Renewable diesel production, planned projects on the rise

Source: U.S. EIA, based on F.O. Licht, April 2015

November 11, 2015

BY The U.S. Energy Information Administration

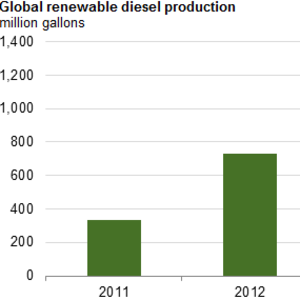

A new type of renewable diesel fuel is meeting the growing demand for renewable biofuels, which is driven by biofuel mandates and customer demands for higher quality. Unlike other biofuels, hydroprocessed esters and fatty acids (HEFA) fuels are nearly indistinguishable from their petroleum counterparts. Worldwide, more than a billion gallons of HEFA fuels were produced in 2014.

HEFA fuels are hydrocarbons rather than alcohols or esters. Hydrocarbons from nonpetroleum sources are known as drop-in fuels because they are nearly identical to comparable petroleum-based fuels. During the refining process, the oxygen present in the alcohols and esters is removed, leaving only hydrocarbons. HEFA fuels are the most common drop-in biofuels; they can be used in diesel engines without the need for blending with petroleum diesel fuel. Currently, HEFA fuels are approved by ASTM International for use in jet engines at up to a 50 percent blend rate with petroleum jet fuel.

The most common HEFA biofuel production to date has been a diesel replacement fuel alternately marketed as hydrotreated vegetable oil (HVO) abroad, or as renewable diesel in the U.S. HEFA fuels are produced by reacting vegetable oil or animal fat with hydrogen in the presence of a catalyst. The equipment and process are very similar to the hydrotreaters used to reduce diesel sulfur levels in petroleum refineries. There are currently 10 plants worldwide that produce renewable diesel, one of which is ENI’s former petroleum refinery in Venice, Italy. Total is planning to convert its La Mede, France, refinery to HVO production, and four additional renewable diesel projects are being developed by other producers. Finnish Neste is the world’s largest producer of renewable diesel. Other major producers are Italy’s ENI, U.S.-based Diamond Green Diesel, and Swedish refiner Preem.

Advertisement

Beyond diesel, another outlet for HEFA fuels using similar technology is biojet fuel, which can currently be blended with petroleum jet fuel in proportions up to 50 percent. As with any alternative jet fuel, HEFA biojet has to meet stringent specifications that ensure it will perform under a wide range of conditions. One potential consumer for this fuel is the U.S. Department of Defense, which intends to use biojet in its JP-8 jet fuel. JP-8 is a versatile fuel used in military vehicles, stationary diesel engines, and jet aircraft. This use of a common fuel simplifies logistics. There is also civilian interest in nonpetroleum jet fuel. Alaska Airlines, KLM, and United Airlines have demonstrated the use of HEFA biojet fuel on commercial flights since 2011.

Principal contributors: Bill Brown, Tony Radich

Advertisement

Related Stories

Biodiesel capacity in the U.S. and Canada dipped slightly stable in 2024, with several renewable diesel producers reporting headwinds and lower margins alongside a drove of SAF projects in various stages of development.

The IEA’s Task 39 group has new research regarding the development and status of the sustainable aviation fuel industry.

The U.S. EPA on Nov. 16 released updated RIN data, reporting that nearly 2.11 billion RINs were generated under the RFS in October, up from 1.81 billion generated during the same month of last year.

Conestoga to host SAFFiRE cellulosic ethanol pilot plant

Conestoga Energy and SAFFiRE Renewables LLC announced on Nov. 16 their agreement for Conestoga to host SAFFiRE’s cellulosic ethanol pilot plant at Conestoga’s Arkalon Energy ethanol facility in Liberal, Kansas.

Officials at Calumet Specialty Products Partners L.P. discussed the company’s proposed plans to boost sustainable aviation fuel (SAF) production at its Montana Renewables biorefinery during third quarter earnings call, held Nov. 9.

Upcoming Events