Ever-Evolving Biodiesel Technology Developments

PHOTO: BDI-BIOENERGY INTERNATIONAL AG

December 30, 2014

BY Ron Kotrba

The biodiesel technology spectrum is vast and diverse, ranging from new techniques demonstrated in the lab to optimization efforts proven industrially. Even so-called conventional chemical processing is riddled with original approaches and unique twists. A cookie-cutter industry biodiesel is not. While too many technologies exist in this field to report on, Biodiesel Magazine offers an overview of several emerging biodiesel process developments or existing optimization techniques that have made headlines and headway recently—some more developed and commercially tested than others.

A unique microwave process to convert used cooking oil (UCO) and other tested feedstock to biodiesel with methanol and a solid catalyst, strontium oxide (SrO), is being developed by Jiunn-Der Liao, professor, and faculty of National Cheng Kung University, Taiwan. Aharon Gedanken, professor emeritus of chemistry, Bar-Ilan University in Ramat-Gan, Israel, invited by Liao, is cooperating with NCKU faculty in conducting the research and scaling up the process. Liao says with Gedanken’s help, NCKU is setting up a converting station at its An-nan campus. “Our goal is to introduce the station to companies in Taiwan or abroad that are in the bioenergy business,” Liao says, adding that they have received inquiries from Thailand, Malaysia and at least three Taiwanese enterprises. The three-year project began in August 2013. With the system designed by the NCKU team, a machine has been built by a company in Taiwan. “The machine is made in Taiwan and working very well, comparing it with similar ones I have at home,” Gedanken says.

Thus far, the lab-based process yields 3 liters per hour, and the only cleanup performed on the UCO is removal of large contaminants. “The reaction is very fast and full conversion is finished in 10 seconds,” Gedanken says. “The role of the microwave oven is not only heating. Microwave radiation affects also the transition state of the reaction, and lowers the activation energy. Therefore, the reaction is much faster.” Gedanken says they are using SrO for catalysis because they sought a base that doesn’t dissolve and isn’t poisonous. “Potassium hydroxide is more difficult to reuse and it also produces an unwanted salt as a byproduct,” he adds.

A patent is pending in Taiwan. “We asked to protect the flow process using nanoparticles of SrO,” Gedanken tells Biodiesel Magazine. “That will guarantee a full conversion to biodiesel even at a fast flow rate.” Keeping the SrO nanoparticles in the microwave is a problem Gedanken hopes to overcome. Capital costs for a microwave oven enabling a flow system to convert 100 kilograms (roughly 29 gallons) of UCO a day would cost $60,000 to $100,000, he adds.

Methes Energies recently introduced its new biodiesel pretreatment process centered on a noncorrosive liquid catalyst it calls PP-MEC. Feedstock with up to 70 percent free fatty acids (FFA) and less than 0.2 percent moisture is combined with methanol and 1,000 parts per million (ppm) of PP-MEC catalyst in a high-pressure reaction vessel. The process temperatures are often less than 480 degrees Fahrenheit with pressures around 800 pounds per square inch (psi). The yield after the first step is 92 percent biodiesel, 7 percent monoglycerides, 2 percent diglycerides and glycerin with no salts or soaps. The reaction time is five to 15 minutes. After glycerin separation, 1 percent sodium methylate by weight is added for base transesterification of the remaining glycerides. For producers using distillers corn oil (DCO) feedstock from ethanol plants, the PP-MEC pretreatment process lightens the color and requires no wax removal or degumming. The separation phase following pretreatment is easy because PP-MEC does not create an emulsion layer. The company says its new pretreatment process can save biodiesel producers 8 to 10 percent on overall catalyst costs. Dorf Ketal Speciality Catalysts LLC is the manufacturer of PP-MEC catalyst.

“There’s been a lot of interest, but the challenge with this new technology is we don’t have a pilot conversion plant running yet,” says Nicholas Ng, president and co-founder of Methes Energies. “We can show the process on lab scale, but people want to make sure it works on a higher volume.” Ng says his company is working with a plant to prove out the process on a commercial scale. Hardware is on track for installation early this year.

The PP-MEC process originally revealed utilizes high pressure and high heat. Since then, Methes has developed a low-pressure, high-heat version tailored for FFA esterification and removal of waxes and color from DCO. “This may have good applications for DCO producers who don’t have the money to invest in a full biodiesel plant,” Ng says. The low-pressure, high-heat process will improve DCO quality while making small amounts of biodiesel from FFA. The low-pressure process operates at 240 psi instead of 800 psi, and capital costs to process 1.3 MMgy of DCO would be around $500,000, Ng says—three times less than the high-pressure version.

In November, Johnson Matthey Davy Technologies was recognized at the annual Institution of Chemical Engineers (IChemE) Awards by winning the IChemE Sustainable Technology Award for its development of a reactive distillation process for biodiesel production. The technology is geared toward converting low-quality feedstocks to biodiesel efficiently and economically.

The reactive distillation process begins with conventional oil hydrolysis to produce fatty acids plus a clean water/glycerol stream. “The molten fatty acid then passes to the esterification reaction column,” the company states. “The preheated liquid fatty acids feed to the top of the esterification reaction column, in which they react with methanol vapor to form their equivalent methyl fatty esters. The reaction proceeds in the presence of a proprietary solid catalyst, achieving complete conversion to the methyl ester product. The water produced in the esterification reaction is stripped out of the methyl esters by excess methanol.” Following this is methanol recovery and biodiesel purification. Michael Winter, technology manager at Johnson Matthey Davy Technologies, says the technology is a valuable, attractive and sustainable option for its customers, “and being recognized in this way is a great achievement for everyone involved.”

Enzymes

Perhaps the most promising new technology being deployed commercially today is enzymatic production. While Biodiesel Magazine has covered enzymatic production quite extensively over the past several years—from inception by pioneers such as Novozymes and Piedmont Biofuels, to the technical descriptions of how the process works—several business and technical developments have been made in the past year.

Early last year, Blue Sun Biodiesel in St. Joseph, Missouri, and Viesel Fuel LLC in Stuart, Florida, announced the full-scale production of enzymatic biodiesel in partnership with Novozymes. The enzyme maker has also worked with WB Services LLC on the Illinois-based biodiesel project co-located with Adkins Energy’s ethanol plant, featuring enzymatic and chemical processing. Adkins Energy began biodiesel production last fall and is recognized as the first producing biodiesel plant co-located with an ethanol refinery. Novozymes is also working with Buster Biofuels in San Diego. Even though Novozymes had been making headlines with a few select producers, the process wasn’t considered market-ready—until now.

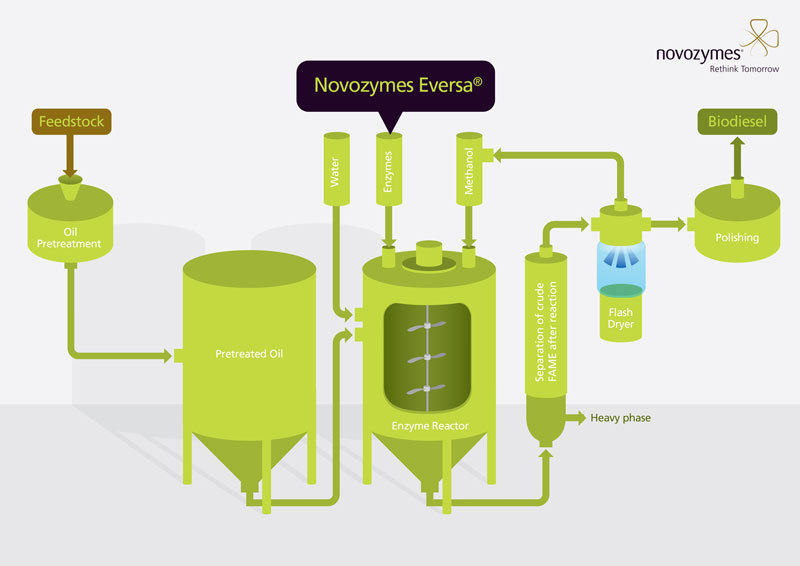

In December, Novozymes announced it is making its Eversa enzymatic biodiesel solution commercially available. “The idea of enzymatic biodiesel is not new, but the costs involved have been too high for commercial viability,” says Frederik Mejlby, marketing director for Novozymes’ grain processing division. “Eversa changes this and enables biodiesel producers to finally work with waste oils and enjoy feedstock flexibility to avoid the pinch of volatile pricing.”

Global biodiesel plant builder Desmet Ballestra says enzymatic processing will prove popular with biodiesel producers. “The enzymatic process is simple and does not need much pretreatment,” says Marc Kellens, group technical director at Desmet Ballestra. “It is the best alternative for modifying existing plants to enable them to incorporate difficult-to-convert oils. In conventional plants, 80 to 85 percent of the costs of biodiesel are linked to feedstock cost. So the more you are able to convert a cheaper feedstock into biodiesel, the more profitable the business is. The enzymatic process makes it possible to convert waste oils into biodiesel with relatively low capital expenditure by retrofitting a plant.”

Kellens says he believes the enzymatic process is a more direct and less complicated one, and will initially be used as an add-on to the existing biodiesel market to make use of cheaper waste oils. “A small number of plants has been producing biodiesel from waste oils using existing technologies,” Mejlby adds. “But this has not been cost-efficient until now, broadly speaking, as the waste oils have had to be refined before being processed using chemicals.” The enzymatic process eliminates the need for sodium methoxide.

Biodiesel production using liquid enzymes has, thus far, involved batch reactions. Progress has been made recently, however, in continuous flow enzymatic production. In collaboration with Tactical Fabrication of Dublin, Georgia, and Novozymes of Denmark, a novel biodiesel production technology developed by Viesel Skunk Works LLC will soon be offered commercially. The system features a continuous flow enzymatic reaction process that also eliminates sulfur from biodiesel when low-grade feedstocks such as brown grease are used.

The patent-pending technology by VSW is a design of several continuously stirred tank reactors (CSTRs). It provides for a complete reaction with the potential of using fewer enzymes than in single-step batch systems, according to VSW.

The simpler design contains several CSTRs and skid-mounted injection pumps, according to Brent Chrabas, Viesel Fuel quality engineer. Each CSTR can be easily switched to batch operation mode in the case of accidental interruption of continuous mode. Intensive caustic washing in the current enzymatic process for FFA removal is overcome by using resin columns to convert FFA to esters. Chrabas says the continuous process is stable and five times faster than conventional batch processing. The company says capital costs for its continuous flow system with single-use liquid enzymes will be lower than batch.

The Novozymes process is based around liquid enzymes, but immobilized enzymes—those fixed to resins—by companies such as Advanced Enzymes Technologies Ltd. and TransBiodiesel Ltd. have also been making market headway. Biodiesel Experts International LLC has built and shipped several small-scale, skid-mounted enzymatic units to points across the globe—from Dallas to Hong Kong—featuring Advanced Enzymes’ immobilized enzymes. Advanced Enzymes began in India more than 50 years ago and is the largest enzyme producer in Central Asia. BEI had formerly partnered with Israel-based TransBiodiesel.

A joint venture partnership was recently announced between TransBiodiesel and Virginia-based project Appalachian Biofuels LLC for production using immobilized enzymes. “Initially we both are going to invest $3.5 million for plant construction,” Ahmed Tafesh, chief technology officer for TransBiodiesel, tells Biodiesel Magazine. “The plant will be built on modular basis starting from 9 MMgy of production capacity and within 12 months reach 28 MMgy of biodiesel. This is why the investment is relatively low at the beginning. Both companies will be sharing expenses such as feedstocks, chemicals, immobilized enzymes and working capital.”

Which enzyme approach—liquid or immobilized—is better depends on who is asked. The differences, according to Ernie DeMartino, BEI president, are: liquid enzymes can be difficult to separate from glycerin and experience some loss, while reaction time can take 20 to 24 hours, and liquid enzymes require refrigeration. Immobilized enzymes, DeMartino says, allow for continuous production as they require no separation, don’t incur loss, reaction time in a stirred reactor is only four hours and they can be stored at 70 degrees Fahrenheit. VSW’s new process now allows for continuous production too, however, as noted. Finally, DeMartino says liquid enzymes cannot be recovered from high-FFA material whereas immobilized enzymes require no recovery since they are fixed to a carrier and held in stirred reactors.

Stu Lamb, president and CEO of Viesel Fuel LLC, gives several reasons why his companies chose liquid versus immobilized enzymes. “The manufacturer could never guarantee the life of the enzymes, or the total gallons that the enzymes would react,” he says. “Also, there is an extremely high initial cost for the enzyme package. If this package is damaged in any way during initial startup, the entire package of enzymes needs to be replaced at considerable cost and the plant is inactive awaiting replacement.” He adds, “The manufacturer is foreign-based and, therefore, any disputes for enzyme performance would be adjudicated abroad and not in U.S. courts. Also, there is no U.S.-based enzyme replacement in inventory.”

Proven Optimizations

One proven biodiesel process optimization technology is the use of ultrasonics to vastly increase surface area for quicker reactions. Steven Myers, vice president of engineering for Ultrasonic Power Corp., says UPC’s reactors are based on its patented Vibra-bar transducer technology. “These transducers are directly bonded to the radiating surface providing long ultrasonic exposure times compared to the systems that are based on sonicator-type designs,” he says. “This also provides opportunities for higher flow rates. Our reactors are also designed and manufactured in our facility in Freeport, Illinois. We have been providing this technology for more than 40 years and are well-respected in this industry.”

Myers says one of UPC’s recent customers reports single-pass conversions greater than 99 percent with the UPR 1000S model. A few systems in place using UPC’s ultrasonics include Solvent Systems Inc. and Mid-South Technical College. Myers says UPC’s ultrasonic systems are easy to install and maintain, and since they are made in the U.S., support is easily attainable.

“Our technology team is talented and ready to match our technology with applications that have yet to be discovered or developed,” Myers says. “We are flexible enough to be able to work with experts in other fields to come up with solutions that could revolutionize the industry.” Myers says there are closely held secrets in biodiesel production regarding employment of ultrasonics in existing designs. “Most customers will only provide basic end results so it is difficult provide information to other customers to help them succeed,” he says. “I believe the industry is prime for someone to step up and standardize a process or machine that would revolutionize the industry. I believe there are investors and entrepreneurs that are waiting for this to happen. I talk to them weekly.”

Austria-based BDI-BioEnergy International AG is a market leader in biodiesel process technology, in addition to retrofit and optimization plays. The company has retrofitted and optimized biodiesel refineries across the world, including projects for the largest U.S. biodiesel producer, Renewable Energy Group Inc. BDI’s most recent U.S. optimization project is Crimson Renewable Energy LP.

BDI is often contracted to expand a plant’s feedstock choices and increase capacity, yield and product quality. The company’s RetroFit program incorporates various units, according to Hermann Stockinger, vice president of global sales, including its FAT Pretreatment unit, which utilizes a Flottweg centrifuge for feedstock preparation and cleaning; Advanced Esterification for feedstock with up to 70 percent FFA; the catalyst-free High FFA Esterification process for feedstock with up to 99 percent FFA; and the ECO or High-end Distillation options, with the latter being a multistage process developed for difficult waste materials such as low-quality tallow or trap grease, with a focus on sulfur reduction and achieving the highest yield possible. Several years ago BDI also developed its RepCat process for poor-quality feedstock, which is a reusable catalyst system that leaves no catalyst residues in the product, Stockinger says, adding that RepCat provides simplification of product purification, requires less production costs and produces a higher-quality end product and salt-free, technical-grade glycerin.

“The range of services included in the BDI RetroFit program comprises all the steps that are required to successfully optimize an existing biodiesel plant,” Stockinger says. This includes status evaluation, pre-engineering, offer preparation, authorization procedure, engineering and delivery, implementation, commissioning and, finally, after-sale service. In addition to Flottweg, some of BDI’s other equipment partners include Westfalia (centrifuges), Endress & Hauser for instruments, AlfaLaval and Tranter for heat exchangers, and UIC Germany—BDI’s daughter company—for distillation and vacuum systems.

Stockinger has his own opinions on new technologies in the space. “For customers, it will be extremely risky to be the guinea pig when investing in new technologies with seeing this technology working only on a lab scale,” he says. “Our investigations have shown that other, so-called new and innovative technologies are not applicable to process stability and efficiency when dealing with low-quality feedstock in industrial scales.”

Author: Ron Kotrba

Editor, Biodiesel Magazine

218-745-8347

rkotrba@bbiinternational.com

Advertisement

Advertisement

Related Stories

Biodiesel capacity in the U.S. and Canada dipped slightly stable in 2024, with several renewable diesel producers reporting headwinds and lower margins alongside a drove of SAF projects in various stages of development.

The IEA’s Task 39 group has new research regarding the development and status of the sustainable aviation fuel industry.

The U.S. EPA on Nov. 16 released updated RIN data, reporting that nearly 2.11 billion RINs were generated under the RFS in October, up from 1.81 billion generated during the same month of last year.

Conestoga to host SAFFiRE cellulosic ethanol pilot plant

Conestoga Energy and SAFFiRE Renewables LLC announced on Nov. 16 their agreement for Conestoga to host SAFFiRE’s cellulosic ethanol pilot plant at Conestoga’s Arkalon Energy ethanol facility in Liberal, Kansas.

Officials at Calumet Specialty Products Partners L.P. discussed the company’s proposed plans to boost sustainable aviation fuel (SAF) production at its Montana Renewables biorefinery during third quarter earnings call, held Nov. 9.

Upcoming Events