RINs behavior after EPA rule shows ethanol-biodiesel relationship

Graph: OPIS via FarmDoc Daily

December 9, 2015

BY Sue Retka Schill

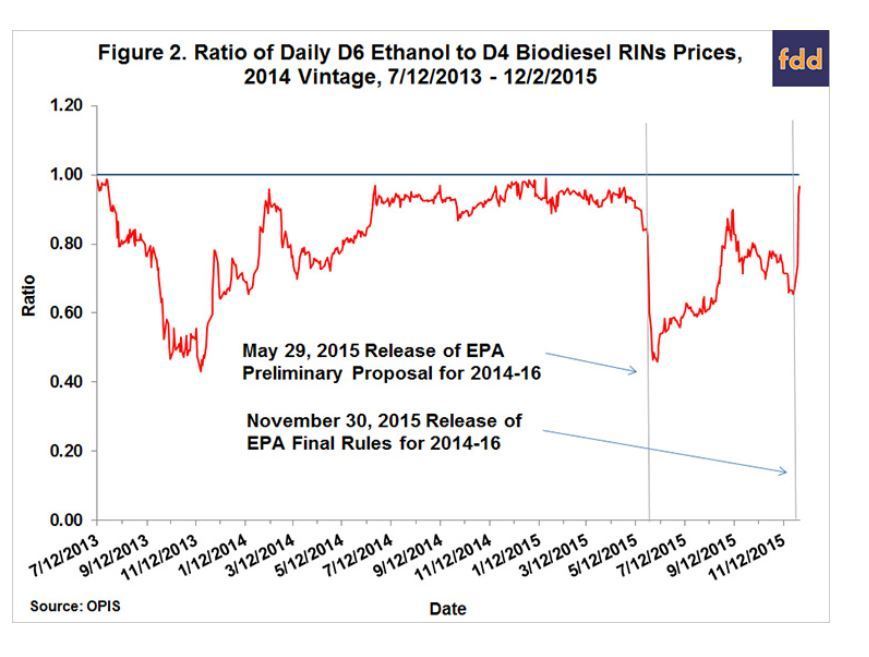

The release of the U.S. EPA’s final rulemaking for the renewable fuel standard (RFS) was a shock to the RIN markets—the renewable identification numbers used by obligated parties to demonstrate compliance. D4 biomass-based diesel RINs went up 30 percent and D6 RINs, dominated by first-generation corn ethanol, increased more than 90 percent. University of Illinois economists Scott Irwin and Darrel Good examined recent RIN trends in a FarmDocDaily post, RINs Gone Wild? (round 2).

“The market was apparently surprised by how much the final conventional ethanol mandates, particularly in 2016, breached the E10 blend wall,” the economists write. The final rulemaking “clearly signaled that the EPA is serious about getting ‘the RFS back on track,’ and it would not be surprising if the EPA set the conventional ethanol mandate at the statutory level of 15.0 billion gallons as soon as 2017.” The market reaction indicates an expectation that instead of having an ample supply of RINs to demonstrate compliance, they might be exhausted in a matter of months. The gap would need to be filled through higher ethanol blends or biodiesel and renewable diesel.

Irwin and Good have written a series of posts of the RINs markets, as they analyze the factors impacting RIN prices, looking for relationships to help understand market trends. In the most recent post, they also analyze the RFS requirements for the different categories of renewable fuels and how that has changed from the preliminary EPA proposal to the final rule. They note that biodiesel and renewable diesel producers have been responsible for a significant portion of D6 RINs as conventional renewable fuels in the past two years—243 million ethanol equivalent gallons in 2014 and more than 400 million gallons in 2015. The conventional mandate gap for 2016 is estimated to be 899 million gallons. The economists are developing and testing models that describe the relationships between the relative prices of D6 and D4 RINS and RINs stocks. The spike in RINs prices following the Nov. 30 EPA announcement is following a similar pattern as the 2013 spike in RINs prices.

“Our theoretical model predicts that the price of a D6 ethanol RINs should equal the price of a D4 biodiesel RINs if biodiesel and renewable diesel are the only feasible options for filling conventional mandate gaps. Consequently, the move of D6 RINs prices to nearly the same level as D4 RINs prices in the days following the Nov. 30 release is an unmistakable sign that the market believes higher ethanol blends are not a feasible source of RINs to fill conventional gaps. Instead, biodiesel and renewable diesel are perceived to be the only viable options for filling the expected conventional gaps.”

Advertisement

Advertisement

To read the full analysis and explanation of the multiple relationships, click here.

Advertisement

Advertisement

Related Stories

The U.S. EPA on July 8 hosted virtual public hearing to gather input on the agency’s recently released proposed rule to set 2026 and 2027 RFS RVOs. Members of the biofuel industry were among those to offer testimony during the event.

The USDA’s Risk Management Agency is implementing multiple changes to the Camelina pilot insurance program for the 2026 and succeeding crop years. The changes will expand coverage options and provide greater flexibility for producers.

President Trump on July 4 signed the “One Big Beautiful Bill Act.” The legislation extends and updates the 45Z credit and revives a tax credit benefiting small biodiesel producers but repeals several other bioenergy-related tax incentives.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

SAF Magazine and the Commercial Aviation Alternative Fuels Initiative announced the preliminary agenda for the North American SAF Conference and Expo, being held Sept. 22-24 at the Minneapolis Convention Center in Minneapolis, Minnesota.

Upcoming Events