Balancing Act

September 20, 2010

BY Bryan Sims

Biodiesel has emerged as a major global commodity. As international production capacity and markets continue to fluctuate, many countries will be looking to fulfill demand from developing markets beyond meeting the needs of their own. Ideally, fundamental biodiesel trade practices would benefit all parties involved, lowering trade deficits, bringing about fuel security, lowering greenhouse gas emissions and reducing dependency on foreign oil. When practices don't conform to these fundamental principles, they can carry long-term consequences, as seen in the case of the controversial "splash-and-dash" loophole that has festered since 2006, creating trade friction in Europe and consternation in the U.S. The World Trade Organization has set strict trade guidelines, yet complaints of unfair trade continue to mount.

Today, biodiesel economics are even more constrained. Not only is it felt in the U.S. under an absent tax incentive, but global demand for biodiesel is expected to increase exponentially to 7.8 billion gallons by 2015, according to the U.S. DOE's Energy Information Administration. This spike in demand means more consumption, and more consumption translates into increased traffic of shipments making its way across the world to meet that demand.

But trade differences seem to be widening, so if biodiesel is to flourish as a globally traded commodity that will ultimately benefit all parties involved and grow as an alternative to petroleum, action to settle these disputes must be taken.

The Usual Suspects

Despite the closing of the U.S. splash-and-dash loophole in the Emergency Economic Stabilization Act of 2008, the European Union remained committed to keeping a watchful eye on biodiesel shipments entering its ports. In August, the EU's legislative arm, the European Commission, launched an anti-circumvention investigation into imports of U.S.-based biodiesel to Europe to determine whether previously imposed anti-dumping measures are being circumvented.

The European Biodiesel Board alleges that, ever since the EC imposed anti-dumping and anti-subsidy duties against U.S. biodiesel in June 2008, which extend five years out, disreputable trading schemes have emerged. The EBB claims that U.S.-based biodiesel is being shipped to the EU through other countries, mainly Canada and Singapore, in order to conceal its origin. The EBB also asserts that substantial volumes of U.S.-produced biodiesel continue to flood European ports in the form of blends-typically B19-not covered by the EU duties, practices that "are a mere attempt to evade the anti-dumping and countervailing duties," the EBB said in a statement.

Specifically, the EC is investigating whether U.S. producers exporting B20 or higher blends to European ports are honoring imposed duties, as not all U.S. producers are intentionally circumventing the tariffs. B19 blends are not covered by last year's tariffs, according to the EBB, whose members produce 80 percent of the continent's biodiesel.

The National Biodiesel Board, representing U.S. producers, denies the claims made by the EBB and states that it intends to painstakingly confront the issue appropriately in defense of its members. "The NBB is disappointed that the EBB has opted to pursue this frivolous complaint, especially in light of the larger shared challenges that confront both the American and European biodiesel industries," says Manning Feraci, vice president of federal affairs for the NBB. "The NBB will actively defend the interests of the U.S. biodiesel industry in this proceeding and will work with the U.S. government and others to ensure that the anti-dumping and countervailing duties currently applied to biodiesel produced in the U.S. are not expanded beyond their proper scope."

In addition to the NBB, the Office of the United States Trade Representative issued a similar rebuttal. "We are disappointed that the EU initiated this investigation," says spokesman Nefeterius Akeli McPherson. "Based on the evidence contained in the European industry's request, it does not appear that a circumvention investigation is warranted." According to McPherson, questionnaires have been issued to interested parties, which were due 37 days from the date of initiation, and that the investigation will likely conclude in approximately nine months from its start.

The anti-circumvention action launched by the EC is backed by a parallel investigation by the EU Anti-Fraud Office (OLAF) "in order to put an end to these unacceptable trade practices which may represent more than €100 million ($129 million) of unpaid import duties," according to the EBB. In the event that "fraudulent" practices persist, unpaid duties would be collected by EU authorities retroactive three years, carrying with them heavy penalties.

In March, the EBB reported that Italian customs authorities seized 10,000 metric tons (approximately 3 million gallons) of biodiesel at the ports of Venice and Trieste. The product was declared as Canadian origin, but the EBB stated at that time that "strong evidences" signaled that it instead originated from the U.S. The product was namely offered at a discount of $150 to $180 per ton (50 to 60 cents per gallon) compared to EU biodiesel of comparable quality, and sold at a discounted price to soybean oil and rapeseed oil.

"We certainly don't believe [the seizure] is indicative of a much broader concern around circumvention," says Gordon Quaiattini, president of the Canadian Renewable Fuels Association. "We don't support any kind of practice that would result in somehow circumventing the European-imposed tariff on U.S.-based biodiesel."

Canadian biodiesel exports to the EU have increased to more than 140,000 tons (42 million gallons) in 2009 from approximately 1,700 tons in 2008, according to Europe's statistics database, Eurostat. The EC's anti-circumvention investigation could be perceived as a protectionist-oriented approach, Quaiattini explains, as much of the biodiesel being imported from the U.S. is attributed to the North America Free Trade Agreement as a vehicle for meeting Canada's domestic biodiesel volume targets.

"I think the Europeans are looking at volumes going from the U.S. into Canada and believe it's purely a circumvention play to have that fuel make its way into Europe, and the reality is that just isn't happening," Quaiattini says. "U.S. biodiesel is staying in the Canadian market in order to meet mandates here. That's been the result of the increase in volume coming in."

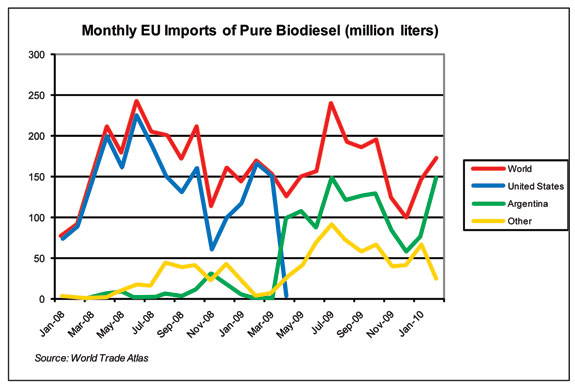

With one eye on U.S. imports, the EU is also concerned by the sharp increase in biodiesel exports from Argentina to Europe, which increased dramatically from approximately 5,000 tons in July 2008 to almost 100,000 tons per month in July 2009. The EBB states that Spain's biodiesel industry particularly has been hit hard by Argentine imports.

Argentina, a net exporter of biodiesel, applies a differential export tax on biodiesel made from soybean oil. The differential between the 32 percent export tax on soybean oil and the 20 percent export tax on biodiesel creates a financial incentive to process soybean oil into biodiesel rather than exporting it. Argentina's trade benefits are in effect until the end of 2011, but they may be challenged early by the EU if there is an indication that Argentina is colluding with the U.S. in selling U.S.-based biodiesel to Europe as its own. Consequently, Argentine biodiesel is expected to remain a strong competitor to European-made methyl esters in the EU.

Australia Takes a Stand

In June, Australia's Customs and Border Protection Service launched concurrent dumping and countervailing duty investigations into U.S. biodiesel imports, specifically B99 and biodiesel blends above 20 percent, from April 2009 through March 2010. The investigation came in light of a complaint lodged by Australian company Biodiesel Producers Ltd. to local customs authorities after it noticed increased volumes of U.S.-based biodiesel being sold at a discount to Australian biodiesel on the Australian market, allegedly causing several producers to lose their share of the market. According to the Biofuels Association of Australia, the country currently houses seven biodiesel plants, four of which are operating at a combined rate of 115 MMly mainly from tallow and used cooking oil.

"We are also receiving product that has lower cetane levels than that of the Australian biodiesel standard," says BAA CEO Heather Brodie. "Thus, the imported product is arriving in Australia at lower prices than we can even buy our feedstocks for."

Rather than a subsidization scheme found in the U.S., Australia employs a complex grant system to incentivize production of biodiesel. The incentive, referred to as the Cleaner-Fuels Grant, is a tax break for producers worth approximately 35 cents per liter. "So the tax outcome to the consumer is neutral," Brodie says. "This changes as of July 1 next year."

Brodie adds that customs officials are investigating the complaint, and if the claims are found legitimate, then any involved parties partaking in the practice would be forced to cease shipments and penalties in the form of fines would be attached.

"The BAA understands that action taken by Customs and Border Protection can be extensive in its support," Brodie says. "Indeed, if there is a positive finding for countervailing subsidies, there is a risk that subsidized biodiesel imported between June 22 and the date of the finding may also be subject to the countervailing action. We will certainly be supporting this to ensure that the Australian industry receives an affirmative determination."

U.S. biodiesel exports to Australia have been infrequent this year and not a key market for U.S. suppliers. A report produced by the USDA's Foreign Agricultural Service in July pegged U.S. biodiesel exports to Australia at less than 1 percent of total U.S. exports, making Australia a very small market for the U.S. by global standards.

However, Brodie insists that the investigation would serve as a warning to importers to either end the dumping of cheap U.S. biodiesel or face possible duties, one that could mirror Europe's anti-dumping measures on to U.S.-produced biodiesel. "It's absolutely imperative for the success of the Australian biofuels industry that these practices cease, and cease immediately," Brodie says. "There is no way that the local industry can then compete on a level playing field and Australian taxpayer's dollars are actually, in effect, supporting the U.S. industry."

Bryan Sims is a Biodiesel Magazine associate editor. Reach him at (701) 738-4974 or bsims@bbiinternational.com

Today, biodiesel economics are even more constrained. Not only is it felt in the U.S. under an absent tax incentive, but global demand for biodiesel is expected to increase exponentially to 7.8 billion gallons by 2015, according to the U.S. DOE's Energy Information Administration. This spike in demand means more consumption, and more consumption translates into increased traffic of shipments making its way across the world to meet that demand.

But trade differences seem to be widening, so if biodiesel is to flourish as a globally traded commodity that will ultimately benefit all parties involved and grow as an alternative to petroleum, action to settle these disputes must be taken.

The Usual Suspects

Despite the closing of the U.S. splash-and-dash loophole in the Emergency Economic Stabilization Act of 2008, the European Union remained committed to keeping a watchful eye on biodiesel shipments entering its ports. In August, the EU's legislative arm, the European Commission, launched an anti-circumvention investigation into imports of U.S.-based biodiesel to Europe to determine whether previously imposed anti-dumping measures are being circumvented.

The European Biodiesel Board alleges that, ever since the EC imposed anti-dumping and anti-subsidy duties against U.S. biodiesel in June 2008, which extend five years out, disreputable trading schemes have emerged. The EBB claims that U.S.-based biodiesel is being shipped to the EU through other countries, mainly Canada and Singapore, in order to conceal its origin. The EBB also asserts that substantial volumes of U.S.-produced biodiesel continue to flood European ports in the form of blends-typically B19-not covered by the EU duties, practices that "are a mere attempt to evade the anti-dumping and countervailing duties," the EBB said in a statement.

Specifically, the EC is investigating whether U.S. producers exporting B20 or higher blends to European ports are honoring imposed duties, as not all U.S. producers are intentionally circumventing the tariffs. B19 blends are not covered by last year's tariffs, according to the EBB, whose members produce 80 percent of the continent's biodiesel.

The National Biodiesel Board, representing U.S. producers, denies the claims made by the EBB and states that it intends to painstakingly confront the issue appropriately in defense of its members. "The NBB is disappointed that the EBB has opted to pursue this frivolous complaint, especially in light of the larger shared challenges that confront both the American and European biodiesel industries," says Manning Feraci, vice president of federal affairs for the NBB. "The NBB will actively defend the interests of the U.S. biodiesel industry in this proceeding and will work with the U.S. government and others to ensure that the anti-dumping and countervailing duties currently applied to biodiesel produced in the U.S. are not expanded beyond their proper scope."

In addition to the NBB, the Office of the United States Trade Representative issued a similar rebuttal. "We are disappointed that the EU initiated this investigation," says spokesman Nefeterius Akeli McPherson. "Based on the evidence contained in the European industry's request, it does not appear that a circumvention investigation is warranted." According to McPherson, questionnaires have been issued to interested parties, which were due 37 days from the date of initiation, and that the investigation will likely conclude in approximately nine months from its start.

The anti-circumvention action launched by the EC is backed by a parallel investigation by the EU Anti-Fraud Office (OLAF) "in order to put an end to these unacceptable trade practices which may represent more than €100 million ($129 million) of unpaid import duties," according to the EBB. In the event that "fraudulent" practices persist, unpaid duties would be collected by EU authorities retroactive three years, carrying with them heavy penalties.

In March, the EBB reported that Italian customs authorities seized 10,000 metric tons (approximately 3 million gallons) of biodiesel at the ports of Venice and Trieste. The product was declared as Canadian origin, but the EBB stated at that time that "strong evidences" signaled that it instead originated from the U.S. The product was namely offered at a discount of $150 to $180 per ton (50 to 60 cents per gallon) compared to EU biodiesel of comparable quality, and sold at a discounted price to soybean oil and rapeseed oil.

"We certainly don't believe [the seizure] is indicative of a much broader concern around circumvention," says Gordon Quaiattini, president of the Canadian Renewable Fuels Association. "We don't support any kind of practice that would result in somehow circumventing the European-imposed tariff on U.S.-based biodiesel."

Canadian biodiesel exports to the EU have increased to more than 140,000 tons (42 million gallons) in 2009 from approximately 1,700 tons in 2008, according to Europe's statistics database, Eurostat. The EC's anti-circumvention investigation could be perceived as a protectionist-oriented approach, Quaiattini explains, as much of the biodiesel being imported from the U.S. is attributed to the North America Free Trade Agreement as a vehicle for meeting Canada's domestic biodiesel volume targets.

"I think the Europeans are looking at volumes going from the U.S. into Canada and believe it's purely a circumvention play to have that fuel make its way into Europe, and the reality is that just isn't happening," Quaiattini says. "U.S. biodiesel is staying in the Canadian market in order to meet mandates here. That's been the result of the increase in volume coming in."

With one eye on U.S. imports, the EU is also concerned by the sharp increase in biodiesel exports from Argentina to Europe, which increased dramatically from approximately 5,000 tons in July 2008 to almost 100,000 tons per month in July 2009. The EBB states that Spain's biodiesel industry particularly has been hit hard by Argentine imports.

Argentina, a net exporter of biodiesel, applies a differential export tax on biodiesel made from soybean oil. The differential between the 32 percent export tax on soybean oil and the 20 percent export tax on biodiesel creates a financial incentive to process soybean oil into biodiesel rather than exporting it. Argentina's trade benefits are in effect until the end of 2011, but they may be challenged early by the EU if there is an indication that Argentina is colluding with the U.S. in selling U.S.-based biodiesel to Europe as its own. Consequently, Argentine biodiesel is expected to remain a strong competitor to European-made methyl esters in the EU.

Australia Takes a Stand

In June, Australia's Customs and Border Protection Service launched concurrent dumping and countervailing duty investigations into U.S. biodiesel imports, specifically B99 and biodiesel blends above 20 percent, from April 2009 through March 2010. The investigation came in light of a complaint lodged by Australian company Biodiesel Producers Ltd. to local customs authorities after it noticed increased volumes of U.S.-based biodiesel being sold at a discount to Australian biodiesel on the Australian market, allegedly causing several producers to lose their share of the market. According to the Biofuels Association of Australia, the country currently houses seven biodiesel plants, four of which are operating at a combined rate of 115 MMly mainly from tallow and used cooking oil.

"We are also receiving product that has lower cetane levels than that of the Australian biodiesel standard," says BAA CEO Heather Brodie. "Thus, the imported product is arriving in Australia at lower prices than we can even buy our feedstocks for."

Rather than a subsidization scheme found in the U.S., Australia employs a complex grant system to incentivize production of biodiesel. The incentive, referred to as the Cleaner-Fuels Grant, is a tax break for producers worth approximately 35 cents per liter. "So the tax outcome to the consumer is neutral," Brodie says. "This changes as of July 1 next year."

Brodie adds that customs officials are investigating the complaint, and if the claims are found legitimate, then any involved parties partaking in the practice would be forced to cease shipments and penalties in the form of fines would be attached.

"The BAA understands that action taken by Customs and Border Protection can be extensive in its support," Brodie says. "Indeed, if there is a positive finding for countervailing subsidies, there is a risk that subsidized biodiesel imported between June 22 and the date of the finding may also be subject to the countervailing action. We will certainly be supporting this to ensure that the Australian industry receives an affirmative determination."

U.S. biodiesel exports to Australia have been infrequent this year and not a key market for U.S. suppliers. A report produced by the USDA's Foreign Agricultural Service in July pegged U.S. biodiesel exports to Australia at less than 1 percent of total U.S. exports, making Australia a very small market for the U.S. by global standards.

However, Brodie insists that the investigation would serve as a warning to importers to either end the dumping of cheap U.S. biodiesel or face possible duties, one that could mirror Europe's anti-dumping measures on to U.S.-produced biodiesel. "It's absolutely imperative for the success of the Australian biofuels industry that these practices cease, and cease immediately," Brodie says. "There is no way that the local industry can then compete on a level playing field and Australian taxpayer's dollars are actually, in effect, supporting the U.S. industry."

Bryan Sims is a Biodiesel Magazine associate editor. Reach him at (701) 738-4974 or bsims@bbiinternational.com

Advertisement

Advertisement

Advertisement

Advertisement

Upcoming Events