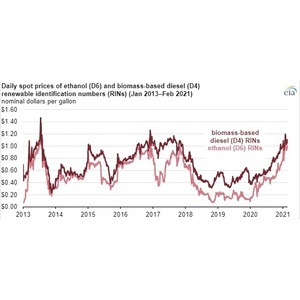

Ethanol, biomass-based diesel RIN prices approach all-time highs

February 25, 2021

BY U.S. Energy Information Administration

The prices of renewable identification number (RIN) credits—the compliance mechanisms used for the Renewable Fuel Standard program administered by the U.S. EPA—have been steadily rising in recent months and are approaching their highest nominal levels in the history of the program.

Renewable fuel producers generate RINs that obligated parties, including refiners and importers of gasoline or diesel, obtain and then ultimately retire for compliance. Market participants can trade RINs, and this trading creates prices that the U.S. Energy Information Administration tracks.

The RFS program is a federal program that requires the nation’s transportation fuel supply to include renewable fuels. Each year, the EPA issues RFS rulemakings with volume requirements for certain renewable fuel categories, and it sets those volumes through annual renewable volume obligations (RVO). RVOs are the volumetric biofuel targets for obligated parties such as refiners and importers of petroleum-based gasoline or diesel fuel.

Advertisement

Advertisement

The price of RIN credits reflects compliance and trading activity in the RFS and can be either used for compliance or traded in the secondary market, allowing market participants to capture the value of RIN credits, which can encourage increased biofuel consumption when RIN prices increase. The corn ethanol (D6) RIN price reached more than $1.00 per gallon (gal) in late January and early February 2021, the highest price since 2013, when the D6 RIN price reached an all-time high. Similarly, the biomass-based diesel (D4) RIN price, applied to volumes of both biodiesel and renewable diesel fuels, approached $1.20/gal during the same period.

Although the RFS renewable volume obligations for 2021 have yet to be released, RIN prices have been increasing because of limited fuel production as a result of lower fuel demand related to responses to COVID-19, fewer approved new small refinery exemptions (SRE) since 2018, and uncertainty around future RFS levels.

Advertisement

Advertisement

In the past, RIN credit prices increased, generally, because of two situations: when the cost of a biofuel was higher than the petroleum fuel it was blended into or when RFS targets increased more than market-driven biofuel consumption. In the second situation, the higher-value RINs encourage additional, more costly blending beyond normal market levels.

The recent price increase is likely attributable to the first situation. In spring 2020, as transportation demand was quickly falling, wholesale gasoline prices fell by more than wholesale ethanol prices, causing ethanol D6 RIN prices to increase enough to encourage increased ethanol blending. Similarly, diesel fuel prices fell significantly lower than biomass-based diesel (both biodiesel and renewable diesel), driving biomass-based diesel D4 RIN prices higher to encourage blending costlier biofuels.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

Upcoming Events