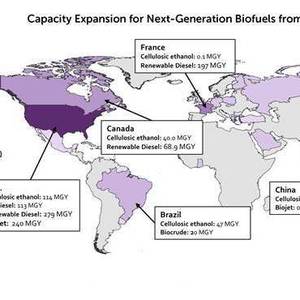

Report: Biofuels capacity to grow to 61 BGY in 2018

Image: Lux Research

September 22, 2015

BY Lux Research

Global biofuels capacity will grow to 61 billion gallons per year (BGY) in 2018, up from 55.1 BGY in 2014. Ethanol and biodiesel will continue to dominate with 96 percent of the capacity in 2018, but novel fuels and novel feedstocks will be major drivers of capacity growth, according to Lux Research.

Novel fuels and novel feedstocks will grow at a rapid 27 percent and 16 percent compound annual growth rate (CAGR), respectively, through 2018. Ethanol and biodiesel will grow at a slower 2 percent rate but will reach capacities of 40 BGY and 19 BGY, respectively.

“While ethanol and biodiesel dominate global biofuel capacity today, limits on their growth mean that novel fuels like renewable diesel, biojet fuel and biocrude are crucial to the future of the industry,” said Victor Oh, Lux Research associate and lead author of the report titled, “Biofuels Outlook 2018: Highlighting Emerging Producers and Next-generation Biofuels.”

Advertisement

“Producers also need to tap into novel feedstocks like waste oils, nonedible biomass, and municipal solid waste to push the industry beyond food-vs.-fuels competition,” he added.

Lux Research analysts studied growth of biofuels utilizing an alternative fuels database of more than 1,800 production facilities globally. Among their findings:

-Waste oils will dominate next-generation biofuels. With a 52 percent share, biodiesel made from novel feedstock, specifically waste oils, will lead novel fuels capacity in 2018. Cellulosic ethanol and renewable diesel follow with 19 percent and 18 percent, respectively.

-Americas continue dominance. With a 64 percent share of global biofuels capacity, the Americas are a dominant force. The region, led by the U.S. and Brazil, also leads in utilization of global production capacity with 86 percent, much higher than the global average of 68 percent in 2014.

Advertisement

-Eight countries are biggest emerging producers. China, Indonesia and Thailand in Asia; Colombia and Argentina in the Americas; and Portugal, Poland and France in Europe are the biggest emerging production centers for biofuels after the U.S. and Brazil.

The report is part of the Lux Research Alternative Fuels Intelligence service.

Related Stories

U.S. operatable biofuels capacity increased slightly in January, with gains for ethanol, according to the U.S. EIA’s Monthly Biofuels Capacity and Feedstock Update, released March 31. Feedstock consumption was down when compared to December.

U.S. farmers are expected to plant 83.5 million acres of soybeans in 2025, down 4% when compared to last year, according to the USDA National Agricultural Statistics Service’s annual Prospective Plantings report, released March 31.

ADM and Mitsubishi Corp. on March 27 announced the signing of a non-binding memorandum of understanding (MOU) to form a strategic alliance to explore potential areas of future collaboration across the agriculture value chain.

China’s exports of used cooking oil (UCO) reached a record high in 2024 but fell sharply in December after the Chinese government eliminated the 13% export tax rebate for UCO, according to a report filed with the USDA.

Ash Creek Renewables expands global reach with exclusive camelina seed licenses and 'Forks and Fuels' initiative

Ash Creek Renewables, a portfolio company of Tailwater Capital LLC, on March 20 announced it has secured exclusive licensing rights from Montana State University for a new high-performance camelina seed variety.

Upcoming Events