Rex American Resources reports record net income for fiscal 2014

Rex American Resources Corp.

March 30, 2015

BY Erin Krueger

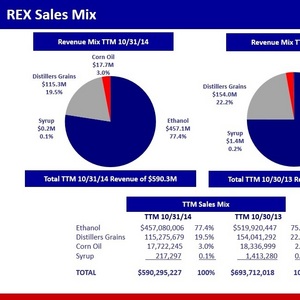

Rex American Resources Corp. has released financial results for fiscal year 2014, which ended Jan. 31, reporting net sales of $572.2 million, down from $666 million in fiscal 2013. Gross profits, however, more than doubled, reaching $141.9 million, up from $64.3 million the previous year. Fiscal 2014 income from continuing operations before income taxes and noncontrolling interests also more than doubled, reaching $152.8 million, up from $58.9 million in fiscal 2013.

Rex reported net income attributable to Rex shareholders of $87.3 million last year, a 149 percent increase compared with $35.1 million in fiscal 2013. Diluted net income per share attributable to Rex common shareholders rose to a record $10.76 in fiscal 2014, compared to $4.29 per share in fiscal 2013.

Advertisement

Advertisement

For the fourth quarter of fiscal 2014, Rex reported net sales and revenue of $127.7 million, down from $146.1 million during the same period of 2013. Gross profit for the quarter increased to $30 million, up from $26.3 million during the same quarter of the previous year. Rex attributed the increase to solid ethanol crush spread margins during the quarter. Net income attributable to Rex shareholders increased to $20.3 million, up from $15.9 million during the fourth quarter of 2013. Fourth quarter 2014 diluted net income per share attributable to Rex common shareholders was a record $2.55 per share, up from $1.95 per share during the same period of 2013.

During an investor call, Stuart Rose, chairman and CEO of Rex, noted demand for ethanol is expected to pick up with the summer driving season. He also noted distillers dried grains prices are improving now that the Chinese market has reopened.

Advertisement

Advertisement

According to Rose, even though crush spreads are down, Rex’s plants are still running at slightly better than breakeven. Margins have improved over the past couple of weeks, he added.

Rose also noted Rex continues to explore the possibility of building a new plant. While the company believes that permitting is now possible, a final decision will have to wait until industry economics improve. Rex is also continuing to look for opportunities to buy additional ethanol plants.

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

EcoCeres Inc. has signed a multi-year agreement to supply British Airways with sustainable aviation fuel (SAF). The fuel will be produced from 100% waste-based biomass feedstock, such as used cooking oil (UCO).

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Upcoming Events