Commodities: Cold winter, other factors boost natural gas prices

March 28, 2014

BY Ben Straus, U.S. Energy Services

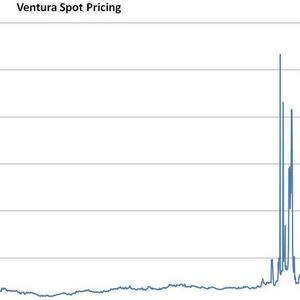

Winter 2013-’14 may be on its last legs, but the experience is still fresh in the minds of many natural gas consumers across the upper Midwest. The coldest winter in the past ten years bundled a host of factors that lifted regional spot prices to unheard-of levels in the shale era. Spot prices spiked above $40 on three separate occasions at Ventura and the price differential between the monthly New York Mercantile Exchange settlement at Henry Hub in Louisiana and the regional Ventura monthly index widened from a discount of 8 cents in December to a premium of $5.64. Understanding the dynamics wreaking havoc on regional prices can help natural gas consumers assess the risk of a repeat performance in the upcoming winter.

The key underlying factor driving the regional premiums was weather related demand. The past winter could be described as cold, but leaving it there is insufficient. Out of 22 winter weeks from Nov. 1 through the end of March, population-weighted temperatures have been warmer than normal only six times. Conversely, six weeks this winter have been at least 25 percent colder than normal. This cold weather has interacted with the natural gas market in a number of ways. Storage inventories were drawn down rapidly from December through March dropping below the five-year lows in January and project to be at the lowest levels in over decade by the end of the heating season. With less gas in storage available to meet peak demand days in January through March, pipelines relied more heavily on gas transported from producing areas of the country to meet demands on their systems. This asymmetry between supply available at the field and pipeline transportation capacity limits was crucial to driving the differential between market and field pricing hubs to painful levels for many natural gas consumers.

To add salt to the wound, a number of logistical issues created further complications. In late January, a significant source of supply for the mid-west market was interrupted, when Transcanada’s Emerson natural gas lateral experienced an explosion, completely cutting off supply to Viking pipeline, which delivers to consumers in Minnesota and Wisconsin, and is source of supply delivering into the western portion of the Chicago market. The Chicago market faced additional challenges as a second pipeline (NGPL natural gas pipeline) experienced challenges in providing sufficient compression to move gas up from the Southwest and the Gulf Coast throughout the month of February.

Advertisement

The combination of limited storage inventories and pipeline transportation issues in the Midwest market has wrought havoc on prices for end-users of natural gas. While the receding cold weather will ameliorate the dire pricing environment experienced through March, inventory levels throughout the injection season should be monitored closely to determine the likelihood of a repeat of this experience in the upcoming heating season.

| Natural Gas Prices | Nymex | Ventura | California Citygate | ||

| 12/31/2013 | $4.42 | $4.86 | $4.64 | ||

| 3/25/2014 | $4.41 | $6.07 | $4.96 | ||

| 3/26/2013 | $3.98 | $4.29 | $4.30 | ||

Advertisement

Related Stories

The U.S. exported 31,160.5 metric tons of biodiesel and biodiesel blends of B30 and greater in May, according to data released by the USDA Foreign Agricultural Service on July 3. Biodiesel imports were 2,226.2 metric tons for the month.

CARB on June 27 announced amendments to the state’s LCFS regulations will take effect beginning on July 1. The amended regulations were approved by the agency in November 2024, but implementation was delayed due to regulatory clarity issues.

Legislation introduced in the California Senate on June 23 aims to cap the price of Low Carbon Fuel Standard credits as part of a larger effort to overhaul the state’s fuel regulations and mitigate rising gas prices.

The government of Brazil on June 25 announced it will increase the mandatory blend of ethanol in gasoline from 27% to 30% and the mandatory blend of biodiesel in diesel from 14% to 15%, effective Aug. 1.

The U.S. EIA reduced its 2025 and 2026 production forecasts for a category of biofuels that includes SAF in its latest Short-Term Energy Outlook, released June 10. The forecast for 2025 renewable diesel production was also revised down.

Upcoming Events