Neste reports continued strong demand for renewable diesel

July 27, 2021

BY Erin Voegele

Neste released financial results for the first half of 2021 on July 27, reporting solid performance for its renewable products segment. Demand for renewable diesel was robust, but feedstock markets were tight, the company reported.

Peter Vanacker, president and CEO of Neste, said that the company’s renewable products business segment continued to be resilient during the first half of the year and was able to maintain a healthy sales margin.

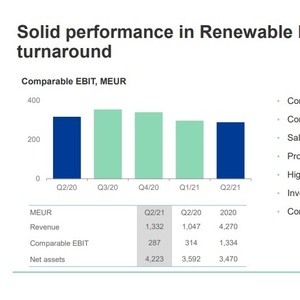

Neste’s renewable products segment posted a comparable operating profit of EUR 287 million for the second quarter he said, down from EUR 314 million during the same period of last year. “The renewable diesel demand was robust, but the feedstock markets remained very tight as expected,” he added. “We were able to reach a healthy comparable sales margin of USD 700/ton. Our sales volumes were 732,000 tons, impacted by the scheduled Porvoo units’ maintenance and postponement of some end-June deliveries. The Porvoo maintenance had a negative impact of approximately EUR 40 million on the segment’s comparable operating profit. Feedstock mix optimization continued, and the share of waste and residue inputs increased to 93 percent.”

Advertisement

Vanacker said work to expand renewables capacity at the Singapore refinery is proceeding according to schedule. “It should expand our annual renewables production capacity by up to 1.3 million tons during the first quarter of 2023,” he continued.

Neste is also progressing with work to increase the production capacity of sustainable aviation fuel (SAF) at the Rotterdam facility. That expansion project will allow the refinery to produce up to 500,000 tons of SAF annually by the end of 2023. “We are now in the definition phase in preparation for a possible next renewable products refinery in Rotterdam, and aim at investment decision readiness late this year or early 2022,” Vanacker said.

Advertisement

Moving into the third quarter, Neste expects renewable diesel sales to be lower due to a large scheduled maintenance project scheduled at the Singapore refinery. The company also expects waste and residue markets to remain tight. Third quarter sales margins are expected to remain healthy, but lower than in the second quarter.

Renewable products comparable operating profit for the second quarter was EUR 287 million, down from EUR 314 million. Neste attributed the decrease to the weaker U.S. dollar and lower sales volumes. For the first six months of 2021, Neste rereported its renewable products segment achieved operating profit of EUR 580 million, down from EUR 644 million. The reduction is attributed primarily to the weaker U.S. dollar.

Neste reported revenue of EUR 3.022 billion for the second quarter of this year, up from EUR 2.542 billion during the same period of last year. Revenue for the first half of 2021 was at EUR 6.155 billion, up from EUR 5.842 billion reported for the same period of 2020.

Related Stories

Luxury North Dakota FBO, Overland Aviation—together with leading independent fuel supplier, Avfuel Corp.— on May 19 announced it accepted a 8,000-gallon delivery of sustainable aviation fuel (SAF) on May 12.

May 21 marks the official launch of the American Alliance for Biomanufacturing (AAB), a new coalition of industry leaders committed to advancing U.S. leadership in biomanufacturing innovation, competitiveness, and resilience.

Neste and FedEx, the world’s largest express cargo airline, have agreed on the supply of 8,800 metric tons (more than 3 million gallons) of blended Neste MY Sustainable Aviation Fuel to FedEx at Los Angeles International Airport (LAX).

The U.S. EPA on May 14 delivered two RFS rulemakings to the White House OMB, beginning the interagency review process. One rule focuses on RFS RVOs and the other focuses on a partial waiver of the 2024 cellulosic RVO.

The U.S. EPA on May 15 released data showing nearly 1.79 billion RINs were generated under the RFS in April, down from 2.09 million generated during the same month of last year. Total RIN generation for the first four months of 2025 was 7.12 billion.

Upcoming Events