Petroleum companies ramp up HVO production in Europe

August 15, 2019

BY UFOP

Production of hydrotreated vegetable oil (HVO) in the European Union has picked up pace since 2012. Petroleum companies, such as Neste, Eni and Total, were the main entities promoting the creation of corresponding capacities. From the perspective of the Union zur Förderung von Oel- und Proteinpflanzen (UFOP), the key reason for the development is that the indirect land use change (iLUC) regulation introduced in 2015 permits that biofuels from waste oils and fats can be counted double. At the same time, pressure on prices has increased in the international vegetable oil markets.

Palm oil has become cheaper and cheaper relative to soybean and, above all, rapeseed oil. Plant operators can order the feedstock flexibly, depending on price. However, the oil company Total underestimated the opposition from French farmers in June 2018. The farmers staged a massive protest against Total’s plans to initially use approximately 0.5 million tonnes of palm oil as a feedstock at La Mède. This translates to about 0.14 million hectares of additional palm oil plantations.

Advertisement

Advertisement

HVO plants can use a wide range of feedstocks, such as native vegetable oil, animal fats, fish oil and used cooking oil, as well as oils that are byproducts of different industrial processes, such as tall oil from the wood and paper industries, palm oil mill effluent and palm fatty acid distillate (PFAD). In view of these feedstock options, UFOP has urged the EU to step up certification and documentation requirements.

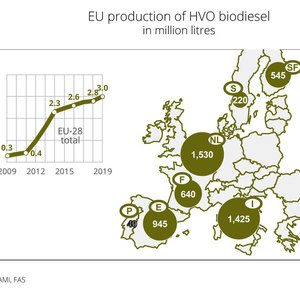

HVO output in the EU is estimated at 2.8 billion liters (740 million gallons) in 2018 and expected to rise slightly to 3 billion liters in 2019. The planned production facilities in France and Italy are expected to boost production to 3.5 and 4.5 billion liters respectively from 2020 onwards. These volumes are major factors in making the EU the largest producer of alternative diesel fuels in the world. According to information published by Agrarmarkt Informations-Gesellschaft mbH (AMI), production of biodiesel including HVO in 2019 will amount to around 14.2 billion liters.

Advertisement

Advertisement

HVO is made by saturating the double bonds in the fatty acid molecules of vegetable oils and animal fats with hydrogen. Propane is produced as a byproduct. The product can be modified in the HVO production process, so that HVO can be blended with fossil fuels at 7 percent (the same as biodiesel) or more to make renewable diesel or biokerosene. This means that HVO can be incorporated specifically and irrespective of the time of year (winter quality) for existing vehicle fleets in the carriage of goods or in traditional kerosene. Contrary to fatty acid methyl ester (biodiesel) production, this method involves very high investment costs.

Along with the option of double counting and superior greenhouse gas (GHG) reduction values compared to conventional biodiesel from vegetable oils, the feedstock price is key to the preference of using HVO. UFOP has noted that the European biodiesel industry is challenged to accept this competition for GHG efficiency and further improvement of product quality as a prerequisite to ensure its future competitiveness. UFOP supports, within the scope of its resources, research projects on biodiesel and rapeseed oil fuels.

Related Stories

The European Commission on July 18 announced its investigation into biodiesel imports from China is now complete and did not confirm the existence of fraud. The commission will take action, however, to address some systemic weaknesses it identified.

On July 18, U.S. EPA announced a reduction in force (RIF) as the agency continues its comprehensive restructuring efforts. With organizational improvements, EPA is delivering $748.8 million in savings.

The U.S EPA on July 17 released data showing more than 1.9 billion RINs were generated under the RFS during June, down 11% when compared to the same month of last year. Total RIN generation for the first half of 2025 reached 11.17 billion.

The U.S. EPA on July 17 published updated small refinery exemption (SRE) data, reporting that six new SRE petitions have been filed under the RFS during the past month. A total of 195 SRE petitions are now pending.

The USDA has announced it will delay opening the first quarterly grant application window for FY 2026 REAP funding. The agency cited both an application backlog and the need to disincentivize solar projects as reasons for the delay.

Upcoming Events