Biotransformation of Crude Glycerin

October 14, 2009

BY David Gaskin

Fermentation processes, combined with traditional recovery methods, are emerging as a successful path to biobased coproducts from biodiesel production. Worldwide, interest in industrial biotechnology grows as new technologies prove product capabilities and economics.

Glycerin is one of the most widely available chemicals in the world, touting a production of more than 2 billion pounds1 and growing. As the biodiesel industry well knows, the supply of glycerin will continue to dwarf demand until more than 5 billion pounds is expected to hit the world by 20201. Prices of glycerin in the U.S. have either been widely fluctuating or painfully low, reflecting a dependence on soybeans, refining capacity and biofuels policy, but predominantly reflecting the large supply of glycerin entering the U.S. marketplace.

In 2008, biodiesel crude glycerin production reached approximately 251 kilotons in the U.S., on top of the estimated 150 kilotons of glycerin from nonbiodiesel sources2,3. U.S. demand for glycerin's traditional uses in soaps and cosmetics, food additives, industrial foams and transportation fluids were outstripped by supply on the order of some 75 to 100 kilotons. The slow rise in crude oil prices over the past six months may give encouragement to biodiesel margins, but it won't solve glycerin's long-term picture.

Businesses and research groups around the world are focused on launching innovative and sustainable technologies capable of connecting glycerin to valuable applications. Researchers in the biotechnology industry are well aware of the supply issues surrounding glycerin, and have recently invested in the means to develop technologies to convert glycerin to biofuels and a portfolio of other end-products.

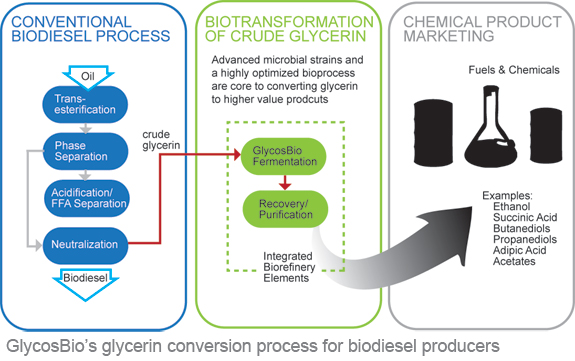

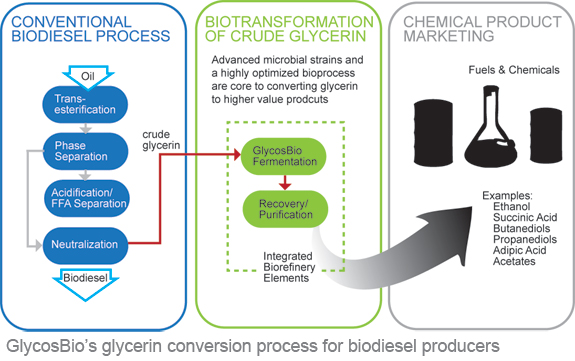

Industrial biotechnology company Glycos Biotechnologies Inc. (GlycosBio) of Houston, Texas, recently developed a biotransformation technique that directs crude glycerin from the biodiesel process into ethanol at high-yield efficiency. Using microorganisms as biocatalysts-enzymes or microbes that initiate or accelerate chemical reactions-GlycosBio makes possible the conversion of a disadvantaged coproduct into another prominent chemical. Scientists recognize that glycerin is sometimes difficult to convert in a microbial transformation, but its inherent chemistry opens alternatives to produce hundreds of compounds. For that reason, biofuel producers can tap crude glycerin streams to produce new and valuable coproducts.

What does this mean for the biodiesel industry? This new biological process enables owners of biodiesel plants to use glycerin streams within their plants to diversify coproducts and provide revenue management flexibility. Crude glycerin exiting the separation units can be converted to products such as ethanol and propylene glycol. Propylene glycol is an important component of polyester resins, industrial solvents and hydraulic fluids, and boasts a U.S. market of $786 million. At 85 cents per pound, propylene glycol has the potential to add 29 cents in production margin per gallon of biodiesel. If soybean oil prices begin to rise again, glycerin provides minimal plant contribution against low oil prices; but unlike glycerin, the industrial uses, and prices, for propylene glycol present a more sustainable source of economic value.

Translating this into plant dollars, a 50 million gallon plant that converts nearly 4.5 million gallons of crude glycerin can churn out 25 million pounds of propylene glycol, the value of which is more than $21 million at today's prices.

Microbial Biotransformation

The science begins by modifying the metabolic pathways of selected microorganisms to digest glycerin and ensuring that growth conditions and metrics are met by the cultured strains. From there, only strains that consume large amounts of glycerin with a minimum of interfering coproducts are selected. High-throughput screening expedites the selection of characteristics based on glycerin consumption, conversion yield and minimizing competing metabolites. Exclusive production of the desired product is crucial, but measures can be taken to moderate byproducts if they prove useful in maximizing the primary target. Successful strains are introduced into fermentation reactors containing crude glycerin with two goals in mind: minimize reaction time and select strains for actual process stream conditions.

From there, the fermentation is scaled up and process development begins. In designing actual operating conditions, feedback to the laboratory fermentation work helps scientists to develop strains with the actual production process conditions. Over the past six months, GlycosBio researchers have doubled the production titer of certain products, while increasing the rate kinetics and glycerin consumption of the strain.

The technical problems that industrial biotech companies such as GlycosBio face include the challenge of scaling a different bioreaction for each biobased product that the company rolls out. Those problems are compounded under risks of contamination, variable crude feedstock content and alignment with downstream recovery operations. However, those tasks can be overcome at manageable expense using prepilot bioreaction volumes far smaller than commercial scale.

The disruptive capability of the technology is the ability to biologically ferment glycerin into higher value biochemicals or fuels that can provide revenue during periods of lower biodiesel crush spreads. That's the concept of a biorefinery-like a petroleum refinery, several strata of liquid fuels, chemicals and energy are produced. The biorefinery was conceived to be a more economically sustainable model.

Different Approaches

The conversion of glycerin to propylene glycol is under development by Dow, UOP and Huntsman4. Separately, Dow and Solvay developed technology for converting crude glycerin to epichlorohydrin. DuPont-Tate & Lyle have been successful in their joint venture to produce and market 1,3-propanediol.

Other companies such as Green Biologics in Oxford, UK, and Myriant Technologies in Quincy, Mass., are also developing processes around glycerin as a viable starting material for diverse chemicals such as butanol and acetone. Arkema SA in France is developing techniques to convert crude glycerin to acrolein, admittedly a small market itself, but having large potential as a precursor to acrylic acid. Arkema's process is entirely non-biological and uses a dehydration reaction on a solid catalyst producing acrolein and by-products hydroxyacetone, acetaldehyde, propionaldehyde, and acetone4.

The production of biobased chemicals and materials is gaining momentum. ADM, Cargill and other traditional grain suppliers are among the most heavily involved in chemical production from biomaterials. Cargill owns the massive NatureWorks bio-polymeric plastics and resins operation in Nebraska. ADM formed its Industrial Chemicals unit in 2007, with the intent to produce USP-grade propylene glycol among other renewable chemicals.

Industrial Biotech Incentives

Companies have their sights set on a projected $215 billion biobased chemicals market. McKinsey & Co. predicts that sales of chemicals from renewable, biobased sources will consume 10 percent of worldwide chemical sales in 20125. It's not a new idea, but the U.S. DOE is betting that these chemicals and other products will service biofuel plants as more profitable coproducts alternatives to glycerin.

The successful approach for GlycosBio and others will be to demonstrate technologies converting high levels of glycerin to a single product, and obtain market traction quickly, making it easier to attract funding for more ambitious projects.

Investment in additional chemical products and capabilities logically follow these initial breakthroughs. In fact, many companies in this space are pursuing the green field of bioderived solvents, monomers and chemical intermediates. According to McKinsey, biofuels will account for $91 billion of these sales. By 2020, most chemical manufacturers will have significant capacity devoted to bioprocessed fuels and chemicals.

David Gaskin is director of planning for Glycos Biotechnologies Inc. Reach him at dgaskin@glycosbio.com.

References

1. Glycerin Market Analysis, ABG, Inc. for the U.S. Soybean Export Council (2007)

2. Monthly Energy Review, Energy Information Administration (2009)

3. BBI International

4. Patent Watch, American Chemical Society (2008)

5. Industrial White Biotechnology, Chemical Week (2009)

Glycerin is one of the most widely available chemicals in the world, touting a production of more than 2 billion pounds1 and growing. As the biodiesel industry well knows, the supply of glycerin will continue to dwarf demand until more than 5 billion pounds is expected to hit the world by 20201. Prices of glycerin in the U.S. have either been widely fluctuating or painfully low, reflecting a dependence on soybeans, refining capacity and biofuels policy, but predominantly reflecting the large supply of glycerin entering the U.S. marketplace.

In 2008, biodiesel crude glycerin production reached approximately 251 kilotons in the U.S., on top of the estimated 150 kilotons of glycerin from nonbiodiesel sources2,3. U.S. demand for glycerin's traditional uses in soaps and cosmetics, food additives, industrial foams and transportation fluids were outstripped by supply on the order of some 75 to 100 kilotons. The slow rise in crude oil prices over the past six months may give encouragement to biodiesel margins, but it won't solve glycerin's long-term picture.

Businesses and research groups around the world are focused on launching innovative and sustainable technologies capable of connecting glycerin to valuable applications. Researchers in the biotechnology industry are well aware of the supply issues surrounding glycerin, and have recently invested in the means to develop technologies to convert glycerin to biofuels and a portfolio of other end-products.

Industrial biotechnology company Glycos Biotechnologies Inc. (GlycosBio) of Houston, Texas, recently developed a biotransformation technique that directs crude glycerin from the biodiesel process into ethanol at high-yield efficiency. Using microorganisms as biocatalysts-enzymes or microbes that initiate or accelerate chemical reactions-GlycosBio makes possible the conversion of a disadvantaged coproduct into another prominent chemical. Scientists recognize that glycerin is sometimes difficult to convert in a microbial transformation, but its inherent chemistry opens alternatives to produce hundreds of compounds. For that reason, biofuel producers can tap crude glycerin streams to produce new and valuable coproducts.

What does this mean for the biodiesel industry? This new biological process enables owners of biodiesel plants to use glycerin streams within their plants to diversify coproducts and provide revenue management flexibility. Crude glycerin exiting the separation units can be converted to products such as ethanol and propylene glycol. Propylene glycol is an important component of polyester resins, industrial solvents and hydraulic fluids, and boasts a U.S. market of $786 million. At 85 cents per pound, propylene glycol has the potential to add 29 cents in production margin per gallon of biodiesel. If soybean oil prices begin to rise again, glycerin provides minimal plant contribution against low oil prices; but unlike glycerin, the industrial uses, and prices, for propylene glycol present a more sustainable source of economic value.

Translating this into plant dollars, a 50 million gallon plant that converts nearly 4.5 million gallons of crude glycerin can churn out 25 million pounds of propylene glycol, the value of which is more than $21 million at today's prices.

Microbial Biotransformation

The science begins by modifying the metabolic pathways of selected microorganisms to digest glycerin and ensuring that growth conditions and metrics are met by the cultured strains. From there, only strains that consume large amounts of glycerin with a minimum of interfering coproducts are selected. High-throughput screening expedites the selection of characteristics based on glycerin consumption, conversion yield and minimizing competing metabolites. Exclusive production of the desired product is crucial, but measures can be taken to moderate byproducts if they prove useful in maximizing the primary target. Successful strains are introduced into fermentation reactors containing crude glycerin with two goals in mind: minimize reaction time and select strains for actual process stream conditions.

From there, the fermentation is scaled up and process development begins. In designing actual operating conditions, feedback to the laboratory fermentation work helps scientists to develop strains with the actual production process conditions. Over the past six months, GlycosBio researchers have doubled the production titer of certain products, while increasing the rate kinetics and glycerin consumption of the strain.

The technical problems that industrial biotech companies such as GlycosBio face include the challenge of scaling a different bioreaction for each biobased product that the company rolls out. Those problems are compounded under risks of contamination, variable crude feedstock content and alignment with downstream recovery operations. However, those tasks can be overcome at manageable expense using prepilot bioreaction volumes far smaller than commercial scale.

The disruptive capability of the technology is the ability to biologically ferment glycerin into higher value biochemicals or fuels that can provide revenue during periods of lower biodiesel crush spreads. That's the concept of a biorefinery-like a petroleum refinery, several strata of liquid fuels, chemicals and energy are produced. The biorefinery was conceived to be a more economically sustainable model.

Different Approaches

The conversion of glycerin to propylene glycol is under development by Dow, UOP and Huntsman4. Separately, Dow and Solvay developed technology for converting crude glycerin to epichlorohydrin. DuPont-Tate & Lyle have been successful in their joint venture to produce and market 1,3-propanediol.

Other companies such as Green Biologics in Oxford, UK, and Myriant Technologies in Quincy, Mass., are also developing processes around glycerin as a viable starting material for diverse chemicals such as butanol and acetone. Arkema SA in France is developing techniques to convert crude glycerin to acrolein, admittedly a small market itself, but having large potential as a precursor to acrylic acid. Arkema's process is entirely non-biological and uses a dehydration reaction on a solid catalyst producing acrolein and by-products hydroxyacetone, acetaldehyde, propionaldehyde, and acetone4.

The production of biobased chemicals and materials is gaining momentum. ADM, Cargill and other traditional grain suppliers are among the most heavily involved in chemical production from biomaterials. Cargill owns the massive NatureWorks bio-polymeric plastics and resins operation in Nebraska. ADM formed its Industrial Chemicals unit in 2007, with the intent to produce USP-grade propylene glycol among other renewable chemicals.

Industrial Biotech Incentives

Companies have their sights set on a projected $215 billion biobased chemicals market. McKinsey & Co. predicts that sales of chemicals from renewable, biobased sources will consume 10 percent of worldwide chemical sales in 20125. It's not a new idea, but the U.S. DOE is betting that these chemicals and other products will service biofuel plants as more profitable coproducts alternatives to glycerin.

The successful approach for GlycosBio and others will be to demonstrate technologies converting high levels of glycerin to a single product, and obtain market traction quickly, making it easier to attract funding for more ambitious projects.

Investment in additional chemical products and capabilities logically follow these initial breakthroughs. In fact, many companies in this space are pursuing the green field of bioderived solvents, monomers and chemical intermediates. According to McKinsey, biofuels will account for $91 billion of these sales. By 2020, most chemical manufacturers will have significant capacity devoted to bioprocessed fuels and chemicals.

David Gaskin is director of planning for Glycos Biotechnologies Inc. Reach him at dgaskin@glycosbio.com.

References

1. Glycerin Market Analysis, ABG, Inc. for the U.S. Soybean Export Council (2007)

2. Monthly Energy Review, Energy Information Administration (2009)

3. BBI International

4. Patent Watch, American Chemical Society (2008)

5. Industrial White Biotechnology, Chemical Week (2009)

Advertisement

Advertisement

Upcoming Events