US biodiesel consumption hits nearly 2.1 billion gallons in 2015

January 25, 2016

BY The National Biodiesel Board

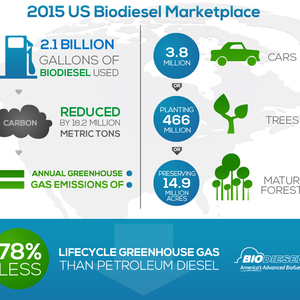

U.S. consumers used a record of nearly 2.1 billion gallons of biodiesel in 2015, reducing America’s carbon emissions by at least 18.2 million metric tons, according to new U.S. EPA data released as the industry kicks off its 2016 Biodiesel Conference & Expo.

Biodiesel industry leaders said the year-end figures demonstrate biodiesel’s rising popularity and its continued success as America’s first and only EPA-designated advanced biofuel to reach commercial-scale production nationwide.

“We’re seeing it take hold across the country,” said Joe Jobe, CEO of the National Biodiesel Board, the industry’s U.S. trade association. “Consumers are seeking out cleaner alternatives to fossil fuels and they see biodiesel as a high-performing, cost-competitive alternative to petroleum diesel. These numbers also show without question that the renewable fuel standard (RFS) is delivering significant volumes of advanced biofuel to the American people. They prove that the RFS is absolutely working.”

Jobe continued, saying, “Biodiesel is still a young industry, but it is becoming a mainstream American fuel that’s having a real impact in helping us cut pollution, create jobs and diversify the fuels market.”

Made from an increasingly diverse mix of resources such as recycled cooking oil, soybean oil and animal fats, biodiesel is a renewable, clean-burning diesel replacement used in existing diesel engines. It is the first and only commercial-scale fuel produced across the U.S. to meet the EPA’s definition as an advanced biofuel—meaning the EPA has determined that it reduces greenhouse gas emissions by more than 50 percent when compared with petroleum diesel.

According to the data, fuel companies reported producing 2.09 billion gallons of biodiesel in 2015, up from about 1.97 billion gallons in 2014.

The figures, however, continue to show a troubling trend in which imports are increasingly flooding the U.S. market and undercutting U.S. production. According to the data, domestic production remained flat at about 1.42 billion gallons, compared with about 1.47 billion gallons in 2014 and 1.50 billion gallons in 2013. Meanwhile, imports rose from 510 million gallons in 2014 to an estimated 670 million gallons in 2015, a jump of more than 25 percent.

“While the overall numbers are positive, we are increasingly seeing subsidized, predatory imports undercutting U.S. production—in part by taking advantage of U.S. policies aimed at building up the domestic industry,” Jobe said. “This is exactly what we have been warning would happen, and it will continue until we take steps to level the playing field, including by reforming the biodiesel tax incentive as a domestic production credit.”

NBB has urged Congress to reform the $1-per-gallon biodiesel tax incentive from a blender’s credit to a producer’s credit. Under the existing blender’s structure, biodiesel that is produced overseas and blended in the U.S. is increasingly taking advantage of the incentive, sending U.S. tax benefits to foreign producers. Most of the imports already receive valuable incentives overseas, while U.S. companies are typically barred from taking advantage of those overseas incentives.

“We welcome competition but U.S. companies can’t fairly compete against foreign companies that are double-dipping on overseas and U.S. incentives while not letting U.S. producers compete in their domestic markets,” Jobe said. “This reform is a simple fix that would appropriately focus U.S. tax dollars on creating jobs and stimulating economic development here at home instead of overseas.”

While the threat of rising imports continues, Jobe said industry optimism is being fueled by stronger policies implemented late last year. In November, after several years of damaging delays, the EPA finalized new biomass-based diesel standards under the RFS requiring 1.9 billion gallons in 2016 and 2 billion gallons in 2017. Additionally, in December, Congress reinstated the biodiesel blender's tax incentive through the end of the year. It had lapsed in 2015.

The reported volumes are made up mostly of biodiesel but also include renewable diesel, a similar diesel alternative that uses a different production technology. The data show volumes of biodiesel (1.58 billion gallons) and renewable diesel (510 million gallons) reported under all categories of the RFS, the federal policy requiring increasing volumes of renewable fuels to be incorporated into the U.S. fuel supply. The data can be found here on EPA's website. NBB represents both biodiesel and renewable diesel companies, and the fuels together comprise the vast majority of advanced biofuel produced in the U.S.

Advertisement

Advertisement

Related Stories

Luxury North Dakota FBO, Overland Aviation—together with leading independent fuel supplier, Avfuel Corp.— on May 19 announced it accepted a 8,000-gallon delivery of sustainable aviation fuel (SAF) on May 12.

Neste and FedEx, the world’s largest express cargo airline, have agreed on the supply of 8,800 metric tons (more than 3 million gallons) of blended Neste MY Sustainable Aviation Fuel to FedEx at Los Angeles International Airport (LAX).

Wheels Up Experience Inc. on May 6 announced the launch of its new SAF program, under which Wheels Up will partner with Delta Air Lines to purchase SAF, allowing private fliers to participate regardless of their flight operator or departure airport.

Germany-based Mabanaft on April 17 announced it started to supply SAF to airlines at Frankfurt Airport in January. The company said it will deliver more than 1,000 metric tons of SAF to the airport this year under the European SAF mandate.

easyJet and ATOBA Energy, in partnership with World Fuel Services, announce the signing of a memorandum of understanding for the development of long-term supply of SAF for easyJet’s operations in Europe and the U.K.

Upcoming Events