Keeping Pace

PHOTO: KEITH WELLER, USDA-ARS

January 18, 2012

BY Bryan Sims

Biodiesel production reached an all-time high of 908 million gallons through the end of November, according to U.S. EPA figures. This is well above the mandated 800 million gallon biomass-based diesel requirement prescribed under RFS2 and shatters the previous annual record production of 690 million gallons set in 2008. At current production, the biodiesel industry will conceivably fulfill the volumetric mandate of 1 billion gallons this year and, pending federal support and favorable supply and demand dynamics in the marketplace, appears poised to hit a proposed 1.28 billion gallons by 2013. After 2013 and beyond, the minimum volumetric threshold for biomass-based diesel can be no less than 1 billion gallons.

While biodiesel demand in both on- and off-road applications is likely to remain strong, the issue of whether a sufficient feedstock supply can support growth under RFS2 can’t be ignored, and raises the glaring question: When will the biodiesel industry no longer be marginalized by a 2 or 3 billion gallon feedstock limit? If the industry stands a chance competing with Big Oil over the next decade, it will need hard data and realistic feedstock projections to keep pace with increased production and demand.

Fortunately, industry stakeholders are working hard at addressing this question and finding answers. In July 2010, a working group was appointed by former NBB chairman Ed Hegland to analyze and assess possible constraints to overall feedstock supply, consumption, industry production capacity and global market conditions to develop recommendations to the EPA regarding future RFS2 volumetric compliance levels. The group is also charged with advising the NBB on what recommendations it should make to the EPA. In June, the group made its recommendations to the NBB, outlining a sustained growth of the volume mandate over a five-year period that would start at 1.3 billion gallons in 2013 and increase by 300 million gallons per year, increasing the volume requirement for biomass-diesel to 2.5 billion gallons by 2017.

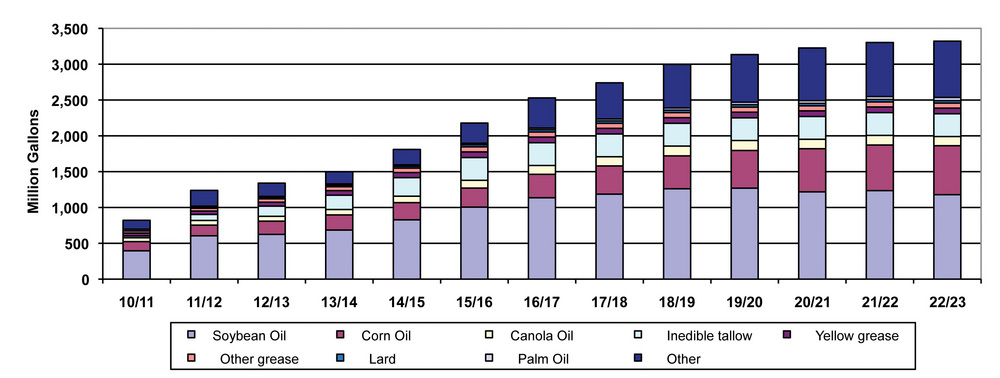

Gene Gebolys, CEO of World Energy and chairman of the NBB working group, tells Biodiesel Magazine the committee hired IHS Global Insight to conduct econometric modeling to assess the long-term availability, price structure and market dynamics of a variety of feedstocks in order to determine a sustainable path forward. In the modeling report, the group determined that it’s possible to reach 3.3 billion gallons of biodiesel by 2022, an increase of 2.5 billion gallons from projected 2010-’11 marketing year levels. In this scenario, nearly 80 percent of the increase comes from three feedstocks: soybean oil (31 percent), corn oil (22 percent) and palm fatty acid distillate (26 percent). Animal fats, yellow grease and other low-grade waste oils supply another 16 percent of the total with the remaining 3 percent coming from canola and palm oil.

“One of the first things we identified was how important it was going to be to get our arms around the feedstock question,” Gebolys says, noting that the data was conservatively generated by design. For example, the group considered feedstocks that either have approved pathways or are currently under review by EPA, including taking into account gross domestic product growth and other ancillary factors, such as global supply and demand. Gebolys says the group intends to generate data on an annualized basis for its volumetric recommendations to EPA.

“Overreaching is probably the worst thing that we can do as a working group [rather] than erring on the side of caution,” Gebolys says. “The models indicate you can get to a robust industry twice the current size or more within current levels of global feedstock without dramatic supply disruption. We’re in a good position going forward.”

An important aspect from within the modeling work Gebolys pointed out was that while traditional virgin oils such as soybean and canola oils, and waste oils such as used cooking oils and yellow greases, will continue to be predominantly used by biodiesel producers, they will all inevitably substitute each other in some form or another when a demand response is signaled. In other words, for example, if an insufficient supply of yellow grease is identified, palm fatty acid distillate will respond to the supply shortage and vice versa.

“You’re going to have the classic supply curve and the products that exist farthest left of that supply curve are going to be the lowest cost and are going to be the ones that get taken off the market the earliest,” Gebolys says, “and you’re going to continue to move out that curve with greater demand until you’re into the higher value oils. As that’s happening, there’s greater economic incentive for substitution and the like.”

Advertisement

Although opportunities exist for a variety of feedstocks, the group primarily focused on fats and oil sources that are either currently commercially available or that have historically been utilized for production. For example, the model didn’t include what the group deemed to be “experimental technologies” such as algae-to-biofuel processes.

“While we discussed algae a lot, we thought that there is a reasonable likelihood that it will be an important part of the picture in the future,” Gebolys says. “It is not part of the present and therefore it’s really hard to model it in because it’s not commercially viable today.” Additionally, camelina and jatropha were not included in their modeling in any meaningful way, Gebolys says.

Corn Oil Advancements

Among the most promising feedstock currently in use today, one that’s factored into the working group’s econometric assessment, is corn oil extracted from the backend of ethanol plants, thanks to improvements in extraction technology over the past several years. In fact, corn oil becomes relevant to the group’s projections around 2013 and it continues to become more relevant as greater technology adoption increases throughout the ethanol industry. By 2015, the group estimates the feedstock will provide an even more meaningful contribution to the biodiesel industry.

According to Alan Weber, partner at Marc-IV Consulting and lead economic advisor to the committee, the group assumed that about 30 percent of the dry-grind ethanol plants incorporated corn oil extraction technology from DDGS in 2011. By 2016, the group model determined that half of all ethanol plants are assumed to be extracting oil from DDGS and by the end of its 10-year horizon, nearly 70 percent of all ethanol plants will have this capability.

“I think those assumptions are going to be proven true and probably even quicker,” Weber says. “Most industry discussions have indicated that within the next couple years, at least half of the ethanol plants will probably have installed capacity.”

How much corn oil yield could potentially come from an existing bushel of No. 2 yellow dent corn used in ethanol production? According to Weber, the group assumed that corn oil yields from de-oiled DDGS per bushel of corn processed will increase from 0.5 pounds in 2010 to 0.6 pounds by 2015 and one pound by 2020.

Advertisement

“Even moving up to one pound is probably only, at most, two-thirds the oil potential in that bushel of corn,” Weber says. “A lot of this also comes down to market dynamics of what the value of the oil is versus its value as a feed ingredient in DDGS, the region where the ethanol plant is located and what the markets are for the DDGS in that region, because the type of livestock can impact how much protein and fat is desired.”

Weber notes that if the biodiesel industry were to pull 0.6 pounds of corn oil from de-oiled DDGS and every dry-grind ethanol plant in the U.S. were to install corn oil extraction technology, “we’re talking 370 to 375 million gallons worth of corn oil potential,” he says. “If we move up to removing one pound per bushel, that’s more than 600 million gallons of inedible corn oil that could be utilized if all of the dry-grind ethanol facilities were removing corn oil from DDGS.”

Dedicated Oil Crops

As it’s being considered now, camelina appears to be a promising dedicated oilseed or rotational cover crop that, at least in trial plots, has shown it can viably fit into wheat rotations in the Pacific Northwest, Weber says, with potential applicability in other regions as well.

“If you look at a three-year rotation, for example, and that three-year rotation historically was wheat-fallow-wheat, the concept is to insert camelina into that rotation without impacting those other two crops,” Weber says. “And maybe even more likely, it’s a four-year rotation, wheat-fallow-wheat-fallow, but you can have one additional crop of camelina. This rotation has the advantage of creating additional amounts of oil for biodiesel production.”

A heavy amount of research is currently underway into effectively capturing a maximum amount of oil without impacting edible markets. Weber notes that if camelina were to yield approximately 1,500 pounds of oil per acre and, assuming the oil is crushed in a mechanical expeller versus solvent extraction, “you’re probably talking about 55 to 60 gallons of oil per acre,” he says. “If you add a couple million acres added into the rotations in the Pacific Northwest, this would be about 120 million gallons worth of biodiesel potential.”

Weber says he’s aware of some elite lines of camelina breeds that are yielding 3,000 to 4,000 pounds of oil per acre in test results, but he emphasizes that while those yields are exceptional, one must take into account what the average yield would be from a farm application standpoint.

“When you think about the number of acres of wheat that are grown in [the Pacific Northwest], 2 to 4 million acres of camelina would be possible if it made sense economically for the growers,” Weber says.

Pennycress is another dedicated cover crop that has garnered interest as a biodiesel feedstock. While a significant amount of research is underway, the challenge, according to Weber, lies in being able to move pennycress into a rotation with soybeans that doesn’t cause yield drag on the soybean crop following the harvest of pennycress. In either case, he says the potential of pennycress providing a meaningful contribution to the biodiesel industry is enormous.

If the state of Illinois has 8 to 9 million acres of soybeans in rotation with corn, then Weber says there’s good potential for pennycress. “If half the farmers in Illinois adopted this in their rotation,” he says, “that’s 4.5 million acres and even at [pennycress] yields of 1,500 pounds per acre, that’s more than 250 million gallons worth of oil for biodiesel production.”

Author: Bryan Sims

Associate Editor, Biodiesel Magazine

(701) 738-4974

bsims@bbiinternational.com

Upcoming Events