Technology harnesses waste gases for power

PHOTO: DAVID BRAUN

February 10, 2016

BY Tom Bryan

A century ago, J.D. Rockefeller amassed one of the greatest fortunes of all time—an equivalent of $340 billion today—by cornering the market on petroleum refining leftovers. Turn-of-the-century kerosene producers were dumping gasoline and other undesirable oil derivatives anywhere they could—including rivers—because the products were ostensibly worthless. Rockefeller, despising wastefulness, rejected this and used gasoline to make thermal energy for his kerosene plants. Automobiles arrived and the rest is history.

Alain Castro, CEO of Irvine, California-based Ener-Core, doesn’t claim to be the next Rockefeller. But he does believe his company’s technology could be a catalyst for transforming unwanted industrial waste gases into new fortunes. “What we think of today as low-quality waste gases will only be considered that for a short time longer,” he says. “We have a technology that could cause industries to really shift.”

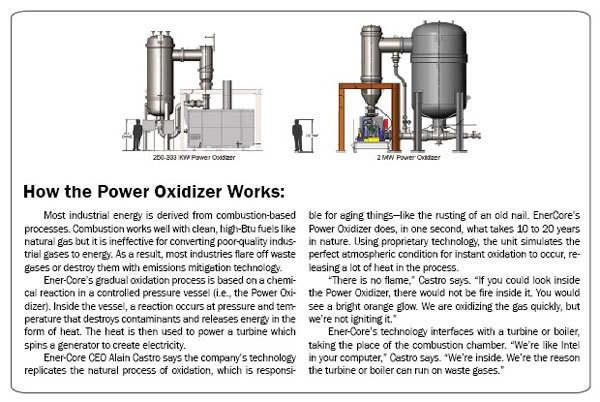

By that, Castro means he believes Ener-Core’s patented Power Oxidizer, which turns low-value industrial waste gases into base-load, on-site power, is poised to change the way industries manage and utilize the gases most of them currently consider a liability. The oxidizers come in 250-kW and 333-kW sizes, and Ener-Core recently completed the primary construction of a highly anticipated 2-MW unit, which will be integrated with a Dresser-Rand gas turbine. One of the first major adopters of the modified turbine will be a Pacific Ethanol plant in Stockton, California, which is waiting for the 2-MW unit to be fully tested.

“They’re planning to install two of our systems,” Castro says. “And they’ve determined that once the systems are installed—and we expect that to happen this summer—they will drop their operational costs by $3 million to $5 million a year. That’s a huge cost advantage for an ethanol plant.”

Rather than sell directly to Pacific Ethanol, Ener-Core will sell its oxidizers to Dresser-Rand, a Siemens-owned company that’s been working with Ener-Core for about two years. “We view this as a game-changer that’s going to allow customers to do something they couldn’t do before—utilize their own low-energy fuels,” says Mike Cormier, business development director for Dresser-Rand.

As planned, Pacific Ethanol will install two Dresser-Rand KG2-3GEF 2-MW gas turbine generators coupled with integrated Power Oxidizers. The deal was made official last spring when Ener-Core received nonbinding notification from Dresser-Rand stating its intent to issue a formal purchase order, valued at $2.1 million, pursuant to Ener-Core’s ability to complete a subscale acceptance test. “We wanted to simulate how the full-scale unit would operate on a small-scale acceptance test,” says Doug Harmin, vice president of engineering for Ener-Core. “To do that, we used our multifuel test facility to simulate the conditions of the 2-MW gas turbine.”

That test was successfully completed last summer and Dresser-Rand followed through with a purchase order. Now, a full-scale acceptance test of the large unit is all that remains before Pacific Ethanol adopts the technology.

“It’s a very good fit for pollution control—it is the best available control technology—and it helps reduce our operating costs,” says Pat McKenzie, director of corporate engineering at Pacific Ethanol. “When we’re finished with the installation of the power oxidizer at our Stockton facility, we’re going to take those results and look at how it fits into our operations in the remainder of our facilities in North America.”

Castro says completing construction of the 2-MW unit represents a big milestone for Ener-Core. “It’s a big step towards final validation,” he says. “At some point, most utility-scale power technologies must prove that they can surpass the 1-MW-size threshold. We are on the cusp of making this historic step in the next few months.”

Pacific Ethanol will reduce its operating costs and become an inordinately clean ethanol plant when it adopts oxidizer-integrated turbines. But Castro says the latter benefit is not the ethanol producer’s chief motivation for change. “They’re not doing this just to be clean,” he says. “This goes way beyond state and federal air emissions standards. They don’t have to go this far. They’re doing this because it gives them a cost advantage and because they’ll be better prepared for the next ethanol price drop.”

Baseload Power

Castro says Ener-Core is on the leading edge of a transformative distributed energy generation movement that’s hungry for clean, baseload power. “I believe distributed generation is not just a trend that’s here now and going to pass,” he says. “This is a big shift in the energy industry. We’re going away from the concept of massive centralized coal and nuclear power, and huge thermal energy plants, and moving toward small generation at the load.”

With wind and solar energy at the forefront of the renewable and distributed energy transformation, Castro says there is a growing need for sources of energy that are not intermittent. “You need baseload energy,” he says. “You can’t just make this transition with wind and solar because consumers need power all the time. That’s why we need baseload power generation assets like gas turbines.”

But Castro says companies that are installing their own gas turbines, often in the form of combined heat and power, are still exposed to fuel price volatility. “Natural gas prices have been cheap lately—we’ve all been spoiled—but I don’t think it can last much longer,” he says.

Regulatory Transcendence

In addition to energy price swings, Castro says industries are also susceptible to the volatility of environmental regulation. “We don’t know what the EPA is going to propose next month or next year, but we are pretty sure that it is not going to go easier on industries with waste gases,” he says. “It’s never going to get easier to emit waste gases into the atmosphere. It’s always going to get tougher. It’s only a question of how steep and how challenging the EPA’s rules will be.”

At a recent technology showcase for the Power Oxidizer, former U.S. EPA administrator Stephen Johnson, an Ener-Core’s advisory board member, said he expects no letup in U.S. industrial regulation in the future. “The policy and regulatory trend is not for relaxation on air quality,” he said. “It is definitely toward tougher air emissions standards.”

There are countless types of manufacturing and industrial plants that emit, flare, mitigate or otherwise manage waste gases. Castro’s list of prospective Power Oxidizer buyers includes ethanol plants, distilleries, oil refineries and petrochemical plants, semiconductor manufacturing plants, animal rendering plants, coal mines, wastewater treatment plants and more. “We think we can make them all more efficient and more cost competitive,” he says. “They all have waste gases, spend lots of money on energy, and are exposed to increasingly strict air-emissions standards. All three of those problems can be taken care of with our technology.”

According to the U.S. EPA, industrial and commercial emissions represent about one-third of all greenhouse gas emissions. If all of the industrial waste gases flared around the world were converted to energy, Castro says, 70 to 100 gigawatts of power would be generated—enough power for every home in the United States for a year.

Castro thinks of industrial emissions as a symptom of inefficiency and misdirected environmental solutions. He says industries would gladly stop emitting waste gases if they had a financial incentive to do so. “We just need to give industries a reason to change for capitalistic reasons rather than by force-feeding them more rules and new costs,” he says. “Here’s something that can make them cleaner and more competitive at once. Everyone has been focused on the problem, and that’s why there are hundreds of technologies on the market that focus on destroying waste gases. That’s like throwing aspirin at a disease. You might feel better, but you haven’t really tackled the problem. Let’s focus on the underlying root cause. Let’s focus on inefficiency.”

Ultimately, the Power Oxidizer’s adoption in the industrial marketplace will depend on its ability to align economic and environmental goals for early adopters like Pacific Ethanol. “When you align capitalism with environmental solutions, it’s powerful,” Castro says. “I’d like to think companies would deploy this solution even in a world where there wasn’t environmental regulation,” he says. “They would do it because it’s a way for them to utilize a resource that will make them more profitable—just like Rockefeller did with gasoline.”

Author: Tom Bryan

Editor in Chief, Ethanol Producer Magazine

701-746-8385

tbryan@bbiinternational.com

Advertisement

Advertisement

Advertisement

Advertisement

Related Stories

European biodiesel producer Greenergy on July 10 confirmed plans to shut down its biodiesel plant in Immingham, Lincolnshire, U.K. The company temporarily suspended operations at the facility earlier this year.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

XCF Global Inc. on July 8 provided a production update on its flagship New Rise Reno facility, underscoring that the plant has successfully produced SAF, renewable diesel, and renewable naphtha during its initial ramp-up.

FutureFuel idles biodiesel production amidst regulatory uncertainty, shifts full focus to specialty chemicals growth

FutureFuel Corp. on June 17 announced it will temporarily idle its biodiesel facility upon completion of its remaining contractual obligations, anticipated to occur by the end of June. The company is shifting its focus to specialty chemicals.

The U.S. EPA on June 18 announced 1.75 billion RINs were generated under the RFS in May, down from 2.07 billion that were generated during the same period of last year. Total RIN generation for the first five months of 2025 reached 9.06 billion.

Upcoming Events