The Myth & Reality of Biodiesel Feedstock Availability

May 19, 2014

BY Ron Kotrba

Since its commercial inception in the 1990s, the biodiesel industry has faced obstacles from all sides. The technical merits of the fuel have been challenged time and time again. Manufacturing costs and fuel pricing have been used to discredit biodiesel. Free marketeers have tarnished its reputation because government mandates and subsidies attempt to level the playing field with the petroleum industry, which still today after more than a century of domination, receives billions of dollars of government handouts a year. And the oil lobbies have waged smear campaigns on all fronts. Even the federal government—and certainly the current administration that has used biodiesel for its own political gains—has seemingly caved to the pressures of Big Oil and Big Food. This became evident last fall when the U.S. EPA suggested stalling the biomass-based diesel quota and shrinking the advanced biofuel mandate in its 2014-’15 renewable volume obligation (RVO) proposal for the renewable fuel standard (RFS). But perhaps the most referenced hindrance to biodiesel growth is global availability of fats, oils and greases (FOG).

“The constraints to biodiesel growth aren’t really from the feedstock side,” says John Kruse, one of the owners and directors of quantitative analysis at World Agricultural Economic and Environmental Services LLC, a firm contracted by the National Biodiesel Board to analyze feedstock markets and different scenarios to better understand how the market reacts with different policies. WAEES also does exploratory work with NBB to look at what the potential for the market is, depending on what EPA does with RFS volumes year-over-year. “Flipping it around a little, the constraints are where the market has to pay a high price for distribution and infrastructure to move biodiesel into the marketplace,” he says.

Kruse says now is a critical time for the biodiesel industry because EPA’s proposal establishes a potentially dangerous precedent for how the agency may set future mandates under RFS. “The longer-term aspect of how they propose to set the mandate based on demand, where you have the crude oil or petroleum industry as strong influencers in how much demand there is by defining the infrastructure available,” Kruse tells Biodiesel Magazine. “That’s perhaps a much more damaging aspect of their foreshadowing of how they want to set policy in the future. How do you ever get growth when you have the petroleum industry, which views you as a competitor, regulating your demand?” Clearly, according to Kruse, the EPA’s proposal to stall the biomass-based diesel standard at 1.28 billion gallons for 2014-’15 is not because of feedstock shortages or potential disruptions in the commodities markets from biodiesel growth.

Gene Gebolys, the founder, president and CEO of World Energy Alternatives, has chaired the RFS working group for NBB for the past five years. “One thing that is becoming increasingly clear to the working group is that RFS matters to biodiesel across all RIN categories—D6, D5, D4, D3,” Gebolys tells Biodiesel Magazine. “They all matter to biodiesel. A lot of people think only what’s important is D4, biomass-based diesel, but what clearly happened in 2013 is that biodiesel was really a D5, an advanced biofuel technology, more so than a biomass-based diesel technology.” Therefore, what the EPA sets for its final rule in the advanced biofuel category (D5) is at least as important as what level it sets the D4 category. On the agency’s proposal to cut back D5 and hold D4 to 2013 levels, Gebolys says, “We think the legislation is pretty clear that the EPA has to come out with a 3.75-billion-gallon requirement in the D5 category—as a matter of statute. We don’t believe they have the authority to do something other than 3.75 billion for advanced.” The NBB RFS working group’s position is clear, he adds. “You have to do what the statute says you have to do, and for D4, you do have flexibility to set at whatever level you chose to, but it’s clear that the statute set a trajectory up. You at least have to do 1 billion gallons, but it also says it can increase year on year. We think that the minimum that EPA ought to consider setting the standard for D4 is 1.7 billion. The industry produced 1.8 billion gallons last year, so even setting it at 1.7 would be a decline from what the industry has already proven it can do.”

More importantly, however, the higher the D5 category is set, the higher the D4 category must be for EPA to address its own objectives. “EPA has made a big deal about its desire to reduce blend wall impacts,” Gebolys says. “And since there are two ways to satisfy the D5 category, [Brazilian ethanol and biomass-based diesel] it’s important to understand that the higher they set the D4 category, the more that D5 category will be met by diesel-based technology rather than gasoline-based technology.”The more that it’s met by diesel-based technology, the less impact the D5 category will have on the blend wall concern. “So for EPA’s own purposes of reducing the pressure on the blend wall, it’s important that they increase the component of the mandate that is biomass-based diesel,” he adds.

Global Perspective

Advertisement

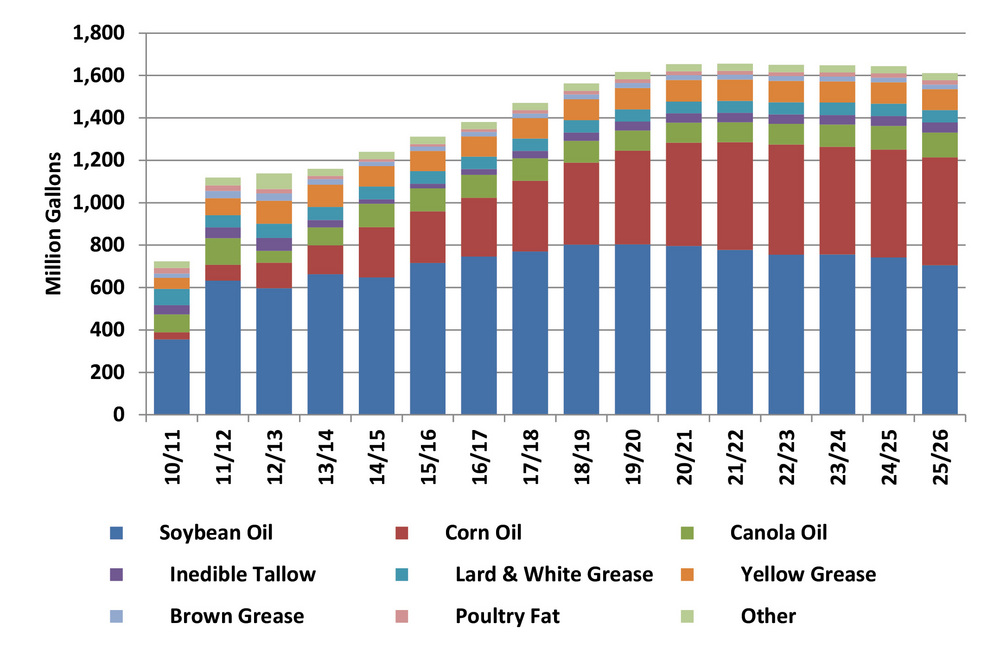

WAEES uses a large, global partial equilibrium model with more than 20,000 equations that looks at everything from biofuels to individual commodity markets, forming the basis for how it looks at biofuel and feedstock markets. “There’s often this perception that there’s this huge shortage of feedstock, and that’s just simply not the case,” Kruse says. “The thing is, we find ourselves potentially in a glut of feedstock, and those feedstocks are coming from sources that we didn’t traditionally necessarily think about.” Distillers corn oil (DCO) from ethanol plants and used cooking oil (UCO) from the food service industries are two of those sources.

Kruse says for DCO, his forecast looks out to 2030 when 90 to 95 percent of U.S. ethanol plants are de-oiling distillers grains. “When we get to 2022, we get about 70 percent [of DCO] going to biodiesel and 30 percent going to animal feed,” Kruse says, “but we peak at around 520 MMgy of biodiesel from distillers corn oil.” He says you can draw more into biodiesel depending on what the mandates are. “It’s closely tied to that,” Kruse explains. “It’s a big jump, about four to five times where we’re at right now.” For UCO, he says data is thin on how much there really is out in the market. “There are estimates that say there might be 50 to 70 percent more, maybe 100 percent more, yellow grease than what’s currently being reported,” he says. “That’s just in the U.S. Globally, that data is quite a bit harder to put your fingers on.”

Biodiesel is a small, minority subset of the overall demand for FOG, and the U.S. is only a subset of global biodiesel demand. So to make sense of any of the feedstock issues, global supply and that which affects supply must be taken into account: weather patterns and currency devaluation in Argentina; political strife in Ukraine; swine disease in the U.S.; the wildcard of China’s purchasing habits; and thousands of other issues around the world.

“Did we know we were going to have a drought in Brazil last year?” Gebolys asks. “No, we didn’t. Did we know we’d have a drought in the U.S. the previous year? No, we didn’t. But we get more and more information as time goes by, and we build it into the model. Do we know what kind of yields we’re going to get year over year? No, we don’t. But we can continue to get more information and improve the model as time goes forward. That said, what we do know is that the world is generating more and more feedstock year on year. Even in the face of a 70 percent increase in biodiesel production in the U.S. last year, feedstock prices went down—not up—meaning we could put a lot more pressure on feedstock markets without causing dramatic disruptions in the market.”

Kruse says, “I always have trouble with the statement about ‘disrupting’ current markets, because part of what the ag sector was so excited about with biofuels in general was it’s a new demand source.” Like any other sector, if you ramp demand up quickly, there will be a price effect. “But what biofuels do is provide another source of demand that helps avoid the spiraling down into a situation of ever-declining real prices for ag products,” Kruse says. “Without growth in demand, that’s ultimately where you go.” He adds that supply has always outpaced demand growth in the ag sector.

Record US Soybean Planting

The U.S. biodiesel industry was founded on soybean oil, and roughly half of all feedstock used in biodiesel production remains soy oil. Based on USDA’s Prospective Plantings report in March, U.S. farmers intend to plant a record 81.5 million acres of soybeans in 2014—up 5 million from 2013. While record planting bodes well for biodiesel feedstock prices, it’s only half of the equation. Favorable growing weather must follow suit to hit record bean production. Also, the U.S. has only so much crush capacity. One source tells Biodiesel Magazine that record U.S. bean production may affect prices, but it doesn’t mean a different supply and demand for soybean oil.

Advertisement

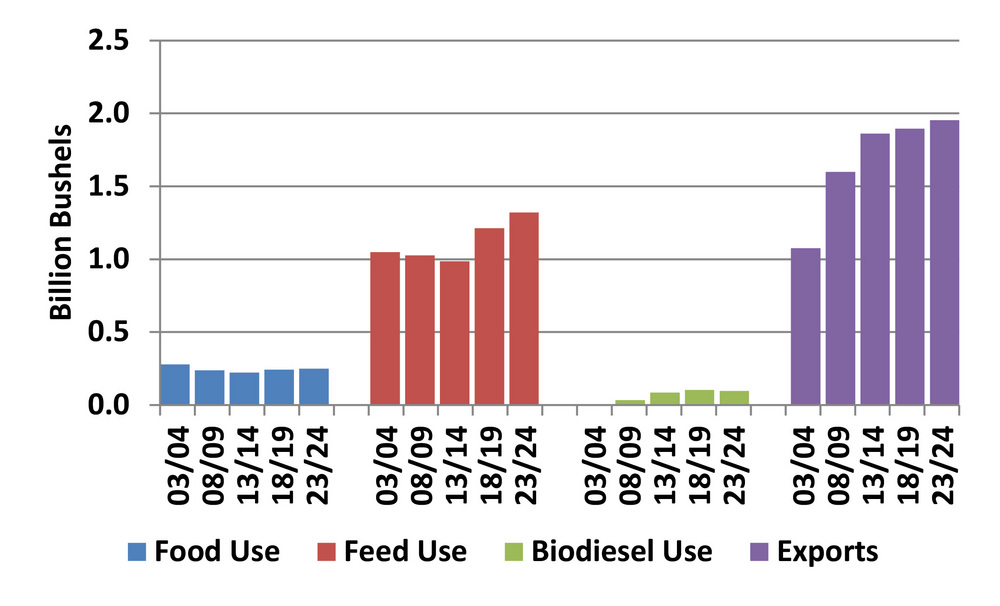

In the past 10 years, record soybean production was experienced in the 2009-’10 crop season. That was 3.359 billion bushels produced. The lowest production was in the 2007-’08 crop year at 2.677 billion bushels. The high and low delta was 682 million bushels. “But in that same period, our record crush numbers in 2006-’07 were at 1.808 billion bushels,” the source says. “And our low crush numbers for the past 10 years were in 2010-’11 at 1.648 billion bushels crushed,” a difference of 160 million bushels. The soybean export numbers are figures that vary much more dramatically than crush. In 2013-’14, the current crop year, the USDA is estimating 1.58 billion bushels of soybean exports, and in the 2005-’06 crop year, exports were only 940 million bushels. This equates to a 640 million bushel difference in the past 10 years, high to low. “If we were to meet our record crush for the 2006-‘07 crop year versus this year, that means an additional 123 million bushels,” the source says.“And for bean oil production, what that means is roughly 1.3 billion pounds of oil, or 175 million gallons of biodiesel year on year.” In short, record soybean acreage does not mean record soybean production; and record soybean production does not correlate linearly to that much more soy oil on the domestic market due to limited crush capacity. What record U.S. soybean production means in general is higher exports.

Nowhere Near the Limits

There’s a growing set of literature out there that correlates commodity yields with respect to commodity prices, Kruse says, so in periods of high prices, the argument is farmers adopt more, and new, technologies. “They’re faster to try some of those things because it’s less risky, and that increases the efficiencies,” he says. “They get more yields per acre, so it’s a win-win for everyone, and all of those technology advancements ultimately benefit consumers the most because it reduces the cost they have to pay for food or whatever the ingredient is. There is a lot of empirical evidence—we have it in our models—where there is some impact back on yields when you have higher prices, and vice versa with lower prices. Certainly from the demand side, it’s been just a little frustrating for me because there’s a lot of misinformation circulating on how additional demand will result in this much new land use being brought into production. We’re going to have to cut the rainforest down to do this, and all this kind of stuff, which is simply not accurate.”

Gebolys says the best thing we can do to develop next-generation feedstocks like algae, jatropha, camelina, pennycress and other sources, is create greater demand for the existing-generation feedstocks. “As long as we can continue to do that, and create expanding demand, I strongly believe that next-generation feedstocks will emerge.” But, he says, they certainly won’t emerge in an environment in which there’s not adequate demand for first-generation feedstocks such as soybean oil. “There are folks out there who want to make innovation in feedstock the enemy of our current capabilities, and that’s really foolish,” Gebolys says. “There’s a lot of talk about foregoing first-generation biofuels for next-generation biofuels, and the most certain way to kill next-generation biofuels is to take a pause in current-generation biofuels.” Conversely, the most certain way to advance next-generation biofuels and the feedstocks from which they will be manufactured is to continue to grow existing-generation biofuels.

On any given day, feedstocks can be tight. But over the course of a year, markets basically adjust. “There is plenty of global feedstock for this industry to continue to expand well into the future,” Gebolys says. “We’ve come nowhere close yet to hitting the far end of our capability. When we were first looking at this stuff, there were people in this industry that said there’s not enough feedstock for this industry to ever produce more than 500 million gallons. And these are very knowledgeable folks.”

In the latter half of 2013, however, the U.S. biodiesel industry was producing at an annualized run rate 2.4 billion gallons. “That’s effectively five times what those so-called experts originally thought was the high end of what we could do,” Gebolys says. “I guess the lessons learned are that the so-called experts don’t really fully take into account how flexible markets are in addressing expanding industry capabilities. If we demand feedstock, feedstock will be there for us to continue to produce biodiesel at higher and higher rates for a long time. Markets have not indicated to us yet that we are anywhere close to reaching those limits.”

Author: Ron Kotrba

Editor, Biodiesel Magazine

218-745-8347

rkotrba@bbiinternational.com

Related Stories

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Scientists at ORNL have developed a first-ever method of detecting ribonucleic acid, or RNA, inside plant cells using a technique that results in a visible fluorescent signal. The technology could help develop hardier bioenergy and food crops.

The 2025 International Fuel Ethanol Workshop & Expo, held in Omaha, Nebraska, concluded with record-breaking participation and industry engagement, reinforcing its role as the largest and most influential gathering in the global ethanol sector.

TotalEnergies and Quatra, the European market leader in the collection and recycling of used cooking oil, have signed a 15-year agreement beginning in 2026, for the supply of 60,000 tons a year of European used cooking oil.

The USDA maintained its forecast for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released June 12. The estimate for 2024-’25 soybean use in biofuel production was revised down.

Upcoming Events