Points of Interest

April 15, 2011

BY Susanne Retka Schill

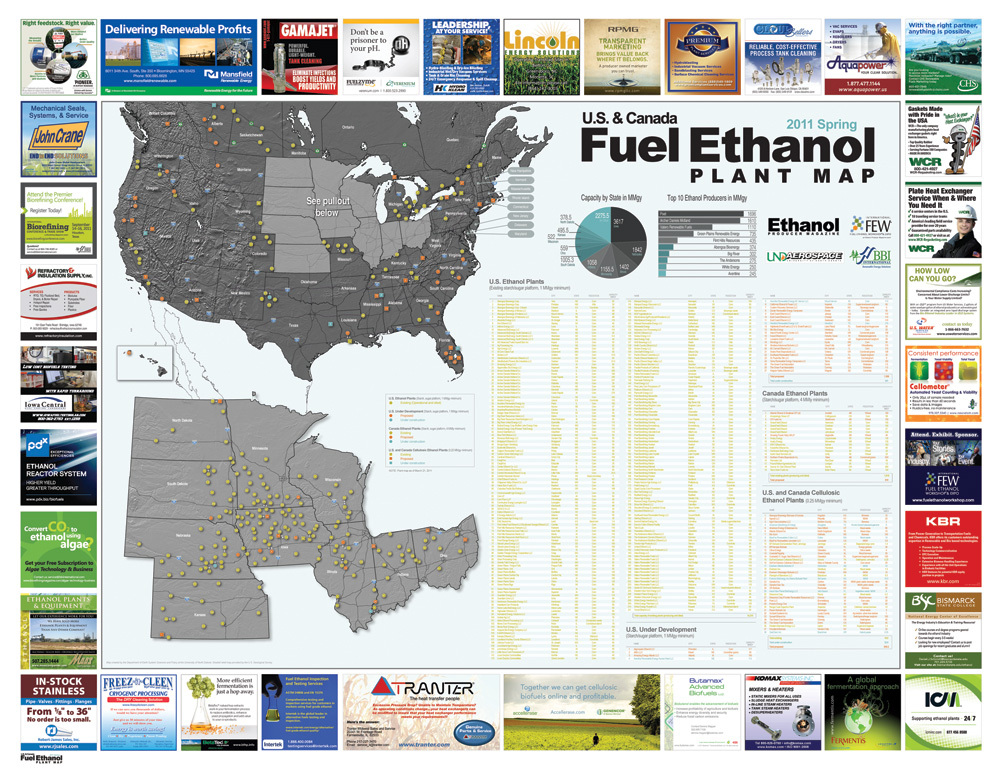

Each spring, the staff at Ethanol Producer Magazine takes a close look at the industry, as it prepares the spring wall map enclosed with this issue. We were pleased this spring to work with the University of North Dakota’s Department of Earth System Science and Policy to add new contextual features to the map and improve plant location accuracy.

We now count 211 ethanol plants in the U.S., both operating and idled, adding up to 14.31 billion gallons of annual capacity. Many producers routinely offer updates to their capacities as they squeeze more ethanol out of their plants. That is an average capacity of 67 MMgy, compared to spring 2005 when there were 92 operational plants on the list, totaling 3.85 billion gallons and averaging 42 MMgy.

We also show three conventional plants under construction, although they may not really count—all three, two Aventine Renewable Energy Inc. plants in Aurora, Neb., and Mount Vernon, Ind., (which announced completion of commisisoning after our deadline) and the former Panda Hereford Ethanol LP in Texas, were under construction at the end of the build-out boom when work was suspended in tough economic times. Compare that to spring of 2007 when we showed 57 plants under construction. Total existing capacity of the 121 operating and idled plants that spring was 5.9 billion gallons. Of the 24 proposed plants on this spring’s map using a sugar/starch platform, half expect to use corn, some in conjunction with other feedstocks, while other proposed projects are looking at sweet sorghum, sugarcane and small grains.

Change in the corn ethanol industry now is occurring in acquisitions and mergers. Hawkeye Energy Holdings LLC once was a regular in the Top 10 list. It has been replaced by Flint Hills Resources LP, which completed the acquisition of Hawkeye’s four plants this winter. We show Flint Hills as the fifth largest producer in volume, bumping Abengoa Bioenergy Corp. to number six. When Poet LLC bought the 90 MMgy plant at Cloverdale, Ind., this past year, it stepped back up to the No. 1 spot, easing Archer Daniels Midland Co. into second place. Valero Renewable Fuels LLC maintains its spot in third place and Green Plains Renewable Energy Inc. in fourth.

Advertisement

The real action is turning to cellulosic ethanol development, reflected in the decision to include those plants on the map beginning in spring 2010. This spring, we have 38 plants on our list, with seven completed plants meeting our minimum capacity requirement of 0.25 MMgy. Completed plants have a total capacity of 18.8 MMgy. Another six plants are under construction, representing 52.8 MMgy and 25 are proposed, which, if all were completed, would add 839.2 MMgy of cellulosic ethanol capacity. The cellulosic space is tough to map, though. Some very viable contenders aren’t on the list because their existing demonstration plants are below the threshold, or because they haven’t named a location. One can’t put a dot on a map without a location. We expect this part of the map to grow, and are already discussing how we will track hybrids, once corn producers begin adding cellulosic modules.

— Susanne Retka Schill

Advertisement

Upcoming Events