Covanta announces progress with UK energy-from-waste projects

SOURCE: Covanta Holding Corp.

February 18, 2019

BY Erin Voegele

Covanta Holding Corp. has released fourth quarter 2018 financial results, reporting record operating and safety performance. The company also said it has made progress with several waste-to-energy projects under development in the U.K.

"We finished 2018 on a strong note, delivering double-digit Adjusted EBITDA growth with record operating and safety performance," said Stephen J. Jones, president and CEO of Covanta. "Further, we have taken significant steps towards our strategic growth objectives, with our first U.K. project and first TAPS project recently moving into construction. Looking ahead to 2019, we expect to generate significantly improved free cash flow, continue to optimize our unmatched domestic fleet, and move several new projects into construction in the U.K."

During an investor call held Feb. 15, Jones said Covanta processed more waste, generated more energy and recovered more metals in 2018 than it has ever before. He also that while plant production set records last year, the company also experienced the safest year in company history. Energy-from-waste plants, he said, saw a 31 percent reduction in incidents year-over-year.

Advertisement

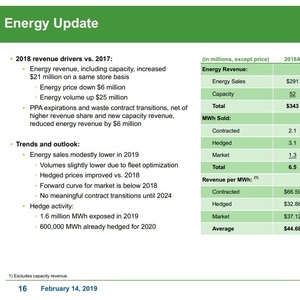

Regarding energy, Jones said record waste throughput and limited plant downtime resulted in record energy production last year. With modest improvements in market energy prices, Jones said Covanta had a better than expected year for energy revenue. However, he also noted that energy prices have remained subdued, and the company’s primary goal is to manage risk and volatility. According to Jones, Covanta entered 2019 well hedged, with nearly 85 percent of the forecasted energy revenue already contracted or hedged.

During the investor call, Jones also discussed progress made on pipeline of waste-to-energy projects in the U.K. In late 2017, Covanta partnered with U.K.-based Green Investment Group Ltd., a subsidiary of Macquarie Group Ltd., to develop, fund and own, energy-from-waste projects in the U.K. and Ireland.

On Dec. 18, 2018 Covanta announced the financial close of the partnership’s first project, the Earls Gate Energy Center, a combined-heat-and-power (CHP) project located in Scotland. The facility will take in approximately 216,000 metric tons of mixed household, commercial and industrial waste per year for use as fuel to generate heat and power that will be supplied to a co-located industrial site host. Construction on the project is expected to take approximately 36 months to complete. Jones said the facility will have the capacity to generate 21.5 MW equivalent of power. Covanta and GIG will each hold a 25 percent equity ownership in the project, with co-investor and developer Brockwell Energy owning the remaining 50 percent stake. Jones said the Earls Gate facility is currently expected to be operational by late 2021.

He also offered a brief update of the Rookery project in England, which is expected to process 500,000 metric tons of residual waste per year, generating more than 60 MW of energy. He said a legal challenge to the issuance of the plant’s operating permit is pending, with the court process expected to play out over the course of 2019. “We view this as an issue of process only, not whether the plant will have the rights to operate,” Jones said. “Therefore we are pursuing options to proceed to financial close and commence construction of the much needed infrastructure prior to the end of the appeals process.”

Advertisement

According to Jones, the two energy projects under development in partnership with Biffa in the U.K. are also positioned to reach financial close this year. Jones said he expects those projects, known as Protos and Newhurst, to be under construction by the end of 2019.

Covanta reported $86 million in energy revenues for the fourth quarter, down from $93 million during the same period of 2017. For the full year, the company reported $343 million in energy revenue, up from $334 million for 2017.

Overall, Covanta reported $1.868 billion in revenue for 2018, up from $1.752 billion in 2017. Net income was $152 million, up from $57 million in 2017. Adjusted EBITDA for 2018 reached $457 million, up from $408 million in the previous year. Diluted earnings per share reached $1.15, up from 44 cents in 2017. Adjusted earnings per share for 2018 was a 10 cent loss, compared to a 37 cent loss for 2017.

Upcoming Events