A Rightful Role in the RFS

January 2, 2019

BY Anna Simet

When the 109th U.S. Congress and President George W. Bush passed the Energy Policy Act of 2005, it authorized the Renewable Fuel Standard, a program aimed at reducing U.S. greenhouse gas emissions, expanding the nation’s renewable fuels industry, and reducing dependence on foreign oil. The RFS, expanded under the Energy Independence and Security Act of 2007, requires an increasing volume of renewable fuel to replace oil-based transportation, heating or jet fuel.

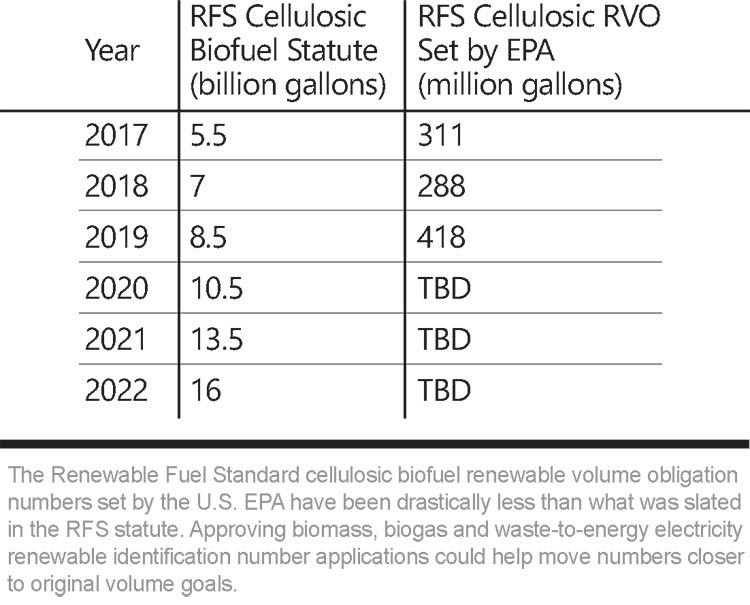

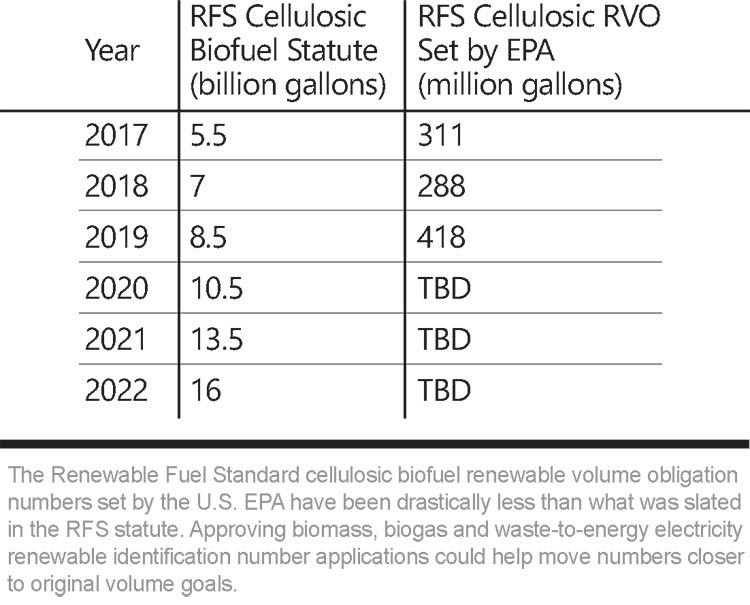

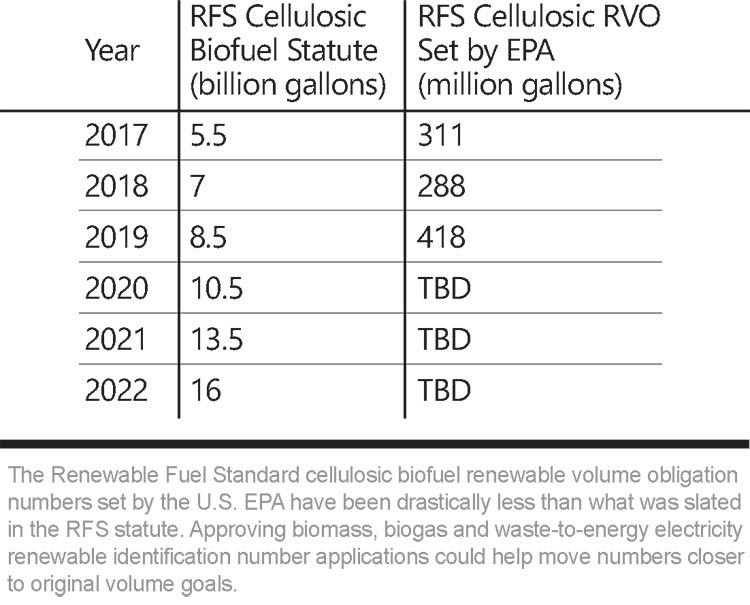

Each year, the U.S. EPA sets renewable volume obligations (RVOs) for the following year, including quantities of cellulosic biofuel, biomass-based diesel, advanced biofuel and total renewable fuel. Each fuel falls under a renewable identification number (RIN) pool, from D3 to D7, based on the feedstock used, fuel produced, energy inputs and GHG reduction thresholds, among other requirements. Producers generate RINs by submitting detailed feedstock and process information, and receiving pathway or process approval by the EPA.

Cellulosic biofuel is assigned as D3, or D7 for cellulosic diesel; biomass-based diesel is assigned D4; advanced biofuel is assigned D5; and first-generation renewable fuel such as ethanol earn D6 RINs, as well as grandfathered fuels. When a producer manufacturer makes a gallon of fuel, RINs are generated, and can be traded or sold to obligated parties to demonstrate compliance.

The vast complexities of the RFS extend far beyond these components, but a much lesser-known provision is beginning to attract attention—the role of renewable electricity in the program, and it’s abilities to fuel electric vehicles (EVs). This provision is one that was embedded in the 2007 statute, but to date, has not been acted on, says Bob Cleaves, president of the Biomass Power Association. “The topic is a complicated one,” he says. “To really understand the genesis of this, you really have to look back to 2010, when EPA adopted a final rule. The rule stated something very important that really dictated almost the entire cellulosic biofuel category since then—that nonliquid fuels, mainly renewable electricity from biomass or renewable natural gas (RNG), could be deemed as transportation fuels, provided it can be demonstrated they’re being used as such.”

The principals under that rule posed legal and practical challenges—for example, how the producer of the renewable electricity or RNG will demonstrate a specific volume was placed into a transmission system or commercial pipeline, that energy withdrawn from that pipeline or facility is matched with its ultimate use, and how to prevent fraud.

A few years later, EPA approved renewable electricity produced from biogas via landfills, wastewater treatment sludge and animal manure, as a cellulosic biofuel, and addressed some features of the rule, including how electricity will be tracked and how producers should document it. But as for solid fuel biomass, “they said in 2014 that it qualifies for renewable electricity under the RFS, but essentially, that they would leave it for another day,” Cleaves says. And as for progress since 2014, EPA has received many biogas electricity registration applications, but not one has been approved, a failure to act that Cleaves says is “part political and part legal, and also partly because of resource constraints within the agency.”

Fast-forward two years beyond that 2014 ruling, and proposed is the Renewables Enhancement and Growth Support Rule, aimed at enhancements to the RFS and other related fuel regulations to support market growth of ethanol and other renewable fuels. Through this rule, the EPA sought comment on a variety of other issues impacting renewable fuels, including RIN generation from renewable electricity used as a transportation fuel. Yet again, however, the road has led nowhere. After the initial, 60-day public comment period post-publishing in the Federal Register was extended, no action has been taken.

“Congress has adopted appropriations language to encourage EPA to act on these registrations, and we have done a pretty thorough legal analysis and concluded that renewable electricity is well-grounded in the 2007 statute,” Cleaves says. “It has been approved by EPA through a rulemaking, so it’s really time for the agency to implement the program.”

As far as the market outlook for EVs goes and the biomass-based electricity industry’s role in helping fulfill cellulosic biofuel’s RVO, the future looks bright.

Market Outlook

EVs are expected to jump from 1.1 million sales worldwide in 2017 to 11 million in 2025 and 30 million by 2030, as they become cheaper to make than internal combustion engine cars, according to Bloomberg’s Electric Vehicle Outlook 2018. And by 2040, over half of new car sales and 33 percent of vehicles worldwide will be EVs, and electric buses and cars will displace a combined 7.3 million barrels per day of transportation fuel.

So how would biomass-based electricity affect the D3 market? Randy Lack, chief marketing officer at Element Markets, says there are still obstacles, but with the expected 481 million gallons of cellulosic biofuel to be produced in 2019, about 27 percent of that RVO pool could be made up from renewable biomass, based on the amount of qualifying power being generated today. “In 2017, the expectation was 5.5 billion gallons of cellulosic biofuel, but it was actually closer to about 227 million gallons,” he says. “So the good news is there is plenty of headroom, but the bad news is that this market is dramatically underperforming. It’s a tier that needs additional supply, and renewable [biomass] electricity helps meet that.”

Further breaking the numbers down, about 2.3 million megawatt-hours of electricity currently go to fuel EVs, or about six percent of the generation of renewable biomass power being generated, Lack says. “So that means about 15 times more is being generated than consumed in EVs alone,” he explains. “The economics are flipped with RNG—in this industry, also the cellulosic biofuels pool, there is about 15 times the amount of supply than sources of consumption, which flips the economics. In the RNG industry, the majority of the value is actually retained by producers or groups injecting into the pipeline.”

Presently, about 104 million RINs could be generated from on-road EVs and plug-in hybrid electric vehicles (PHEVs), according to Lack, a $219 million market at 9 cents per kilowatt-hour (kWh). This doesn’t take into account municipal fleets, which could account for an additional 300 million-plus kWh, and 13.3 million more D3 RINs valued at nearly $28 million, or $2.10 per D3 RIN. “It’s easy to project that this could be a $400 million to $500 million market by 2020,” Lack says.

The question now is how EV load development will be factored into RVO calculations, when this pathway moves ahead, Lack adds. “You’ll have a huge supply coming into the market, and demand is already set, so it could oversupply a market in one year, if it’s not done appropriately.”

As far as RIN ownership goes, there are a few different potential models—the manufacturer of vehicles, the utilities generating the power, or the charging stations contracting for the electricity and fueling the vehicles. What’s essential, according to both Cleaves and Lack, is ensuring there is no double counting or fraud, potentially one of the main issues EPA is hung up on.

Moving Forward

The only scenario supported by law and consistent with how RNG and other biofuels are managed, Cleaves says, is such that the producer of the power is awarded the RIN. “The producer registers the facility, manages and confirms feedstock supply and verification that it’s a qualified feedstock,” he says, explaining that this can be done two ways. “The first is, consistent with how EPA has administered the RNG program, the agency can honor contracts between power producers and end users—and it’s highly likely that those end users will be aggregated with an auto manufacturer like GM, Ford or Tesla, and the manufacturer will be able to provide the telemetric data, which will be matched with the generation put onto the grid, creating a RIN that is placed in the generator’s account.”

Alternatively, Cleaves says, a method BPA believes is simpler and ultimately fool proof, is that every producer that makes power that could be used as transportation fuel shares a split of the pot. “Everyone who produces power qualified under the program, would be registered and recorded in the EPA database, and on an annual basis, EPA would calculate how many EVs are on the road and how much power they consume, and therefore, how many RINs are potentially available from that pool of consumption. Then, they would take the amount generated and consumed, and give everyone a fractional or prorated RIN. It makes a lot of sense to do it that way, but either way, EPA has got to get off the dime and do it.”

For the impact earning RINs would have on the industry, Cleaves calls it “a game-changer, just like it was for RNG. Before the RFS, RNG was worth just about what the value of natural gas was,” he says. “A lot of new projects have come online and many are being developed, and it’s a really good thing for the bioeconomy.”

The exact same thing can happen for biopower, he believes. “In fact, not only will it promote growth of the industry, but it will stunt closure of a lot of these facilities that can’t compete with natural gas, and we think it can help solve the wildfire problem in California. Right now, there just isn’t enough money in that business to justify spending, and even with the BioMAT contracts, the cost of hauling high-hazard fuel is exorbitant. This would go a long way toward allowing those facilities to pull more and more high-hazard fuel from areas under threat of fire.”

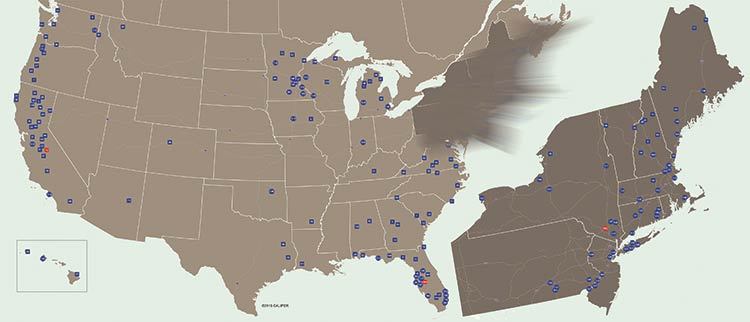

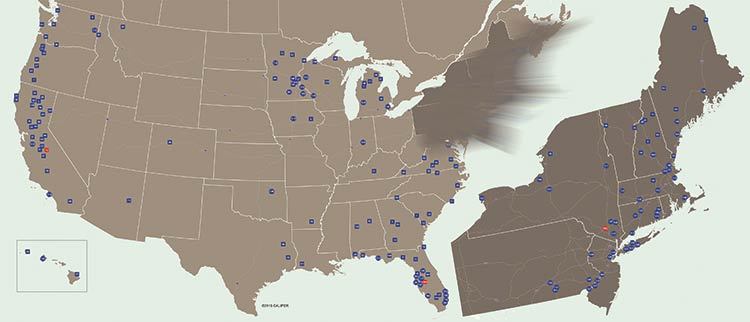

Support for eRINs is there on the Hill, and continues to gain momentum, especially in areas where biomass power is prominent—i.e., recently, several New Hampshire congresspersons wrote EPA an open letter, stating that the EPA’s inaction has created a multiyear backlog of applications from power producers seeking registration as RIN producers, and “discouraged investment in new and innovative technologies that are ready to use this approved pathway….while we understand the need to carefully review changes to the RFS program, we are concerned that delaying the inclusion of biomass and waste-to-energy electricity producers inadvertently favors certain types of agricultural feedstocks and fuel types,” it states.

And an effort headed by BPA, the American Biogas Council and the Waste Recovery Council, over 111 organizations signed a similar letter, pointing out the shortfalls in the cellulosic biofuel category and the difference eRINs could make.

Biomass power producers are also individually reaching out to EPA. In October, Dean Rostrom, owner of Eagle Valley Clean Energy LLC, a 13-MW biomass cogeneration facility located in Eagle County, Colorado, sent a letter to Acting EPA Administrator Andrew Wheeler, urging him to promptly process applications. Rostrom notes that Eagle Valley’s fuel is primarily sourced from waste material at regional saw mills and a 10-year stewardship contract issued by the U.S. Forest Service, which relies on the contract and the power plant as an essential tool to safely and efficiently dispose of hazardous fuel, including beetle-kill forest material. “Our facility is the only one in Colorado that can consistently accept substantial amounts of hazardous fuel, and the arrangement among Eagle Valley Clean Energy, our logger, and the U.S. Forest Service is a model example of public-private cooperation to mitigate wildfire risk in our national forests…it is essential to our financial well-being that this program be extended to our plant, and it is only fair that biomass plants be entitled to benefit from the RFS program on an equal footing with other generators of renewable energy, such as wind and solar.”

The longer it takes for the EPA to approve pathways for eRINS, the more challenging it becomes for biomass power producers to stretch the clock and survive financially, says Stacy Cook, manager of biomass power plant Koda Energy in Shakopee, Minnesota. “Renewable biomass power must compete with other generation sources that benefit from production tax credits that biomass power is not eligible to receive," he says. "These other generation sources can then deliver watts into the system at a much lower price than biomass that does not receive the production tax credit revenue, creating an uneven playing field when presenting a rate case to the Public Utilities Commissions.”

In Minnesota, Cook says, there have recently been closings of biomass power facilities that provided many career jobs with benefits in the facilities, provided employment for hundreds in the transportation and handling of the biomass feedstocks, and provided a beneficial outlet for excess forestry and agriculture waste residuals in the state while keeping a portion of that volume from landfills. “The ability to earn eRINs in our facility would reduce the price we would need to receive from energy sales while still remaining financially viable,” Cook adds. “The cost per watt that the ratepayer sees, compared to other sources that receive PTC support, would be much more equitable. It would help our facility to remain in service to the community as an outlet to beneficially use the diseased tree and excess nature-derived waste materials.”

Cleaves says every Senate and House member who has a biomass or biogas plant in their state is aware of the eRIN issue, and that there is favorable language in the Senate House appropriations bills currently being worked on in conference. “We would like to strengthen those bills to send a very clear message to EPA that says this isn’t discretionary, it is mandated under the RFS, and it needs to be acted upon,” he says. “We’re pursuing a political strategy that involves outreach to the agency at the highest political level and the White House, and also exploring all legislative options. We’re doing what we can, and what we have heard from EPA recently is very favorable in terms of them caring about the issue—they believe it’s a valid pathway and they are committed to getting it done, but there are other competing priorities and limited resources. Our strategy on the Hill is making it clear to EPA this is just as important as anything else the agency is doing with the RFS right now, because these are rural jobs, this is baseload power, and they can’t pick winners and losers in implanting a federal statute, which we’re concerned has happened.”

Cleaves urges biomass power producers to write their representatives. “Congress is most effective when they hear from people who vote them in and out of office, and this is a perfect example of that. We have had a steady drum beat of biomass and biogas producers communicate their concerns to Congress, and there has been significant success in terms of educating staffers on the seriousness of the issue, and motivating members of Congress to reach out to the agency and the White House. If this continues, we believe we will ultimately prevail.”

Many people have been frustrated by the agency’s inability to act quickly on the pathway, but it isn’t a simple issue, Cleaves points out. “It’s not a pathway from an individual company or a boutique fuel,” he adds. “Once this pathway is implemented, it will be approaching 50 percent of the D3 RIN market, so it’s a very significant programmatic issue and not just a niche, one-off issue. We’re excited about it. We think it’s the future of the RFS because growth of EVs will be very significant, and we want to make sure the industry is part of that.”

Author: Anna Simet

Editor, Biomass Magazine

701-738-4961

asimet@bbiinternational.com

Advertisement

Advertisement

Advertisement

Advertisement

Upcoming Events