REG moves into construction phase of Geismar expansion

August 5, 2021

BY Erin Krueger

Renewable Energy Group Inc. released second quarter financial results on Aug. 4, reporting the company’s board of directors has approved plans to expand and improve its renewable diesel biorefinery in Geismar, Louisiana.

REG said the project, which is designed to boost production capacity at the Geismar facility from 90 MMgy to 340 MMgy, is on track to be mechanically complete in 2023, with full operations in 2024. The improvement project will also improve operational reliability and logistics. REG said the expected capital cost for the Geismar project is approximately $950 million. The company has received all required permits to proceed, secured necessary project funding, and agreed upon a long-term lease for marine terminal and logistics services.

Advertisement

Advertisement

Regarding second quarter operational and financial performance, REG reported increased revenues despite a drop in gallons sold. "Our flexible feedstock capabilities, diverse production fleet, and commercial optimization systems helped us to manage through the volatile market conditions of the second quarter and deliver strong financial results," said Cynthia (CJ) Warner, president and CEO of REG. "This solid performance, alongside our successful navigation of the many external challenges of the past year, reinforces our optimism about the future."

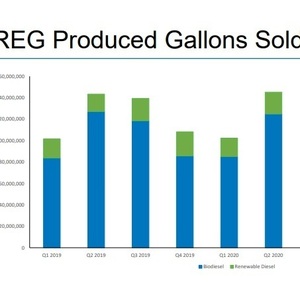

REG sold 163 million gallons of fuel during the second quarter, down 11 percent when compared to the same period of last year. Self-produced renewable diesel sales increased by 2 million gallons, with sales to Norway down 7 million gallons. Third party renewable diesel sales were up 2 million gallons. In addition, REG said self-produced North American biodiesel sales decreased by 15 million gallons, while sales of lower margin petroleum diesel decreased by 6 million gallons.

Advertisement

Advertisement

REG produced 132 million gallons of biodiesel and renewable diesel during the second quarter, flat when compared to the same period of 2020. The company delivered a record quarter of production at four facilities, including the Geismar facility, where renewable diesel production was up 8 million gallons. European biodiesel production was up 2 million gallons, or 14 percent, due to record production at the Emden, Germany, facility. REG said those production increases were offset by a decline of 10 million gallons in North American biodiesel production, due largely to production optimization.

Revenues reached $816 million, up from $544 million. Gross profit was $124 million, or 15 percent of revenues, compared to a gross profit or $23 million, or 4 percent of revenues, reported for the same period of last year. Operating income was at $88 million, up from an operating loss of $6 million in the second quarter of 2020. GAAP net income available to common stockholders was $79 million, or $1.62 per share, on a fully diluted basis, compared to GAPP net loss available to common stockholders of $2 million, or 4 cents per diluted share on a fully diluted basis. Adjusted EBTIDA was $103 million, compared to $6 million.

Related Stories

The U.S. Energy Information Administration maintained its forecast for 2025 and 2026 biodiesel, renewable diesel and sustainable aviation fuel (SAF) production in its latest Short-Term Energy Outlook, released July 8.

XCF Global Inc. on July 10 shared its strategic plan to invest close to $1 billion in developing a network of SAF production facilities, expanding its U.S. footprint, and advancing its international growth strategy.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events