Maximizing Biopower Development

PHOTO: THE PARTON GROUP

April 3, 2012

BY Bob Synk

Power plant developers, project financiers, and government energy planners are well aware that the potential for biopower generation is limited by the availability of economic biomass fuel. The way allowable fuels are defined has a significant impact on the project development potential. A dramatic 500 percent increase in project development would be possible if whole tree chips were not disqualified from biopower feedstock.

Whole tree chips and certain other types of biomass are often excluded from tax qualifications and, in many cases, from power purchase agreements (PPA) and air permits. The procurement of unmerchantable timber and under-utilized pulpwood like bark and leaves in the form of whole tree chips, however, can be a significant advantage for many biopower projects, both in reduced cost and security of fuel supply.

Whole tree chips are excluded out of concern for the protection of traditional forest product industries, such as pulp and paper and wood products manufacturing, and to ensure overabundance of caution in protecting the environment. There have been both systemic and cyclical declines in the demand for timber from the traditional industries. As a result, the amount of available timber in many areas far exceeds the real long-term production needs of these users. The availability of this biomass represents a significant opportunity to the biopower industry.

Unmerchantable Exclusion

Unmerchantable timber is defined by the U.S. Forest Service as “material that is unsuitable for conversion to industrial wood products due to its size, form or quality.” Under-utilized pulpwood is frequently described as economically unmerchantable pulpwood and exists when perfectly good pulpwood is located too far from a pulp mill to be affordably delivered.

Use of these feedstocks as biofuel has been prohibited by many government policies that limit the definition of qualified biofuel to logging and mill residues. More than 20 definitions of biomass circulate among agencies in the federal government, not to mention definitions in different states and power off-take agreements.

For example, the IRS Tax Code currently excludes whole tree chips for production and investment tax credits, limiting acceptable biofuel to residues only. IRS Bulletin 2006-42, Oct. 16, 2006, provides guidance on a tax credit for electricity produced from open-loop biomass, which it defines as mill and harvesting residues, pre-commercial thinning, slash and brush, or solid wood waste materials, including landscape or right-of-way trimmings.

Advertisement

Advertisement

This exclusion of unmerchantable timber and under-utilized pulpwood for production and investment tax credits unnecessarily curtails biomass fuel availability and limits the development of the biopower industry. Clearly, policies that limit the definition of biomass constrain local timberland-based economies.

Georgia Case Study

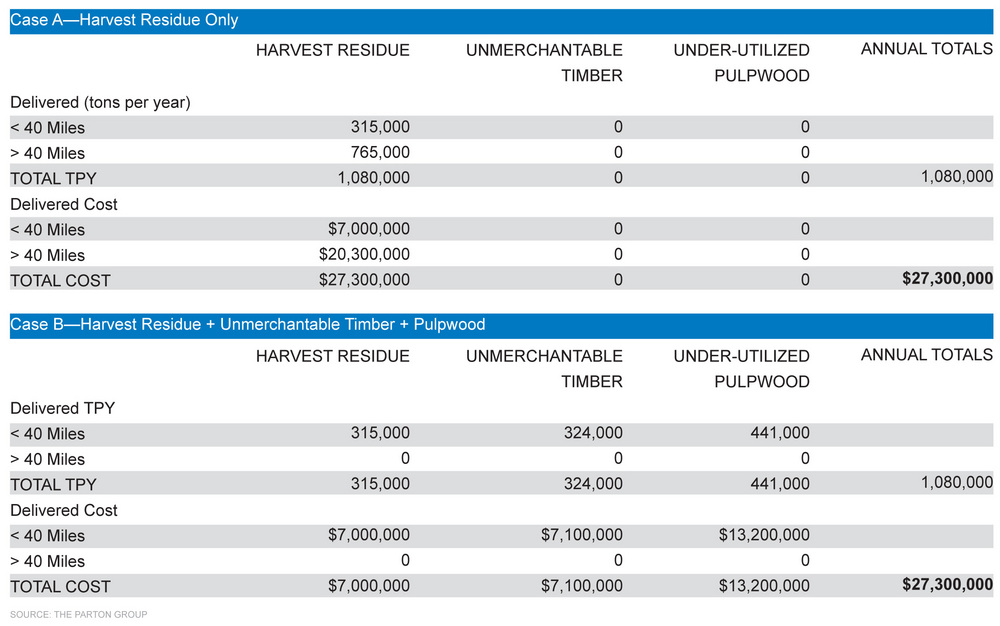

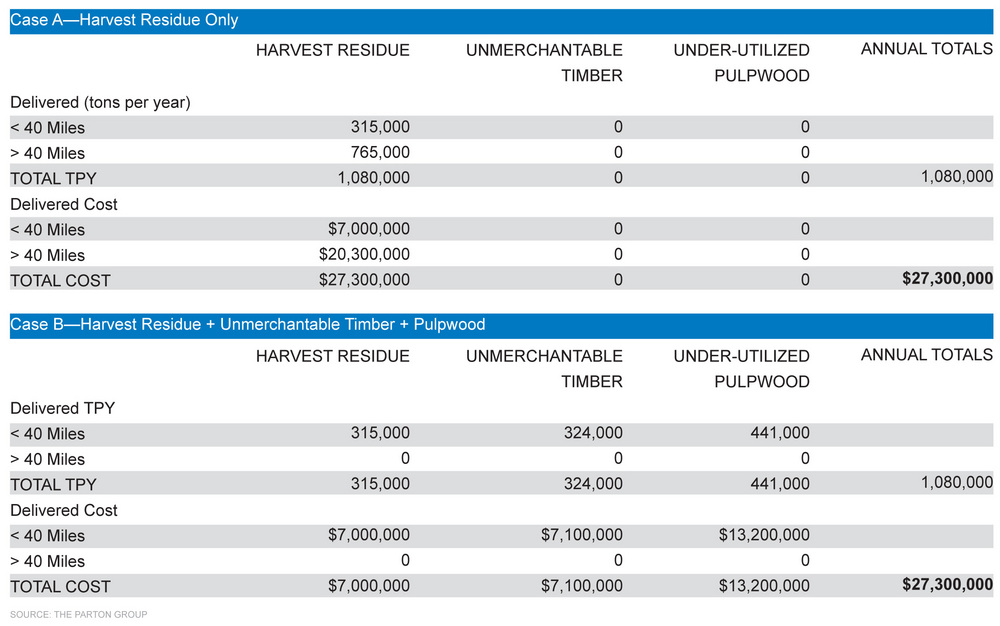

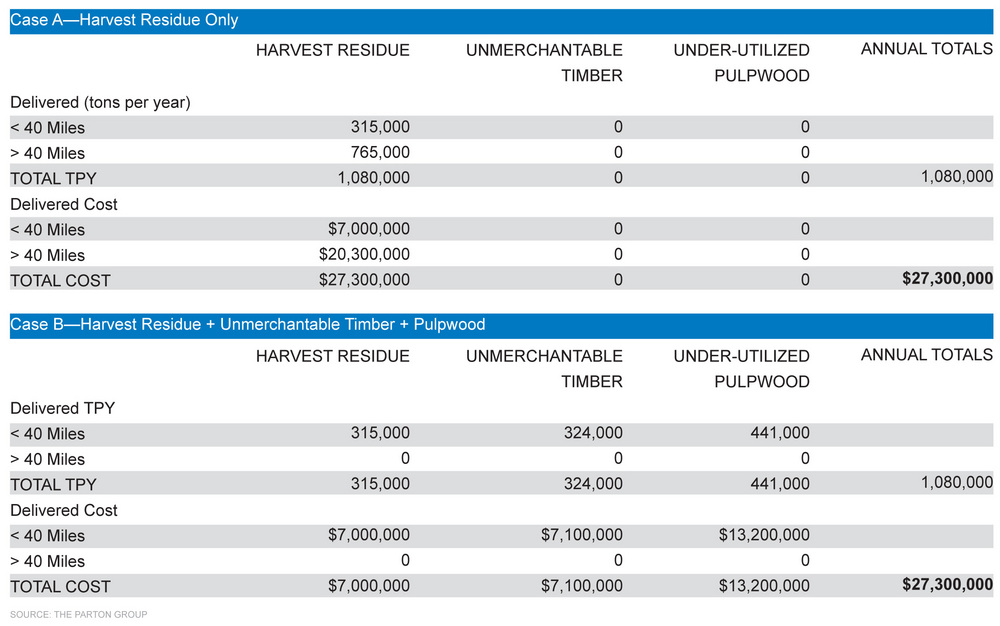

The Parton Group has explored these issues with a case study investigation of the biopower feedstock availability for all 159 counties in the state of Georgia. Using our proprietary methodology and the U.S. Forest Service 2010 database, we determined the biopower development potential of each of the counties based first on biofuel consisting of harvest residue only, and second, based on a biofuel mix consisting of harvest residue and whole tree chips. Our case study also determined the optimal counties for biofuel sourcing.

In our analysis, each county in Georgia was analyzed as a separate biopower development site, having a 100-mile radius wood basket. In all cases, we assumed that only 60 percent of harvest residue was actually recoverable and that to finance a project, the developer needed to identify twice the amount of net recoverable biofuel the plant will actually consume.

We determined that the recoverable quantities of logging residues from private timberland provide sufficient feedstock for the financeable development of only up to 250 MW of biopower statewide. By including whole tree chips with the logging residues, however, more than 1,200 MW of biopower can be developed and financed statewide—nearly a 500 percent increase. This situation is typical in many states.

So, how do the delivered costs of biofuel types compare? Whole tree chips from unmerchantable timber are generally sold at the same delivered cost per ton as fuel chips from logging residue. The in-woods cost of whole tree chips from under-utilized pulpwood is slightly higher than the in-woods cost of logging residue because higher stumpage fees are added to its cost. Because transport distance greatly impacts delivered price, however, these higher in-woods costs for pulpwood can be offset by delivery cost savings when significant quantities are sourced nearby.

Advertisement

Advertisement

The in-woods cost of pulpwood includes stumpage fees (for this example $8 to $9 per ton), a cost not incurred by logging residue. At the current freight cost of 13 cents per ton-mile, this additional cost will be offset by delivery cost savings if the pulpwood is available 65 miles closer to the plant than residue. In this case the annual cost of residue fuel plus shipping is essentially the same as the annual cost of a fuel blend with whole tree chips plus shipping. Additionally, there is a very significant reduction, roughly 50 percent, in greenhouse gas emissions associated with fuel shipping from the smaller radius wood basket.

As more biopower is developed, the availability of logging residues is tightening and projects are sourcing fuel farther from their sites. Biomass supply regions of 100-plus mile radii will become more common. The biomass supply-demand ratios of 2:1 preferred by many project financiers may be obtainable only if whole tree chips are considered part of the project’s fuel blend.

The availability and security of biomass supply are important considerations in biopower project development, and may outweigh the value of available tax credits. Government policies (time period, funding level, material qualifications, implementation details, etc.) are always uncertain and, therefore, at risk as project development considerations.

Renewable Whole Tree Chips

Some in the environmental community and traditional forest products industries are opposed to defining biomass derived from whole wood as a renewable source. But a 2011 ruling by the North Carolina Utilities Commission approved Duke Energy’s petition to classify its biopower plants as renewable energy facilities, using a fuel mix that includes whole tree chips. Based on scientific information provided by the North Carolina Forestry Commission, the Utilities Commission rejected the argument that whole trees chips are not available on a renewable basis.

Currently, only five states have developed specific harvest guidelines that protect the environment while allowing the managed harvesting of whole trees for biopower. They are Maine, Minnesota, Missouri, Pennsylvania and Wisconsin.

The Parton Group believes that the definition of qualified biomass should be expanded to include whole tree chips from unmerchantable timber and from under-utilized pulpwood. We recommend that project developers very carefully draft the definition of allowable biomass in critical project documents including power purchase agreements and air emissions permits.

Author: Bob Synk

The Parton Group

(706) 559-4536

bobsynk@thepartongroup.com

Upcoming Events