Commodities: Gulf storms can impact natural gas market

September 29, 2015

BY Andy Huenefeld, U.S. Energy Services

The Atlantic hurricane season has always been a point of interest for the natural gas market. Any storm that moves into the Gulf of Mexico can prompt personnel evacuations from offshore producing wells, leading to shut in volumes and adversely affecting the market’s near-term supply. In more extreme cases, such as those observed in 2005 when a pair of major hurricanes moved through the Gulf, damage to production and transportation infrastructure can lead to more long-lasting outages and create violent price spikes.

Mid-September marks the traditional peak of Atlantic hurricane season, but so far the tropics have been mostly quiet. While there have been several named storms and even a few hurricanes, there had been no hurricane activity in the Western Atlantic into late September. This marks the latest in the summer since 1914 that this part of the Atlantic, which includes the Caribbean Sea and the Gulf of Mexico, has been without a hurricane. The lack of activity can at least be partially attributed to a historically-strong El Niňo that has increased vertical wind shear in this area and limited activity. El Niňos are usually highly correlated with lower Atlantic tropical activity.

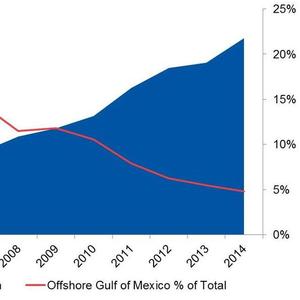

In general, hurricanes do not pose the same level of fundamental threat to the natural gas market as they once did. A product of the shale revolution—a boom of production in the Northeast and other non-traditional supply center—is a declining reliance on offshore natural gas. As overall U.S. production has risen to record levels north of 70 Bcf per day, total production that is sourced from offshore Gulf of Mexico wells has fallen since 2004 from more than 10 Bcf per day, or about 20 percent of total volumes, to less than 4 Bcf per day, or about 5 percent. During that same timeframe, overall dry production has risen by nearly 40 percent. To be sure, a Gulf storm can still usher volatility into the futures market as traders react to the news and anticipate the potential impact, but reduced reliance on this area represents an important, if unheralded, benefit of growing production in other regions of the country.

Advertisement

Advertisement

Advertisement

Advertisement

Related Stories

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

Upcoming Events