Concerns rise as low palm oil prices may increase use for biofuel

June 19, 2019

BY UFOP

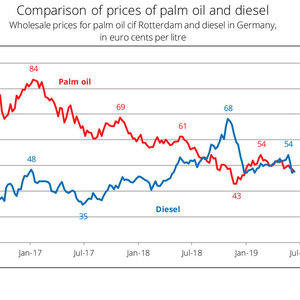

Selling prices for palm oil and diesel fuel have recently converged to the same level, after the former had even been at a lower price for six months. The Union zur Förderung von Oel- und Proteinpflanzen (UFOP) has drawn attention to the regulation laid down in the redrafted European Renewable Energy Directive (RED II) that specifies the reference amount of biofuels from cultivated biomass involving a high risk of changes in land use.

The regulation sets out that from 2024 onwards, the amount of palm oil-based fuels (biodiesel or hydrogenated vegetable oil, aka renewable diesel) that counts towards national quota obligations in 2019 must gradually be reduced to “zero” tons by 2030.

UFOP fears that the use of palm oil will increase, because palm oil prices have tumbled to a very low level since January 2017, temporarily even falling below the price for diesel fuel. The main reason is the continuing rise in global supplies of vegetable oil, especially palm oil. Experts estimate that in Indonesia alone supplies will grow from 37 million metric tons in 2017 to 43 tons in the running year. The oversupply has of course led to pressure on prices. A particularly sharp decline in prices was seen in November 2018, with prices plunging to a level last seen nine years earlier, Agrarmarkt Informations-Gesellschaft (mbH) has reported.

Advertisement

During the same period, crude oil prices moved in the opposite direction, climbing substantially due to U.S. penalties against Iraq and the OPEC countries’ self-imposed cuts in crude output. Moreover, reduced output in Russia and the U.S. limited supply and drove up oil prices. In Germany, diesel peaked at 68.14 euro cents per liter net ex-tank storage facility, which was a six-year high. This meant that diesel prices exceeded those of palm oil for the first time in July 2018 and remained above that level for several weeks. From UFOP’s standpoint, it would be absurd if palm oil-based fuels, of all things, would benefit from these freak changes in prices in 2019.

Advertisement

Related Stories

The USDA significantly increased its estimate for 2025-’26 soybean oil use in biofuel production in its latest World Agricultural Supply and Demand Estimates report, released July 11. The outlook for soybean production was revised down.

U.S. fuel ethanol capacity fell slightly in April, while biodiesel and renewable diesel capacity held steady, according to data released by the U.S. EIA on June 30. Feedstock consumption was down when compared to the previous month.

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

Upcoming Events