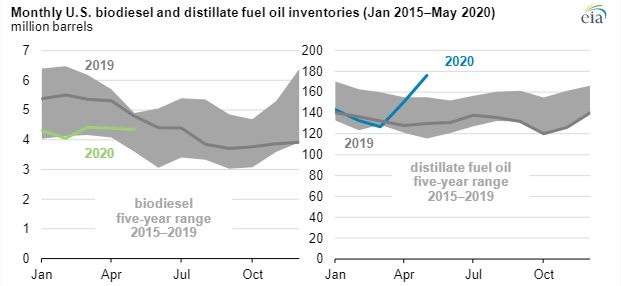

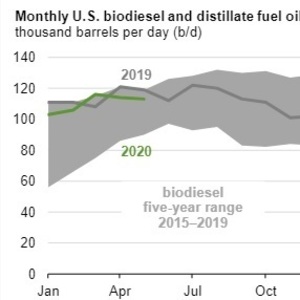

EIA: US biodiesel production largely unchanged since 2019

August 19, 2020

BY U.S. Energy Information Administration

Advertisement

Advertisement

Related Stories

Global digital shipbuilder Incat Crowther announced on June 11 the company has been commissioned by Los Angeles operator Catalina Express to design a new low-emission, renewable diesel-powered passenger ferry.

ATR and French SAF aggregator ATOBA Energy on June 19 signed a memorandum of understanding (MOU) to explore ways to facilitate and accelerate sustainable aviation fuel (SAF) adoption for ATR operators.

Argent Fuels, a leading provider of carbon-saving fuels in the UK, is accelerating its efforts to support a greener future. The expansion of its High Blend Biodiesel will supply to bus, coach, HGV fleets and rail in the south of the UK.

Sprague Operating Resources LLC on June 24 announced it has been selected by the New York City Department of Citywide Administrative Services to supply renewable diesel for its marine fleet, including the iconic Staten Island Ferry.

On June 17, the NYC Department of Citywide Administrative Services and the Department of Transportation announced the start of the Staten Island Ferry’s transition to renewable diesel, marked by the delivery of the first barge of fuel.