EIA: US imports of biomass-based diesel up 12% in 2020

May 6, 2021

BY U.S. Energy Information Administration

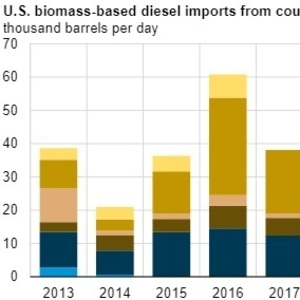

U.S. imports of biomass-based diesel, which include biodiesel and renewable diesel, grew 12 percent in 2020 to more than 31,000 barrels per day (b/d), increasing for the second consecutive year. Imports of biomass-based diesel increased in 2020 because of growing demand to meet government renewable fuel programs. U.S. consumption of biomass-based diesel, unlike demand for other fuels, remained relatively unaffected by responses to COVID-19 during 2020.

Biodiesel is a mixture of chemical compounds known as alkyl esters and is often combined with petroleum diesel in blends of 5 percent to 20 percent, known as B5 to B20, respectively. Renewable diesel is chemically indistinguishable from petroleum diesel, meaning that it meets specifications for use in existing infrastructure and diesel engines. As a result, renewable diesel is not subject to any blending limitations.

Because biomass-based diesel typically costs more to produce than petroleum diesel, primarily federal and state policies drive biomass-based diesel consumption. At the federal level, biomass-based diesel qualifies as an advanced biofuel under the U.S. Environmental Protection Agency’s Renewable Fuel Standard program, which sets targets to incorporate renewable fuels into the nation’s fuel supply. Biomass-based diesel volumes also qualify for a $1.00 per gallon tax credit through the end of 2022. In California, biomass-based diesel generates credits under California’s Low Carbon Fuel Standard.

Advertisement

Advertisement

Nearly 60 percent of the U.S. biomass-based diesel that was imported into the United States in 2020 was renewable diesel—which has come exclusively from Singapore since 2015. U.S. imports of renewable diesel increased to a record-high level of more than 18,000 b/d in 2020. Since 2016, all renewable diesel imports have entered the country through California. Demand for renewable diesel is high in California because it has one of the lowest carbon intensities under the LCFS, and so many market participants use it to comply with the LCFS.

U.S. imports of biodiesel increased to more than 12,800 b/d in 2020. Imports from Canada accounted for the majority of the U.S. biodiesel imports in 2020 at 7,500 b/d, a 47 percent increase from 2019.

Advertisement

Advertisement

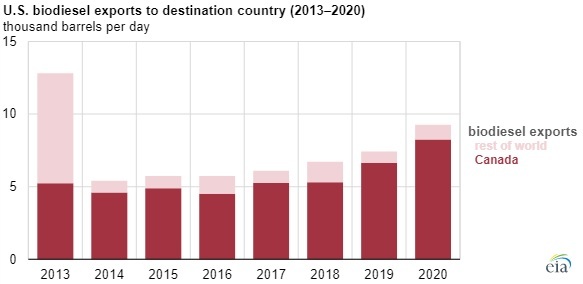

The United States also produces and exports biodiesel, and Canada is a key trading partner. U.S. exports of biodiesel totaled 9,000 b/d in 2020, an increase of 29 percent from 2019. Canada received nearly 90 percent of those U.S. exports, much of which was produced in the midwestern United States.

In our April 2021 Short-Term Energy Outlook, we forecast that continued growth in renewable diesel imports will drive growth in total biomass-based diesel imports. We expect net biomass-based diesel imports to increase by 43 percent in 2021 and by 49 percent in 2022.

Related Stories

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

Kintetsu World Express Inc. has signed an additional agreement with Hong Kong, China-based Cathay Pacific Airways for the use of sustainable aviation fuel (SAF). The agreement expands a three-year partnership between the two companies.

Broco Energy on July 17 announced a new partnership with the Massachusetts Port Authority (Massport) to deliver and transition Massport's fuel tanks to renewable diesel across its various facilities.

Shell Aviation, Accenture, and Amex GBT on July 10 announced Avelia is in the process of evolving to an industry solution with independent data hosting and a multi-supplier model helping users access the GHG benefits of SAF.

The U.S EPA on July 17 released data showing more than 1.9 billion RINs were generated under the RFS during June, down 11% when compared to the same month of last year. Total RIN generation for the first half of 2025 reached 11.17 billion.

Upcoming Events