Corn Report

February 9, 2007

BY Jason Sagebiel, FCStone

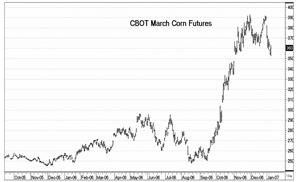

Jan. 11—The corn market exhibited huge gains finishing out 2006. Corn rallied to close out the end of the year, as March corn traded near the contract high of $3.93 per bushel. Funds and speculative monies were a major culprit of this price increase. The price increase included a reduction in global wheat production, lower world feed grain carryout and the future demand for corn that the ethanol industry has placed on the feed grain market, making each production year-ending stocks more uncertain.

Shortly after the New Year, corn suffered a sell-off around 30 cents. The anticipation of speculative money rebalancing and/or taking profits was the perceived reason for the sell-off. The USDA didn't make changes to the carryout in the December supply/demand scenarios, which at press time rested at 935 million bushels or a 7.9 percent carryout-to-use ratio. Many will be awaiting the December quarterly stocks figure released later in January to see if any changes will be made to the production and possibly the demand released in the annual USDA report. The next highly anticipated figure, due to be released March 31, is the prospective plantings report. Traders will actively assume increases of 6.5 million to 10 million more planted acres versus one year ago. Corn could be under some pressure if speculative dollars decide to exit the market. Any perceived disruptions in potential plantings or supply this summer will send this market climbing upward. In addition, this will increase volatility and day-to-day price swings. Corn should remain supportive above $3.40 in nearby futures, barring any surprises through the spring. Nearby corn at $4 may be a reality in the coming summer months based on production concerns.

Shortly after the New Year, corn suffered a sell-off around 30 cents. The anticipation of speculative money rebalancing and/or taking profits was the perceived reason for the sell-off. The USDA didn't make changes to the carryout in the December supply/demand scenarios, which at press time rested at 935 million bushels or a 7.9 percent carryout-to-use ratio. Many will be awaiting the December quarterly stocks figure released later in January to see if any changes will be made to the production and possibly the demand released in the annual USDA report. The next highly anticipated figure, due to be released March 31, is the prospective plantings report. Traders will actively assume increases of 6.5 million to 10 million more planted acres versus one year ago. Corn could be under some pressure if speculative dollars decide to exit the market. Any perceived disruptions in potential plantings or supply this summer will send this market climbing upward. In addition, this will increase volatility and day-to-day price swings. Corn should remain supportive above $3.40 in nearby futures, barring any surprises through the spring. Nearby corn at $4 may be a reality in the coming summer months based on production concerns.

Advertisement

Advertisement

Advertisement

Advertisement

Upcoming Events