Irwin RINs analysis points to rollback of proposed RFS cuts

Image: FarmDocDaily

August 12, 2014

BY Susanne Retka Schill

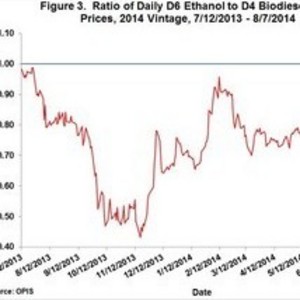

The ratio between D6 ethanol renewable identification numbers (RINs) and D4 biodiesel RINs is a primary clue indicating the market expects the U.S. EPA to roll back its proposed cuts to the renewable fuels standard (RFS). Furthermore, the sustained ratio above 0.90 indicates the RINs market is pricing in a renewable mandate higher than 13.8 billion gallons, writes University of Illinois economist Scott Irwin in a recent FarmDocDaily post.

Saying that a decision is expected soon from the U.S. EPA regarding the 2014 mandate, Irwin reviews his earlier analyses and brings them up to date in “Rolling Back the Write Down of the Renewable Mandate for 2014: The RINs Market Rings the Bell Again.” RINs are the renewable identification numbers used by blenders to demonstrate compliance with the RFS. Irwin explains that last October, his analysis showed that RINs traders likely had information about the proposed write down of renewable mandate for 2014 as early as July 2013. In February, Irwin estimated market signals were indicating an 80 percent probability of the EPA reversing its proposed write down.

In the current post, he reviews how the coupling and uncoupling of D6 ethanol RINs from D4 biodiesel RINs can be used to infer the market expectation of the direction of EPA policy. D4 and D6 prices were fully coupled in early July 2013, but uncoupled later in the month, he writes, “reflecting the changed market expectation, subsequently proved correct, that the EPA would write down the 2014 renewable mandate so it would not exceed the E10 blend wall,” he writes. He continues to chart the gap in RINs prices in recent months, showing that in mid-June D6 prices increased sharply relative to D4. Charting the ratio of D6 to D4 RINs prices show an average ratio of 0.93 since mid-June. “This is the longest sustained period of the ratio being above 0.90 since early July 2013. The clear implication is that RINs market traders believe there is a very high probability that the cut to the 2014 renewable mandate will be rolled back.”

Advertisement

The high ratio means, he suggests, “that the RINs market is pricing in a renewable mandate that is higher than 13.8 billion gallons. This may be due to new information about the likely final level of the renewable mandate in 2014 or accounting for the possibility that a court decision eventually restores the renewable mandate to its full statutory level of 14.4 billion gallons in 2014 and 15 billion gallons thereafter.”

Advertisement

Related Stories

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

International Sustainability & Carbon Certification has announced that Environment and Climate Change Canada has approved ISCC as a certification scheme in line with its sustainability criteria under its Clean Fuel Regulations.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

Upcoming Events