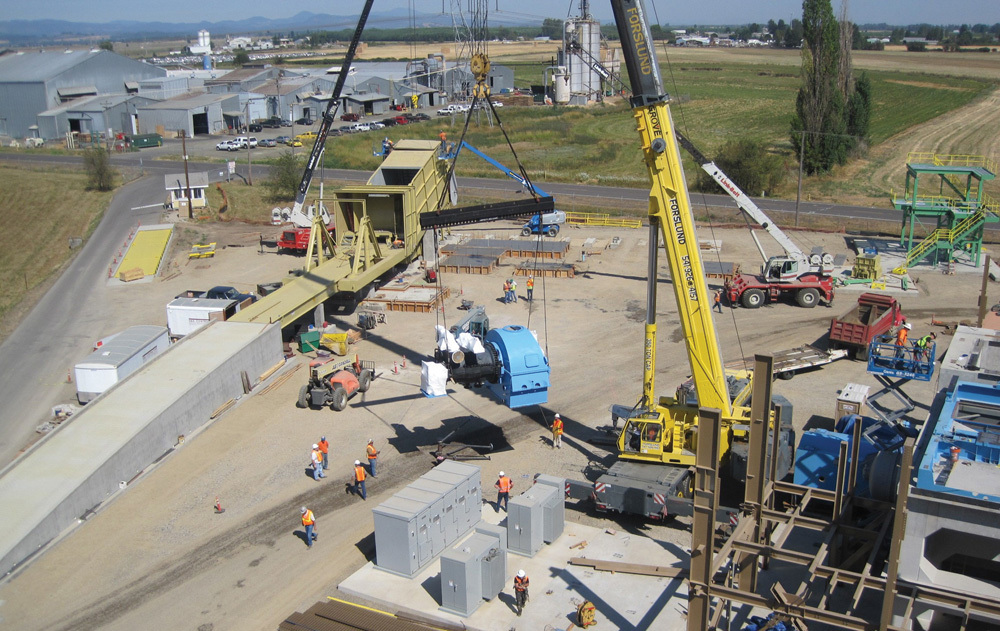

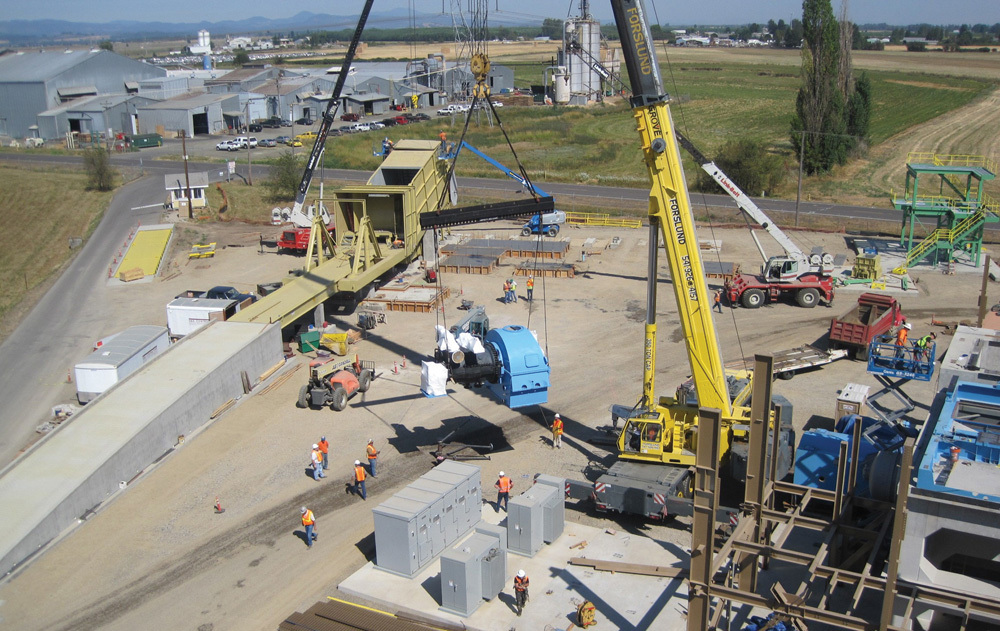

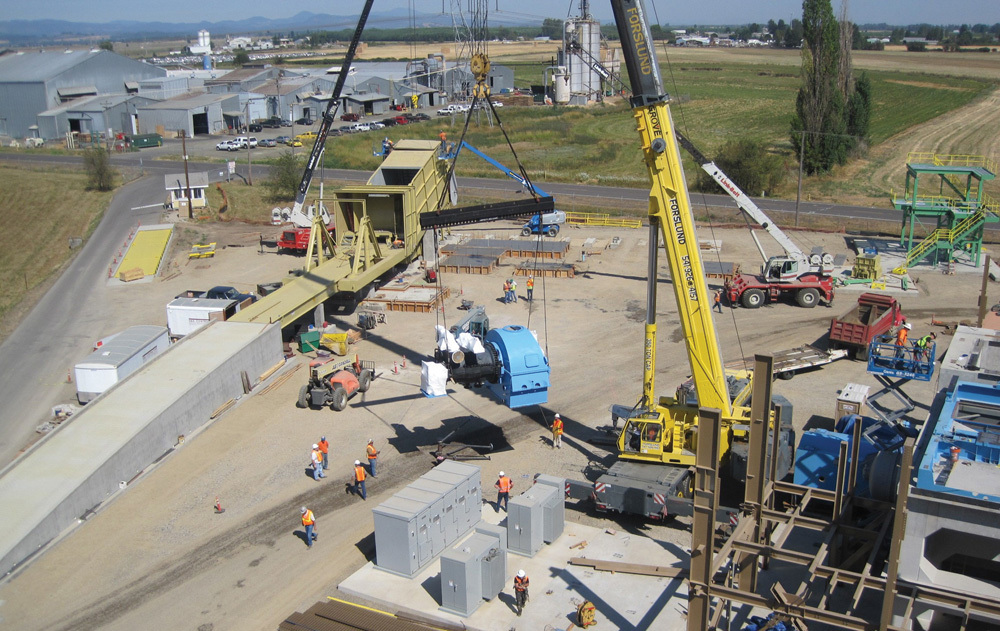

CHP: Cutting It at Sawmills

PHOTO: SENECA SAWMILL

April 29, 2011

BY Anna Austin

When Aaron Jones founded Seneca Sawmill Co. in 1953, he was prepared to lead the company through the good times and the bad. Although he is no longer involved in the daily operations of the company, over the past half century Jones inspired his employees to continue to persevere during challenging times. And they have, even during the worst slump the U.S. housing market has ever experienced.

In fact, Eugene, Ore.-based Seneca has faced the trying economy head on, with the recent completion of a $90 million cogeneration (combined-heat-and-power) plant, without the help of any state or federal grants. “The way that [Jones] has run his business, and what he has always taught people like me, is to be prepared for the worst case scenario,” says Rick Re, general manager and senior vice president of the company. “We’ve been able to get through this downturn because we were always prepared for the worst.”

Having gone into full operations in mid-March, Re says he’s glad that Seneca began the cogeneration project when it did, which was in 2008 with the permitting process; construction began in 2009. “It’s a challenging environment right now,” he says.

Well-financed with a large asset base, Seneca owns three sawmills all located on the same site, as well as 150,000 acres of timberland. Though the company had been evaluating cogeneration for roughly the past 12 years, it never seemed to quite pencil out, says Re, who has been working for Seneca since 1973.

That is, until demand for kiln-dried wood significantly increased. “We manufacture green lumber, and we have a couple of dry kilns, so we got into drying a small portion of our volume,” Re says. “Over the period of a decade, the marketplace shifted more toward dry lumber, and we recognized we would have to start doing more of that.”

Seneca had been running its dry kilns with natural gas, but realized that it was no longer the best option with increased drying activity. “Then we started looking at a biomass boiler,” Re says. “Because of fuel costs, there was some value in that.”

Perhaps the most beneficial aspect of building a cogeneration plant at the site of Seneca’s sawmills is the fact that the company is able to supply the plant with all of its fuel demands, which is sometimes the case with similar projects.

That’s actually how Seneca gauged the size of the plant—by how much fuel the company could supply using just in-house materials. “That was one of the big issues when we began looking at the project,” Re says. “We wanted to build based on the resources that we control from our own holdings—timberland slash and byproducts of manufacturing. We figured out that we could justify a plant that would produce 20 megawatts (MW).”

That equates to about 130,000 bone-dry tons of wood fuel a year.

Some CHP projects have difficulty producing power for the grid because they are remotely located or they can’t get a sufficient price for their power. In Seneca’s case, it was largely a matter of luck. “Fortunately, we have two different BPA [Bonneville Power Administration] lines right next to us as well as two local utilities, so we had access,” Re says.

Advertisement

In some states such as Montana, these issues have kept sawmills from implementing cogeneration projects. Two years ago, the Montana Department of Commerce provided funding for feasibility studies to look at cogeneration at seven saw mills within the state, to determine what the obstacles are and how they could be overcome.

Determining Feasibility

Craig Rawlings of the Montana Community Development Corp., a leader in the project, says the final feasibility report found that cogeneration plants are doable for the seven mills, a prototypical plant being sized at about 18.8 MW and costing $55 million. As a result of the study’s findings, all of the plants are working on developing cogeneration plants but at different paces, he says. “Some are trying to get power purchase agreements in place, and some are working on energy audits so they can be competitive for the Rural Energy for American Program low-interest loans and grants.”

Some have also applied for the U.S. Forest Service’s woody biomass grant program. Though a total cost of $55 million per plant is a large financial investment according to Montana standards, with the help of these numerous state and federal programs, the MCDC report finds that the daunting task of financing is possible with the right financial packaging expertise. “Also from a financing perspective, although they can burn their mill residues—they already have the intent to do that—they can also use the mill byproducts as collateral when they go to a financing institution,” Rawlings says.

If the sawmill can run a cogeneration plant on its own fuel alone, like Seneca does, that will also result in significant cost savings. In western Montana, for every $1 increase in the average daily cost to deliver one bone-dry ton of fuel to a mill site, the required power sale price increases by about 88 cents. “For a stand-alone power plant, you’ve got to go outside and bring all of your material in, whereas these mills already have a stream of byproducts that they could use if they need to,” Rawlings says. “They need to be motivated to go outside of that. In Montana, we’ve got some real forest health issues with the beetle-killed pine.”

Out of the seven Montana mills, four are actively pursuing the projects. “There is still a challenge with energy prices being so low in the Midwest, and they’re predicted to stay relatively low,” Rawlings says. A financial analysis revealed that a cogeneration plant in Montana would have to sell power at a rate of $88 per megawatt hour (MWh) to provide the owner a 12 percent return on investment (ROI). That amount could be as low as $78 per MWh, however, and still achieve the same ROI, if the project can take advantage of available financing and grant programs in a given location. While that cost is higher than other available sources of power in the state, the development of a network of CHP plants at sawmills may provide a number of social, environmental and electric system benefits that would justify the higher cost.

Also, if a plant in a state with low power prices is located near the border of a state with higher power prices, selling the power across the border may be an option, which is the case for Iberdrola Renewables and Collins Co.’s cogeneration plant, Lakeview Cogeneration LLC, under construction at its Lake County, Ore., sawmill.

Just 15 miles from the California border, that state is the logical market for power produced at the plant because of the significant difference in power prices. “Right now you can buy industrial power in Oregon for about 4.5 cents per kilowatt, and the same in California goes for about 11.5 cents,” says Wade Mosby, senior vice president of Collins Co. “It costs about 8.5 cents to operate a cogeneration plant, so you’re probably not going to sell it in Oregon.”

Partnering Up

For Collins, a project partner was a must. The company teamed up with renewable energy giant Iberdrola for a number of reasons, including financials.

“The problem with cogeneration is that the prices are astronomical,” Mosby says. “Lakeview is a $90 million investment and we’ve had several tough years. We’re a profitable company, but we don’t have that kind of cash lying around.”

Advertisement

The sawmill business has been tough especially with the depressed housing market. “It’s all tied to the housing market,” he says.

The 26.8-MW cogeneration plant currently under construction will change the landscape a bit for the Fremont sawmill. It will use mill byproducts to generate all the steam for the mill as well as power for the grid, and Collins is responsible for supplying the plant with its fuel needs.

Overall, the project is expected to have many positive economic impacts on the county, which has seen four sawmill closures in the past couple of decades.

Utilizing wood resources in western Oregon has been a complicated and contentious issue over the past 15 years, Mosby says. Beginning in the early 1990s, the government put strict harvest regulations on federal forestland, which constitutes about 78 percent of the forestland in Lake County, and they are still in effect today, according to Mosby. “The environmental community has made it pretty tough to harvest any timber,” he says.

Then it became apparent that there was a need for forest health management in the region. “We’ve had some huge fires,” Mosby says. “In 2001, we had a 100,000-acre fire and people started to realize we had a huge problem. If we didn’t ever harvest timber, we were going to perpetually have these fires coming through, generally started by lightening.”

The solution was to build a sawmill in a remote location in Lake County, which is where Collins entered the picture. Not owning quite enough forestland in the region, Collins was able to work out a 10-year forest stewardship agreement with the government, with a 20-year memorandum of understanding. “They guaranteed us 5,000 acres, and we decided to build a mill there, which opened at the end of 2007,” Mosby says.

Realizing that there would be a substantial amount of biomass resulting from the mill’s operations, regional stakeholders decided that a nearby cogeneration plant seemed to make sense. After the project changed hands a few times, Iberdrola took it over and moved forward. “We’ll shut down our boiler when it’s complete in 2012,” Mosby says.

Financially, what has made the large project investment attractive is the federal 1603 Program investment tax credit. “A $90 million facility with a 30 percent grant, they [Iberdrola] will get $27 million back, and up to $10 million back under a state plan,” Mosby says. “Those kinds of incentives make it attractive to bigger players.”

Mosby advises sawmills considering similar projects to be patient, as a good project takes considerable time to develop. “The whole idea of our cogeneration project was formed in 2004, and it won’t be operational until 2012,” he says.

Because it has been in the cogeneration business since 1985, operating a 12-MW plant at its sawmill in western California, Collins has a good understanding of it. ”You need fuel, financing and a PPA (power purchase agreement) that makes sense,” Mosby says. “A lot of communities are interested in this type of a project, but realistically the stars have to align.”

Choose a project partner with know-how and access to capital, he says. “A lot of developers have big ideas, but they don’t have very deep pockets.”

Author: Anna Austin

Associate Editor, Biomass Power & Thermal

(701) 738-4968

aaustin@bbiinternational.com

Upcoming Events