Carbon Dioxide Apps Are Key In Ethanol Project Developments

April 15, 2011

BY Sam Rushing

About 36 standing CO2 plants today are fed by ethanol byproduct raw gas, representing about 32 percent of the total number of fermentation plants serving the merchant sector of the CO2 market. Numerous additional CO2 plants are under consideration, or slated to be built alongside future or existing ethanol ventures. Despite the lag in ethanol plant construction in the past few years, facilities being idled and a few going bankrupt, the industry is healing itself and will continue to expand with advanced biofuels operations growing in importance. As the role of biofuels increases in the domestic and international energy supply, the output of CO2 from fermentation will also increase and with it the need to deal with it appropriately.

All ethanol ventures should take a fresh look at CO2 as a great opportunity, initially for future revenue streams through CO2 recovery and marketing. In due time, cap and trade or some other scenario for emissions reduction will take hold domestically, increasing the value of CO2 projects in making ethanol more environmentally acceptable.

Markets are key to making a commercial CO2 project work, unless sequestration is the aim and assuming carbon credits, tax incentives or other government programs make these efforts economical. The existing U.S. CO2–from-ethanol plants have found markets that should provide a steady stream of income for decades.

Wholesale vs. Direct Marketing

Historically, many of the CO2 plants were owned and operated by the businesses that provided the ethanol or ammonia. Since the emergence of major gas companies, most of the raw CO2 has been sold to the gas refiner, who handles marketing to the merchant CO2 sector. Today, however, numerous independents thrive in the U.S. selling directly to consumers. This direct CO2 marketing scheme is quite common in Latin America, and many other regions as well, supported by the large difference in margins that commonly occurs. Prices of raw gas sold to a refiner or gas company range from $5 to $25 per ton, compared to consumer market prices averaging $90 to $100 per ton; and, in some high-priced markets with little regional competition or no local supply, even $200 to $300 per ton.

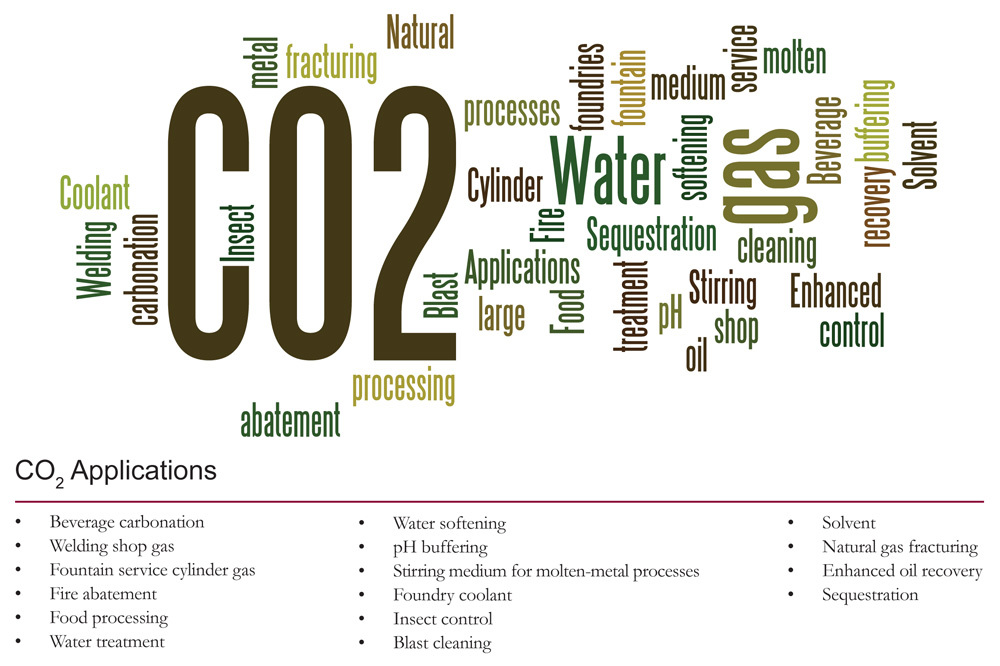

CO2 Uses Varied and Growing

For years in the U.S., and in developing economies now, the lion’s share of CO2 was dedicated to beverage carbonation, with smaller amounts sold to welding shops, as cylinder gas for fountain service and for fire abatement. A large number of industries simply vented the gas.

Advertisement

Advertisement

New applications in food processing have emerged for liquid CO2. In individually quick-frozen product manufacturing, the process freezes portions that do not stick together in straight-thru, multiple-pass or spiral-type cryogenic freezers. In tumble freezers, CO2 liquid is injected into a blender or grinder and “flashed” under atmospheric pressure into a fine CO2 “snow” used to freeze products such as pizza toppings. Sometimes the liquid CO2 is vaporized for a gas flush or modified gas environment intended to preserve the food product, improve appearance and reduce bacteria count. CO2 is delivered to these various freezer systems via insulated piping from storage vessels. Such CO2 applications amount to 40 percent of the average developed economy’s usage of the commodity, with some large plants using hundreds of tons daily for food processing. A plant with CO2 in a region with many such food plants has a captive market.

The traditional market, soft drink carbonation, has rather straightforward requirements. Some breweries, which do not recover sufficient CO2 via fermentation, may supplement supplies with merchant product, and some large breweries use the gas to backpressure their systems.

In many developed economies, the food and beverage applications comprise 70 percent of all merchant product sold. In addition, there is captive use for making commodity or specialty chemicals, numerous industrial uses, enhanced oil recovery, and unique markets, such as recovering natural gas molecules from coal bed seams, which is then replaced with CO2.

Advertisement

Advertisement

In most cases, one standard grade of CO2 is produced achieving a high quality product that meets the beverage standard known as ISBT. The beverage grade will suit most applications, and far exceeds the specifications required for a captive, enhanced oil recovery application. There also is a very small market for gas that meets pharmaceutical and medical usage standards for use as respiratory stimulation.

Emerging Industrial Uses

In addition to food and beverage applications, there is a large industrial sector that uses CO2 in water treatment facilities, water softening plants and for pH buffering. The use of CO2 in the form of the weak, environmentally friendly carbonic acid has been a safe acid replacement material in the paper and pulp industries. It also has applications in treating alkaline streams such as effluent from chemical plants and food processing facilities.

Use of CO2 has been popular in some metallurgical settings, as a stirring medium for large, molten-metal processes, and as a coolant in foundries. Plastics manufacturing and rubberized belt manufacturers also use the gas. Using CO2 to control insects in sealed grain elevators and ship holds has been popular in warm climates, replacing hazardous fumigants.

CO2 in the form of dry ice—which sells for many times more than a liquid product—is popular in a wide variety of settings beyond the food processing industry. Dry ice has numerous uses as a portable coolant, which sublimates as it cools. Dry ice has grown in popularity in blast-cleaning applications, where very small, rice-like pellets are blasted under pressure to remove paint, grease, ink or dirt, among other things, in settings from printing presses to refineries. Solvent applications are growing in all types of markets, including dry cleaning, where it eliminates a hazardous chemical, and under pressure to extract essential oils replacing hydrocarbons.

CO2 has a huge market in natural gas fracturing applications, given the right location. Another niche market is using CO2 for enhanced secondary or tertiary oil recovery. Though specific to oil-producing regions, it could serve as a niche market for CO2 for decades.

Future carbon sink and sequestration applications could include CO2 use in greenhouse operations to enhance plant growth or for raising algae to be used in next-generation biofuels. Numerous, diverse applications are underway in test phases.

These are all examples of opportunities where an ethanol project could capitalize on marketing CO2 directly to the consumer—sometimes with lucrative terms. The first step is understanding, in depth, the options. Comparing wholesale raw gas sales or direct markets requires evaluating the cost of production, distribution and overhead. Once potential markets are identified and understood, potential risks for direct marketing can be properly evaluated. Numerous cases exist where a niche market makes the most sense and direct marketing provides a true opportunity to produce solid revenues.

Author: Sam Rushing

President, Advanced Cryogenics Ltd.

(305) 852-2597

rushing@terranova.net

Upcoming Events