Constructing a Full-Service Vision

February 27, 2015

BY Ron Kotrba

A groundbreaking ceremony symbolically represents the beginning of a construction project. But for those who have traveled that long and often rocky road of project development, the event is equally representative of an end, punctuating years of studies, planning, fundraising, engineering and analyses, a transition from the virtual to the concrete. The advanced biofuel space is an industry of startups, some much farther along and more experienced than others. But even the most developed companies in this sector are still relatively new; and they all had a beginning, a time in the early stages of project development when enthusiastic executives strove to turn their business model and vision into commercial-scale production.

Formed in 2012, SG Preston is one of hundreds of startup companies in the advanced biofuel space. The name first appeared on the advanced biofuel radar last summer when it announced plans to build a 120 MMgy renewable diesel facility in Lawrence County, Ohio. “The cornerstone of SG Preston’s bioenergy development and service strategy is the integration of existing delivery systems into the energy supply and development value chain through four divisions,” says R. Delbert LeTang, the company’s founder and CEO. Those divisions are SGP Biomass, SGP Wood Pellets, SGP BioEnergy and SGP Biofuels.

SGP Biomass is “an integrated developer and supplier of various forms of environmentally sustainable and certified biomass feedstock to leading companies in the U.S.,” LeTang says. Using its proprietary U.S. Biomass Supercorridor logistics platform, this division involves the responsible harvesting, collection, processing, manufacturing and delivery of naturally occurring waste-derived products, including wood, fats, oils and more, for use by industry. “SGP Biomass’ vertically integrated feedstock development and supply model allows the company to control the volatility of the traditional feedstock supply chains, eliminate middlemen and brokers, and mitigate commoditization of its own, and its clients,’ primary input raw materials,” LeTang says.

SGP Wood Pellets is an integrated developer of wood pellets from environmentally sustainable and certified biomass feedstock that intends to eventually supply international markets with product. “We have more than 2 million metric tons of orders from the EU market,” LeTang says, although he admits the company currently possesses no pellet mill production assets. “We are very conservative, very careful in developing our steps forward until we thoroughly understand the financing and political aspects of these markets,” he says. “We are investment and operations guys. Members of our management team have an average of 20 years’ experience in development, power generation, renewable energy, capital markets, investment banking and operations. We know how the renewable energy game is being played. Most of it is being led by who’s financing you and how pretty your website is—that’s not us. We are more interested in getting tangible, real work done and being consistent within our model. We want to make that crystal clear to the market. Most are riding the wave of the momentum, but we’re different. We are the momentum.”

The company’s third division is SGP BioEnergy, which LeTang says was recently established to acquire distressed or noncore biomass-to-electricity assets at significant discounts. “These are plants that have been shuttered or have underperformed due to volatile feedstock prices, unpredictable supplies or environmental regulation,” he says.

SGP Biofuels, the company’s fourth division, is a developer of low-carbon biofuels and chemicals from biomass using proven, commercial-scale conversion technologies to supply global clients in the petroleum and chemical industries. “SGP Biofuels’ facilities are designed to be profitable without incentives,” LeTang says. “Our business’ cash flow is predictable, sustainable and real from the outset. We believe in a fundamentally sound business and prefer to pass on some or all of the incentives that we have to our investors in order to accelerate getting their investment capital back to them sooner.”

So far, the company is delivering waste woodchips to customers, LeTang says, but “everything else is in development. This industry is an industry of start-ups. It’s all new. What separates us from others is how completely we develop our business model.”

He says SG Preston strives to stand as a “thought leader” in the bioenergy industry. “SG Preston’s model for renewable energy is unique,” LeTang says. “Each project begins by first establishing a thorough understanding of the challenges, then executing a contract for developing a turnkey bioenergy product and delivery solution to the project’s unique specifications. We believe that all customers are different and focus our bioenergy solutions on being additive to the client’s unique offerings.”

When asked to explain what SG Preston’s renewable diesel project development business model is, Clifton B. Strain, the company’s senior vice president and chief financial officer, says, “The formula is very simple and well-known—best-of-breed execution team, technology that has been proven at commercial scale with products that are guaranteed, a value-added approach to meeting client needs, strategic relationships with our community partners, a financial model that works without much need for federal incentives, complete integration on feedstock acquisition and effectively planned logistics.” LeTang says the plan to develop renewable diesel facilities “came as another spoke in the company’s overall operating philosophy that various forms of organic waste and innovative technologies for converting these wastes into usable fuels and products have met at a crossroad,” he says. “We call that crossroad ‘opportunity,’ especially when we see that overall client demand is virtually unserved for these renewable products.”

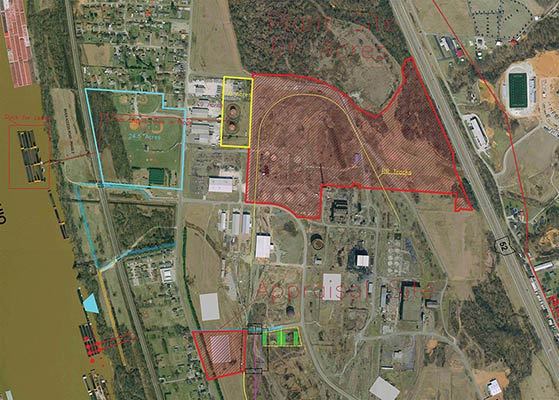

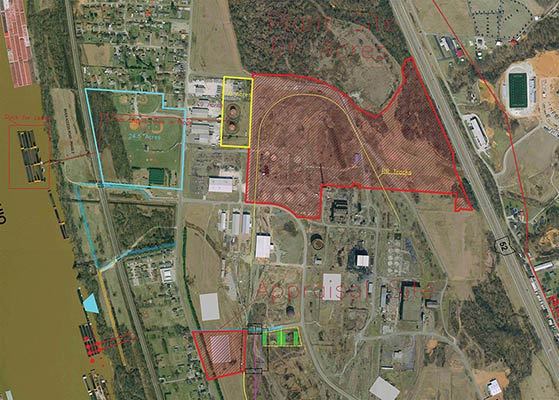

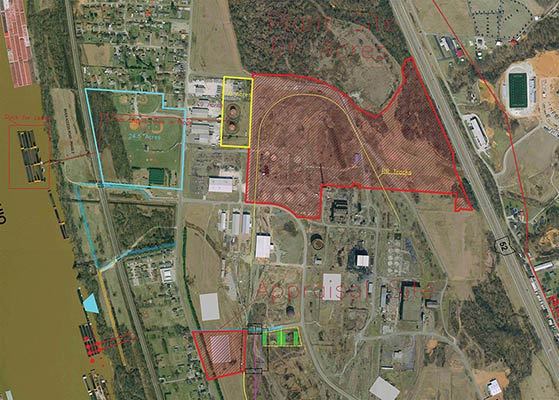

South Point

The site in Lawrence County, Ohio, where SG Preston plans to construct its renewable diesel facility, is a 66-acre plot in South Point. “The South Point site has the ideal profile for our facilities because it offers all of the components of our logistics strategy—skilled labor, established logistics infrastructure and a community motivated by the promise of rebuilding itself,” says Dwayne Brown, senior vice president of SG Preston’s internal division the company refers to as its Strategic Intelligence Group. LeTang describes its SIG as an internal group within SG Preston that houses its proprietary strategy and process intellectual property. The group was designed as a filter for identifying, evaluating and commercializing proven biomass conversion technologies. “It’s where we do our magic with the integration of logistics, various forms of biomass and conversion technologies,” LeTang explains.

“The plant site in Lawrence County is currently under option until we have completed our pre-engineering study,” Brown says. A pre-engineering study is the first stage of engineering an actual facility, which assesses the operational and integration aspects of installing the chosen conversion technology into a standard refining platform, and ballparks the capital costs required to build the plant. “The rest of the development process is the fine-tuning of that,” LeTang says, adding that reproducibility of subsequent facilities will be a “fine-tuning function of logistics and location.” Brown says each planned facility has a series of standard development stages for which pre-engineering is the first and necessary step. “From our standpoint, once we have begun this phase of exploration, we are pretty much committed to that location,” Brown says, adding that the South Point site is “all about the logistics—the combination of rail, road, water and even the presence of available pipeline capacity is critical to our strategy.”

Bill Dingus, executive director of the Lawrence County Economic Development Council, says, “This project will be of significant economic importance to southern Ohio, bringing long-term employment and income to the region. We look forward to supporting the development of new energy technologies, and passing on the benefits of commerce and cleaner air to local residents.”

Preliminary estimates on the cost to build SG Preston’s South Point facility come in at around $400 million. Strain wouldn’t disclose details on how the company plans to pay for it, or how much SG Preston has raised to date. “I will say that the project will be financed with a combination of debt and equity and that we are in discussions and negotiations with several interested financing sources,” Strain says. “We have a very process-driven and demonstrated financing strategy for our company, as well as for our biofuels portfolio. Investment partners will be announced as we progress through our development cycle.”

LeTang says SG Preston is not involved in research and development, and it does not rely on experimental technologies. “We license waste conversion technologies developed by leading universities, research labs, think tanks, government agencies and private groups, globally,” he says. “Our emphasis is replicability, scale and rapid deployment to match the pace of our global energy and resource challenges and demand.” LeTang says the technology it will license for the South Point facility is proven on a commercial scale and “one of only two used in commercial production today.” After its announcement last year, reports indicated the company would be licensing Honeywell’s UOP EcoFining technology, “and I didn’t refute that,” he says. Last summer a spokesperson for Honeywell’s UOP did admit negotiations were underway. “We wanted to be clear that there is no formal agreement, although UOP and SGP are in talks,” the spokesperson said. LeTang says his technology partner is reluctant about him publicly disclosing any information on SG Preston’s use of its technology at this point.

Though SG Preston has experience in supplying waste woodchips, and technologies do exist for converting wood to renewable diesel, LeTang reiterates that SG Preston does not involve itself with “experimental technologies, only proven ones,” intimating the company will use more traditional sources of waste fats, oils and greases. The company would not give specifics on its feedstock arrangements for the South Point site. “The majority of feedstock for our products and fuels are developed and sourced internally,” Brown says. LeTang adds that the majority of the feedstock used in this market is purchased from trading platforms or brokers. “We go directly to the waste owners and developers,” he says, “and we have our own program and logistics expertise to get it to our own facilities. When 50 to 70 percent of the cost of production is feedstock, we cannot allow third-party control over that.”

Brown says the process of selecting an EPC contractor is already underway. “We have begun this process and will continue to explore the universe of players who offer the capabilities that we need and, most importantly, demonstrate the ability to work well with the remainder of our team and at our pace of development,” he says.

Well before a shovel has broken ground in South Point, Ohio, SG Preston is already eyeing a site in Indiana for its second renewable diesel plant. “Logansport, Indiana, is slated as a second location that we have added to our development calendar,” Brown says. “We expect to announce more locations shortly.” Logansport is home to a Tyson chicken plant, but when asked if feedstock negotiations are underway with Tyson, Brown says SG Preston’s discussions with feedstock owners are confidential.

Today’s environment of low oil prices and significant policy uncertainty in the U.S. with the on-again off-again biodiesel and renewable diesel blenders credit and woefully late renewable fuel standard (RFS) volume obligations certainly alter the value proposition for advanced biofuels. Strain says SG Preston’s business model is designed to operate profitably without incentives. “Having said that, incentives will only help to strengthen the model. We have committed to building a tremendous franchise with long-lasting benefits for our customers, community, employees and investors,” he says. “We are not comfortable tying the success of our business to the vagaries of the incentive environment, but we do think that incentives will allow us to build an even stronger company.” Regarding state and local incentives, Strain says they are helpful and demonstrate a community’s commitment to a given project. “Should these incentives be available, it would allow us to build a more financially sound business with less financial leverage and greater financial flexibility,” he says.

SG Preston demands recognition that it is different than the myriad of other start-ups in renewable energy. Why? “The SG Preston model is client-demand driven,” LeTang says. “Not a single product is developed without a committed client attached. We are not research and development driven, nor are we scientists. We only license proven technologies from credible research institutions. So there is no guessing game with the technology. Our company is also fully vertically integrated, so many of the commodity exposures that plague our competition do not exist with our business. The rest is really a function of execution as we have virtually de-risked the most challenging elements, and for that, we assemble and partner with the best of the best of service providers to ensure effective execution.”

Ultimately, SG Preston wants to build a brand people trust. “From our standpoint, a brand represents a promise,” LeTang says. “It is the basis from which clients, communities, investors and other stakeholders determine whether what we are doing is in line and a good fit with who they are and what their own brand represents. This is where the relationship of business happens. For SG Preston, we are building a company based on a promise to deliver a competitive, tangible return to investors, to reinvigorate jobs in our host communities, to deliver value-added products to strengthen our clients’ product blend, and to be an overall good steward to other stakeholders in our industry.”

Author: Ron Kotrba

Senior Editor, Biomass Magazine

218-745-8347

rkotrba@bbiinternational.com

Advertisement

Advertisement

Upcoming Events