REG reports first quarter financial results

May 4, 2021

BY Erin Krueger

Renewable Energy Group Inc. released first quarter financial results on May 3, reporting strong financial results despite the ongoing COVID-19 pandemic, extreme weather, and volatility in feedstock and renewable identification number (RIN) prices.

"We are pleased with the strong financial performance in the first quarter," said Cynthia (CJ) Warner, president and CEO of REG. "There was significant volatility, as we saw both feedstock and RIN prices rise rapidly. Strong operations and commercial optimization within this dynamic market environment enabled us to deliver exceptional financial results well in excess of our guidance.

Advertisement

"We continue to see signals for growing demand for lower carbon fuels and believe we are well positioned to help drive the energy transition and deliver additional value for our customers and shareholders,” she added.

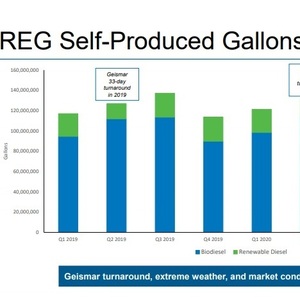

REG completed a 31-day turnaround at its renewable diesel plant in Geismar, Louisiana, during the first quarter, Warner said. The turnaround was executed safely, on time and within budget, she added. In addition to the 2021 planned maintenance and upgrade projects for the Geismar turnaround, Warner said the company also completed two carryover projects from 2020 that were deferred last year due to workplace challenges associated with the early days of the pandemic. The improvement projects completed as part of the turnaround are expected to increase the plant’s competitive advantage for years to come, she said, including proprietary improvements that are expected to extend the time between turnaround, increase throughput and decrease costs per gallon. Warner estimated the turnaround reduced renewable diesel production by approximately 8 million gallons for the quarter.

First quarter biodiesel production was also down by approximately 3 million gallons at the company’s European facilities. Warner primarily attributed the reduction to COVID-related international supply disruptions of used cooking oil. Biodiesel production at REG’s North American facilities was down an estimated 11 million gallons during the first quarter due to continued margin optimization efforts and unplanned downtime caused by extreme cold, she added.

Advertisement

Despite those declines in production, Warner said gallons sold were down only 4 percent when compared to the first quarter of 2020 while revenue was up 14 percent.

REG reported first quarter revenues of $539.74 million, up from $472.96 million reported for the same period of last year. Net income available to common stockholders was $38.58 million, down from $73.16 million. Adjusted EBITDA was $56.06 million, down from $88.73 million reported for the first quarter of 2020.

Related Stories

Neste and DHL Express have strengthened their collaboration with the supply of 7,400 tons (9.5 million liters) of neat, i.e. unblended, Neste MY Sustainable Aviation Fuel to DHL Express at Singapore Changi Airport starting July 2025.

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

Upcoming Events