Illinois economist: 80% chance EPA will reverse RVO write-down

March 6, 2014

BY Susanne Retka Schill

The implied probability that the U.S. EPA will reverse the write-down of the renewable fuel standard (RFS) found in its proposed 2014 renewable volume obligations (RVO) is 80 percent, according to an analysis by University of Illinois economist Scott Irwin published March 5 on FarmDocDaily.

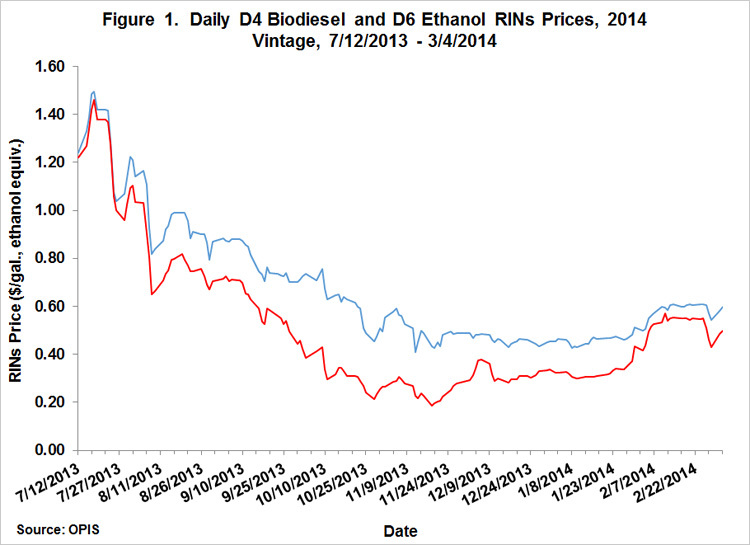

In the post, Irwin outlines the method of analysis and assumptions as he considered possible outcomes of the EPA policy regarding the renewable mandate for 2014. Irwin built some of his equations on earlier work looking at the market for renewable identification numbers (RINs). “The probability calculation is fairly consistent across 2014 vintage D4 and D6 RINs prices,” Irwin wrote.

“Given the heated political battle surrounding the 2014 RFS rulemaking it is more than a bit surprising to see the RINs market leaning so heavily in the direction of a reversal,” he said. But this view received a boost recently from a prominent supporter of biofuels. Senator Charles Grassley of Iowa last week told reporters, "I would doubt there would be a complete reversal [from the proposal], which is what I would like to happen. I'd be surprised if there wasn't some modification of the original rule that still might be considered a partial victory for ethanol." A public statement of this nature from Senator Grassley suggests the main uncertainty at this point is not whether the EPA will reverse the write down of the renewable mandate for 2014, but, rather, how much the write down will be rolled back.

Advertisement

Advertisement

This is the third in a series in recent weeks. In the first, “Will the EPA Reverse Itself on the Write Down of the Renewable Mandate for 2014? The Message from the RINs Market,” Irwin analyzed the RINs market, writing, “the rise of D6 ethanol prices relative to D4 biodiesel prices suggested that RINs traders believed the odds of the EPA reversing the proposed write down of the renewable mandate for 2014 in final rulemaking had increased sharply. The ‘coupling’ of D4 and D6 RINs prices indicated a revised expectation that the renewable mandate for 2014 would exceed the E10 blend wall.”

The second analysis, “Who Wins if the EPA Reverses Itself on the Write Down of the Renewable Mandate in 2014?,” concluded the most likely winner from a reversal of the policy would be the biodiesel industry. “Biomass-based diesel was cheaper than E85 in most scenarios in terms of compliance costs for obligated parties under the RFS,” Irwin concluded.

Advertisement

Advertisement

Related Stories

The USDA has announced it will delay opening the first quarterly grant application window for FY 2026 REAP funding. The agency cited both an application backlog and the need to disincentivize solar projects as reasons for the delay.

CoBank’s latest quarterly research report, released July 10, highlights current uncertainty around the implementation of three biofuel policies, RFS RVOs, small refinery exemptions (SREs) and the 45Z clean fuels production tax credit.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

Upcoming Events