Commodities: Wet, cold April confounds forecasting models

May 22, 2014

BY Ben Straus, U.S. Energy Services

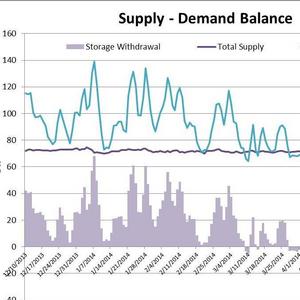

Over the past two years April has been a funny month in the natural gas market. Although not technically part of winter, 2013 and 2014 served up wet cold Aprils in many of the heavy gas consuming regions of the country. Consequently, natural gas demand in those months has been relatively high compared to prior years. This demand has slowed the start of the injection season and did little to provide a solid base for forecasting over the summer. Although U.S. Energy Information Administration data will not be available until the end of June, information scraped from pipeline bulletin boards shows that the weather has been a drag on the start of the injection season, with residential and commercial demand almost 2.8 billion cubic feet (Bcf) per day higher in 2014 than the already elevated numbers of 2013. Power demand also bucked expectations, coming in almost 1 Bcf per day higher than analyst models anticipated.

The good news is that while April was a month seemingly designed to confound forecasting models, May could be the antidote. Where April was consistently colder than normal, with a blip in the middle of the month where demand jumped back above supply levels to cause a net withdrawal from storage, May has been more or less in line with historical temperature norms. Combined with the fact that May is typically one of the lowest demand months, it will provide a chance to get a clearer picture regarding the overall supply, demand balance of the market.

Advertisement

The early returns are perhaps best described as guardedly encouraging. While April saw anemic growth in domestic production, May has seen a slight uptick, reaching as high as 68 Bcf per day. While power demand continues to remain sticky and higher than analysts might expect, given a relatively elevated price compared to 2013, industrial demand has been a pleasant surprise, coming in almost 1 Bcf per day lower than the April 2014 level and contributing solidly to injections that have met or exceeded analyst expectations over the first few weeks of the month. In the big picture, May will not make or break end-of-season inventory levels, but it does provide some insight into whether or not there will be a comfortable amount of natural gas stored for the upcoming winter. It looks like the market will be able to scrape by getting inventories back to roughly 3,500 Bcf on higher production levels. That should be sufficient, if not comfortable for the upcoming winter.

Advertisement

Upcoming Events