can hit the ground running.”

Peterson said the company is actively searching for new acquisitions. “We are even looking at maybe a new plant build or two,” he said. “We are very bullish on biodiesel. We believe certain separate geographies in the U.S. are underserved and additional production assets are needed.”

W2Fuel

“It’s frustrating, but we’re doing the best we can,” W2Fuel President and CEO Roy Strom told Biodiesel Magazine in early May, referring to the coronavirus pandemic and how the crisis is affecting the restart of his 15 MMgy biodiesel plant in Adrian, Michigan, and 10 MMgy facility in Crawfordsville, Iowa. “We were in the middle of an extended maintenance turnaround anyway, but this has slowed us down a bit and pushed back our restart plan.”

Last August, Strom made the tough decision to idle W2Fuel’s plants after EPA granted 31 SREs and after more than a year and a half without the biodiesel tax credit. When the tax credit was retroactively reinstated in late December for the two lapsed years of 2018-’19 and three years forward through 2022, it “was a welcomed site,” Strom said, adding that W2Fuel is investigating diversification for the future. But at the start of 2020, Strom was cautiously optimistic about the next three years. “I knew going into the start of the year, however, there would still be a bit of a ‘hangover’ on RINs due to the SREs—there wasn’t going to be a lot of RIN demand, which I figured would hold through most of the first quarter,” he said. “So rather than race to start up and get into a price war in a buyer’s market, we made the decision to do some much-needed maintenance and upgrades. We thought it was a perfect time to do it.”

Sacrificing a few months to optimize its biodiesel plants, rather than jumping right in as fast as it could to compete against producers whose margins and quality were more finely tuned from operating consistently over the past 30 months, is “where we were,” Strom said. “Then the pandemic hit.”

The economic fallout from the health crisis and unattractive biodiesel blending margins due to low petroleum prices have taken a hit on demand, Strom said. “It wouldn’t be as bad if we still had contracts in place,” he said. “We were out of position by not having contracts in place early enough. Once heating oil prices dropped, any margins we had [were wiped out]. Until market equilibrium comes back, or until we get our contracts in place, it will be tough.”

He mentioned recent petitions by a handful of governors from petroleum-producing states to waive oil companies’ 2020 RFS obligations. “Oil companies are suffering, and they want complete relief from the RFS,” Strom said. “But we’re in the same boat. If they get relief, it will only shift their pain onto us. When their demand goes down, our demand goes down.”

This spring W2Fuel began the rehire process of the dozens of personnel it laid off in August. “From the time we shut down to [early May], I’ve brought back the first wave,” Strom said. As existing contracts between biodiesel producers and buyers begin to expire, and once the market stabilizes, Strom says he will be in position to lock in supply agreements. “Customers call me on a regular basis, wondering when they can start taking product—and I’m anxious to start giving it to them,” he said.

W2Fuel received its refund from the retroactive biodiesel tax credit April 16, right at the 60-day mark from the date it was filed, according to Strom. “That was a great feeling,” he said. “The vast majority of it had to be paid out. When you go two years without it, you’ve got a lot of tax credit shares you have to pay out [to customers and vendors], not to mention repaying investors back that kept us rolling throughout that time. Then you have to make sure you’ve got the capex in place to keep the machines running for the next three years. And cash reserves.” Strom asserted that he is fully committed to running for the next few years.

Strom said he anticipates his two plants operating in June and running at capacity by July. “If something comes up and stops us—well, I can’t control that,” he said. “We just want to get back to running. And we want to see this virus go away tomorrow.”

Western Dubuque Biodiesel

Biodiesel Magazine spoke with Tom Brooks, general manager of Western Dubuque Biodiesel, in mid-May about how the coronavirus pandemic and the economic downturn are affecting operations at his 33 MMgy biodiesel production facility in Farley, Iowa. “We had to make changes to how we load trucks, and how we deal with drivers and even our own employees,” he said. “A lot of changes have been made because of the coronavirus, and we plan to leave them in place—even after the pandemic is over.”

Brooks said before the virus outbreak, truckdrivers servicing Western Dubuque Biodiesel would enter the office to provide paperwork and had access to the employee breakroom and bathroom facilities. “That’s not allowed anymore,” he said. “We now have a window slot through which they can put the paperwork, and we provide [portable toilets] for them outside to mitigate the possibility of them spreading the virus to our employees. They pretty much stay in their trucks the entire time now.”

It’s not just truckdrivers at Western Dubuque Biodiesel following new social distancing protocols. “Our plant personnel do not go into cross-contaminated areas at all,” Brooks said. “Plant workers stay in the plant, loadout personnel stay in the loadout area, and the same with those in our lab. Lab personnel get their mail through a window slot. This way, if someone has the virus, we are reducing the chances they’ll give it to someone else.” Brooks noted that Western Dubuque Biodiesel implemented these changes before the authorities issued procedures. “We wanted to be overly cautious,” he said.

With spring fuel demand nosediving due to stay-at-home orders, Brooks said he is worried about how this will affect RVOs later this year and next. He is particularly concerned for those biodiesel producers that did not lock in forward sales.

“I sold all of my gallons for 2018 in one day in November 2017,” he said. “The same happened in late December [2019] when the tax credit passed, I sold all my gallons [through most of 2020] at a profit. If you don’t have forward sales, you’re going to take a beating when RIN prices drop.”

Advertisement

Hedging is a necessity to be successful and profitable with forward sales contracts, according to Brooks. “The downside of hedging is you need money to make margin calls,” he explained. “It’s not simple. It’s a complicated process.”

Western Dubuque Biodiesel learned the hard way how to navigate this process in 2010 when several market factors coalesced, ultimately resulting in a shakedown in the biodiesel industry. Today, however, Brooks seems to have mastered the risk management aspect of running his biodiesel plant. “We’re running like gangbusters,” he said.

Before the pandemic hit, Western Dubuque Biodiesel began evaluating a new technology to expand production. This has been put on hold, however, as a result of the health crisis. Board members have opted to redistribute money back to shareholders rather than reinvesting in plant expansion, Brooks said.

Despite operating at high capacity right now, Brooks said the ongoing crisis is giving his employees extra anxiety. “Our employees are smart and in-tune with what’s going on,” Brooks said. “They ask me, ‘Will they change the RVOs?’ and ‘Are we able to run late into this year?’ I don’t know the answers, and that causes anxiety.” The long-term effects of social distancing are also anxiety-producing. “Employees can’t just go to work and come home, go to work and come home,” he said. “If they aren’t going out and enjoying themselves, this has an effect.”

The silver lining of all this, according to Brooks, is that social distancing in some respects is good—from the standpoint of the flu, for instance. “It also allows companies to look at efficiencies and make them better,” he said. “If they can become more efficient in tough times, then they can operate with better margins in great times.”

After 25 years in this industry, Brooks said he’s seen good times and bad. “This too will pass, hopefully sooner rather than later,” he said. “If we keep a positive attitude and weather the storm, we’ll come out on the back end of this better as a company—as an industry. It will not be without pain, there will be growing pains, but we’ll be stronger as an industry if we can weather this together.”

REG

While COVID-19 has had little impact on U.S. diesel demand, the nation’s largest biodiesel producer, Renewable Energy Group, reported in its Q1 financials that the pandemic has significantly impacted feedstock markets. Cynthia Warner, president and CEO of REG, opened the Q1 earnings call April 30 with a discussion of how REG is being impacted by COVID-19. She said REG realized a strong EBITDA in Q1 “despite the considerable market turmoil from the onset of COVID-19 and the freefall in oil prices.”

Warner confirmed REG’s operations are considered to be essential business during the pandemic, and full operations were maintained during the first quarter. She said REG took early action to mitigate the impacts of the pandemic. “We activated our newly formed COVID-19 emergency response team, or ERT, on a high-alert basis in January to begin monitoring the situation and planning for possible contingencies should the virus spread globally,” Warner said. “As the pandemic has unfolded, the ERT guides the company in taking decisive action. They provide our leaders with daily tracking and situational updates, as well as crisis-related services, such as orchestrating the distribution of critical PPE across the company.”

REG has adopted practices in line with CDC guidelines for sanitation, travel restrictions and social distancing, Warner added. This includes moving all office-based operations to remote work. At REG refineries, the company implemented social distancing, extra sanitation practices and proactive quarantine measures.

“In order to reduce anxiety, better support our employees and encourage precautionary quarantine when warranted, we granted all of our employees an extra 80 hours of paid time off as needed in order to deal with health or family issues related to the virus,” Warner said.

She discussed the turnaround that was executed at the company’s Geismar renewable diesel plant in April. “A turnaround under normal circumstances is complex, but especially so in the context of a virus outbreak in Louisiana,” Warner said, adding that the team applied stepped up health control practices including daily health checks for workers, increased PPE requirements, and several carefully planned separation measures. “This enabled us to carry out the essential work with zero safety or health issues to date,” she said.

Warner confirmed that REG has been impacted by fuel demand destruction, but said she believes the company is in a relatively resilient position given the primary use of fuels it produces. While EIA data showed gasoline demand down 50 percent and jet fuel demand down 70 percent, diesel demand was relatively stable during the first quarter.

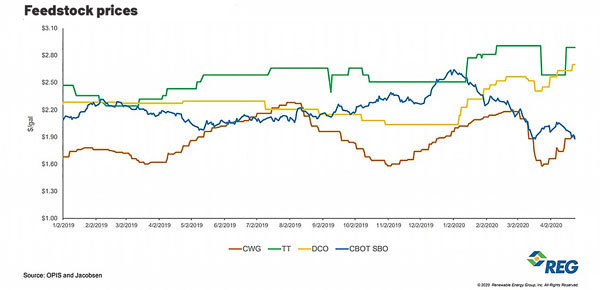

The impact REG experienced most in Q1 related to feedstock disruption. Warner said restaurant closures have resulted in a 45 percent reduction in the availability of UCO. In addition, significant plant closures in the ethanol industry has reduced DCO supply by an estimated 55 percent. Rendering plants are also being impacted by COVID-19, with the supply of animal fats down by an estimated 50 percent. Soybean crush levels, however, have increased. Warner said feedstock pricing has been extremely volatile.

REG produced 121 million gallons of biodiesel and renewable diesel during the quarter, an increase of 4 percent over Q1 2019. Revenues of $475 million were essentially flat, impacted by lower selling prices due primarily to significantly lower ULSD prices, which declined 21 percent; a 14 percent decrease in gallons sold; and a 10 percent decrease in average D4 RIN prices. These negative impacts were mostly offset by a $68 million increase due to the tax credit being in effect throughout Q1.

Hand Sanitizer

The global health crisis has caused a shortage of hand sanitizer. Given two of the main ingredients in hand sanitizer are alcohol and glycerin, both ethanol and biodiesel producers have stepped up to the plate to meet the high demand. In late March, Western Iowa Energy was recognized by the Iowa Renewable Fuels Association for its donation of glycerin to the state of Iowa for use by Iowa Prison Industries to produce hand sanitizer during the national shortage. In mid-April, Brad Wilson, WIE president and general manager, told Biodiesel Magazine, “We are holding in there given that sales demand is down, and values are down. It doesn’t look good given the issue with a few governors wanting the RFS to be waived due to hurting big oil margins. We are lucky to have a strong balance sheet to help weather the storm.”

In Indiana, Integrity Biofuels shut down last November due to poor market conditions and policy uncertainty surrounding the tax credit lapse and SREs. In late May, Biodiesel Magazine reached out to John Whittington, owner of the closed 6.4 MMgy biodiesel plant in Morristown, Indiana, to see if he planned to restart. Whittington said the plant is converting from biodiesel manufacturing to hand sanitizer production to help with the national shortage. More details are expected in June.

In the end, the biodiesel sector is a small part of a big energy complex, and that energy complex will be different when this is all over, Gebolys predicted. “You can’t go through this level of bloodletting and it all be the same afterwards,” he said. “So, as happens in downturns the strong will get stronger, and my guess is there may be a fair bit of consolidation in [the oil] sector too.”

Meanwhile, the U.S. biodiesel sector—an essential service—has fared about as well as any industry could during this global crisis. With the supply chain infused with billions of dollars in retroactive tax credit refunds from the past two years, in addition to federal stimulus money to keep people employed and businesses operating, U.S. biodiesel producers are ready, willing and able to ramp up production and invest in their operations to optimize, expand and deliver like never before.

Author: Ron Kotrba

Editor in Chief, Biodiesel Magazine

218-745-8347

rkotrba@bbiinternational.com

Related Stories

The International Air Transport Association has established the Civil Aviation Decarbonization Organization to manage the IATA-developed Sustainable Aviation Fuel (SAF) Registry when it is released.

LRQA, the leading global assurance partner backed by Goldman Sachs Alternatives, has acquired EcoEngineers, a U.S.-based consulting, auditing and advisory firm with an exclusive focus on the energy transition.

The USDA on March 25 announced it will release previously obligated funding under the Rural Energy for America Program To receive the funds, applicants will be required to remove “harmful DEIA and “far-left climate features” from project proposals.

BIO, in partnership with Kearney, a global management consulting firm, on March 24 released a report showing the U.S. bioeconomy currently contributes $210 billion in direct economic impact to the U.S. economy, excluding healthcare.

Airbus is taking a significant step toward scaling the adoption of sustainable aviation fuel (SAF) by testing a new “Book and Claim” approach. This initiative aims to boost both supply and demand for SAF worldwide.

Upcoming Events