Paving the Way for Higher Blends

October 3, 2007

BY Dave Nilles

The push for intermediate-level ethanol blends—between E10 and E85—begins where E10 started. Minnesota was the first to implement E10 in 1997. It's a decade later and Minnesota is preparing to become the first to implement 20 percent ethanol in the state's gasoline supply—either through E10 and increased E85 use, or through an E20 standard. It's the first step in what many ethanol stakeholders hope is the widespread use of higher blend levels.

The potential E20 move has been met with opposition, as was the initial shift to E10. Despite the hurdles, E10 is an established part of the nation's fuel supply with more than 50 percent of gasoline now blended with ethanol. Despite the success story, it seems the ethanol industry will be fighting the same battles with E20. The challenges were outlined by several speakers participating in panel discussions at the American Coalition for Ethanol's 20th annual conference and trade show held Aug. 7-9 in St. Paul, Minn.

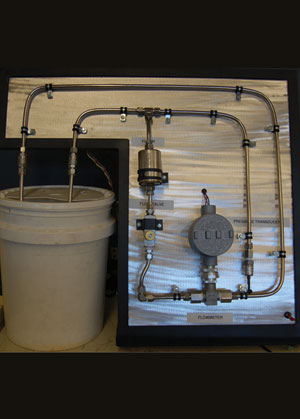

Understandably, there are technical challenges to using E20 and moving more ethanol across the country. The first is being solved through a multi-pronged research effort, which is an old hat for Bruce Jones, director of the Minnesota Center for Automotive Research (MnCAR) at Minnesota State University in Mankato. His lab is conducting the material compatibility portion of a two-year E20 study that's being coordinated by the Renewable Fuels Association (RFA). Jones' students are testing fuel system components, the raw materials used to manufacture fuel system components (e.g., alloys, plastic and rubber) and small engines.

In 1999, Jones released a study, "Use of Mid-range Ethanol/Gasoline Blends in Unmodified Passenger Cars and Light Duty Trucks," which tested the drivability, fuel economy, emission characteristics and component compatibility of 30 percent ethanol blends in unmodified vehicles. The test results showed that the use of E30 was feasible and likely helped spark legislative debate for the 20 percent ethanol requirement, Jones said.

At press time, testing was projected to wrap up in September. "There have been no real surprises," he told EPM. He said the group has found a measurable corrosion rate in materials tested with gasoline, E10 and E20. However, the biggest unknown is discovering the corrosion limits acceptable to manufacturers.

In addition to component testing, MnCAR has undertaken small engine testing with support of the Minnesota Corn Research and Promotion Council. A portion of the test includes driving a Kawasaki motorcycle on E20 to test drivability and durability.

Vehicle compatibility isn't the only source of concern for higher level ethanol blends. Fuel distributors are also studying the potential effects of the fuel. Kerry McManama of Underwriters Laboratories Inc. (UL) said there is no UL-certified dispenser on the market today for use with E85. The organization is conducting field observations and laboratory tests to study ethanol's galvanic and corrosive effects. McManama said UL's short-term gasket and seal testing research program is complete. UL announced Aug. 2 that it is accepting requests for certification investigations of gaskets and seals for use with concentrated ethanol blends.

UL also conducted a field observation of current E85 pumps. Sixty-two percent of the E85 pumps surveyed consisted of regular gasoline pumps with no retrofits. Although the study concluded that E85 has not resulted in significant safety or maintenance problems, it didn't provide definitive conclusions. More accurate data is expected to be obtained from ongoing testing on fuel dispensers and components at the U.S. DOE's Oakridge National Laboratory and the U.S. EPA's National Vehicle Fuel Emissions Lab.

Handling ethanol at the fuel pump isn't the only hurdle to clear when distributing higher blends. Distribution is a significant issue as the fuel is hauled a long way from the plant to the pump.

From Here to There

Ethanol, corn and distillers grains are all part of the renewable fuels production equation and are connected by their heavy dependence on rail transportation for distribution. The growth of all three promises to put the rail system in a tight bind to efficiently move product. Ethanol production, and its distillers grains coproduct, is expected to continue to increase. As farmers prepare to harvest a record corn crop, there are already concerns about whether the rail industry can keep up.

The increase in ethanol shipping is not lost on the Federal Railroad Administration (FRA), according to Mark Maday, hazardous materials manager for Union Pacific Railroad. "It's unparalleled growth," he said, referring to the ethanol industry's projected 12.5 billion gallons of annual production capacity by 2009, of which 85 percent is slated to move by rail.

Table 1

Statistically speaking, in 2007 ethanol became the No. 1 most transported hazardous material on the U.S. rail system. Maday said there will be between 120,000 and 150,000 loads of ethanol, surpassing liquefied petroleum, which now moves into second place with approximately 120,000 loads shipped per year (Table 1). The typical railcar holds approximately 29,000 gallons.

The number of railcars carrying ethanol is expected to increase significantly by 2010. Further, Maday said the figures don't include residue cars, or tank cars that return empty to an ethanol plant. Those cars are still considered to be carrying a hazardous material due to the possibility of vapor releases. Nonaccidental releases (NARs) cover any liquid, solid or vapors released from railcars. Factoring in residue cars, the ethanol industry will be responsible for 520,000 to 650,000 rail shipments by 2010.

The increase has naturally, and unfortunately, pushed ethanol into the top spot of another category. Ethanol had the most NARs in 2007 with 87 nationwide. Hydrochloric acid solution was second with 46, and liquefied petroleum gas reported 43. As a result, FRA Staff Director William Schoonover announced that ethanol is on a zero-tolerance policy when it comes to NARs, Maday said. The good news is that ethanol is a developing industry, with room for improvement, he added.

While the regulatory focus is on ethanol, fuel isn't the only product being shipped by rail. Jim Hansen of Poet Nutrition said by 2012 there will be an estimated 33 million tons of distillers grains production. Railcar manufacturers are trying to catch up with demand, but a 35,000-car backlog still exists, according to Gordon Heisler, former Sunoco executive turned consultant for Professional Logistics Group Inc. Hansen said an expected 5,000 additional railcars entering the market in 2008 should begin to stabilize railcar lease rates, which have gone from $450 per car per month in 2000 to $750 per car per month in 2007. However, the ethanol industry isn't leaving much time for builders to catch their breath. In 2003, the railroads reached a supply/demand equilibrium for the first time in 90 years, Heisler said. The crunch has resulted in a 16 to 38 cent per gallon cost for ethanol distribution. Ethanol's growth coincides with the railroad industry's record profits, Heisler said.

While Minnesota Gov. Tim Pawlenty can be largely credited for the push to E20, the ethanol industry can expect further legislative support for higher level blends. Sen. John Thune, R-S.D., has also stressed the need to approve higher blends. "Beyond the E10 wall, E85 and intermediate blends depend on cellulosic ethanol," he said.

Three major hurdles exist before higher blend levels can become part of the fuel market—vehicle and dispenser compatibility, and distribution. Perhaps Ralph Groschen, senior marketing specialist with the Minnesota Department of Agriculture, summed it up best when he said, "We need to figure out how and where to find a market beyond E10."

Dave Nilles is the Ethanol Producer Magazine contributions editor. Reach him at dnilles@bbibiofuels.com or (701) 373-0636.

The potential E20 move has been met with opposition, as was the initial shift to E10. Despite the hurdles, E10 is an established part of the nation's fuel supply with more than 50 percent of gasoline now blended with ethanol. Despite the success story, it seems the ethanol industry will be fighting the same battles with E20. The challenges were outlined by several speakers participating in panel discussions at the American Coalition for Ethanol's 20th annual conference and trade show held Aug. 7-9 in St. Paul, Minn.

Understandably, there are technical challenges to using E20 and moving more ethanol across the country. The first is being solved through a multi-pronged research effort, which is an old hat for Bruce Jones, director of the Minnesota Center for Automotive Research (MnCAR) at Minnesota State University in Mankato. His lab is conducting the material compatibility portion of a two-year E20 study that's being coordinated by the Renewable Fuels Association (RFA). Jones' students are testing fuel system components, the raw materials used to manufacture fuel system components (e.g., alloys, plastic and rubber) and small engines.

In 1999, Jones released a study, "Use of Mid-range Ethanol/Gasoline Blends in Unmodified Passenger Cars and Light Duty Trucks," which tested the drivability, fuel economy, emission characteristics and component compatibility of 30 percent ethanol blends in unmodified vehicles. The test results showed that the use of E30 was feasible and likely helped spark legislative debate for the 20 percent ethanol requirement, Jones said.

At press time, testing was projected to wrap up in September. "There have been no real surprises," he told EPM. He said the group has found a measurable corrosion rate in materials tested with gasoline, E10 and E20. However, the biggest unknown is discovering the corrosion limits acceptable to manufacturers.

In addition to component testing, MnCAR has undertaken small engine testing with support of the Minnesota Corn Research and Promotion Council. A portion of the test includes driving a Kawasaki motorcycle on E20 to test drivability and durability.

Vehicle compatibility isn't the only source of concern for higher level ethanol blends. Fuel distributors are also studying the potential effects of the fuel. Kerry McManama of Underwriters Laboratories Inc. (UL) said there is no UL-certified dispenser on the market today for use with E85. The organization is conducting field observations and laboratory tests to study ethanol's galvanic and corrosive effects. McManama said UL's short-term gasket and seal testing research program is complete. UL announced Aug. 2 that it is accepting requests for certification investigations of gaskets and seals for use with concentrated ethanol blends.

UL also conducted a field observation of current E85 pumps. Sixty-two percent of the E85 pumps surveyed consisted of regular gasoline pumps with no retrofits. Although the study concluded that E85 has not resulted in significant safety or maintenance problems, it didn't provide definitive conclusions. More accurate data is expected to be obtained from ongoing testing on fuel dispensers and components at the U.S. DOE's Oakridge National Laboratory and the U.S. EPA's National Vehicle Fuel Emissions Lab.

Handling ethanol at the fuel pump isn't the only hurdle to clear when distributing higher blends. Distribution is a significant issue as the fuel is hauled a long way from the plant to the pump.

From Here to There

Ethanol, corn and distillers grains are all part of the renewable fuels production equation and are connected by their heavy dependence on rail transportation for distribution. The growth of all three promises to put the rail system in a tight bind to efficiently move product. Ethanol production, and its distillers grains coproduct, is expected to continue to increase. As farmers prepare to harvest a record corn crop, there are already concerns about whether the rail industry can keep up.

The increase in ethanol shipping is not lost on the Federal Railroad Administration (FRA), according to Mark Maday, hazardous materials manager for Union Pacific Railroad. "It's unparalleled growth," he said, referring to the ethanol industry's projected 12.5 billion gallons of annual production capacity by 2009, of which 85 percent is slated to move by rail.

Table 1

Statistically speaking, in 2007 ethanol became the No. 1 most transported hazardous material on the U.S. rail system. Maday said there will be between 120,000 and 150,000 loads of ethanol, surpassing liquefied petroleum, which now moves into second place with approximately 120,000 loads shipped per year (Table 1). The typical railcar holds approximately 29,000 gallons.

The number of railcars carrying ethanol is expected to increase significantly by 2010. Further, Maday said the figures don't include residue cars, or tank cars that return empty to an ethanol plant. Those cars are still considered to be carrying a hazardous material due to the possibility of vapor releases. Nonaccidental releases (NARs) cover any liquid, solid or vapors released from railcars. Factoring in residue cars, the ethanol industry will be responsible for 520,000 to 650,000 rail shipments by 2010.

The increase has naturally, and unfortunately, pushed ethanol into the top spot of another category. Ethanol had the most NARs in 2007 with 87 nationwide. Hydrochloric acid solution was second with 46, and liquefied petroleum gas reported 43. As a result, FRA Staff Director William Schoonover announced that ethanol is on a zero-tolerance policy when it comes to NARs, Maday said. The good news is that ethanol is a developing industry, with room for improvement, he added.

While the regulatory focus is on ethanol, fuel isn't the only product being shipped by rail. Jim Hansen of Poet Nutrition said by 2012 there will be an estimated 33 million tons of distillers grains production. Railcar manufacturers are trying to catch up with demand, but a 35,000-car backlog still exists, according to Gordon Heisler, former Sunoco executive turned consultant for Professional Logistics Group Inc. Hansen said an expected 5,000 additional railcars entering the market in 2008 should begin to stabilize railcar lease rates, which have gone from $450 per car per month in 2000 to $750 per car per month in 2007. However, the ethanol industry isn't leaving much time for builders to catch their breath. In 2003, the railroads reached a supply/demand equilibrium for the first time in 90 years, Heisler said. The crunch has resulted in a 16 to 38 cent per gallon cost for ethanol distribution. Ethanol's growth coincides with the railroad industry's record profits, Heisler said.

While Minnesota Gov. Tim Pawlenty can be largely credited for the push to E20, the ethanol industry can expect further legislative support for higher level blends. Sen. John Thune, R-S.D., has also stressed the need to approve higher blends. "Beyond the E10 wall, E85 and intermediate blends depend on cellulosic ethanol," he said.

Three major hurdles exist before higher blend levels can become part of the fuel market—vehicle and dispenser compatibility, and distribution. Perhaps Ralph Groschen, senior marketing specialist with the Minnesota Department of Agriculture, summed it up best when he said, "We need to figure out how and where to find a market beyond E10."

Dave Nilles is the Ethanol Producer Magazine contributions editor. Reach him at dnilles@bbibiofuels.com or (701) 373-0636.

Advertisement

Advertisement

Upcoming Events