Rex reports strong first quarter, continues capacity expansion

Rex American Resources Corp.

June 2, 2016

BY Erin Krueger

Rex American Resources Corp. has released first quarter financial results, reporting net sales and review of $100.2 million, compared to $105.02 million during the same period of the prior year. The reductions are attributed to a 6.4 percent decline in the average price per gallon of ethanol and a 13.1 percent decline in distiller grains pricing, partially offset by increased ethanol volume. Gross profit for the quarter was $8.4 million, compared with $9.1 million during the first quarter of 2015.

Net income attributable to Rex shareholders was $2.8 million, compared to $3.9 million during the same period of last year. Diluted net income per share attributable to Rex common shareholders was 43 cents per share, compared to 50 cents per share during the first quarter of 2015.

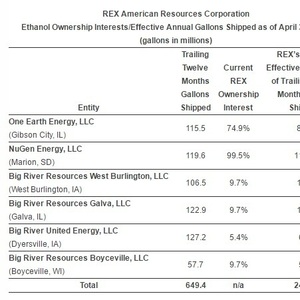

The company’s financial results primarily reflect its interests in six ethanol plants. Rex currently owns 74.9 percent of One Earth Energy LLC in Gibson City, Illinois; 99.5 percent of NuGen Energy LLC in Marion, South Dakota; 9.7 percent of Big River Resources West Burlington LLC in West Burlington, Iowa; 9.7 percent in Big River Resources Galva LLC in Galva, Illinois; 5.4 percent in Big River United Energy LLC in Dyersville, Iowa; and 9.7 percent in Big River Resources Boyceville LLC in Boyceville, Wisconsin. The operations of One Earth and NuGen are consolidated, with those of the company’s four remaining plants reported as equity in income of unconsolidated ethanol affiliates.

Advertisement

Advertisement

Equity in income of unconsolidated ethanol affiliates was $200,000, compared to $1.5 million during the first quarter of last year. The drop is attributed to lower crush spreads and reduced distiller grain prices, along with the recognition of approximately $500,000 less due to the company’s second quarter 2015 sale of its interest in Patriot Holdings LLC.

“We are pleased with our ability to generate profitable operating results in our fiscal 2016 first quarter given the challenging market environment during this time period,” said Zafar Rizvi, CEO of Rex. “We believe these results reflect our ability to leverage our strategically positioned ethanol plants and the disciplined manner in which we operate at both the plant and corporate level.”

According to Rex, the average selling price for ethanol was $1.32 per gallon, down from $1.41 per gallon during the first quarter of 2015. The average selling price per ton of dried distillers grains also dropped, from $144.23 during the first quarter of 2015 to $125.29 during the first quarter of this year. The average selling price of non-food grade corn oil was 24 cents per pound during the first quarter, down from 28 cents per pound during the same period of the previous year. The average selling price of modified distillers grains dropped to $59.82 per ton, down from $79.96 per ton during the same period of last year. The average cost of grain was $3.52 per bushel, up slightly from $3.67 per bushel during the first quarter of 2015. The average cost of natural gas dropped to $3.22 per MMBtu, from $4.80 per MMBtu during the first quarter of last year.

During an investor call, Stuart Rose, executive chairman of Rex, indicated the company is seeing improvement in the second quarter. Crush spreads are improving and distillers grains prices have been rising, he said. According to Rose, the outlook for Rex’s ethanol business is good. The corn harvest is expected to be good and the company sees no political threats he said, adding that current presidential candidates have shown support for ethanol.

Advertisement

Advertisement

While Rex is always looking for opportunistic mergers and acquisitions (M&A) opportunities in the ethanol business, Rose said the company currently sees no imminent opportunities. Rather, he said the biggest opportunity at this time is to expand the company’s ethanol plants. It’s the least expensive and safest opportunity, he said, noting the company thinks expanding the capacity of its current ethanol plants will result in the biggest return.

Rizvi noted Rex continues to make capital investments to improve its plants. Since the start of last year, he estimated Rex has made $17 million in investments aimed at increasing production, with $6 to $10 million of capital spending expected this year. He stressed the company continues to focus on improving operational efficiencies, managing costs of production and increasing ethanol yield.

Related Stories

Neste Corp. on July 24 released second quarter results, reporting record quarterly renewable product sales volumes despite weaker margins. SAF sales were up nearly 80% when compared to the first quarter of 2025.

Valero Energy Corp. on July 24 released second quarter results, reporting a profitable three-month period for its ethanol segment. The renewable diesel segment posted a loss, but the company’s new sustainable aviation fuel (SAF) unit operated well.

The IRS on July 21 published a notice announcing the 2025 calendar-year inflation adjustment factor for the Section 45Z clen fuel production credit. The resulting adjustment boosts maximum the value of the credit by approximately 6%.

The U.S. Senate on July 23 voted 48 to 47 to confirm the appointment of Aaron Szabo to serve as assistant administrator of the U.S. EPA’s Office of Air and Radiation. Biofuel groups are congratulating him on his appointment.

U.S. Secretary of Agriculture Brooke L. Rollins today announced the reorganization of the USDA, refocusing its core operations to better align with its founding mission of supporting American farming, ranching, and forestry.

Upcoming Events