REG: Gallons sold up in Q1, buyer for Life Sciences identified

Source: Renewable Energy Group Inc.

May 3, 2019

BY Erin Krueger

Renewable Energy Group Inc. released first quarter 2019 results May 2, reporting a significant increase in biofuel gallons produced. The company also reported it has identified a buyer for its Life Sciences division and is working to expand renewable diesel capacity.

During an earnings call, Cynthia Warner, president and CEO of REG, said the first quarter was a challenging margin environment. She said first quarter challenges were further exacerbated by extreme weather conditions and flooding in the Midwest, fog in the Gulf of Mexico and other factors, all of which impacted production and logistics at some REG plants.

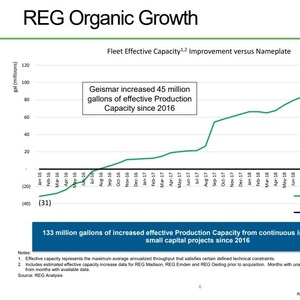

Despite those challenges, Warner said the company’s underlying operational performance in terms of production and gallons sold was strong. The company sold 162 million gallons of fuel, up 20 percent when compared to the first quarter of last year. REG produced 117 million gallons during the quarter, up 10 percent when compared to the same period of 2018. The company’s Geismar renewable diesel plant produced 20 million gallons, up 14 percent when compared to same period last year.

Advertisement

Advertisement

According to Warner, the 117 million gallons produced during the first quarter represents a first-quarter record for the company. She also noted five of the company’s plants set new production records during the three-month period.

Regarding the Life Sciences division, Warner said the company has identified a buyer and is in late stages of negotiation. She said the transaction is expected to close soon.

Advertisement

Advertisement

Warner also said further expansion into renewable diesel continues to be a focus for REG. She said the company is advancing its project efforts with Phillips 66 and noted work is progressing on schedule to engineer a 250 MMgy renewable diesel plant adjacent to Phillips Ferndale Washington refinery.

In addition, Warner said REG continues to await a retroactive reinstatement of the biodiesel tax credit (BTC). She said bipartisan support continues to grow and the company remains confident that the incentives will be reinstated for 2018 and 2019.

REG reported revenues of $478.2 million for the quarter on 162.5 million gallons of fuel sold. Net loss attributable to common stockholders was $41.4 million for the quarter, compared to net income attributable to common stockholders of $212.6 million during the same period of 2018. Excluding the effect of the BTC reinstatement, net income attributable to commons stockholders for the first quarter of 2018 was $12.9 million. First quarter 2019 adjusted EBITDA was negative $27.4 million, compared to adjusted EBITDA of $21 million in the first quarter of 2018.

REG estimates that if the currently lapsed BTC is retroactively reinstated for 2019 and 2018 on the same terms as in 2017, the company’s net income and adjusted EBITDA would each increase by approximately $55 million and $42.5 million for business conducted in the first quarters of 2019 and 2018, respectively.

Related Stories

The U.S EPA on July 17 released data showing more than 1.9 billion RINs were generated under the RFS during June, down 11% when compared to the same month of last year. Total RIN generation for the first half of 2025 reached 11.17 billion.

The U.S. EPA on July 17 published updated small refinery exemption (SRE) data, reporting that six new SRE petitions have been filed under the RFS during the past month. A total of 195 SRE petitions are now pending.

European biodiesel producer Greenergy on July 10 confirmed plans to shut down its biodiesel plant in Immingham, Lincolnshire, U.K. The company temporarily suspended operations at the facility earlier this year.

Aemetis Inc., a renewable natural gas and biofuels company, announced on July 17 that its India subsidiary, Universal Biofuels, appointed Anjaneyulu Ganji as chief financial officer, effective July 17.

Avia Solutions Group, the world's largest ACMI (aircraft, crew, maintenance, and insurance) provider, has partnered with DHL Express to reduce greenhouse gas emissions from its international shipments using SAF.

Upcoming Events