Corn stocks down, but not as much as previously predicted

October 5, 2011

BY Holly Jessen

Old crop corn stocks are down more than 30 percent compared to a year ago, according to the USDA quarterly grain stocks report released Sept. 30. While that might sound alarming, Geoff Cooper, vice president of the Renewable Fuels Association, pointed out that, of corn stocks in all positions, the number is nearly 200 million bushels higher than many experts previously predicted.

“Pushing corn stocks back above one billion bushels is important for the psyche of the market,” he said. “Having more corn available should somewhat ease supply concerns brought on by poor growing conditions this year and provide more of a buffer until farmers complete the harvest of this year’s crop. Despite this temporary tightness in the corn market, it is clear that with the proper market signals American farmers can and will ensure enough corn is available for all uses.”

Corn stocks in all positions totaled 1.13 billion bushels on Sept. 1, a 34 percent increase from Sept. 1, 2010, the report said. A total of 315 million bushels of the total stocks are stored on farm, down 35 percent compared to a year ago. Off-farm corn stocks added up to 813 million bushels, down 33 percent. Corn disappearance from June to August was at 2.54 billion bushels. During the same period last year disappearance was at 2.6 billion bushels, USDA said.

Advertisement

Advertisement

Smaller than typical corn stocks and the possible impact on corn prices have been a big topic of concern. And, the usual line-up of ethanol critics have tried to pin the blame on ethanol production for those higher prices—even though they lack statistical evidence, Cooper said. In fact, from January 2009 to August 2010, a period of high growth for ethanol, corn prices were between $3 and $4 a bushel and were actually trending downward. (See chart, Monthly U.S. Ethanol Production Relatives to Avg. Corn Price.) “The bottom line remains that ethanol’s influence on corn prices is marginal and has been greatly exaggerated by our critics,” Cooper said. “Corn prices and retail food prices increase for a host of reasons, not the least of which is the price of oil.”

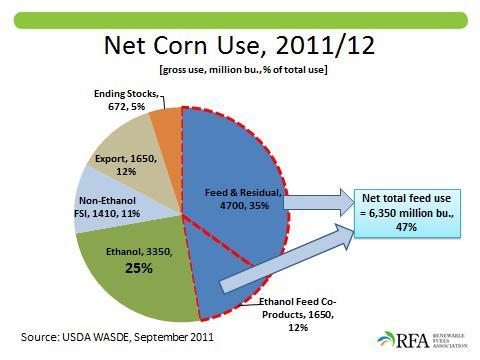

Distillers grains should also be factored into the equation. Looking at it from only a net basis, ethanol production takes in 25 percent of the nation’s corn crop. However, that corn isn’t consumed, never to be seen again. Examining feed and residual demand plus the coproducts from ethanol production, total feed demand is 6.35 billion bushels, adding up to 47 percent of the expected use of corn in 2011-’12. In other words, corn and ethanol coproducts for feed use is still the largest user of the nations’ corn crop. (See chart, Net Corn Use, 2011/12.)

Advertisement

Advertisement

Upcoming Events