The Path to Biointermediates

May 23, 2023

BY Katie Schroeder

The U.S. EPA released biointermediate provisions in July 2022 with the goal of expanding the feedstock pool available to renewable fuel producers. The provisions came into effect the following August, and nearly a year later, there have not been any completed biointermediate registrations.

Identifying Biointermediates

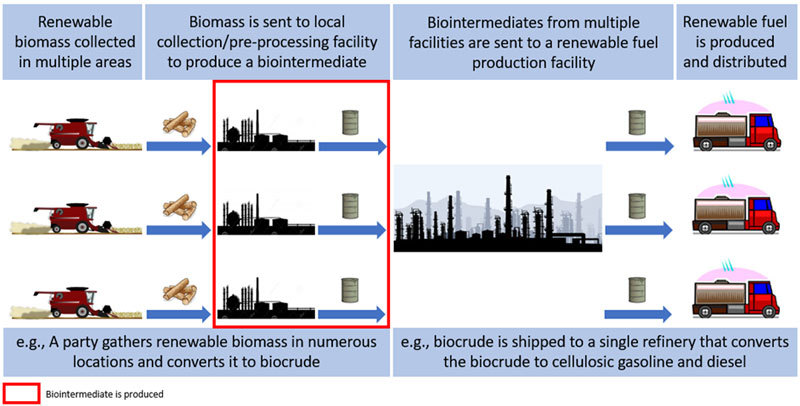

The EPA’s biointermediate provisions defined what a biointermediate is and listed those that are currently recognized by the agency. Last year, the EPA held a biointermediate workshop, in which Robert Anderson described the regulatory criteria that define a biointermediate as found in 40 CFR 80.1401. First, a biointermediate is a feedstock used to make a renewable fuel made from biomass. Biointermediates cannot generate renewable identification numbers (RINs), he explained, and they must be produced at a different facility than the one that produces the finished renewable fuel. “If all the production happens at a single [renewable] fuel facility, then it’s not a biointermediate,” Anderson said.

Before a biointermediate can be used it must be one of the specific biointermediates listed in the EPA’s provisions, follow an EPA approved pathway and be utilized in the production of the renewable fuel listed in the pathway. The different biointermediates that currently have eligible pathways under the EPA’s provisions include bio-crude, biodiesel distillate bottoms, biomass-based sugars, digestate, free fatty acid feedstock, glycerin, soapstock and undenatured ethanol. “It’s supposed to open up the supply chain. And it’s going to bring on products like sustainable aviation fuel (SAF),” says Kari Buttenhoff, partner at Christianson CPAs & Consultants. “So, it’s definitely set up to do that. For biodiesel with the feedstock shortages, if we can open up additional types of feedstocks that were currently not allowed, [that is] definitely a major benefit.”

Buttenhoff explains that though these provisions have the potential to provide a lot of feedstock options for the biodiesel industry and make ethanol-to-jet possible, the mandatory Quality Assurance Plan audit process is not yet ready for producers to apply. She says that the QAP program is currently voluntary for participants under the RFS, but it has become mandatory for all renewable fuel producers using biointermediates and biointermediate producers. The goal of the QAP program is to ensure that RINs are not double counted. For example, that no RINs are being produced by the biointermediate and all of the RINs are generated from the renewable fuel. Both the biointermediate provider and the renewable fuel producer must go through the same QAP auditor.

One of the limitations of the biointermediate provisions is that biointermediate producers may only sell to one renewable fuel producer, Buttenhoff explains. “You can’t sell to multiple renewable fuel plants; you have to choose one person and hitch your wagon to them and that’s where all of your product goes,” she says. However, renewable fuel producers are able to get biointermediates from multiple providers.

Biointermediate producers will need to undergo an engineering review and a list of registration requirements with the EPA, as well as quarterly and annual reporting along with participating in the RIN attest auditing part of the program.

Biodiesel and Renewable Diesel Opportunities

Matt Herman, senior director of renewable product marketing with the Iowa Soybean Association, explains that there are a handful of good opportunities for the biodiesel and renewable diesel industries. Coming from a background of helping producers optimize their technology to be able to meet requirements for as many incentives as possible, Herman sees these biointermediate provisions as a long-awaited open door for technologies and processes that make environmental and economic sense.

The three primary benefits biointermediate provisions could bring to the biodiesel industry include the ability to use free fatty acids and distillate bottoms as a feedstock, and the possibility of using undenatured ethanol as an alternative alcohol for the production process.

Free fatty acids as a biointermediate enable biodiesel producers to send leftover FFAs stripped from the triglycerides to another facility that is equipped to process them into fuel. “That just makes all the economic and environmental sense in the world,” Herman says. “To me, that’s just a huge green light flashing, that’s a major win there, and [it’s] one that the industry can immediately commercialize and bank on.”

It remains to be seen whether producers will go through the QAP process for the sake of “capturing value” on tens of millions of gallons when they produce hundreds of millions, Herman explains.

Distillate bottoms are also an exciting inclusion, as it may encourage the production of higher-quality biodiesel with better cold flow properties, which can be more easily blended with renewable diesel. Prior to this rule, the production of distillate bottoms were largely seen as a cost due to lost RIN value. Now, there is the potential to sell it as a feedstock.

This rule may also help the industry achieve a long-time milestone, the production of a 100% renewable biodiesel, Herman explains. “I’m really hopeful about the ethyl ester, butyl ester and renewable methanol for just ... a 100 percent renewable biodiesel, that’s something that I’m really hopeful for,” he says. “I think the economics, the environmental economics make sense now that the rules are a little bit clearer.”

Undenatured ethanol as a biointermediate is also useful for biodiesel producers, Herman explains, because of the possibility of replacing the alcohol molecule within the production process with renewable alcohols, such as ethanol, which would likely reduce the carbon intensity score of the final fuel, as well as the energy content of the fuel, and positively impact biodiesel’s performance in other markets.

Ethanol Producer Opportunities

Undenatured ethanol as a biointermediate is a “huge deal,” Herman says. From the ethanol perspective, the major opportunity is SAF, and the alcohol-to-jet pathway made available through the inclusion of undenatured ethanol in the provision, according to Buttenhoff.

“I think on its face the industry’s most excited about it because it allows ethanol aggregation,” Herman says. “If you wanted to do something like ethanol-to-jet or upgrade it, which is great, that would end up—as we’ve seen through EPA—falling as a D4 RIN, as we saw with the LanzaJet Georgia pathway. But from the biodiesel side, now we can think about things like ethyl esters and butyl esters, when we’ve been stuck making a methyl ester for a long time.”

The first good sign for biointermediate users was the approval of LanzaJet’s undenatured sugarcane ethanol-to-jet process, according to Herman. This was the first biointermediate-using process that was approved. However, the QAP part of the process, which is needed before producers can start generating RINs, has not yet been completed. “The methodology behind it and the overall process that’s been laid out for the EPA has been approved, now it’s the registration and the biointermediate supplier, the QAP piece and … all of the technical steps that go into it, will now have to take place,” Buttenhoff says.

The primary outlet for undenatured ethanol is SAF, Buttenhoff explains, and the goal is to get the QAP process worked out so that ethanol-to-jet is workable from a regulatory standpoint.

Hurdles of Implementation

The biointermediates provision has its benefits; however, those opportunities also come with a significant amount of hurdles. One of these hurdles is the complexity around RIN generation, such as that the renewable fuel producer needs to identify each biointermediate supplier’s feedstock. “There are also some physical handling rules around the feedstock, so the biointermediate feedstock has to be physically segregated from any other feedstocks or products, in its own tank and separate from anything else,” Buttenhoff says.

The rules in place around biodiesel producers using these other feedstocks are challenging, she further explains. “To segregate feedstocks from a biodiesel perspective—everybody co-mingles—it’s almost impossible,” she says. “There are a lot of hurdles from the biodiesel side to actually make this work, which is probably an industry that’s very much in need of additional feedstocks with all the renewable diesel facilities coming up.” Buttenhoff explains that this hurdle may be less of a problem for ethanol producers supplying undenatured ethanol as a biointermediate to a renewable fuel producer.

Another future hurdle may be the shortage of available third-party QAP providers, Buttenhoff explains. Currently, Christianson, EcoEngineers and Weaver Tidwell are the only third-party auditors for the whole program. As of late April, none of the three had applied for a biointermediate protocol, Buttenhoff explains. “Part of the struggle with the QAP part, with providers is that … we have to develop what our processes will be for our biointermediates, and then we have to submit that to EPA, and they have to approve the procedures that we’re actually going to complete in order to audit or Q-RIN that particular product,” she says.

In the past, putting together and getting EPA approval for initial QAP plans took roughly a year and a half, going a little faster for approval of additional plans. The first biointermediate producer will probably take a while to get through the QAP pathway approval process, Buttenhoff explains, because there will probably be some back-and-forth conversation between the EPA and the auditor in establishing the first procedures for biointermediates.

Buttenhoff adds that should the EPA’s RFS set rule pass in June 2023 in its current form, which outlines mandatory QAP for waste feedstock suppliers and biodiesel companies, it could cause the strain on QAP providers to intensify. “The amount of incoming work from a QAP perspective, and with the three of us providers also being low carbon program verifiers, plus what the country is seeing for staff shortage issues in general, it’s a lot [for these providers to absorb],” she says.

Herman agrees that the speed of adoption is tempered by the QAP process, since many producers have never been through the process before, and some may not find it worth it for the volume of fuel they would be able to produce.

“I think we’re waiting for the first movers to act,” Buttenhoff says. “It is difficult to be the first one going through a new regulatory process like this one.”

Buttenhoff adds that she hopes in the future, further conversations with the EPA will help tweak the process to be more workable as implementation begins.

Biointermediates may not be the silver bullet that will open the feedstock floodgates, at least not yet. However, the opportunities available may encourage companies such as LanzaJet to begin walking down the long road to biointermediate utilization and RIN generation from fuels that use them.

Author: Katie Schroeder

Contact: katie.schroeder@bbiinternational.com

Advertisement

Advertisement

Advertisement

Advertisement

Related Stories

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

International Sustainability & Carbon Certification has announced that Environment and Climate Change Canada has approved ISCC as a certification scheme in line with its sustainability criteria under its Clean Fuel Regulations.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

Upcoming Events