Clean Diesel Developments

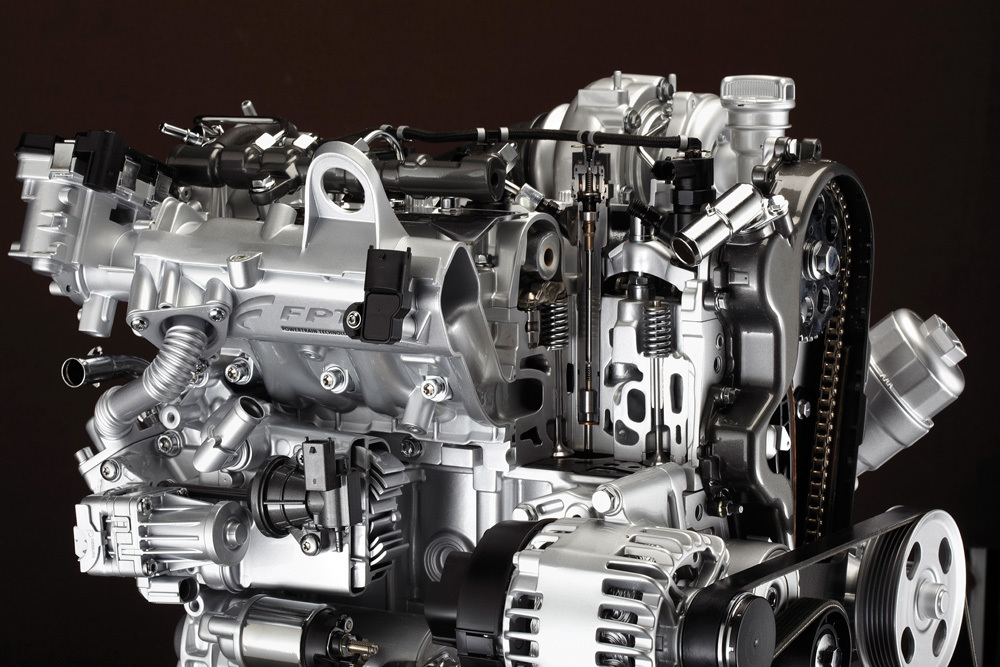

PHOTO: FIAT

January 12, 2011

BY Bryan Sims

While electric and hybrid vehicles garner most of the fanfare as the next-generation of ecofriendly transportation, clean diesels are making noise of their own—in a big way. Stigmatized in the U.S. as loud and dirty, the latest iterations are getting better with every new model year. Technological advancements in fuel and engine platforms, improved fuel economy, biodiesel compatibility, increased torque, complex emissions control systems and exceptional resale value are just some of the reasons why diesel-powered vehicles are preferred in many parts of the world.

Interestingly, the U.S., where diesel passenger vehicles never really caught on, has seen an uptick in public interest for diesel-powered vehicles lately, and this trend is expected to pick up, according to information compiled by the U.S. Coalition for Advanced Diesel Cars. Its Executive Director Jeff Breneman tells Biodiesel Magazine that, from January 2009 to January 2010, consumers preferred a diesel powertrain over their gasoline-powered or hybrid counterparts. This shift in buyer propensity, Breneman describes, is defined as a “take rate.”

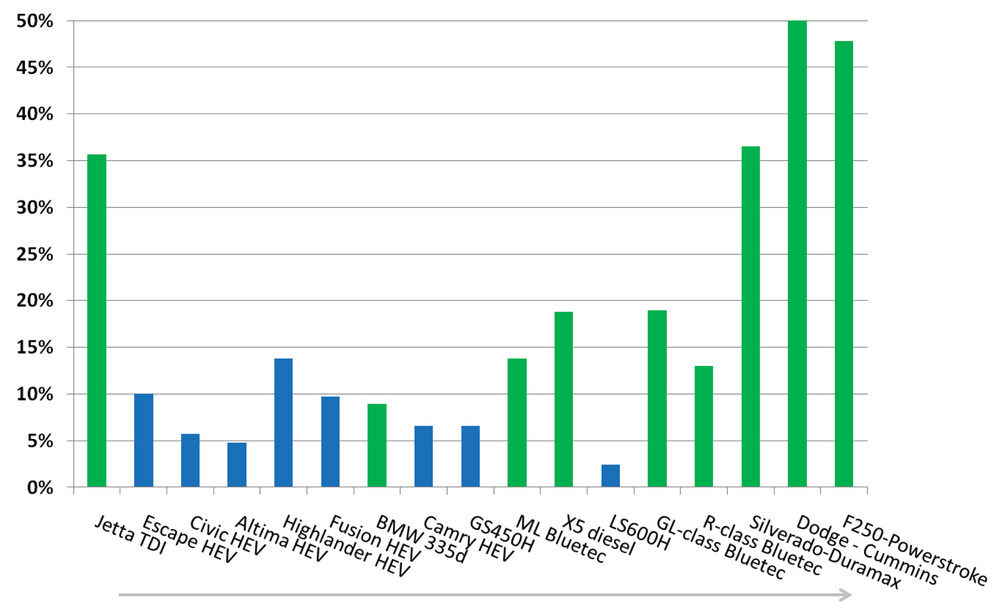

“The take rate for the hybrid models are actually lower than that of the diesels right now,” Breneman says. “Overall, we’re seeing an average 10 to 15 percent take rate for the hybrids and more like a 30 to 50 percent take rate for diesels right now. We’ve seen take rates of nearly 50 percent on a number of diesel models and even higher on a few, such as the Volkswagen Jetta and Audi A3. And most of the SUVs, like the Audi Q7 and Volkswagen Touareg, are all between 40 and 50 percent.”

Similarly, industry prognosticators like JD Power and Associates forecast a significant increase in diesel light-duty vehicle sales within the next two to three years, with the electric vehicle and hybrid markets expected to trail behind diesel’s emergence, according to Michael Omotoso, senior manager global powertrain. “For the past couple of years, it’s been in the 2 percent range,” Omotoso says. “We expect that number to go up to 7 percent in 2015 and to 8 percent by 2017, which is the end of our forecast period.”

While there are some diesel vehicles available in the U.S., they largely remain a minority market. Because a market for heavy-duty pickup diesel models already exists there, Omotoso is seeing German automakers like BMW, Mercedes, Audi and Volkswagen exploiting the niche diesel passenger luxury vehicle segment, with a high percentage of diesel passenger vehicles set to launch in the coming years.

For BMW, market acceptance for both its U.S. diesel passenger offerings, the 335d sedan and X5 xDrive35d, have gained significant momentum during 2010, according to spokesman Dave Buchko. “Sales of the 335d are up 162 percent so far [in 2010] compared to last year, and X5 xDrive35d sales are up 106 percent from [2009],” Buchko says. “So far [in 2010], nearly one in four X5s sold in the U.S. is a diesel.”

Much of the growth in U.S. diesel sales, according to Omotoso, hinges on Corporate Average Fuel Economy standards, which prescribe specific greenhouse gas (GHG) emission reduction and improved fuel economy targets across all model fleet types, and clean diesels are expected to help achieve those goals.

With emissions and fuel economy standards set both in the U.S. and abroad, many automakers are already testing biodiesel to see how the advanced biofuel will help them reach federally mandated fuel efficiency and emission targets.

Advertisement

Biodiesel’s Factor

For nearly 90 years, Fiat has been synonymous with introducing some of the most cutting-edge diesel engine technology on the market. The Multijet engine, which was produced in 2009, is an example of Fiat’s innovative work on the diesel motor. But this is not to say that the Italian original equipment manufacturer (OEM) hasn’t come head-on with challenges to ensure its products are capable of running on higher biodiesel blends.

Although European diesel powertrains are currently capable of running on the continent’s 7 percent mix of biodiesel in its diesel pool, Fiat has begun additional testing of higher biodiesel blends in preparation for a potential increase from B7 to B10. Pier Franco Ciselli, of Fiat’s Alternative fuels division, says implementation likely won’t be until 2012 or 2013. “B10 is something that we are going to explore quite carefully in the next year,” Ciselli says. “However, nothing will be launched on the market by Fiat before a clear specification is decided.”

In light of its cautious yet calculated approach to testing B10 in future diesel engines, Ciselli says Fiat is actively testing B20 and B30 blends within closed heavy-duty fleets.

Although virtually all diesel engines are approved to run on B5, Fiat is just one in a long line of other OEMs grappling with the issue of solving biodiesel’s tendency to contribute to fuel dilution in the engine oil crankcase, and clogging of fuel filters, the latter notably in cold weather.

In the U.S., General Motor Corp.’s Duramax 6.6-liter turbo diesel engine is capable of running on B20. The new Duramax will power the redesigned 2011 Chevy Silverado and GMC Sierra heavy-duty pickups, as well as the Chevrolet Express and GMC Savana full-sized vans. According to Shilesh Lopes, senior fuels engineer for GM, the company made some notable modifications and upgrades for its fuel system to be compatible with B20.

“Specifically for biodiesel, we upgraded all of our seal and gasket materials to withstand the ester content of biodiesel, and we included an improved fuel filter that includes a coalescing element,” he says. “We also modified our fuel heating strategy to specifically address the biodiesel issue since biodiesel naturally has a higher cloud point. What we’ve done is we basically brought the heating utensils right to the fuel filter so that any new clogging of the filter could be avoided.”

Advertisement

Across the pond, German engine manufacturer Deutz AG, which manufactures engines for automotive, agriculture, marine, mobile and gen-set applications, released a service fluid recommendations announcement last year approving various blends of biodiesel for different engine applications, ranging from the standard European B7 blend to B30. In some cases Deutz approves the use of neat biodiesel, or B100. All Deutz engines from Tier 4 Interim/Stage III B are approved for B7 use, according to the company.

Biodiesel inherently reduces most tailpipe-out and greenhouse gas emissions, but advancements in emission reduction technologies, such as selective catalytic reduction systems, lean NOx traps and exhaust gas recirculation as different means to control nitrogen oxides, and diesel particulate filters for soot collection—all of which are driven by government regulations—already make the new clean diesel models clean. A good thing can always get better, and while diesels have come a long way in improving efficiency, emissions and public appeal, the U.S. EPA and U.S. DOT’s National Highway Traffic Safety Administration released proposed regulations to establish the nation’s first standards to improve the fuel efficiency and reduce the GHG emissions of medium- and heavy-duty vehicles. The regulations are essentially an extension of the Clean Cars Program, which established similar requirements for light-duty vehicles earlier this year. The agencies proposed new standards for three categories of heavy-duty trucks; combination tractors, heavy-duty pickups and vans, and vocational vehicles. For combination tractors, the agencies have proposed engine and vehicle standards that begin with model year 2014 vehicles and achieve up to a 20 percent reduction in carbon dioxide (CO2) emissions and fuel consumption by model year 2018. For heavy-duty pickups and vans, the proposal separates gasoline and diesel truck standards. Diesel-fueled vehicles must achieve a 15 percent CO2 and fuel reduction. Both standards would be phased in from model years 2014-’18. Finally, the proposal would require vocational vehicles to achieve up to a 10 percent CO2 and fuel consumption reduction between the same model years. The final rule is expected to be published soon, but the proposal indicates that the diesel technology has no time for stagnation as improvements are always being sought, even when those being improved upon are themselves models of accomplishment.

What To Expect in 2011—And Beyond

French automaker Peugeot plans to introduce a diesel-electric version of its 3008 series crossover HYbrid4 model by spring. The car can operate in three driving modes: electric-only, diesel-only or a combination of both. The diesel hybrid achieves 69 mpg and can go zero to 60 mph in 8.8 seconds.

Japanese automaker Mazda has officially announced plans to launch its clean diesel Mazda6 model to the U.S. by market in 2012. In addition, the company intends to introduce its SKY-D diesel engine, which Mazda promises to increase fuel economy by 30 percent over its current 2.2L diesel (not available in U.S.). Mazda says the vehicle will return at least 43 mpg. The engine is part of a new family of SkyActiv diesel engines with an all new transmission called Sky-Drive. Already under the hood in models sold in Europe and Japan, the design is expected in the U.S. market by sometime in late 2013 or early 2014, according to Mazda spokesman Jeremy Barnes.

Also, as reported by Biodiesel Magazine last year, the future may hold an interesting marriage between ethanol and diesel emissions control if Tenneco Automotive’s plan to use E85 instead of urea dosing for SCR NOx control catches on. There is an established E85 infrastructure that could double as reductant stations so when drivers of SCR-equipped diesels run out of the dosing agent, they can fill up at one of hundreds of E85 stations across the U.S.

Omotoso says expect more fuel efficient diesel engines in GM’s line of light-duty trucks in the coming year or two. The company developed a 4.5L diesel engine that it was initially going to launch in its light-duty pickups, but pulled it out due to the economic collapse of 2008 and eventual bankruptcy. “The engine is developed and ready to be launched,” Omotoso says.

Omotoso also expects Nissan to use Renault’s diesel engines in its future diesel passenger and light-duty models. “They have 4-cylinder and 6-cylinder diesel engines that we expect to see in the Maxima and Altima in the coming year or two.”

No matter what new clean diesel vehicles are introduced, one fact remains, according to Breneman. “At the end of the day, every country needs a portfolio of vehicle technologies,” he says. “Clean diesels are simply one of them that have undergone dramatic improvements over the years. Overall, the technology has improved and they’re still fun to drive.”

Author: Bryan Sims

Associate Editor, Biodiesel Magazine

(701) 738-4974

bsims@bbiinternational.com

Upcoming Events