Holding Strong: U.S. Biodiesel Producers Surveyed

January 13, 2021

BY Tom Bryan

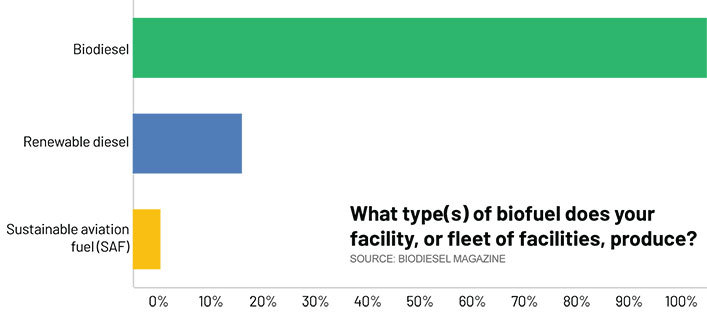

This publication’s survey of U.S. biomass-based diesel producers, conducted in early December, captured responses from qualified personnel at about one-fifth of the industry’s operational facilities. While the number of plants represented in the survey offers a limited picture of the industry and its fleet of 100-plus plants, the sample includes both biodiesel and renewable diesel facilities. In fact, 19% of survey respondents specified some form of involvement with renewable diesel production in 2020, including one facility that produces both renewable diesel and sustainable aviation fuel (SAF). Every respondent was either a biodiesel producer exclusively, or a producer of both biodiesel and renewable diesel/SAF.

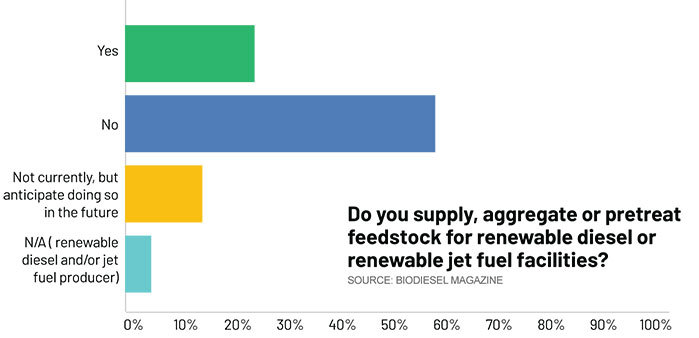

Most respondents with a stated involvement in renewable diesel production were biodiesel plants involved with aggregating or pretreating feedstock for renewable diesel or SAF, not actual renewable diesel plants. In addition to those currently supplying feedstock to renewable diesel producers, several other respondents said they anticipate doing so in the future. This is notable, as a number of U.S. biodiesel plants are, or will soon be, supplying all or some of their product stream as ready-made feedstock for renewable diesel production. In July, for example, Marathon Petroleum Corp. purchased the 50 MMgy Duonix biodiesel plant in Beatrice, Nebraska, with the intention of using the facility to aggregate and pretreat feedstock for renewable diesel production in Dickinson, North Dakota. Other producers are expected to follow suit.

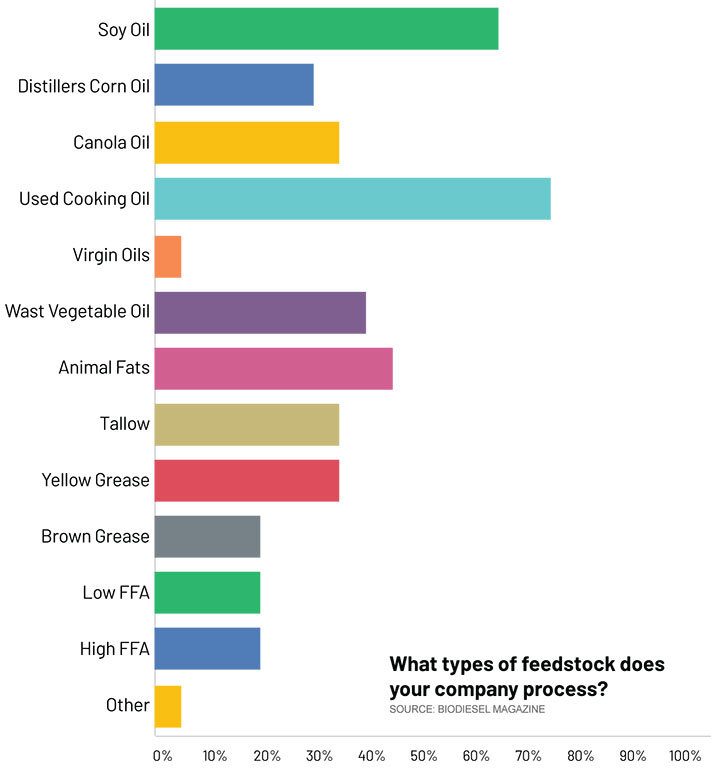

Due to the survey’s sample size, portions of the results may not be reflective of the industry as a whole. Feedstock usage among respondents, for example, appeared to be relatively consistent with known levels of utilization, except for a seemingly disproportionate number of respondents (71%) saying they process used cooking oil. The second most utilized feedstock among survey takers was soy oil, which came in at 62%. Nearly 43% of respondents utilize animal fats as a feedstock, while one-third said their facility processes one or more of the following inputs: waste vegetable oil, canola, distillers corn oil, tallow, and yellow grease. Fewer producers surveyed said they use brown grease, low- and high-FFA feedstocks, and virgin oils. Note: the survey’s feedstock categories were non-exclusive and not volume specific; most respondents selected more than one feedstock.

That industry’s trend toward feedstock diversity may ultimately hit a wall, however, as the biodiesel and renewable diesel industry grows rapidly over the next several years. The U.S. biodiesel industry currently has the capacity to produce 2.8 billion gallons annually, with planned and proposed expansions (predominantly renewable diesel) potentially adding another 5.5 billion gallons of capacity by 2024, according to our page-20 feature, “Renewable Diesel's Rising Tide.”

The NBB, in fact, has a stated vision for the industry to exceed not only 6 billion gallons, but 15 billion gallons by 2050. The organization believes this will be made possible by increased soybean production—driven by the world’s rising demand for protein—which is expected to result in massive amounts of excess soy oil (as much as 5.5 billion pounds more by 2030) becoming available for biodiesel and renewable diesel production.

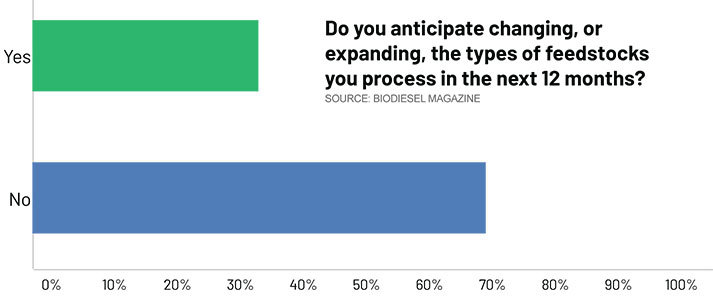

Despite the expectation of increased feedstock homogeny in the future, more than one-third of surveyed producers said they anticipate changing or expanding the type of feedstock they process in the next 12 months, suggesting that 2021 could bring a continued reshuffling of the current biodiesel feedstock balance, with more producers looking to become multi-feedstock capable.

What have historically been lower-cost, lower-quality feedstocks such as used cooking oil (UCO) and distillers corn oil (DCO) have risen in value during the pandemic due to restaurants (UCO suppliers) and ethanol plants (DCO suppliers) shutting or slowing down. DCO production, however, returned to near-normal levels later in 2020, after dropping by more than 50% earlier in the year. Rendering plants, too, were impacted by COVID-19, with the supply of animal fats being cut in half during the onset of the pandemic. Soybean crush levels have actually increased, but pricing has been volatile.

Most (62%) of producers surveyed said their facility was online and operating close to full capacity in early December; another 29% said their plant was operating at a reduced rate; One producer indicated their plant was not operating due to an ongoing expansion project, while another respondent—representing multiple facilities—said some of the company’s plants were running and at least one was not. Nine respondents said their facility was either undergoing, or actively considering, an expansion.

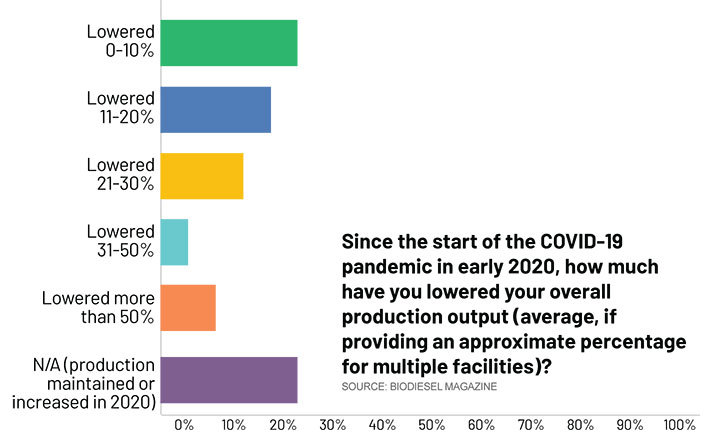

More specific to COVID-19, two-thirds of responding producers lowered their production in 2020, either as a result of the pandemic or not. One-fourth of respondents said their plant lowered production by 10% or less during the pandemic, and one-fifth had dropped production 11% to 20%. Only 15% of survey respondents lowered production more than 30%, with two reporting facilities cutting output by more than half. Interestingly, 25% of respondents had not lowered their production at all during the pandemic, telling Biodiesel Magazine their production levels had either held steady or increased in 2020.

Diesel demand has been resilient during COVID-19, even while gasoline and oil prices crashed hard during the onset of the crisis. Still, biodiesel didn’t escape 2020 unscathed. Blending margins, even with the $1-per-gallon tax credit, were insufficient at times. That, in addition to demand destruction caused by lower overall fuel use, meant biodiesel producers were hit indirectly through a less powerful compliance pull. More generally, low prices at the pump, coupled with harder-to-find, costlier feedstocks, has made COVID-19 more formidable than it initially appeared. In fact, three-fourths of survey respondents lowered their production during the pandemic.

Of those that pulled back on production in 2020, 35% initiated their reduction in March and 20% did so in April or May, as the pandemic worsened nationwide. The earliest reductions were in February, and the latest reported output reduction among respondents was in October. Some survey respondents chose not to indicate what month they first made reductions.

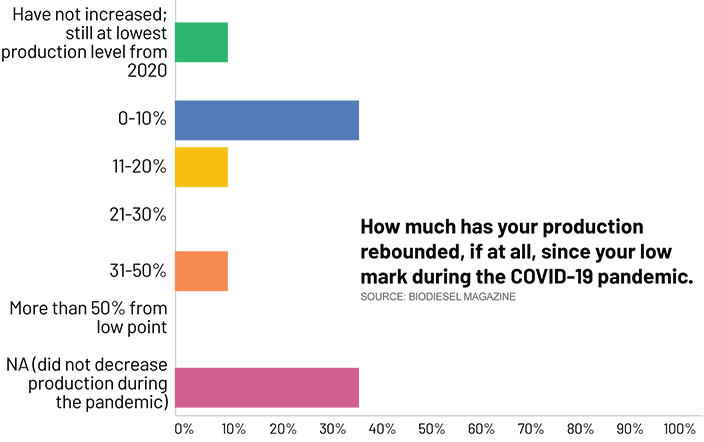

Nearly 85% of all producers that reduced production during the pandemic later restored output partially. While none reported having reinstated output to full capacity by December, 54% had restored production by less than 10%; one-tenth had brought back output by 11% to 20%; and another 10% restored production by 31% to 50%. No plants fell into the 21% to 30% category, and none increased production by more than 50% from their pandemic low.

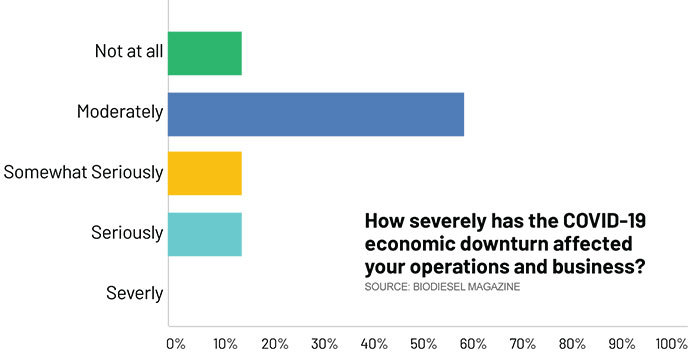

When asked how COVID-19 has affected their business, the majority (57%) of producers said the pandemic has impacted them only moderately. Nearly one-third (29%) said the pandemic has impacted their business somewhat seriously or seriously, while over 14% said COVID-19 has not affected their business at all. Zero producers believed the pandemic severely impacted their business in 2020.

A vast majority of U.S. biodiesel and renewable diesel producers altered their operational protocols during COVID-19, including adjustments to scheduling, meetings, training and other activities. In fact, only 10% of survey respondents said their facility had not made changes to operational protocols during the pandemic. About a quarter (24%) of survey takers reported making “few changes;” more than half (52%) reported “numerous changes;” and just 14% reported drastic changes.

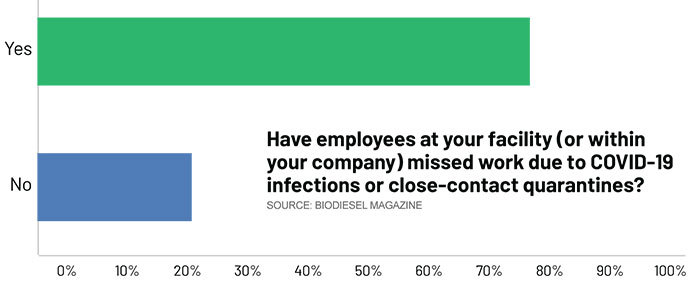

Over three-fourths (76%) of respondents said employees at their plant, or within their company, have missed work due to being COVID-19 positive or because of close-contact quarantines. Many producers (48% of all respondents representing 62% of those reporting COVID-19 positive employees or close-contact quarantines) reported experiencing staffing challenges during the pandemic.

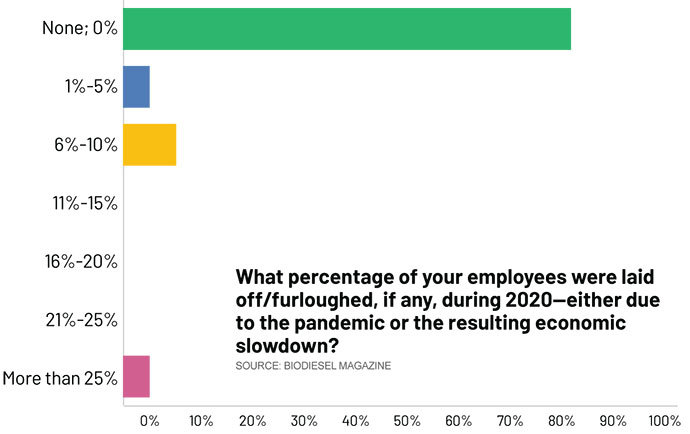

Aside from the obvious challenges of working in an industrial facility during a pandemic, most U.S. biodiesel plant employees have fared well. According to survey respondents, few biodiesel plants laid off or furloughed plant personnel during the pandemic. In fact, over 80% of respondents have not laid off or furloughed a single employee during the health crisis. Of the 20% of respondents that did, one-fifth of them laid off less than 5% of their personnel; 10% laid off between 6% and 10% of their personnel; and another 5% of survey takers laid off more that 25% of their staff during the pandemic.

For many producers, employee morale held strong during the pandemic. In fact, one-third of all responding producers said employee morale at their facility has not been impacted by the health crisis at all. A larger number of respondents (43%), however, said morale has been moderately affected; 14% said morale was somewhat seriously affected; and 10% said it was seriously affected. No respondents said the pandemic had severely impacted the morale of their employees.

Eight out of 10 responding producers said their facility is still hiring, despite the ongoing pandemic, and 62% said their company has not suspended raises or bonuses. Nearly 24%, however, said their facility had, indeed, suspended raises, bonuses, or both, while 14% were unsure if raises and bonuses were still being offered.

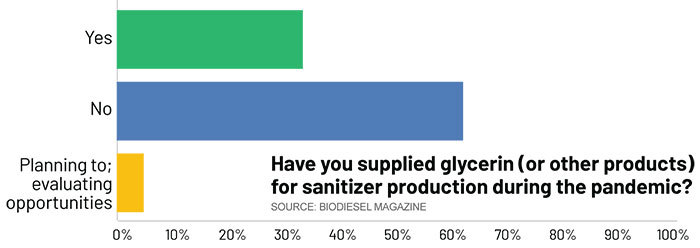

It’s been widely reported that a number of U.S. biodiesel producers supplied glycerin to hand sanitizer manufacturers during the pandemic and, in fact, nearly 62% of survey respondents said they had. Another 5% said they had not supplied glycerin for sanitizer but were evaluating opportunities to do so. As COVID-19 worsened in the spring of 2020, it became clear that there was a global shortage of hand sanitizer. Given that two of the main ingredients in sanitizers are alcohol and glycerin, both U.S. ethanol and biodiesel producers helped meet the demand, selling or donating product locally, regionally and nationally.

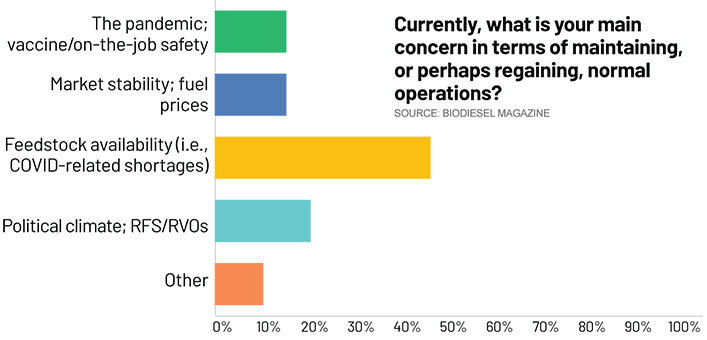

When asked to identify their primary challenge to maintaining or regaining normal operations, a high number of respondents (43%) said “feedstock availability” was their top concern. Nearly 20% said their primary area of concern was policy—maintaining the integrity of the Renewable Fuel Standard, preserving the biodiesel blender’s tax credit (BTC) past 2022, and more. Several respondents (14%) said the pandemic itself (i.e., waiting on the vaccine rollout and keeping plant personnel safe) was their top worry; and another 14% said market stability and fuel prices was their No. 1 issue. Others said completing ongoing construction projects during the pandemic was their top concern.

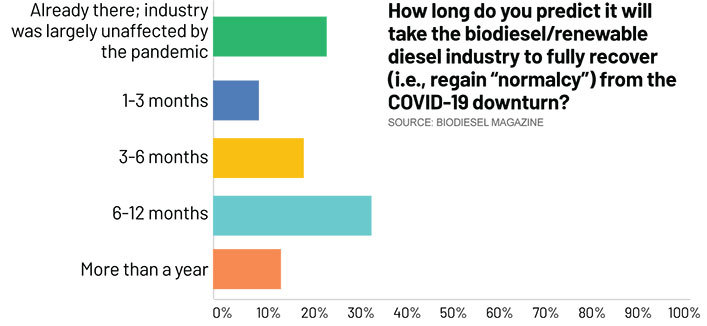

When asked to predict how long it would take for the biodiesel industry to fully recover from the COVID-19 pandemic—if they believed the industry had been harmed by it—a full one-third (33%) of respondents said it would take six months to a year to fully recover. However, the second most common answer, coming in at 24%, was that the biodiesel industry did not need to recover because it was “largely unaffected by the pandemic.” Other survey participants, however, agreed that the industry has suffered from the COVID-19 downturn, if only moderately: 10% said it would take one to three months to regain normalcy; 19% said it would take three to six months; and 14% said it would take more than a year. All said, about half of the respondents believed the industry did suffer damage from COVID-19, and that it would take six months to more than a year for the industry to fully rebound.

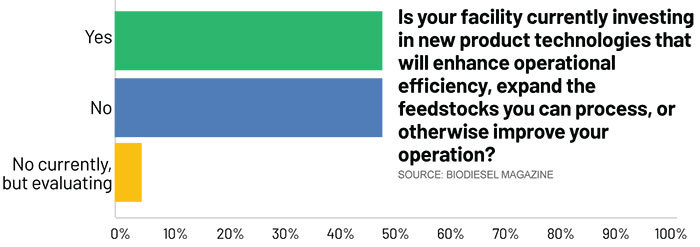

Despite a general feeling among producers that the industry will remain in a state of recovery for several months, over half (53%) said they are currently investing (or considering investing) in new products or technologies that will enhance operational efficiency, expand the feedstocks they can process, or otherwise improve their operation. While some respondents were unwilling to share the details of their planned investments, some did. Investments included: biodiesel blending infrastructure; new pretreatment platforms; wastewater processing equipment; process improvements; enzymatic-assisted feedstock conversion; solar power installation; glycerin processing; and renewable diesel production.

When asked how important the 2020 U.S. presidential election was to the future of the U.S. biodiesel and renewable diesel industry, and why, respondents provided an array of answers. Most, but not all, expressed optimism about the incoming Biden Administration.

At press time in mid-December, President-Elect Joe Biden had just been officially confirmed as the nation’s next president by The Electoral College, assuring that he will be sworn into office on January 20. Generally, survey respondents believed that the Biden Administration will be more “climate focused” and, therefore, more friendly to low-carbon, renewable fuels like biodiesel and renewable diesel.

“This was a very important election,” one respondent said. “We need a president who is mindful of the effects of climate change but also understands the benefits of using biomass-based diesels to reduce GHG, immediately.”

Another said, “Electing politicians that have favorable opinions of renewable fuels is essential to the long-term growth of our industry.”

Others said having a Democrat in office “will advance carbon reduction policies and reduce the likelihood of EPA granting small refinery exemptions (SREs);” and that the Biden Administration poses “less risk” to the biofuels sector.

The EPA’s granting of SREs—and the impact of those actions on RIN values—was echoed by several respondents, as was the importance of fighting for the continuance of the biodiesel tax credit over the next 24 months.

“Our industry still requires some combination of RINs, the BTC, and/or LCFS to be competitive with fossil fuels,” said another.

“We need a more robust RFS and additional clarity on the blender credit program past 2022,” another producer said. “We have already lost 2020 due to COVID and the late return of retroactive BTC payments.”

Other respondents were less specific about the industry’s policy priorities, and more uncertain about the Biden administration. The impact of the new administration on the biodiesel industry will be “neutral,” one respondent said, echoing the sentiment of another who said the impact of the changeover would likely do “nothing” for the industry. One producer said, “I personally think both parties have shown support for renewable energy. So, in regards to the future of the industry, I don't see the election having a large effect either way.”

Beyond the results of the election, the concerns of respondents were predominately related to upholding the integrity of the RFS and assuring the continuance of the BTC past 2022. One producer expressed concern about the RFS “sunsetting,” and another, the “RFS reset,” suggesting that some question the permanence of the nation’s biofuels policy past 2022.

Multiple respondents mentioned their concern about “market size” and “volume increases,” apparent references to planned and proposed renewable diesel capacity entering the market. And several producers indicated the importance of the Biden administration’s unlikeliness to continue issuing unjustified SREs, citing the unprecedented number, and dubious nature, of exemptions granted to refiners during the Trump presidency. As one producer stated, “It was the No. 1 item facing the industry and adding uncertainty.”

Author: Tom Bryan

Biodiesel Magazine

tbryan@bbiinternational.com

701-746-8385

Advertisement

Advertisement

Advertisement

Advertisement

Related Stories

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

Upcoming Events