Bankrolling the Next Generation

November 3, 2008

BY Bryan Sims

Corn-based ethanol has been under intense scrutiny this past year. It's been blamed for numerous ills from high food prices to increased pollution in the Gulf of Mexico. If that weren't enough, the industry has also been saddled with high feedstock costs and is not immune to the crisis in the banking industry and the volatility on Wall Street.

Currently, developers looking to build new plants or even recapitalize to expand or retrofit existing plants are hard-pressed to find lines of credit and/or debt to finance projects in the current economic climate. Limited availability of working capital has forced some plants to shut down operations until market conditions improve.

Even for proponents, corn-based ethanol was never the silver bullet that would wean America from its dependence on imported oil. Today, the renewable fuel serves as a meaningful bridge to develop and eventually commercialize cellulosic ethanol.

Thanks to the support of the federal government, private investors and the many people involved in research and development, the stage is set for cellulosic ethanol's commercial-scale debut. The renewable fuels standard (RFS) in the Energy Independence & Security Act of 2007, calls for the use of 16 billion gallons of cellulosic ethanol by 2022, with the near-term target being 100 million gallons by 2010. Additionally, the RFS caps corn-based ethanol at 15 billion gallons. At press time, there were 182 operating plants with a combined capacity of 11.21 billion gallons. There were also 26 plants under construction with a combined capacity of 2.49 billion gallons.

Although it's a work in progress, many cellulosic developers are actively engaged in pilot and demonstration phases to prove that their process technologies can economically operate commercially. So what will it take for developers to obtain the financing necessary to propel their unique projects onto the commercial stage? Many in the industry are taking a wait-and-see approach to who will provide the financial blueprint for others to follow. Those people will no doubt be watching the companies that are already constructing facilities such as Range Fuels Inc. and BlueFire Ethanol Fuels Inc.

"There is no one vehicle to get these plants built to commercial scale," says Mitch Mandich, chief executive officer for Range Fuels. The Broomfield, Colo.-based company is currently building a 100 MMgy cellulosic ethanol plant near Soperton, Ga., that will use woody biomass as its feedstock. The plant, scheduled to be in operation by late 2009, will initially produce 10 MMgy in its first phase. Production will be ramped up to maximum capacity shortly after its test phase.

"It's going to come down to the size of those first plants in an effort to match the corn-based ethanol industry," Mandich adds. "In my opinion, the industry will have to scale those plants along a continuum of size based upon capital needs and requirements. It's unlikely that anyone in the cellulosic ethanol space will be able to raise commercial-level funding to build a 100 MMgy plant right out of the chute."

Like the financial boost corn-based ethanol received four to five years ago by eager farmer-owned co-ops where equity was the primary source behind much of its growth, the same exuberance may be seen by venture capitalists as the first commercial ventures come on line.

"The next few years will be a very important time for the industry to demonstrate that it can stand on its own," says Paul Ho, principal at Hudson Clean Energy Partners. Ho joined HCEP in September and oversees transactions in the biofuels and biomass sectors. "Nobody doubts that the technologies will work," he says. "The million-dollar-question is whether it can scale up economically to accommodate commercial production operations. Until then, people are still going to view it with a skeptical eye, but as soon as the first company cracks the mold I think there will be a lot of interest in this space."

The current credit environment is tight, but several large firms, backed by both government funds and private-equity investors, are going ahead with plans to test their technology.

Capital Concerns

Cellulosic ethanol plant developers agree there is still substantial capital—whether it involves varying forms of debt and/or equity—flowing into the cellulosic industry in an effort to accelerate projects to commercial scale. "The capital markets perform when the structure is right and when there is a demand market for the end product," says Arnold Klann, president and chief executive officer of BlueFire Ethanol. The company will soon break ground on a 17 MMgy cellulosic ethanol facility near Palm Springs, Calif., and a 3.2 MMgy facility near Lancaster, Calif. Both would use wood wastes, waste plant material and other refuse-derived biomass. "It's one of those situations where everyone is waiting to see if the equity markets are going to return to some kind of normalcy," Klann says. "You do have some equity funds today that have billions of dollars with no place to put their money at the moment."

Another source of capital has been provided by the U.S. DOE in the form of federally funded loan guarantees. In March 2007, the U.S. DOE awarded several grants to cellulosic ethanol companies for technology enhancements and to reassess viable economics applicable to commercialization deployment strategies. Range Fuels and BlueFire Ethanol are two of six companies that have received federal grant money toward their respective projects.

According to John May, managing director for St. Louis, Mo.-based Stern Brothers Co., the DOE federal loan guarantee program should be seen as a "lynchpin" for cellulosic ethanol developers looking to gain financial footing and to scale up their projects. "I think [the DOE grant program] is an indispensible tool for the industry as it moves toward cellulosic ethanol," he says.

BlueFire Ethanol was awarded $40 million and was the first company to draw down on the grant money. Range Fuels received $76 million to construct its Soperton facility. The company also received an additional $100 million of equity from a Series B round and $6 million from the state of Georgia. The company is also backed by venture capital, including Vinod Khosla's investment firm Khosla Ventures.

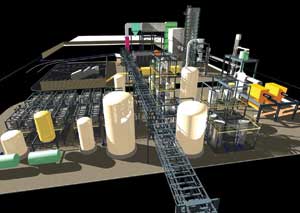

Pictured is a schematic detailing BlueFire Ethanol's conversion process using Arkenol's concentrated acid hydrolysis process technology.

SOURCE: BLUEFIRE ETHANOL FUELS INC.

"With the DOE guaranteeing a portion of that loan, it should allow us to bring additional investment banks to participate under that loan guarantee program," Mandich says. "However, it will be based upon the risk of the technology, its ability to reach commercial scale and its ability to meet the right ‘pro forma' that will give investors a solid return."

Federal grant funds, or the federal loan guarantee program, typically cover about 80 percent of a company's debt that would not otherwise be supplied by traditional "merchant-type" lenders. The remaining 20 percent would come in the form of venture capital, private and/or public equity entities.

"I think you're probably two years away yet before the financial markets are actually mature enough to finance these projects," Klann says.

Historically, lenders committed a 50/50 or even 60/40 debt-to-equity ratio to corn-based ethanol plants. This new combination of federal grant money, equity and/or venture capital could create a paradigm shift within the lending community, which experienced nominal risk in the corn-based ethanol industry due to its commercially proven technology. If and when these commercial cellulosic ethanol plants are operational, obtaining working capital to sustain operations will be another challenge, according to May. "I think the lending paradigm changes somewhat just because you're applying project finance rules around risk mitigation to a different set of facts," he says. "In the end, the same concerns about managing feedstock cost, reliability, managing technology risk and where ethanol prices will be going remains."

Improving Technological Appeal

Like the beginning of the corn-based ethanol industry, cellulosic ethanol is striving to establish a proven track record. Much of the debate over how cellulosic ethanol projects will get financed to commercial scale depends on what technologies lenders and investors perceive as the most feasible.

"You have a lot of technology confusion in the marketplace right now because the government has sponsored enzymatic hydrolysis for years and years, so everyone believes that's the way to go," Klann says. "That's added a lot of confusion and a lot of resistance. The banks are waiting to see which technology is better because they've heard all kinds of hype and have seen no performance on a commercial scale."

BlueFire Ethanol holds the exclusive rights for a process technology developed by Arkenol Fuels LLC. Arkenol's patented process utilizes a concentrated acid hydrolysis pathway, which is amenable to handling the wide range of feedstocks BlueFire Ethanol intends to use, according to Klann. BlueFire Ethanol determined that it could produce approximately 70 gallons of ethanol per dry ton of biomass.

As for Range Fuels, it will deploy a patented thermochemical process to convert woody biomass into ethanol at its Soperton facility. The company has also partnered with Ceres Inc. to research, develop and commercialize energy crop feedstocks for ethanol production. The two companies began working together during the 2008 spring planting season and plan to continue the collaboration for several years.

"The banks that are going to come forward with the funding and take the risk are still very concerned about developmental technology and how much money they will put into play in a debt market," Mandich says. "The initial foray into a commercial plant will most likely need to be on a smaller scale as opposed to the mid-range or higher end because you won't be able to get the financing."

Bryan Sims is an Ethanol Producer Magazine staff writer. Reach him at bsims@bbiinternational.com or (701) 738-4950.

Currently, developers looking to build new plants or even recapitalize to expand or retrofit existing plants are hard-pressed to find lines of credit and/or debt to finance projects in the current economic climate. Limited availability of working capital has forced some plants to shut down operations until market conditions improve.

Even for proponents, corn-based ethanol was never the silver bullet that would wean America from its dependence on imported oil. Today, the renewable fuel serves as a meaningful bridge to develop and eventually commercialize cellulosic ethanol.

Thanks to the support of the federal government, private investors and the many people involved in research and development, the stage is set for cellulosic ethanol's commercial-scale debut. The renewable fuels standard (RFS) in the Energy Independence & Security Act of 2007, calls for the use of 16 billion gallons of cellulosic ethanol by 2022, with the near-term target being 100 million gallons by 2010. Additionally, the RFS caps corn-based ethanol at 15 billion gallons. At press time, there were 182 operating plants with a combined capacity of 11.21 billion gallons. There were also 26 plants under construction with a combined capacity of 2.49 billion gallons.

Although it's a work in progress, many cellulosic developers are actively engaged in pilot and demonstration phases to prove that their process technologies can economically operate commercially. So what will it take for developers to obtain the financing necessary to propel their unique projects onto the commercial stage? Many in the industry are taking a wait-and-see approach to who will provide the financial blueprint for others to follow. Those people will no doubt be watching the companies that are already constructing facilities such as Range Fuels Inc. and BlueFire Ethanol Fuels Inc.

"There is no one vehicle to get these plants built to commercial scale," says Mitch Mandich, chief executive officer for Range Fuels. The Broomfield, Colo.-based company is currently building a 100 MMgy cellulosic ethanol plant near Soperton, Ga., that will use woody biomass as its feedstock. The plant, scheduled to be in operation by late 2009, will initially produce 10 MMgy in its first phase. Production will be ramped up to maximum capacity shortly after its test phase.

"It's going to come down to the size of those first plants in an effort to match the corn-based ethanol industry," Mandich adds. "In my opinion, the industry will have to scale those plants along a continuum of size based upon capital needs and requirements. It's unlikely that anyone in the cellulosic ethanol space will be able to raise commercial-level funding to build a 100 MMgy plant right out of the chute."

Like the financial boost corn-based ethanol received four to five years ago by eager farmer-owned co-ops where equity was the primary source behind much of its growth, the same exuberance may be seen by venture capitalists as the first commercial ventures come on line.

"The next few years will be a very important time for the industry to demonstrate that it can stand on its own," says Paul Ho, principal at Hudson Clean Energy Partners. Ho joined HCEP in September and oversees transactions in the biofuels and biomass sectors. "Nobody doubts that the technologies will work," he says. "The million-dollar-question is whether it can scale up economically to accommodate commercial production operations. Until then, people are still going to view it with a skeptical eye, but as soon as the first company cracks the mold I think there will be a lot of interest in this space."

The current credit environment is tight, but several large firms, backed by both government funds and private-equity investors, are going ahead with plans to test their technology.

Capital Concerns

Cellulosic ethanol plant developers agree there is still substantial capital—whether it involves varying forms of debt and/or equity—flowing into the cellulosic industry in an effort to accelerate projects to commercial scale. "The capital markets perform when the structure is right and when there is a demand market for the end product," says Arnold Klann, president and chief executive officer of BlueFire Ethanol. The company will soon break ground on a 17 MMgy cellulosic ethanol facility near Palm Springs, Calif., and a 3.2 MMgy facility near Lancaster, Calif. Both would use wood wastes, waste plant material and other refuse-derived biomass. "It's one of those situations where everyone is waiting to see if the equity markets are going to return to some kind of normalcy," Klann says. "You do have some equity funds today that have billions of dollars with no place to put their money at the moment."

Another source of capital has been provided by the U.S. DOE in the form of federally funded loan guarantees. In March 2007, the U.S. DOE awarded several grants to cellulosic ethanol companies for technology enhancements and to reassess viable economics applicable to commercialization deployment strategies. Range Fuels and BlueFire Ethanol are two of six companies that have received federal grant money toward their respective projects.

According to John May, managing director for St. Louis, Mo.-based Stern Brothers Co., the DOE federal loan guarantee program should be seen as a "lynchpin" for cellulosic ethanol developers looking to gain financial footing and to scale up their projects. "I think [the DOE grant program] is an indispensible tool for the industry as it moves toward cellulosic ethanol," he says.

BlueFire Ethanol was awarded $40 million and was the first company to draw down on the grant money. Range Fuels received $76 million to construct its Soperton facility. The company also received an additional $100 million of equity from a Series B round and $6 million from the state of Georgia. The company is also backed by venture capital, including Vinod Khosla's investment firm Khosla Ventures.

Pictured is a schematic detailing BlueFire Ethanol's conversion process using Arkenol's concentrated acid hydrolysis process technology.

SOURCE: BLUEFIRE ETHANOL FUELS INC.

"With the DOE guaranteeing a portion of that loan, it should allow us to bring additional investment banks to participate under that loan guarantee program," Mandich says. "However, it will be based upon the risk of the technology, its ability to reach commercial scale and its ability to meet the right ‘pro forma' that will give investors a solid return."

Federal grant funds, or the federal loan guarantee program, typically cover about 80 percent of a company's debt that would not otherwise be supplied by traditional "merchant-type" lenders. The remaining 20 percent would come in the form of venture capital, private and/or public equity entities.

"I think you're probably two years away yet before the financial markets are actually mature enough to finance these projects," Klann says.

Historically, lenders committed a 50/50 or even 60/40 debt-to-equity ratio to corn-based ethanol plants. This new combination of federal grant money, equity and/or venture capital could create a paradigm shift within the lending community, which experienced nominal risk in the corn-based ethanol industry due to its commercially proven technology. If and when these commercial cellulosic ethanol plants are operational, obtaining working capital to sustain operations will be another challenge, according to May. "I think the lending paradigm changes somewhat just because you're applying project finance rules around risk mitigation to a different set of facts," he says. "In the end, the same concerns about managing feedstock cost, reliability, managing technology risk and where ethanol prices will be going remains."

Improving Technological Appeal

Like the beginning of the corn-based ethanol industry, cellulosic ethanol is striving to establish a proven track record. Much of the debate over how cellulosic ethanol projects will get financed to commercial scale depends on what technologies lenders and investors perceive as the most feasible.

"You have a lot of technology confusion in the marketplace right now because the government has sponsored enzymatic hydrolysis for years and years, so everyone believes that's the way to go," Klann says. "That's added a lot of confusion and a lot of resistance. The banks are waiting to see which technology is better because they've heard all kinds of hype and have seen no performance on a commercial scale."

BlueFire Ethanol holds the exclusive rights for a process technology developed by Arkenol Fuels LLC. Arkenol's patented process utilizes a concentrated acid hydrolysis pathway, which is amenable to handling the wide range of feedstocks BlueFire Ethanol intends to use, according to Klann. BlueFire Ethanol determined that it could produce approximately 70 gallons of ethanol per dry ton of biomass.

As for Range Fuels, it will deploy a patented thermochemical process to convert woody biomass into ethanol at its Soperton facility. The company has also partnered with Ceres Inc. to research, develop and commercialize energy crop feedstocks for ethanol production. The two companies began working together during the 2008 spring planting season and plan to continue the collaboration for several years.

"The banks that are going to come forward with the funding and take the risk are still very concerned about developmental technology and how much money they will put into play in a debt market," Mandich says. "The initial foray into a commercial plant will most likely need to be on a smaller scale as opposed to the mid-range or higher end because you won't be able to get the financing."

Bryan Sims is an Ethanol Producer Magazine staff writer. Reach him at bsims@bbiinternational.com or (701) 738-4950.

Advertisement

Advertisement

Upcoming Events